The Unsustainable Path? Election Promises And The Growing Deficit Problem

Table of Contents

The Allure of Popular but Costly Promises

Politicians often make appealing promises during election campaigns to garner votes. However, many of these promises come with hefty price tags, contributing significantly to the election promises and the growing deficit problem.

Analyzing the Promises

Common costly election pledges include significant tax cuts, expansion of social programs (like healthcare or retirement benefits), and large-scale infrastructure projects. For example, promises of universal basic income or substantial cuts to income tax rates can dramatically increase government spending without corresponding revenue increases. Similarly, ambitious infrastructure plans, while beneficial, require substantial upfront investment.

- Specific Promises and Costs: A recent election might have included a promise to lower income taxes by 20%, costing the government an estimated $500 billion over five years. Simultaneously, a pledge to expand access to healthcare could add another $200 billion annually to the national budget.

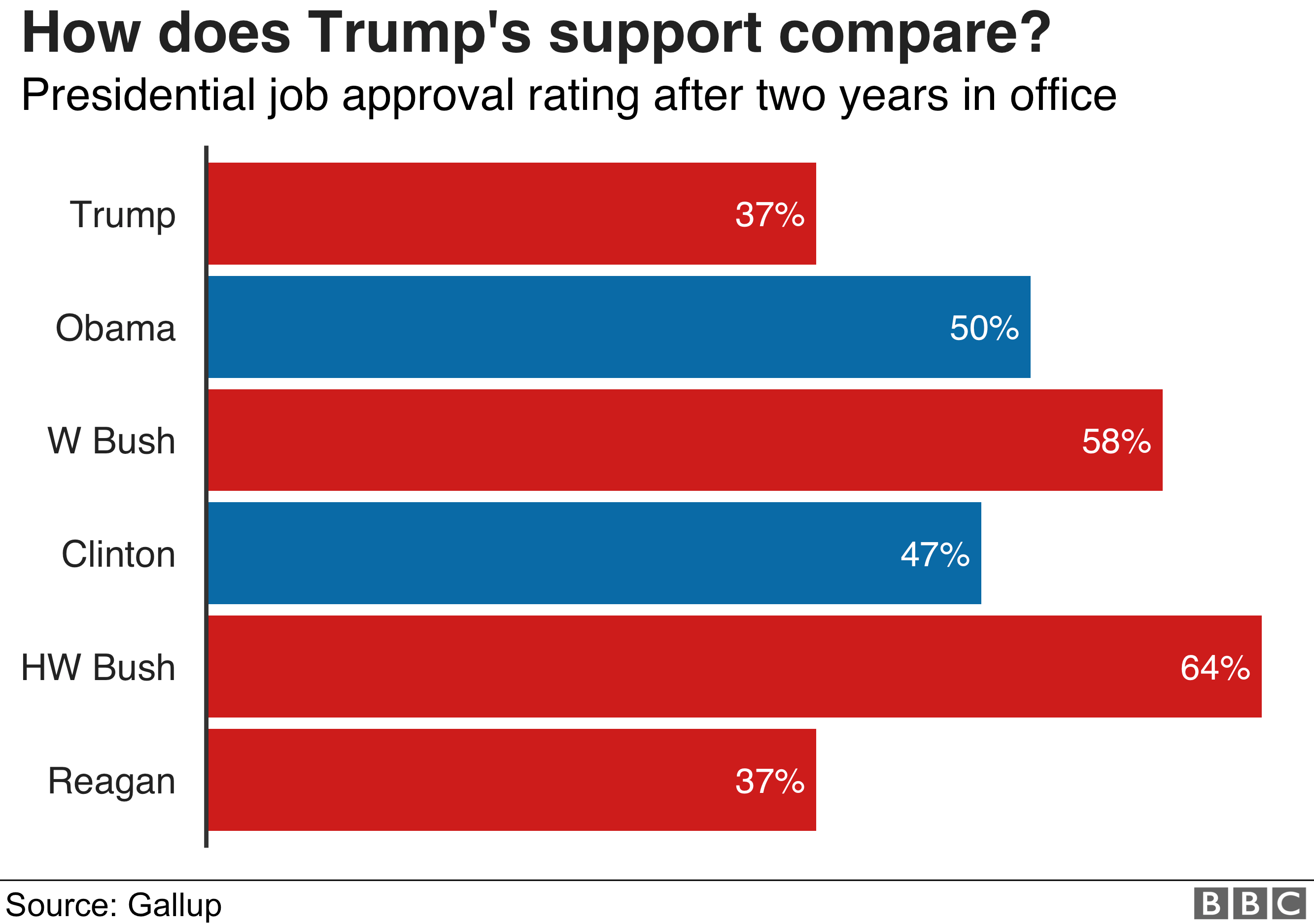

- Short-Term Gains, Long-Term Losses: These promises can offer short-term political advantages, boosting a candidate's popularity. However, the long-term economic consequences of unsustainable spending often outweigh these immediate gains.

- Campaign Financing's Influence: The influence of campaign financing plays a role here. Generous donations from special interest groups can incentivize politicians to make promises that benefit those groups, even if they burden the national budget.

The Impact on Government Spending and Revenue

Election promises significantly impact government spending and revenue streams, exacerbating the election promises and the growing deficit problem.

Increased Spending vs. Revenue Generation

Ambitious pledges often lead to a widening gap between government spending and revenue generation.

