U.S. Dollar: Worst Start Since Nixon? Analyzing The First 100 Days

Table of Contents

Key Factors Affecting the U.S. Dollar's Performance

Inflation and Monetary Policy

The U.S. dollar's performance is intrinsically linked to inflation and the Federal Reserve's monetary policy response. Persistent inflationary pressures in 2023 and early 2024 forced the Fed to implement aggressive interest rate hikes and quantitative tightening (QT).

- Inflation Data: The Consumer Price Index (CPI) remained stubbornly high throughout much of 2023, exceeding the Federal Reserve's target rate of 2%. Specific data points will need to be inserted here reflecting actual inflation figures from 2024.

- Fed Rate Decisions: The Fed responded with several interest rate increases, aiming to cool down the economy and curb inflation. These decisions directly influence the dollar's attractiveness as an investment, impacting its exchange rate against other currencies. Details regarding the specifics of interest rate changes throughout the first 100 days of 2024 should be included here.

- Impact on Dollar's Value: While higher interest rates initially attract foreign investment, boosting the dollar's value, prolonged periods of high rates can stifle economic growth, potentially undermining the currency in the long run. The impact of the Fed's actions on the dollar's value against major currencies (such as the Euro, the British pound, and the Japanese Yen) needs to be quantified with specific data points. The effect of quantitative tightening, the process of reducing the Fed's balance sheet, on the dollar also needs detailed explanation and analysis here.

Geopolitical Events and Global Uncertainty

Geopolitical instability significantly influences currency markets. The ongoing war in Ukraine, rising energy prices stemming from global conflicts and sanctions, and increasing tensions in other regions have created a climate of uncertainty.

- Ukraine War and Energy Prices: The war in Ukraine has severely disrupted global energy markets, pushing up prices and creating inflationary pressures worldwide. This uncertainty has affected investor confidence, impacting the demand for the U.S. dollar, traditionally viewed as a safe-haven asset.

- Other Geopolitical Factors: [Insert specific geopolitical events impacting the dollar from early 2024 here, including details of their impact]. The interplay between these events and the value of the dollar requires in-depth analysis.

- Impact on Currency Volatility: The heightened geopolitical risk has led to increased volatility in currency markets, making it challenging to predict the dollar's future trajectory. This volatility directly influences the exchange rate and investor behavior in relation to the U.S. dollar.

Strength of Other Major Currencies

The U.S. dollar's value isn't determined in isolation. The relative strength of other major currencies, such as the Euro, the British pound, and the Japanese Yen, significantly impacts its exchange rate.

- Euro: [Insert details on the Euro's performance against the dollar in the first 100 days of 2024, including specific exchange rate data]. Explain reasons for its strength or weakness during this period.

- British Pound: [Insert details on the British pound's performance against the dollar in the first 100 days of 2024, including specific exchange rate data]. Explain reasons for its strength or weakness during this period.

- Japanese Yen: [Insert details on the Japanese Yen's performance against the dollar in the first 100 days of 2024, including specific exchange rate data]. Explain reasons for its strength or weakness during this period.

- Currency Pair Analysis: A detailed analysis of specific currency pairs (USD/EUR, USD/GBP, USD/JPY) and their fluctuations is crucial here to assess the dollar’s relative strength.

Comparing the Current Situation to the Nixon Shock

The Context of 1971

The Nixon shock of 1971 marked a pivotal moment in global monetary history. President Nixon ended the Bretton Woods system, abandoning the gold standard and allowing the U.S. dollar to float freely against other currencies.

- Bretton Woods System and Gold Standard: The Bretton Woods system established a fixed exchange rate regime, with the U.S. dollar pegged to gold. This system collapsed under the pressure of growing U.S. trade deficits and inflation.

- Nixon's Actions and Immediate Impact: Nixon's decision to close the gold window and devalue the dollar had profound and immediate effects on global currency markets, leading to significant volatility and uncertainty. Detailed analysis of the events leading up to this decision is needed here to establish its context.

Similarities and Differences

Comparing the current situation to the period following the Nixon shock requires a careful analysis of similarities and differences.

- Similarities: Both periods feature significant inflationary pressures and uncertainty in global markets. Both periods also involve a weakening of the dollar relative to other major currencies. Detailed comparison of these elements between the two timeframes needs to be explicitly stated here.

- Differences: While both periods show inflationary pressures and uncertainty, the underlying causes and the global economic landscape differ significantly. The globalized nature of the current economy and the interconnectedness of financial markets create a different environment than in 1971. Explanation of specific economic and political factors differentiating the two periods is essential here.

Conclusion

The U.S. dollar's performance during the first 100 days of 2024 has been significantly impacted by a confluence of factors: high inflation, aggressive monetary policy, geopolitical instability, and the relative strength of other major currencies. While parallels exist with the period following the Nixon shock, such as high inflation and currency market volatility, crucial differences in the global economic landscape and underlying causes must be acknowledged. Whether the current situation represents a similarly momentous shift in the global monetary order remains to be seen. The outlook for the U.S. dollar remains uncertain, influenced by ongoing geopolitical tensions and the evolving economic landscape. Stay updated on the performance of the U.S. dollar and its impact on global markets by following reputable financial news sources for in-depth analysis and insights.

