Traders Pare Bets On BOE Rate Cuts As Pound Rises After UK Inflation Data

Table of Contents

UK Inflation Data Surprises Markets

The recently released UK inflation data surprised analysts and market participants alike. Instead of the anticipated decline or stagnation, inflation figures came in significantly higher than forecasts, suggesting a more persistent inflationary pressure within the UK economy. This unexpected strength has major implications for inflation expectations and the BOE's upcoming monetary policy decisions.

- CPI figures: The Consumer Price Index (CPI) rose to X%, exceeding the predicted Y% and the previous month's Z%. This substantial increase signals a stronger inflationary pressure than previously anticipated.

- RPI figures: The Retail Price Index (RPI), another key inflation measure, also showed a similar upward trend, reaching X%, compared to the forecast of Y% and the prior month's Z%.

- Core inflation data: Core inflation, which excludes volatile energy and food prices, also showed an increase, further indicating broad-based inflationary pressures.

- Contributing factors: This unexpected rise is largely attributable to sustained increases in energy and food prices, along with other contributing factors such as supply chain disruptions and robust consumer demand.

The implications of this stronger-than-expected inflation data are far-reaching. It suggests that the BOE’s battle against inflation is far from over and that further interest rate hikes may be necessary to curb rising prices.

Pound Strengthens Against Major Currencies

The release of the unexpectedly high inflation data sparked an immediate strengthening of the pound against major global currencies. This positive correlation between improved inflation data and currency appreciation highlights the market's renewed confidence in the UK economy's resilience. A stronger-than-anticipated inflation figure often signals a more robust economy, capable of weathering inflationary pressures. This, in turn, attracts foreign investment and boosts demand for the pound.

- GBP/USD exchange rate change: The GBP/USD exchange rate saw a noticeable increase of X%, reflecting the pound's appreciation against the US dollar.

- GBP/EUR exchange rate change: Similarly, the GBP/EUR exchange rate rose by Y%, indicating a strengthening of the pound against the euro.

- Other significant currency pair movements: The pound also gained ground against other major currencies such as the Japanese yen and the Australian dollar.

This strengthening of the pound reflects a shift in market sentiment, with investors betting on a more resilient UK economy and a potential continuation of the BOE's monetary tightening cycle.

Reduced Expectations of BOE Rate Cuts

The robust inflation data has significantly reduced market expectations of future BOE rate cuts. Previously, many analysts anticipated that the BOE might begin easing its monetary policy in the coming months. However, the unexpectedly high inflation figures have made this scenario less likely, leading to a recalibration of market pricing for future interest rate decisions.

- Changes in market pricing of future BOE rate decisions: Market pricing now suggests a lower probability of rate cuts and a greater likelihood of further interest rate hikes or at least a prolonged period of holding rates steady.

- Impact on UK government bond yields: The reduced expectation of rate cuts has led to a rise in UK government bond yields, as investors demand higher returns to compensate for the increased risk of holding bonds in an environment of persistent inflation.

- Impact on mortgage rates and borrowing costs: This shift in expectations will likely translate into higher mortgage rates and increased borrowing costs for consumers and businesses across the UK.

This change impacts various financial instruments, including gilts and government bonds, influencing their yields and overall market value. The implications are widespread, affecting both investors and borrowers.

Trader Behavior and Market Sentiment

Traders reacted swiftly to the inflation data, rapidly adjusting their positions to reflect the reduced likelihood of BOE rate cuts. This involved unwinding positions betting on lower interest rates and taking positions that benefit from a stronger pound and higher bond yields. The overall market sentiment shifted from a cautious optimism towards a more assertive stance, reflecting renewed confidence in the UK economy's ability to manage inflation. However, uncertainties remain. While the stronger-than-expected inflation data is positive in terms of economic strength, persistent high inflation could still lead to economic slowdown or even recession.

The potential risks include further inflationary pressures, supply chain disruptions, and geopolitical instability. Traders are closely monitoring these factors and adjusting their strategies accordingly.

