This New Investment: A Critical Look For Retirement Investors

Table of Contents

Understanding the Risks and Rewards of Index Funds

Index funds are a type of mutual fund or exchange-traded fund (ETF) designed to track a specific market index, such as the S&P 500. They aim to mirror the performance of the index, offering broad diversification across numerous companies. This simple investment strategy eliminates the need for active stock picking, often resulting in lower management fees.

Potential returns from index funds are tied to the overall market performance. Historically, the stock market has delivered positive returns over the long term, making index funds attractive for long-term investors aiming for retirement security. However, it's crucial to understand the inherent risks:

- Market Volatility: Index funds are susceptible to market downturns. During economic recessions, their value can decrease significantly.

- Inflation Risk: The purchasing power of your investment can erode if returns fail to outpace inflation.

- Interest Rate Changes: Interest rate hikes can impact the overall market performance and subsequently affect index fund returns.

- Liquidity: Index funds are generally highly liquid, meaning you can easily buy or sell them. However, during extreme market volatility, liquidity can temporarily decrease.

- Fees and Expenses: While index funds typically have lower fees than actively managed funds, there are still associated costs, including expense ratios.

- Tax Implications: Capital gains earned from selling index funds are subject to capital gains taxes. Tax implications can vary based on your individual circumstances and holding period.

Comparing Index Funds to Traditional Retirement Options

Index funds offer a compelling alternative to traditional retirement investment options. Let's compare them to some common choices:

| Investment Option | Returns | Risk | Liquidity | Fees |

|---|---|---|---|---|

| Index Funds | Market-linked | Moderate to High | High | Low to Moderate |

| 401(k)s | Varies | Varies | Moderate to Low | Varies |

| IRAs | Varies | Varies | Moderate to Low | Varies |

| Annuities | Guaranteed (some) | Low to Moderate | Low | Moderate to High |

| Bonds | Fixed income | Low to Moderate | Moderate | Low to Moderate |

Risk Tolerance Comparison: Index funds are generally considered a moderate-to-high risk investment, suitable for investors with a longer time horizon and higher risk tolerance. Bonds and annuities offer lower risk but potentially lower returns.

Diversification Benefits: Index funds inherently provide diversification across multiple companies within a specific market segment. However, a truly diversified portfolio may need additional asset classes beyond index funds.

Long-Term Growth Potential: Historically, index funds have demonstrated long-term growth potential, making them a suitable option for retirement planning, but past performance doesn't guarantee future results.

Practical Considerations for Retirement Investors

Successfully incorporating index funds into your retirement strategy requires careful planning:

- Time Horizon: The longer your time horizon until retirement, the greater your ability to withstand market fluctuations.

- Asset Allocation: Determine an appropriate asset allocation strategy that balances index funds with other investments to manage risk. Consider your risk tolerance and time horizon when deciding the allocation.

- Investment Amount: Determine the appropriate amount to invest in index funds based on your retirement goals and overall financial situation.

- Diversification Strategies: Diversify your portfolio by including different asset classes such as bonds, real estate, and alternative investments alongside index funds.

- Seeking Professional Advice: Consulting a financial advisor can provide personalized guidance tailored to your circumstances and risk tolerance.

Making Informed Decisions About Index Funds for Retirement

Index funds offer a potentially valuable tool for retirement planning, providing diversification and generally low fees. However, it's crucial to acknowledge the inherent risks associated with market volatility and inflation. Remember that past performance is not indicative of future results.

Before including index funds in your retirement investment strategy, carefully consider your risk tolerance, time horizon, and overall financial goals. Research thoroughly, and consider consulting a qualified financial advisor to determine the suitability of this retirement investment for your unique circumstances. Making informed decisions regarding this new investment opportunity is crucial for achieving a secure and comfortable retirement.

