Trump's Tax Bill: A Look At The Challenges And Prospects

Table of Contents

Intended Economic Prospects of the Trump Tax Bill

The Trump tax bill, officially known as the Tax Cuts and Jobs Act (TCJA), aimed to stimulate economic growth through supply-side economics. This theory posits that tax cuts, particularly for corporations and high-income earners, incentivize investment, job creation, and ultimately, faster economic growth.

Stimulating Economic Growth

The TCJA's central strategy was a significant reduction in the corporate tax rate, from 35% to 21%. Proponents argued this would unleash business investment, leading to increased productivity and higher GDP growth.

- Supply-side theory: Lower taxes incentivize businesses to invest more, hire more workers, and expand operations.

- Projected GDP growth: While initial forecasts predicted significant GDP growth, the actual impact remains a subject of ongoing debate amongst economists. Some studies suggest a modest positive effect, while others found minimal or even negative impacts.

- Business investment and job creation: The bill also included provisions for expensing, allowing businesses to immediately deduct the cost of new equipment, theoretically boosting investment. However, the resulting increase in job creation has been less pronounced than initially projected.

Increased Investment and Wages

Lower corporate tax rates were anticipated to translate into increased investment and, consequently, higher wages for workers.

- Business investment: While some businesses did increase investment, others used the tax savings for stock buybacks, which benefit shareholders but do not directly lead to increased job creation or wage growth.

- Wages: The relationship between corporate tax cuts and wage increases is complex and debated. While some sectors saw wage increases, the overall impact on wages has been less dramatic than predicted.

- Challenges to the theory: Critics argued that the benefits of the tax cuts disproportionately flowed to shareholders and high-income earners, rather than trickling down to workers in the form of higher wages.

Challenges and Criticisms of the Trump Tax Bill

Despite the stated goals of economic growth and increased investment, the Trump tax bill faced significant criticism and challenges.

Income Inequality and its Exacerbation

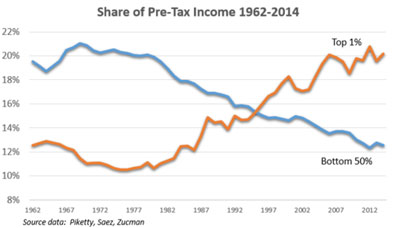

One of the most prominent criticisms of the TCJA is its contribution to income inequality. Tax cuts disproportionately benefited high-income earners and corporations, widening the gap between the rich and the poor.

- Regressive nature: The tax cuts offered larger percentage reductions to higher-income individuals, further concentrating wealth at the top.

- Impact on the national debt: The substantial tax cuts significantly increased the national debt, raising concerns about long-term fiscal sustainability.

- Studies on increased inequality: Numerous studies by organizations like the Congressional Budget Office and the Tax Policy Center have documented the increase in income inequality following the passage of the TCJA.

Long-Term Fiscal Sustainability Concerns

The TCJA's impact on the federal budget deficit and the national debt represents a major long-term challenge.

- Increased budget deficit: The tax cuts led to a significant increase in the federal budget deficit, adding trillions to the national debt over the next decade.

- Government spending and social programs: The growing national debt puts pressure on government spending, potentially impacting social programs and future economic stability.

- Debate on "pay-for-itself" claims: The assertion that the tax cuts would "pay for themselves" through increased economic activity has been widely disputed, with most economic analysis showing the opposite.

Political and Social Impact

The Trump tax bill's passage was fraught with political controversy, and its impact extended beyond purely economic considerations.

- Political fallout: The bill's passage was highly partisan, with no Democratic support in either the House or the Senate.

- Social impact: The bill's effects varied across different demographics, impacting lower-income families differently than higher-income families.

- Public opinion: Public opinion on the TCJA was highly divided, reflecting the partisan nature of the debate.

Conclusion: Evaluating the Legacy of Trump's Tax Bill

The Trump tax bill, while aiming to boost economic growth, sparked significant debate regarding its long-term effects. While some argue that it stimulated investment and job creation, critics point to increased income inequality and a ballooning national debt as major drawbacks. The actual economic impact remains a subject of ongoing study and analysis, highlighting the complexity of tax policy and its multifaceted implications. Understanding the complexities of Trump's tax bill requires careful consideration of its multifaceted impact. Further research into the long-term effects of the Tax Cuts and Jobs Act is crucial for informed policymaking and public discourse.