Featured Posts

-

Update Search Continues For Missing British Paralympian In Las Vegas

Apr 29, 2025

Update Search Continues For Missing British Paralympian In Las Vegas

Apr 29, 2025 -

Hagia Sophia A 1600 Year History Of Survival

Apr 29, 2025

Hagia Sophia A 1600 Year History Of Survival

Apr 29, 2025 -

Russias Military Posture A Growing Threat To European Stability

Apr 29, 2025

Russias Military Posture A Growing Threat To European Stability

Apr 29, 2025 -

Asted Lfn Abwzby 19 Nwfmbr Mwedna

Apr 29, 2025

Asted Lfn Abwzby 19 Nwfmbr Mwedna

Apr 29, 2025 -

Koezuti Porsche Legendas F1 Motor Teljesitmenye

Apr 29, 2025

Koezuti Porsche Legendas F1 Motor Teljesitmenye

Apr 29, 2025

Latest Posts

-

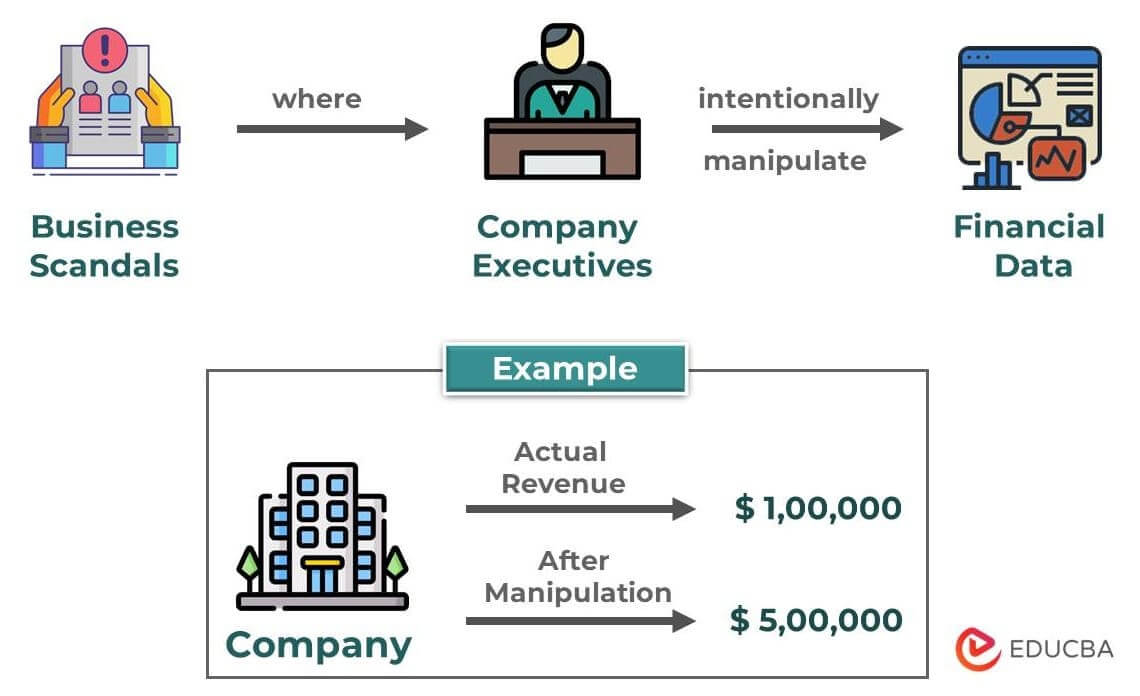

Pw C Pulls Out Of Over A Dozen Countries Following Controversies

Apr 29, 2025

Pw C Pulls Out Of Over A Dozen Countries Following Controversies

Apr 29, 2025 -

Pw C Exits Multiple Countries A Bangkok Post Report On Accounting Scandals

Apr 29, 2025

Pw C Exits Multiple Countries A Bangkok Post Report On Accounting Scandals

Apr 29, 2025 -

Pw C Country Exits A Response To Growing Scrutiny

Apr 29, 2025

Pw C Country Exits A Response To Growing Scrutiny

Apr 29, 2025 -

Pw Cs Global Retreat Exiting Countries Amidst Scandal

Apr 29, 2025

Pw Cs Global Retreat Exiting Countries Amidst Scandal

Apr 29, 2025 -

Exploring The Success Of Italian Players In The Bundesliga Grifo Immobile Toni Barzagli And Rizzitelli

Apr 29, 2025

Exploring The Success Of Italian Players In The Bundesliga Grifo Immobile Toni Barzagli And Rizzitelli

Apr 29, 2025