Featured Posts

-

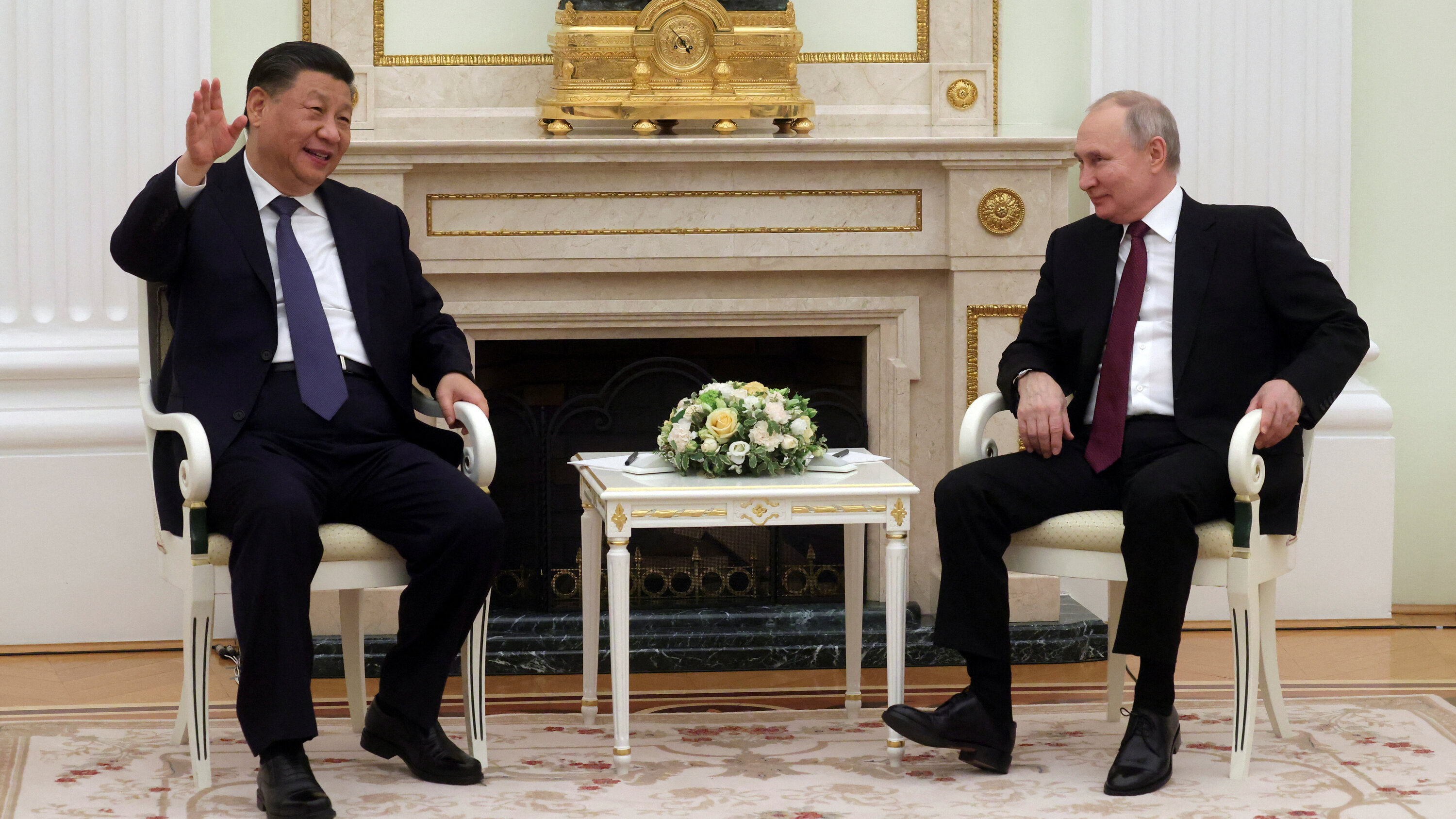

Trumps China Trip Offer A Meeting With Xi Jinping On The Horizon

May 18, 2025

Trumps China Trip Offer A Meeting With Xi Jinping On The Horizon

May 18, 2025 -

Profit Taking In Gold Market After Positive Us China Trade News

May 18, 2025

Profit Taking In Gold Market After Positive Us China Trade News

May 18, 2025 -

Cassie Speaks Out Refuting Assault Claims And Sharing Good News

May 18, 2025

Cassie Speaks Out Refuting Assault Claims And Sharing Good News

May 18, 2025 -

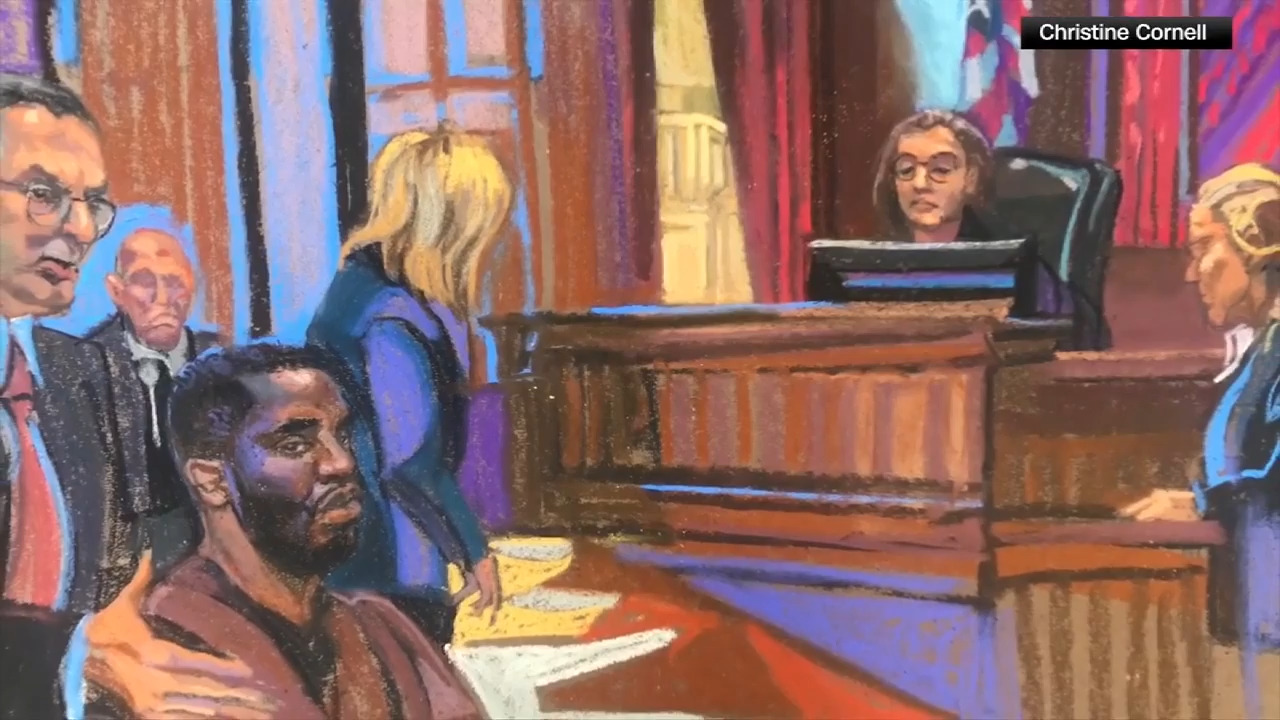

Sean Combs Trial Update Cassie Ventura And Dawn Richard Testimony Highlights

May 18, 2025

Sean Combs Trial Update Cassie Ventura And Dawn Richard Testimony Highlights

May 18, 2025 -

Een Op De Zes Blijft Vuurwerk Kopen Ondanks Dreigend Verbod

May 18, 2025

Een Op De Zes Blijft Vuurwerk Kopen Ondanks Dreigend Verbod

May 18, 2025

Latest Posts

-

Jersey Mikes Subs Galesburg Grand Opening

May 18, 2025

Jersey Mikes Subs Galesburg Grand Opening

May 18, 2025 -

New Jersey Mikes Subs Location Opens In Galesburg

May 18, 2025

New Jersey Mikes Subs Location Opens In Galesburg

May 18, 2025 -

Galesburg Welcomes Jersey Mikes Subs

May 18, 2025

Galesburg Welcomes Jersey Mikes Subs

May 18, 2025 -

Post 2025 Nfl Draft Analysts Take On The New England Patriots

May 18, 2025

Post 2025 Nfl Draft Analysts Take On The New England Patriots

May 18, 2025 -

Patriots Future Nfl Analyst Weighs In On Post 2025 Draft Outlook

May 18, 2025

Patriots Future Nfl Analyst Weighs In On Post 2025 Draft Outlook

May 18, 2025