Tracking The Net Asset Value (NAV) Of Amundi MSCI World II UCITS ETF USD Hedged Dist

Table of Contents

Methods for Tracking Amundi MSCI World II UCITS ETF USD Hedged Dist NAV

Tracking the NAV of the Amundi MSCI World II UCITS ETF USD Hedged Dist is straightforward, with several reliable methods available.

Official Sources for NAV Data

The most accurate and reliable NAV data comes directly from official sources:

- Amundi's official website: Amundi, the ETF provider, publishes daily NAV information on their website. Look for a section dedicated to ETF factsheets or performance data. [Insert Placeholder Link to Amundi Website Here]. This is the definitive source for NAV figures.

- Major financial data providers: Bloomberg Terminal, Refinitiv Eikon, and similar professional platforms provide real-time and historical NAV data for a wide range of ETFs, including the Amundi MSCI World II UCITS ETF USD Hedged Dist. However, access to these services often requires a paid subscription.

- Your brokerage account: Most reputable brokerage firms display the current NAV of your held ETFs directly within your account's portfolio summary. Check your account statements or online portfolio view for this information.

Utilizing Third-Party Financial Websites and Apps

Many free, publicly accessible websites and apps offer ETF NAV data:

- Popular finance platforms: Yahoo Finance, Google Finance, and others provide readily available NAV information for many ETFs. While generally reliable, be aware that there may be slight delays in updating the data compared to official sources.

- Benefits and drawbacks of third-party platforms: The advantage of these platforms is their free accessibility and ease of use. However, they might not always be as up-to-the-minute as official sources, and the data's accuracy can vary.

Understanding NAV Calculation and Factors Affecting it

The NAV of an ETF like the Amundi MSCI World II UCITS ETF USD Hedged Dist is calculated as follows: (Total Asset Value - Liabilities) / Number of Outstanding Shares.

-

Factors impacting NAV: Several factors influence the daily NAV:

- Market fluctuations: Changes in the prices of the underlying assets within the ETF directly impact its NAV.

- Currency exchange rates: The "USD Hedged" aspect is crucial here. Fluctuations in exchange rates between the underlying assets' currencies and the US dollar will affect the hedged NAV. A strong dollar might result in a lower NAV (relative to an unhedged version), and vice-versa.

- Dividends: When underlying holdings pay dividends, these are usually reinvested, impacting the total asset value and consequently, the NAV.

-

NAV vs. Market Price: The NAV represents the intrinsic value of the ETF's holdings, while the market price is the actual price at which the ETF is traded. These can differ slightly due to supply and demand factors.

Importance of Regular NAV Monitoring for Investment Decisions

Regular monitoring of the Amundi MSCI World II UCITS ETF USD Hedged Dist NAV is essential for effective investment management.

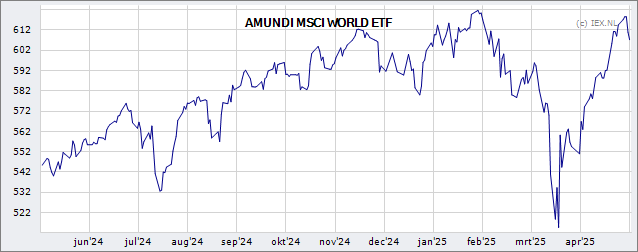

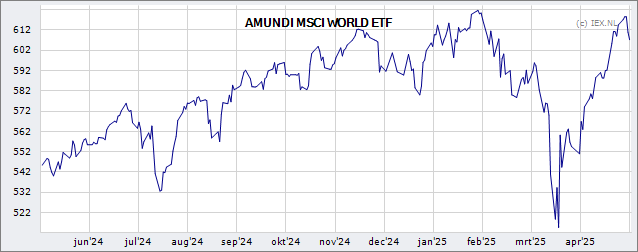

Assessing Investment Performance

- Performance tracking: Tracking NAV changes over time allows you to accurately assess the performance of your investment in the ETF.

- Return calculation: You can use the NAV data to calculate your returns, either on a periodic basis or since your initial investment.

Identifying Potential Risks and Opportunities

- Significant NAV fluctuations: Large upward or downward movements in the NAV can signal underlying market shifts or potential risks.

- Connecting to broader market trends: Analyzing NAV changes in the context of broader economic events and global market trends can provide valuable insights into future investment opportunities.

Informed Buy/Sell Decisions

- Buy/sell decisions: Monitoring the NAV can inform your decisions about buying or selling the ETF, particularly when considering dollar-cost averaging or other investment strategies.

- Dollar-cost averaging: This strategy involves investing a fixed amount of money at regular intervals, regardless of the NAV. Tracking NAV helps determine if the current price represents a good entry point.

Conclusion: Stay Informed on Your Amundi MSCI World II UCITS ETF USD Hedged Dist Investment

Effectively tracking the NAV of your Amundi MSCI World II UCITS ETF USD Hedged Dist investment is vital for informed decision-making. This can be achieved through official sources like Amundi's website, major financial data providers, your brokerage account, or third-party platforms. Remember that while these sources are helpful, always refer to official sources for the most accurate data. Regularly monitor your Amundi MSCI World II ETF NAV, track your MSCI World II ETF NAV, and understand the factors impacting the USD Hedged ETF NAV to optimize your investment strategy and manage risk effectively. Start actively tracking your Amundi MSCI World II UCITS ETF USD Hedged Dist NAV today to make the most of your investment.

Featured Posts

-

Golz Und Brumme Erfolgsgeschichte Essener Leistungstraeger

May 24, 2025

Golz Und Brumme Erfolgsgeschichte Essener Leistungstraeger

May 24, 2025 -

Tracking The Net Asset Value Nav Of Amundi Msci World Ii Ucits Etf Dist

May 24, 2025

Tracking The Net Asset Value Nav Of Amundi Msci World Ii Ucits Etf Dist

May 24, 2025 -

Leeds Contact Kyle Walker Peters Is A Transfer On The Cards

May 24, 2025

Leeds Contact Kyle Walker Peters Is A Transfer On The Cards

May 24, 2025 -

Crystal Palaces Pursuit Of Free Agent Kyle Walker Peters

May 24, 2025

Crystal Palaces Pursuit Of Free Agent Kyle Walker Peters

May 24, 2025 -

Walker Peters To Crystal Palace Free Transfer Rumours Intensify

May 24, 2025

Walker Peters To Crystal Palace Free Transfer Rumours Intensify

May 24, 2025

Latest Posts

-

M56 Road Closure Live Traffic Updates And Diversion Routes

May 24, 2025

M56 Road Closure Live Traffic Updates And Diversion Routes

May 24, 2025 -

M56 Traffic Delays Live Updates Following Serious Crash

May 24, 2025

M56 Traffic Delays Live Updates Following Serious Crash

May 24, 2025 -

M56 Crash Live Traffic Updates And Long Queues

May 24, 2025

M56 Crash Live Traffic Updates And Long Queues

May 24, 2025 -

Annie Kilner Addresses Allegations Public Statement And Social Media

May 24, 2025

Annie Kilner Addresses Allegations Public Statement And Social Media

May 24, 2025 -

Allegations Of Poisoning Emerge Annie Kilner Speaks Out

May 24, 2025

Allegations Of Poisoning Emerge Annie Kilner Speaks Out

May 24, 2025