The Trump FDA's Influence On The Biotech Market

Table of Contents

Deregulation and Accelerated Approvals

The Trump administration's focus on deregulation significantly influenced the FDA's approach to drug approvals. This manifested in two key areas: "Right to Try" initiatives and changes to the overall drug approval process.

Right to Try Initiatives

"Right to Try" laws, gaining momentum during this period, aimed to increase patient access to experimental treatments outside of traditional clinical trials.

- Increased patient access to experimental treatments: Patients with life-threatening conditions gained access to medications not yet fully approved, potentially offering a lifeline.

- Potential risks and ethical considerations: The lack of rigorous clinical trial data raised concerns about safety and efficacy, prompting ethical debates about informed consent and potential exploitation of vulnerable patients.

- Impact on biotech company investment strategies: While offering potential benefits, the uncertainty surrounding "Right to Try" and its impact on liability influenced how biotech companies allocated resources and designed clinical trials.

Changes to the Drug Approval Process

The Trump FDA prioritized faster drug approvals through accelerated approval pathways, aiming to expedite access to innovative therapies.

- Faster approval times for certain drugs: This resulted in quicker market entry for some medications, particularly those targeting unmet medical needs.

- Increased market entry for innovative therapies: The streamlined approval process encouraged investment in novel therapies, potentially accelerating progress in areas like oncology and rare diseases.

- Potential risks associated with expedited approvals: The speed of approvals raised concerns regarding the thoroughness of safety assessments. Post-market surveillance became increasingly critical to identify and address any unforeseen adverse events. This created a need for robust pharmacovigilance systems.

Impact on Funding and Investment

The regulatory changes under the Trump FDA significantly affected funding and investment in the biotech sector.

Investor Confidence and Market Volatility

The shift towards deregulation and accelerated approvals influenced investor sentiment.

- Increased investment in certain sectors: Sectors benefiting from expedited approvals saw a surge in investment, fueling further innovation.

- Fluctuations in stock prices due to regulatory uncertainty: The changes introduced uncertainty, leading to fluctuations in biotech stock prices as investors weighed the risks and rewards.

- The role of the Trump administration's economic policies on biotech investment: Overall economic policies, such as tax cuts, also influenced the availability of capital for biotech ventures.

Government Funding and Research

Changes in government funding for biotech research and development under the Trump administration had a cascading effect.

- Increased or decreased funding for specific programs: Some programs received increased funding while others experienced cuts, influencing the direction of research efforts.

- Impact on the development of new therapies: Changes in funding directly impacted the feasibility and speed of developing novel therapies.

- Effect on public-private partnerships in biotech: The shifts in government funding affected the landscape of public-private partnerships, altering collaborative research dynamics.

Changes in Regulatory Oversight and Enforcement

The Trump FDA's approach to regulatory oversight and enforcement also underwent significant changes.

Enforcement Actions and Penalties

The administration's stance on enforcement impacted the biotech industry's compliance strategies.

- Increase or decrease in penalties for violations: Variations in the severity of penalties influenced corporate compliance strategies and risk management practices.

- Impact on corporate compliance strategies: Biotech companies adapted their compliance programs in response to the changes in enforcement priorities.

- Shift in FDA priorities and focus areas: The FDA's focus shifted towards certain areas, impacting how companies prioritized compliance efforts.

Transparency and Public Access to Information

Changes in the transparency of FDA decision-making processes had implications for public trust and accountability.

- Increased or decreased public access to data: Variations in the accessibility of data influenced public scrutiny of the FDA's decisions.

- Impact on public trust and accountability: The level of transparency directly influenced public trust in the regulatory agency and its processes.

- Role of lobbying and influence on FDA policies: The influence of lobbying efforts on the Trump FDA's policies remains a subject of ongoing debate and scrutiny.

Conclusion

The Trump administration's influence on the FDA profoundly shaped the biotech market, creating both opportunities and challenges. Accelerated approvals, while speeding up access to new therapies, raised safety concerns. Changes in funding and regulatory oversight significantly impacted investment strategies and corporate behavior within the Trump FDA biotech market. Understanding this legacy is essential for navigating the current complex landscape. Further research into the long-term effects of these changes is crucial for investors, researchers, and policymakers to successfully manage the evolving Trump FDA biotech market and its future implications.

