Traders Pare Bets On BOE Cuts: Pound Strengthens After UK Inflation Data

Table of Contents

UK Inflation Data Surprises Markets

The latest UK inflation figures revealed a stubbornly high rate of inflation, defying analysts' predictions and significantly impacting market expectations. The Office for National Statistics reported an inflation rate of [Insert Actual Inflation Rate Here]%, exceeding the consensus forecast of [Insert Consensus Forecast Here]%.

- Inflation Rate: [Insert Actual Inflation Rate Here]%

- Previous Month's Data: [Insert Previous Month's Inflation Rate Here]%

- Market Consensus: [Insert Consensus Forecast Here]%

- Impact on Inflation Expectations: The higher-than-expected inflation figure has reignited concerns about persistent inflationary pressures within the UK economy, suggesting that the fight against inflation is far from over.

This unexpectedly high inflation rate significantly alters the landscape for the Bank of England's monetary policy decisions. The central bank now faces a more challenging task in balancing the need to curb inflation with the risks of stifling economic growth.

Reduced Expectations of BOE Rate Cuts

The unexpected inflation data triggered a dramatic shift in market sentiment concerning future BOE interest rate cuts. Bets on further rate reductions have been significantly scaled back.

- Percentage Decrease in Bets: Estimates suggest a [Insert Percentage Here]% decrease in bets on BOE rate cuts in the coming months.

- Trading Activity: Analysis of trading activity in interest rate futures contracts shows a clear move away from expectations of further easing.

- Financial Instruments: Traders utilize various financial instruments, such as short-term interest rate futures, to speculate on the future direction of interest rates. The recent price movements in these instruments reflect the reduced expectation of BOE rate cuts.

- Analyst Quotes: [Insert quotes from reputable financial analysts commenting on the reduced expectation of BOE rate cuts].

Several factors beyond the immediate inflation data contribute to this shift. Positive economic growth forecasts, although tentative, have also played a role in tempering expectations of aggressive BOE rate cuts.

Pound Strengthens Against Major Currencies

The reduced expectation of BOE rate cuts has been directly correlated with the pound's recent strengthening against major global currencies. The market interprets less likely rate cuts as a sign of a stronger UK economy and a more attractive investment destination.

- Exchange Rate Movements: The GBP/USD exchange rate rose by [Insert Percentage or Points Here]%, while the GBP/EUR increased by [Insert Percentage or Points Here]%. The GBP/JPY also saw an appreciation of [Insert Percentage or Points Here]%.

- Illustrative Charts: [Insert relevant charts showing the pound's appreciation against major currencies].

- Impact on Exporters/Importers: A stronger pound makes UK exports more expensive and imports cheaper, potentially impacting the UK trade balance.

- Future Implications: The potential for further pound appreciation remains, although unforeseen economic factors could act as countervailing forces.

Implications for UK Economic Outlook

This shift in market sentiment carries significant implications for the UK's economic outlook.

- Consumer Spending/Borrowing: Higher interest rates might curb consumer spending and borrowing, potentially slowing economic growth.

- Business Investment/Economic Growth: Uncertainty surrounding interest rates might dampen business investment decisions, affecting long-term economic growth.

- Long-Term Prospects: The long-term implications depend largely on the trajectory of inflation and the Bank of England's response.

While a stronger pound benefits consumers through cheaper imports, it simultaneously poses challenges for UK exporters who now face reduced competitiveness in international markets. The overall effect remains to be seen, requiring a nuanced and careful assessment of the interplay between inflation, interest rates, and currency fluctuations.

Conclusion

The unexpectedly high UK inflation data has significantly altered market expectations, leading to a reduction in bets on BOE rate cuts and a subsequent strengthening of the pound. This development presents a complex interplay of factors impacting the UK economy, necessitating close monitoring of inflation, interest rates, and currency fluctuations. To stay informed about future developments regarding BOE interest rate decisions and their impact on the pound and UK economy, stay updated on BOE rate cut predictions and monitor the latest on BOE interest rate changes. Follow our analysis on future BOE rate cuts for insightful commentary and expert opinions.

Featured Posts

-

The Surprising Truth About How The Who Got Their Name

May 23, 2025

The Surprising Truth About How The Who Got Their Name

May 23, 2025 -

Sse Announces 3 Billion Reduction In Spending Plan

May 23, 2025

Sse Announces 3 Billion Reduction In Spending Plan

May 23, 2025 -

Vybz Kartel Accepts Trinidad Government Restrictions

May 23, 2025

Vybz Kartel Accepts Trinidad Government Restrictions

May 23, 2025 -

The Who Re Hires Zak Starkey Drummer Returns Days After Dismissal

May 23, 2025

The Who Re Hires Zak Starkey Drummer Returns Days After Dismissal

May 23, 2025 -

Poraka Od Ronaldo Do Kho Lund Po Inspiriranata Proslava

May 23, 2025

Poraka Od Ronaldo Do Kho Lund Po Inspiriranata Proslava

May 23, 2025

Latest Posts

-

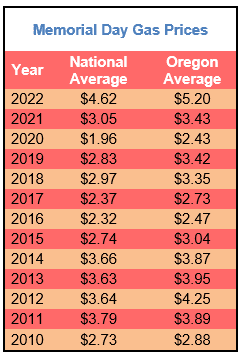

Low Gas Prices Forecast For Memorial Day Weekend

May 23, 2025

Low Gas Prices Forecast For Memorial Day Weekend

May 23, 2025 -

Memorial Day Gas Prices A Decade Low Prediction

May 23, 2025

Memorial Day Gas Prices A Decade Low Prediction

May 23, 2025 -

Memorial Day Gas Prices A Look At The Expected Low Costs

May 23, 2025

Memorial Day Gas Prices A Look At The Expected Low Costs

May 23, 2025 -

Arrows Damien Darhk Would Neal Mc Donough Return To The Dc Universe

May 23, 2025

Arrows Damien Darhk Would Neal Mc Donough Return To The Dc Universe

May 23, 2025 -

Actor Neal Mc Donough Takes On Pro Bull Riding In New Film

May 23, 2025

Actor Neal Mc Donough Takes On Pro Bull Riding In New Film

May 23, 2025