Conclusion: Understanding the Impact of UK Inflation Data on BOE Rate Cut Bets

In conclusion, the unexpected UK inflation data has had a profound impact on market expectations surrounding future BOE rate cuts. The stronger-than-anticipated figures led to a significant strengthening of the pound and a marked decrease in bets on future interest rate reductions. The connection between inflation data, currency movements, and trader behavior is clearly evident, underscoring the importance of monitoring economic indicators for informed decision-making. It is crucial to continue monitoring upcoming UK economic data releases and BOE policy announcements to make well-informed predictions regarding BOE interest rate decisions and GBP trading strategies. Stay informed about the UK inflation outlook and make sound decisions regarding your pound sterling trading and BOE interest rate predictions.

Featured Posts

-

Could A New Record Be Set For The Trans Australia Run

May 22, 2025

Could A New Record Be Set For The Trans Australia Run

May 22, 2025 -

Remont Pivdennogo Mostu Prozorist Ta Kontrol Zatrat

May 22, 2025

Remont Pivdennogo Mostu Prozorist Ta Kontrol Zatrat

May 22, 2025 -

Rockies Vs Tigers 8 6 Upset Shows Promise For Detroit

May 22, 2025

Rockies Vs Tigers 8 6 Upset Shows Promise For Detroit

May 22, 2025 -

Home Depot Stock Impact Of Tariffs On Q Quarter Earnings

May 22, 2025

Home Depot Stock Impact Of Tariffs On Q Quarter Earnings

May 22, 2025 -

Slot Admits Liverpools Fortune Enrique Offers Alisson Analysis

May 22, 2025

Slot Admits Liverpools Fortune Enrique Offers Alisson Analysis

May 22, 2025

Latest Posts

-

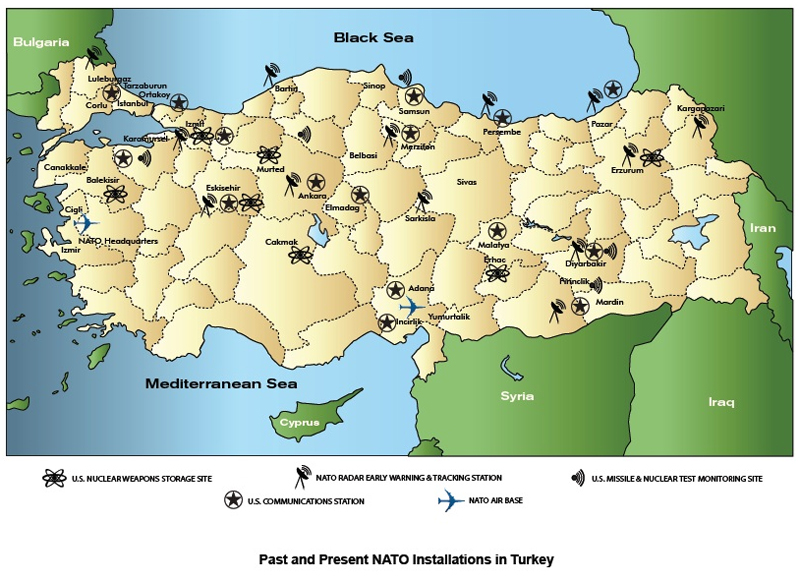

Vstup Ukrayini Do Nato Zapobigannya Podalshiy Rosiyskiy Agresiyi Chi Ilyuziya

May 22, 2025

Vstup Ukrayini Do Nato Zapobigannya Podalshiy Rosiyskiy Agresiyi Chi Ilyuziya

May 22, 2025 -

Tuerkiye Ve Italya Ya Ayni Goerev Nato Planini Paylastilar

May 22, 2025

Tuerkiye Ve Italya Ya Ayni Goerev Nato Planini Paylastilar

May 22, 2025 -

Naslidki Vidmovi Ukrayini U Vstupi Do Nato Posilennya Rosiyskoyi Agresiyi

May 22, 2025

Naslidki Vidmovi Ukrayini U Vstupi Do Nato Posilennya Rosiyskoyi Agresiyi

May 22, 2025 -

Nato Protiv Rossii Patrushev O Planakh Zakhvata Kaliningrada

May 22, 2025

Nato Protiv Rossii Patrushev O Planakh Zakhvata Kaliningrada

May 22, 2025 -

Ispanya Ve Nato Elektrik Kesintileri Uezerine Kritik Goeruesme

May 22, 2025

Ispanya Ve Nato Elektrik Kesintileri Uezerine Kritik Goeruesme

May 22, 2025