Featured Posts

-

M3 As Autopalya Hetekig Tarto Forgalomkorlatozasok

Apr 23, 2025

M3 As Autopalya Hetekig Tarto Forgalomkorlatozasok

Apr 23, 2025 -

Posthaste Recession Fears Canadian Economists Issue Warning

Apr 23, 2025

Posthaste Recession Fears Canadian Economists Issue Warning

Apr 23, 2025 -

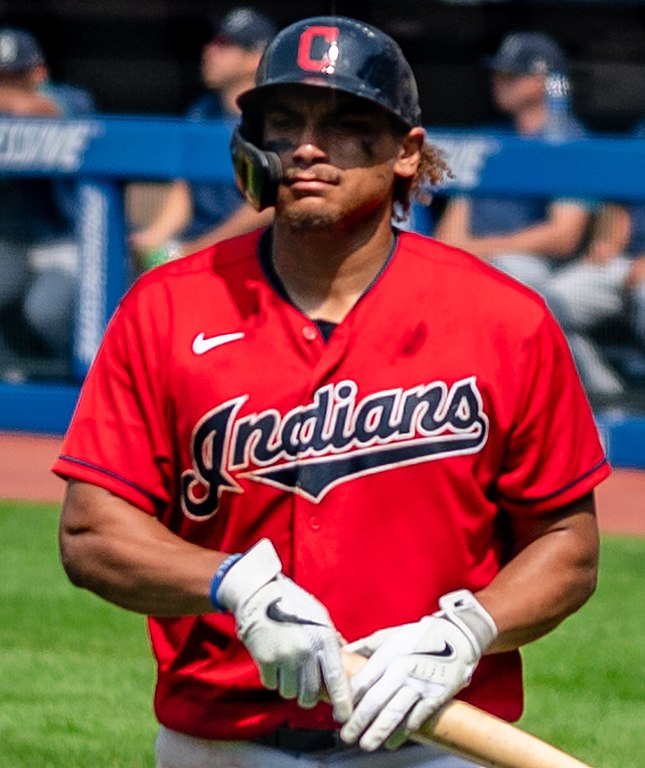

Diamondbacks Victory Josh Naylor Delivers Game Winning Rbi

Apr 23, 2025

