This New Investing Idea Isn't Right For Your Retirement Plan

Table of Contents

The recent surge in popularity of meme stocks and cryptocurrencies has many individuals wondering if these high-risk investments are the key to early retirement. While the potential for quick riches is alluring, the reality is that many new investment ideas are fundamentally unsuitable for the long-term, stable growth needed for a secure retirement. This article will explore why some popular "new" investment approaches should be avoided in your retirement planning, and how to build a truly secure retirement portfolio.

The Volatility Factor: Why Risk Tolerance Matters in Retirement Planning

The Difference Between Short-Term Gains and Long-Term Stability

Retirement investing isn't about chasing the next big thing; it's about preserving capital and generating steady, predictable returns. Short-term gains in volatile investments might look impressive, but they often come with significant downside risks. Retirement planning demands a focus on long-term stability and consistent growth, not high-risk, high-reward ventures.

- Example 1: The rollercoaster ride of cryptocurrency prices illustrates the inherent volatility. A substantial investment could plummet in value, severely impacting your retirement savings just when you need them most.

- Example 2: Meme stocks, driven by social media hype, often experience dramatic price swings, leaving investors vulnerable to significant losses.

- Emotional Toll: The constant ups and downs of volatile markets can take a significant emotional toll, especially for retirees who rely on their investments for income. The stress of managing unpredictable fluctuations can negatively impact your overall well-being.

- Consistent Income: Retirement requires a reliable income stream. High-risk investments offer no guarantee of consistent returns, leaving you vulnerable to financial instability during your retirement years.

Assessing Your Personal Risk Tolerance

A successful retirement investment strategy is tailored to your individual risk tolerance and time horizon. Understanding your risk tolerance is crucial in making informed investment decisions.

- Risk Tolerance Levels:

- Conservative: Prioritizes capital preservation and low risk, often favoring low-risk investments like government bonds and high-quality dividend stocks.

- Moderate: Balances risk and return, diversifying investments across various asset classes with a mix of stocks and bonds.

- Aggressive: Focuses on higher growth potential with higher risk, often investing a larger proportion in stocks and potentially alternative assets.

- Investment Options: Conservative investors might focus on Certificates of Deposit (CDs) and government bonds, while moderate investors might diversify across a broader range of stocks and bonds. Aggressive investors might consider investing in emerging markets or growth stocks.

- Risk Tolerance Assessment: Several online tools and questionnaires can help you assess your personal risk tolerance. Consulting a financial advisor is highly recommended for personalized guidance.

The Time Horizon: Why Retirement Requires a Long-Term Perspective

The Importance of Time in the Market (Not Timing the Market)

The power of compounding is crucial for long-term investment success. Consistently investing over a long period allows your investments to grow exponentially, benefiting from the reinvestment of earnings. This is why "time in the market," not "timing the market," is paramount.

- Long-Term Growth: Historically, diversified, low-risk investments have demonstrated consistent long-term growth, outpacing inflation and providing substantial returns over time.

- Market Timing Dangers: Attempting to time the market—buying low and selling high—is notoriously difficult and often results in significant losses. It’s nearly impossible to consistently predict market fluctuations accurately.

The Sequence of Returns Risk

Negative returns close to retirement can severely impact your retirement income. The sequence of returns risk highlights the danger of experiencing market downturns just as you begin withdrawing funds.

- Impact of Downturns: A significant market downturn shortly before or during retirement can drastically deplete your retirement nest egg, forcing you to reduce spending or even run out of funds prematurely.

- Protecting Principal: Protecting your principal in the years leading up to retirement is critical. Conservative investment strategies that emphasize capital preservation become increasingly important as retirement nears.

Diversification: The Cornerstone of a Secure Retirement Portfolio

Spreading Your Risk Across Asset Classes

Diversification is a cornerstone of sound retirement planning. By spreading your investments across various asset classes, you mitigate the risk of significant losses from any single investment.

- Asset Classes:

- Stocks: Offer higher growth potential but come with higher volatility.

- Bonds: Provide stability and income but generally offer lower returns than stocks.

- Real Estate: Can offer diversification and potential for rental income.

- Alternative Investments: Include commodities, precious metals, and others, offering diversification but often with higher risk.

- Reducing Volatility: Diversification helps reduce the overall volatility of your portfolio, smoothing out the impact of market fluctuations.

Avoiding Concentrated Investments

Over-reliance on a single investment or sector is extremely risky. A downturn in that specific area could severely damage your entire portfolio.

- Pitfalls of Concentration: Investing heavily in a single company's stock, for example, exposes you to significant risk if that company underperforms.

- Professional Advice: A financial advisor can help you create a diversified portfolio tailored to your individual needs and risk tolerance, ensuring you are appropriately diversified and not overexposed to any single asset class.

Conclusion

Building a secure retirement requires a long-term perspective, a well-defined risk tolerance, and a diversified investment strategy. Chasing short-term gains with trendy, volatile investments like cryptocurrencies or meme stocks can severely jeopardize your retirement security. Remember, consistent, low-risk investments, coupled with a well-defined plan, provide a much more reliable path to a comfortable and financially secure retirement.

