Ueda Cautious On Long-Yield Surge, Eyes Potential Ripple Effects

Table of Contents

Ueda's Concerns Regarding the Long-Yield Surge

Governor Ueda has expressed significant concerns about the rapid increase in long-term government bond yields. His statements highlight the potential for this surge to undermine the effectiveness of the Bank of Japan's (BOJ) monetary policy, create risks to financial stability, and negatively impact economic growth. Specific yield levels haven't been publicly stated as absolute triggers, but the pace and magnitude of the recent increase have clearly raised red flags. His concerns are reflected in various press releases and speeches, emphasizing the need for careful observation and potential policy adjustments.

- Impact on monetary policy effectiveness: A sharp increase in long-term yields can complicate the BOJ's efforts to maintain its yield curve control (YCC) policy and achieve its inflation target.

- Risks to financial stability: Rapidly rising yields could strain financial institutions and potentially lead to increased volatility in the markets.

- Potential negative effects on economic growth: Higher borrowing costs stemming from the long-yield surge can dampen business investment and consumer spending, hindering economic expansion.

- Mention specific yield levels that have triggered concern: While specific yield levels haven't been publicly declared as red lines, the speed and scale of the recent increase have been cause for worry.

- Reference any press releases or speeches by Ueda: Official transcripts and summaries of Ueda's public appearances should be consulted for precise quotes and detailed explanations.

Potential Ripple Effects on the Japanese Economy

The long-yield surge's potential consequences for the Japanese economy are far-reaching. The increased borrowing costs associated with higher long-term yields could significantly impact various sectors:

- Increased borrowing costs for businesses and consumers: Higher interest rates make it more expensive for businesses to invest and expand, and for consumers to borrow for purchases like homes or cars.

- Impact on corporate investment and expansion plans: Increased borrowing costs can lead to reduced corporate investment, potentially slowing down economic growth. Companies might postpone or cancel expansion projects, affecting job creation and overall economic activity.

- Effects on the housing market and real estate prices: Higher mortgage rates, a direct consequence of rising long-term yields, can cool down the housing market, leading to lower real estate prices and reduced construction activity.

- Potential for deflationary pressures if borrowing becomes too expensive: If borrowing costs rise substantially, it could reduce consumer and business spending, potentially leading to deflationary pressures, counteracting the BOJ's inflation targets.

- Implications for the Yen exchange rate: Changes in Japanese interest rates relative to global interest rates can significantly impact the Yen exchange rate, influencing import and export prices and overall economic competitiveness.

Analyzing the Underlying Causes of the Long-Yield Surge

Several factors contribute to the recent increase in long-term yields:

- Changes in global interest rate environments: Rising interest rates in major economies globally impact investor expectations and capital flows, putting upward pressure on Japanese long-term yields.

- Inflationary pressures in Japan and globally: Persistent inflation, both domestically and internationally, leads to expectations of higher future interest rates, driving up long-term yields.

- Shifts in investor sentiment and risk appetite: Changes in investor confidence and risk appetite can significantly influence bond yields. A shift towards risk aversion might lead to increased demand for safe-haven assets like government bonds, potentially pushing up their yields.

- Market speculation and anticipation of future policy changes: Market participants might speculate about future policy changes by the BOJ, influencing their trading behavior and affecting long-term yields.

- Government debt levels and fiscal policy: High levels of government debt and fiscal policy decisions can influence investor perception of risk and impact long-term yields.

The Role of the Bank of Japan's Monetary Policy

The BOJ's current monetary policy, particularly its yield curve control (YCC) mechanism, plays a crucial role in managing the long-yield surge.

- Yield curve control (YCC) and its limitations: YCC aims to keep long-term interest rates low, but its effectiveness is challenged by the recent surge. The BOJ's capacity to maintain control over yields is being tested.

- Potential adjustments to monetary policy: The BOJ may need to adjust its monetary policy in response to the long-yield surge, possibly through modifications to YCC or other policy tools.

- Effectiveness of interventions to control yields: The BOJ's interventions to control yields through bond purchases have had varying degrees of success, highlighting the limitations of direct market intervention.

- Communication strategies to manage market expectations: Clear communication by the BOJ regarding its policy intentions is crucial in managing market expectations and stabilizing long-term yields.

