Three-Day Slump On Amsterdam Stock Exchange: Market Down 11%

Table of Contents

Keywords: Amsterdam Stock Exchange, Stock Market Crash, Market Slump, AEX Index, Dutch Economy, Investment Losses, Market Volatility, Financial Crisis, Trading Losses, Investing in Amsterdam

The Amsterdam Stock Exchange (AEX) suffered a significant blow this week, experiencing an unprecedented three-day slump that resulted in an 11% market decline. This dramatic drop has sent shockwaves through the Dutch economy and raised serious concerns among investors. This article delves into the causes of this sharp downturn, analyzes the impacted sectors, and explores the potential ramifications for the future. Understanding the factors behind this market slump is crucial for investors navigating the complexities of the Amsterdam Stock Exchange.

Causes of the Amsterdam Stock Exchange Slump

Global Economic Uncertainty

The recent downturn on the Amsterdam Stock Exchange is not an isolated incident but reflects broader global economic anxieties. Several interconnected factors contributed to this market slump:

-

Rising inflation globally: Persistently high inflation rates in many countries erode purchasing power and increase the cost of borrowing, impacting business profitability and investor confidence. This uncertainty directly translates into decreased investment in the Amsterdam Stock Exchange.

-

Geopolitical instability and its impact on global markets: The ongoing war in Ukraine, coupled with escalating tensions in other regions, creates significant geopolitical uncertainty. This instability disrupts supply chains, increases energy prices, and dampens investor sentiment, leading to market volatility and declines, including those seen on the AEX.

-

Increased interest rates impacting investor confidence: Central banks worldwide are raising interest rates to combat inflation. While necessary to curb inflation, higher interest rates increase borrowing costs for businesses and reduce the attractiveness of riskier assets, contributing to the market slump.

-

Supply chain disruptions and their effect on business performance: Lingering supply chain issues continue to plague global businesses, leading to increased costs, production delays, and reduced profitability. These disruptions directly impact company performance and investor confidence in the Amsterdam Stock Exchange.

-

Example: The recent release of unexpectedly weak economic data from the Eurozone further fueled concerns about a potential recession, triggering a sell-off in the Amsterdam Stock Exchange and exacerbating the three-day slump.

Sector-Specific Downturns

The recent market slump wasn't evenly distributed across all sectors. Some sectors were hit harder than others:

-

Technology: The technology sector experienced a significant decline, with several tech giants seeing double-digit percentage losses. This downturn reflects concerns about the future profitability of tech companies, especially amidst rising interest rates and slowing economic growth.

-

Energy: Fluctuating oil and gas prices, driven by geopolitical tensions and supply chain constraints, significantly impacted energy companies listed on the AEX.

-

Finance: The financial sector also felt the pressure, with banks and insurance companies facing increased scrutiny and reduced investor confidence.

-

Percentage Losses (Example):

- Technology: -15%

- Energy: -12%

- Finance: -8%

These are illustrative examples; actual percentages may vary.

Impact on Key Sectors of the Dutch Economy

The three-day slump on the Amsterdam Stock Exchange has significant implications for various sectors of the Dutch economy:

Financial Services

- Increased pressure on banks' profitability due to reduced trading activity and potential loan defaults.

- Reduced investment in financial innovation and expansion.

- Potential job losses within the financial services sector.

Energy Sector

- Increased volatility in energy prices impacting Dutch energy companies' profitability.

- Potential delays in investments in renewable energy projects.

- Uncertainty surrounding energy security and supply.

Technology Sector

- Reduced funding for Dutch tech startups.

- Potential layoffs in the tech industry.

- Decreased investor confidence in the Dutch tech sector's growth potential.

Investor Sentiment and Future Outlook

Analysis of Investor Behavior

The market slump prompted a wave of selling by many investors, leading to increased market volatility. However, some investors chose to hold onto their investments, believing the decline presents a buying opportunity.

Expert Opinions

Financial analysts predict continued market volatility in the short term. Several economists suggest that while a full-blown financial crisis is unlikely, the Dutch economy will face challenges in the coming months. "The current situation calls for caution and careful portfolio management," stated [Name of Financial Analyst], a leading expert at [Financial Institution].

Potential Recovery Strategies

Investors are exploring several strategies:

- Diversification: Diversifying investments across different asset classes and geographical regions to mitigate risk.

- Value Investing: Seeking out undervalued companies with strong long-term growth potential.

- Defensive Strategies: Focusing on less volatile investments, such as bonds and gold.

Conclusion

The three-day slump on the Amsterdam Stock Exchange, resulting in an 11% market decline, highlights the significant impact of global economic uncertainty and sector-specific downturns. The slump’s impact on key sectors of the Dutch economy underscores the interconnectedness of global markets. While the future outlook remains uncertain, understanding these factors is crucial for navigating the Amsterdam Stock Exchange. Stay informed about the fluctuating Amsterdam Stock Exchange and understand the risks involved in investing. Monitor market trends and consult with financial advisors before making any investment decisions related to the Amsterdam Stock Exchange. Consider diversifying your portfolio to mitigate potential future market slumps on the Amsterdam Stock Exchange.