Featured Posts

-

Activite Des Cordistes A Nantes Impact De La Construction De Tours

May 22, 2025

Activite Des Cordistes A Nantes Impact De La Construction De Tours

May 22, 2025 -

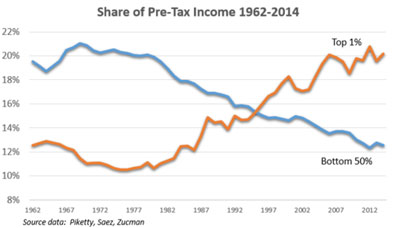

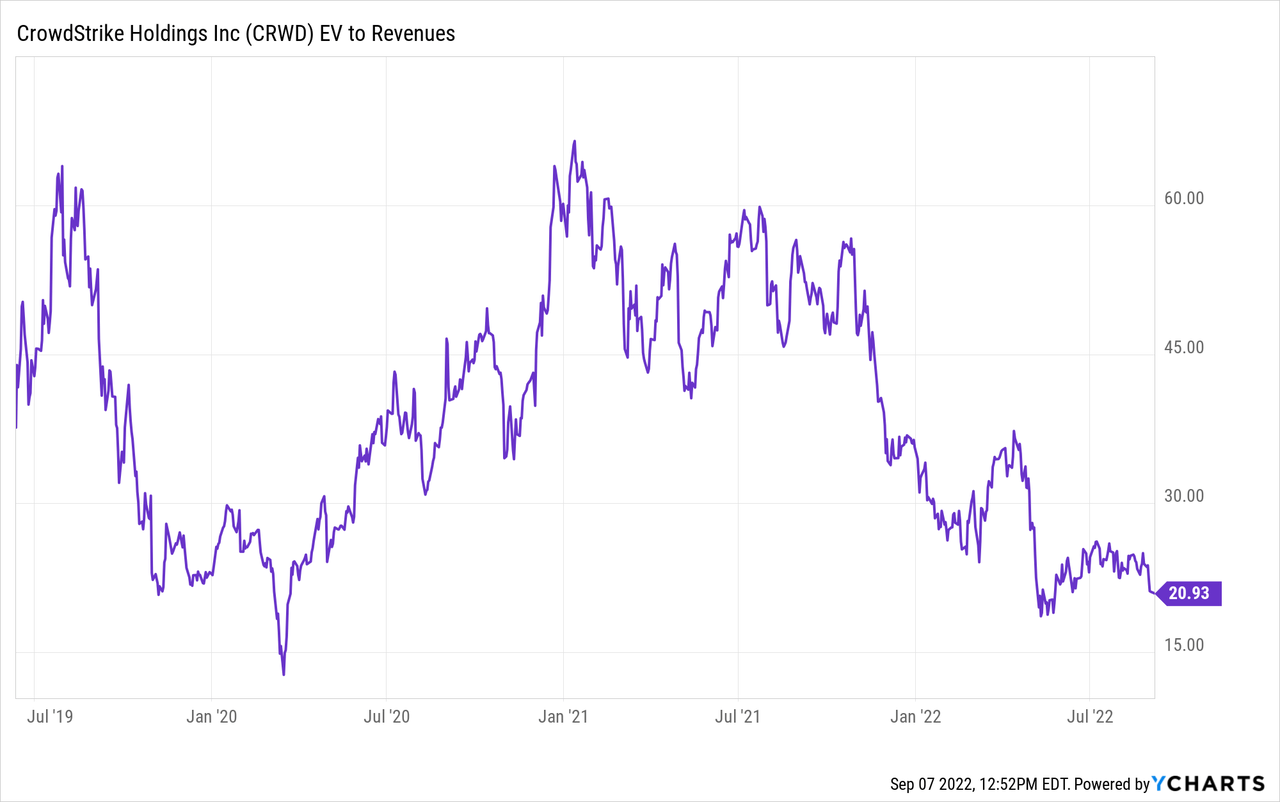

Understanding Core Weaves Crwv Tuesday Stock Increase

May 22, 2025

Understanding Core Weaves Crwv Tuesday Stock Increase

May 22, 2025 -

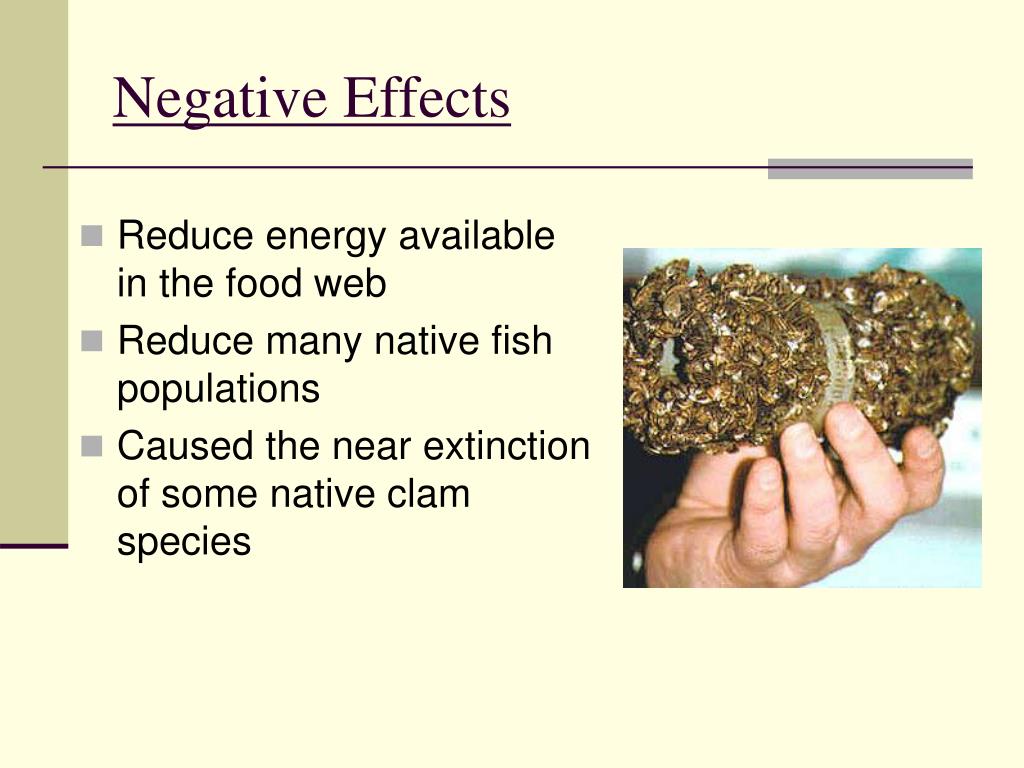

Dealing With A Zebra Mussel Invasion A Casper Residents Story

May 22, 2025

Dealing With A Zebra Mussel Invasion A Casper Residents Story

May 22, 2025 -

Half Dome Wins Abn Group Victoria Pitch A New Era Of Design

May 22, 2025

Half Dome Wins Abn Group Victoria Pitch A New Era Of Design

May 22, 2025 -

The Love Monsters Grip How Negative Self Talk Impacts Relationships And Well Being

May 22, 2025

The Love Monsters Grip How Negative Self Talk Impacts Relationships And Well Being

May 22, 2025

Latest Posts

-

Interstate 83 Closed After Produce Truck Accident

May 22, 2025

Interstate 83 Closed After Produce Truck Accident

May 22, 2025 -

Produce Truck Rollover Shuts Down Part Of I 83

May 22, 2025

Produce Truck Rollover Shuts Down Part Of I 83

May 22, 2025 -

Produce Hauling Truck Accident On Interstate 83

May 22, 2025

Produce Hauling Truck Accident On Interstate 83

May 22, 2025 -

Fed Ex Truck Inferno Shuts Down Route 283 In Lancaster County

May 22, 2025

Fed Ex Truck Inferno Shuts Down Route 283 In Lancaster County

May 22, 2025 -

Route 283 Closed Due To Fed Ex Truck Fire In Lancaster County Pa

May 22, 2025

Route 283 Closed Due To Fed Ex Truck Fire In Lancaster County Pa

May 22, 2025