Don't let the allure of risky, trendy investments derail your retirement plan. Consult a financial advisor today to build a secure and sustainable retirement strategy. [Link to a financial advisor finder website]

Featured Posts

-

Damiano David Maneskin Solo Debut Funny Little Fears Everything We Know

May 18, 2025

Damiano David Maneskin Solo Debut Funny Little Fears Everything We Know

May 18, 2025 -

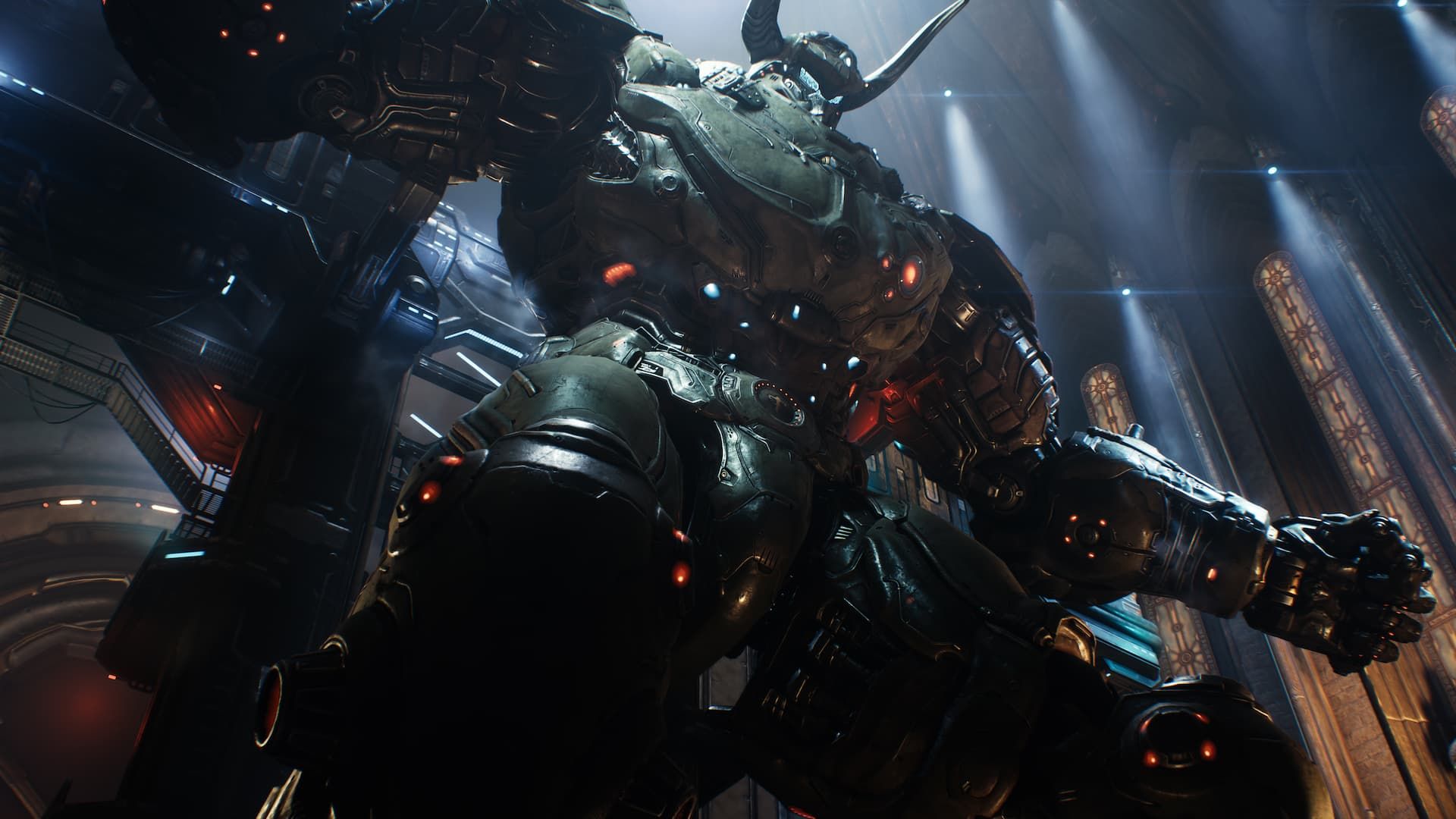

Doom The Dark Ages Why It Appeals To Diverse Players

May 18, 2025

Doom The Dark Ages Why It Appeals To Diverse Players

May 18, 2025 -

Recent Developments Kanye Wests Relationship With His Kids

May 18, 2025

Recent Developments Kanye Wests Relationship With His Kids

May 18, 2025 -

Where To Invest Mapping The Countrys Thriving Business Centers

May 18, 2025

Where To Invest Mapping The Countrys Thriving Business Centers

May 18, 2025 -

Investment Opportunities Locating The Countrys Booming Business Regions

May 18, 2025

Investment Opportunities Locating The Countrys Booming Business Regions

May 18, 2025

Latest Posts

-

Mlb Daily Fantasy Baseball May 8th Picks Sleepers And Avoid

May 18, 2025

Mlb Daily Fantasy Baseball May 8th Picks Sleepers And Avoid

May 18, 2025 -

Post Only Fans Launch Amanda Bynes Spotted Out And About

May 18, 2025

Post Only Fans Launch Amanda Bynes Spotted Out And About

May 18, 2025 -

Amanda Bynes Seen With Friend After Only Fans Launch

May 18, 2025

Amanda Bynes Seen With Friend After Only Fans Launch

May 18, 2025 -

Amanda Bynes Steps Out New Only Fans Content Revealed

May 18, 2025

Amanda Bynes Steps Out New Only Fans Content Revealed

May 18, 2025 -

Amanda Bynes Post Only Fans Public Appearance

May 18, 2025

Amanda Bynes Post Only Fans Public Appearance

May 18, 2025