Featured Posts

-

Crisi Moda Come I Dazi Di Trump Hanno Colpito I Brand

May 25, 2025

Crisi Moda Come I Dazi Di Trump Hanno Colpito I Brand

May 25, 2025 -

Annie Kilners Engagement Ring A Look At The Jewellery Following Kyle Walker Rumours

May 25, 2025

Annie Kilners Engagement Ring A Look At The Jewellery Following Kyle Walker Rumours

May 25, 2025 -

Woody Allen Abuse Allegations Sean Penn Expresses Doubt

May 25, 2025

Woody Allen Abuse Allegations Sean Penn Expresses Doubt

May 25, 2025 -

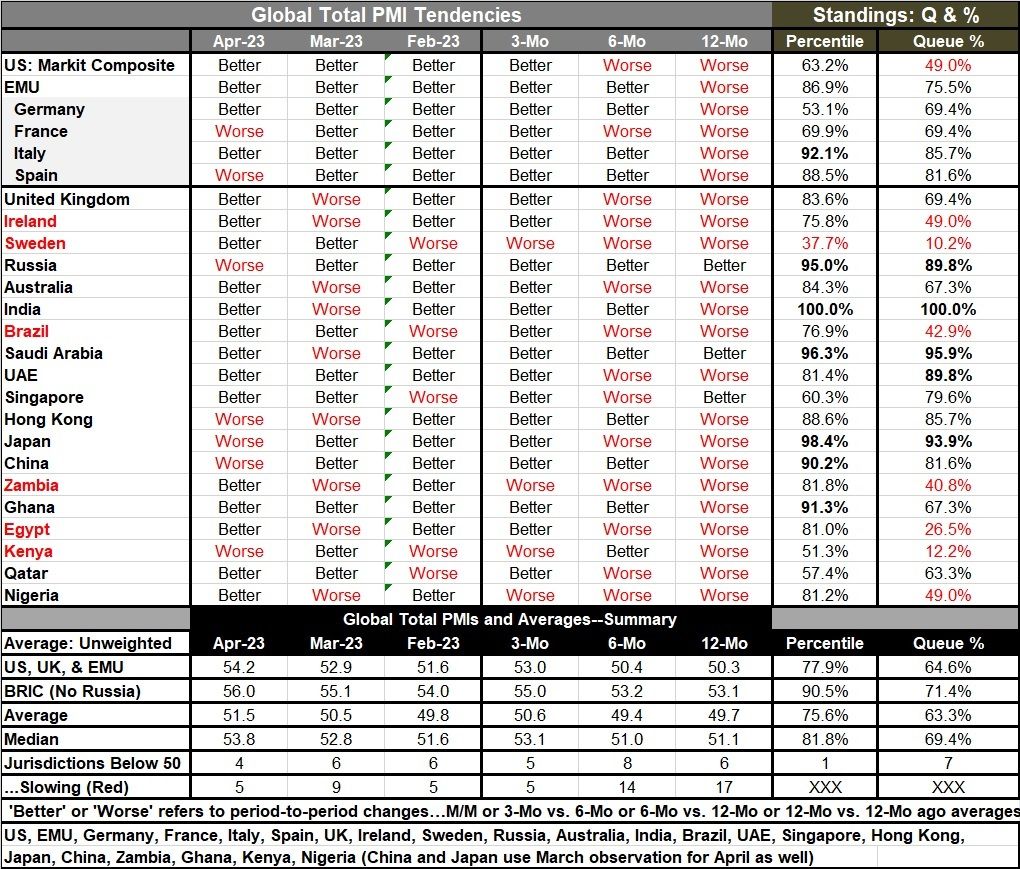

Pmi Strength Boosts Dow Joness Gradual Climb

May 25, 2025

Pmi Strength Boosts Dow Joness Gradual Climb

May 25, 2025 -

Avrupa Borsalari Buguenkue Kapanis Fiyatlari Ve Analizi

May 25, 2025

Avrupa Borsalari Buguenkue Kapanis Fiyatlari Ve Analizi

May 25, 2025

Latest Posts

-

Analysis Of Sean Penns Stance On Dylan Farrows Accusations Against Woody Allen

May 25, 2025

Analysis Of Sean Penns Stance On Dylan Farrows Accusations Against Woody Allen

May 25, 2025 -

The Sean Penn Woody Allen Dylan Farrow Controversy A Deeper Look

May 25, 2025

The Sean Penn Woody Allen Dylan Farrow Controversy A Deeper Look

May 25, 2025 -

Woody Allen Sexual Assault Allegations Sean Penns Doubts

May 25, 2025

Woody Allen Sexual Assault Allegations Sean Penns Doubts

May 25, 2025 -

Understanding Frank Sinatras Four Marriages Wives Love And Legacy

May 25, 2025

Understanding Frank Sinatras Four Marriages Wives Love And Legacy

May 25, 2025 -

Sean Penns Response To Dylan Farrows Sexual Assault Claims Against Woody Allen

May 25, 2025

Sean Penns Response To Dylan Farrows Sexual Assault Claims Against Woody Allen

May 25, 2025