Diamondbacks Victory Josh Naylor Delivers Game Winning Rbi

Apr 23, 2025 -

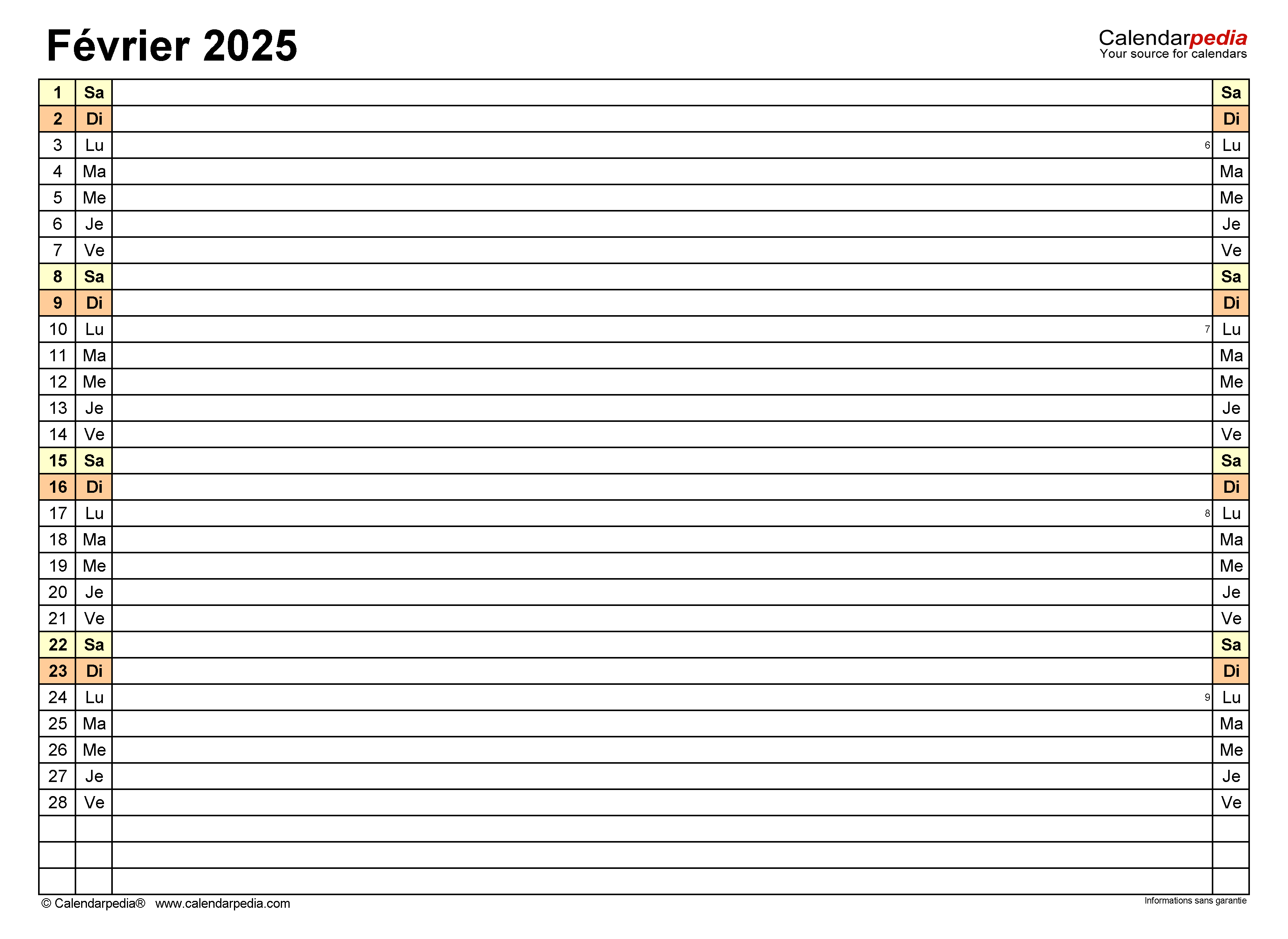

Bfm Bourse Edition Du 17 Fevrier A 15h Et 16h

Apr 23, 2025

Bfm Bourse Edition Du 17 Fevrier A 15h Et 16h

Apr 23, 2025 -

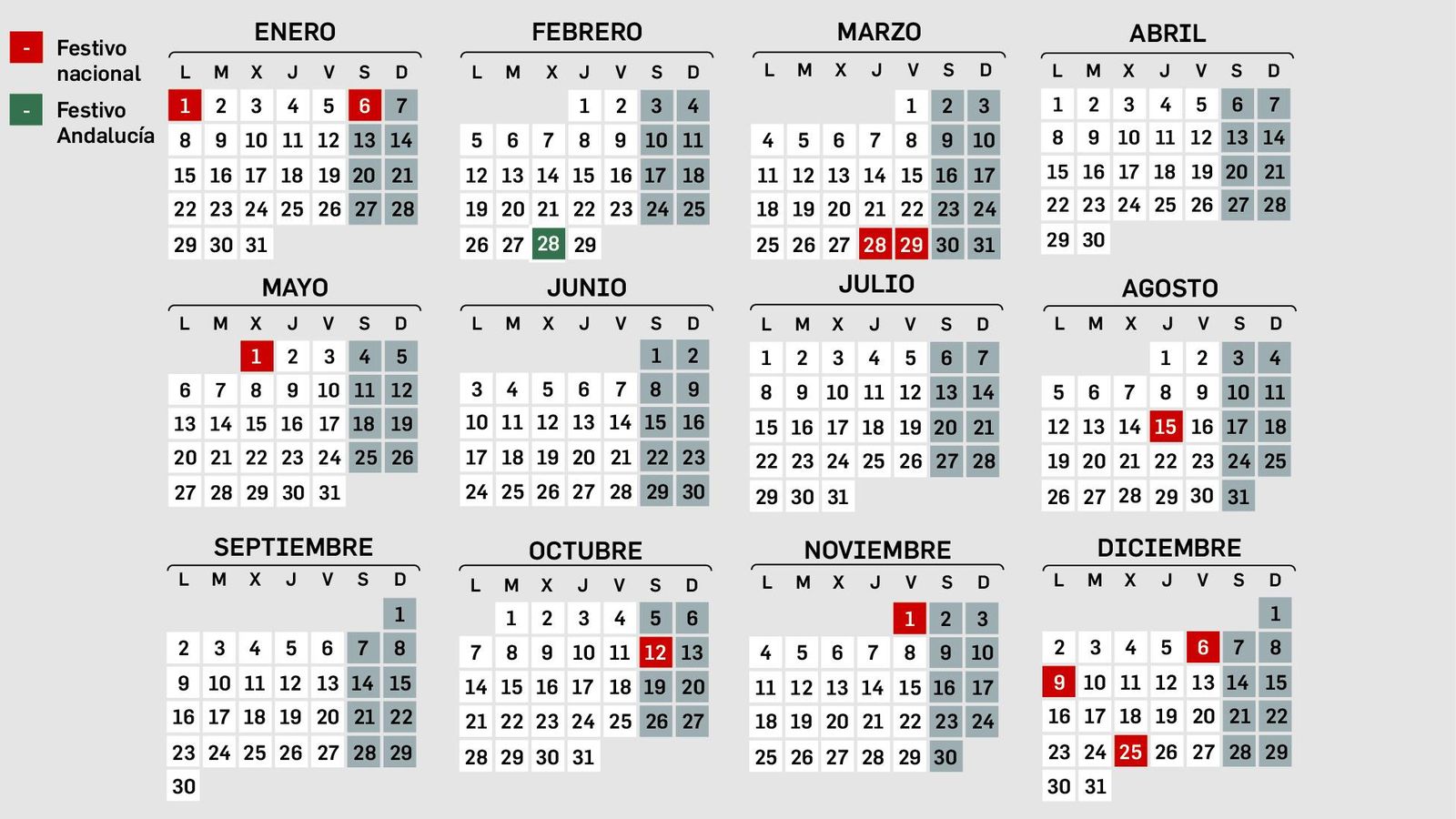

16 5 Millones De Espanoles Disfrutaran De Puente Calendario Laboral Abril 2024

Apr 23, 2025

16 5 Millones De Espanoles Disfrutaran De Puente Calendario Laboral Abril 2024

Apr 23, 2025