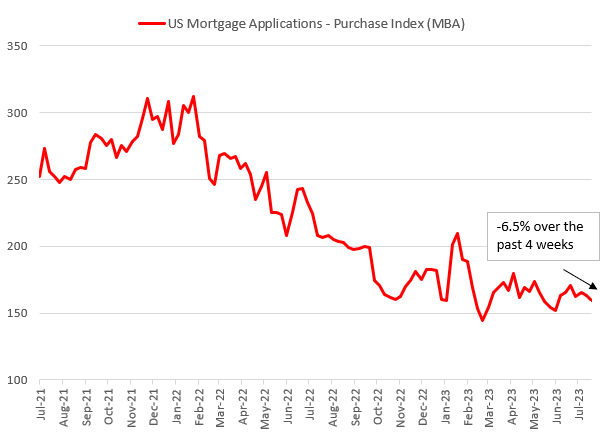

- Tax Cuts' Effects on Revenue: Tax cuts, while popular, reduce government revenue, making it harder to fund existing programs and new initiatives. The projected revenue loss needs careful consideration against the potential economic stimulus effects.

- Sustainability of Increased Social Programs: Expanding social programs without corresponding revenue increases is fiscally unsustainable. The long-term cost of these programs needs to be factored into future budgets.

- Implications for Future Budget Allocations: Uncontrolled spending now leaves less room for crucial investments in education, infrastructure, and other vital areas in the future.

The Long-Term Economic Consequences

The unchecked growth of the national deficit due to unrealistic election promises has severe long-term economic consequences.

Debt Accumulation and Interest Payments

A persistently high deficit leads to accumulating national debt, resulting in higher interest payments.

- Compounding Interest: The interest on the national debt compounds over time, meaning that the total cost increases exponentially.

- Impact of Higher Interest Rates: Higher interest rates make future borrowing more expensive, further straining the national budget. This can lead to a vicious cycle of increased debt and higher interest payments.

- Effects on Inflation and Economic Growth: High national debt can contribute to inflation, eroding purchasing power and hindering economic growth.

Potential Solutions and Fiscal Responsibility

Addressing the election promises and the growing deficit problem requires a multi-pronged approach focusing on fiscal responsibility.

Strategies for Reducing the Deficit

Several strategies can help reduce the deficit and promote sustainable economic growth.

- Realistic and Sustainable Solutions: Implementing tax reforms that broaden the tax base while lowering rates for certain sectors can boost revenue without stifling economic activity. Spending reviews and targeted cuts in inefficient programs are also crucial.

- Political Challenges: Implementing these solutions often faces significant political hurdles. Compromise and bipartisan cooperation are essential for successful deficit reduction strategies.

- Examples from Other Countries: Learning from successful deficit reduction strategies employed by other countries can provide valuable insights. For instance, analyzing the approaches taken by countries that have successfully navigated periods of high debt can provide valuable lessons.

Conclusion

The link between unrealistic election promises and the growing deficit problem is undeniable. The unsustainable nature of current trends threatens long-term economic stability. Understanding the implications of costly campaign pledges on government spending, revenue, and the national debt is crucial for responsible governance. Ignoring the election promises and the growing deficit problem will lead to further economic instability. Let's demand fiscal responsibility from our leaders and work towards a more financially secure nation by holding them accountable for the economic consequences of their campaign promises. Contact your elected officials, research the topic further, and support organizations advocating for fiscal responsibility to make a difference. Let’s move away from unsustainable practices and towards a future built on fiscal prudence.

Featured Posts

-

Significant Events Donald Trumps Presidency On April 23 2025

Apr 25, 2025

Significant Events Donald Trumps Presidency On April 23 2025

Apr 25, 2025 -

Import Tariffs A Major Hurdle For A Montreal Based Guitar Company

Apr 25, 2025

Import Tariffs A Major Hurdle For A Montreal Based Guitar Company

Apr 25, 2025 -

Lotus Eletre Suv 230 000 Price Tag Explained

Apr 25, 2025

Lotus Eletre Suv 230 000 Price Tag Explained

Apr 25, 2025 -

Brutal Honesty Life Changing Results A 30 Stone Weight Loss Story

Apr 25, 2025

Brutal Honesty Life Changing Results A 30 Stone Weight Loss Story

Apr 25, 2025 -

Chinas Enduring Strength Xis Vision For A Protracted Conflict With Trumps Legacy

Apr 25, 2025

Chinas Enduring Strength Xis Vision For A Protracted Conflict With Trumps Legacy

Apr 25, 2025

Latest Posts

-

Are We Normalizing Disaster Betting The Los Angeles Wildfires Example

Apr 26, 2025

Are We Normalizing Disaster Betting The Los Angeles Wildfires Example

Apr 26, 2025 -

The China Factor Analyzing The Difficulties Faced By Premium Car Brands

Apr 26, 2025

The China Factor Analyzing The Difficulties Faced By Premium Car Brands

Apr 26, 2025 -

Gambling On Catastrophe The Los Angeles Wildfires And The Future Of Disaster Betting

Apr 26, 2025

Gambling On Catastrophe The Los Angeles Wildfires And The Future Of Disaster Betting

Apr 26, 2025 -

Navigating The Chinese Market The Struggles Of Bmw Porsche And Other Auto Brands

Apr 26, 2025

Navigating The Chinese Market The Struggles Of Bmw Porsche And Other Auto Brands

Apr 26, 2025 -

The Growing Market Of Betting On Natural Disasters A Case Study Of The La Wildfires

Apr 26, 2025

The Growing Market Of Betting On Natural Disasters A Case Study Of The La Wildfires

Apr 26, 2025