Conclusion

Governor Ueda's caution regarding the long-yield surge reflects genuine concerns about its potential negative ripple effects on the Japanese economy. The increased borrowing costs, potential dampening of corporate investment, and implications for the housing market are all significant risks. Underlying causes range from global interest rate environments and inflationary pressures to shifts in investor sentiment and the BOJ's monetary policy. The BOJ's response, including potential adjustments to its YCC policy and communication strategies, will be crucial in managing this situation. Understanding the interplay between global economic conditions, domestic factors, and the BOJ's actions is key to navigating the complexities of this long-yield surge and its potential impact. Stay informed about the evolving situation regarding the long-yield surge and its impact on the Japanese economy. Further research on the BOJ's response and the implications for investors is crucial. Follow reputable financial news sources for updates on Ueda's statements and the Bank of Japan's actions concerning the long-term yields and its potential ripple effects.

Featured Posts

-

New Crown Zenith Pokemon Tcg Pocket A Closer Look At The New Cards

May 29, 2025

New Crown Zenith Pokemon Tcg Pocket A Closer Look At The New Cards

May 29, 2025 -

Fincantieri And Tui A New Era For Uk Cruise

May 29, 2025

Fincantieri And Tui A New Era For Uk Cruise

May 29, 2025 -

Elon Musks Concerns Trumps Plan And The Future Of Dogecoin

May 29, 2025

Elon Musks Concerns Trumps Plan And The Future Of Dogecoin

May 29, 2025 -

Talk To Me Directors Next Horror Project Bring Her Back Exclusive Image

May 29, 2025

Talk To Me Directors Next Horror Project Bring Her Back Exclusive Image

May 29, 2025 -

Pccs 2024 Profit A Deeper Look Into Community Market Success

May 29, 2025

Pccs 2024 Profit A Deeper Look Into Community Market Success

May 29, 2025

Latest Posts

-

Birmingham Supercross 2025 Round 10 Results And Highlights

May 31, 2025

Birmingham Supercross 2025 Round 10 Results And Highlights

May 31, 2025 -

Man Admits To Animal Pornography Kelvedon Case Update

May 31, 2025

Man Admits To Animal Pornography Kelvedon Case Update

May 31, 2025 -

Kelvedon Animal Pornography Case Matthew Sextons Conviction

May 31, 2025

Kelvedon Animal Pornography Case Matthew Sextons Conviction

May 31, 2025 -

Animal Pornography Charges Kelvedon Resident Pleads Guilty

May 31, 2025

Animal Pornography Charges Kelvedon Resident Pleads Guilty

May 31, 2025 -

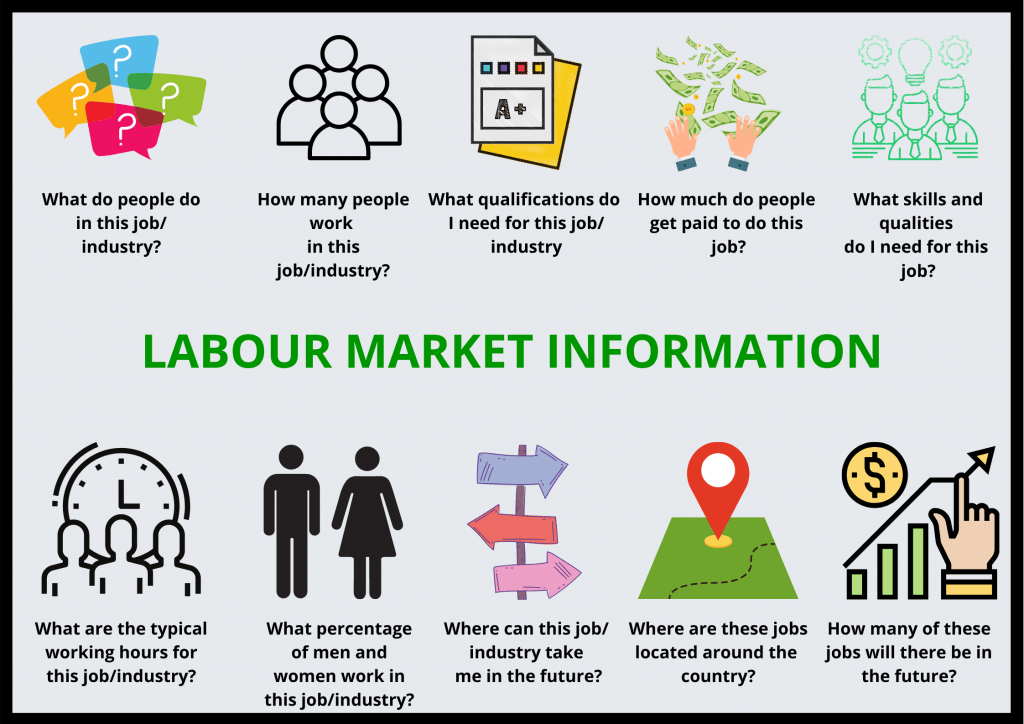

The Bank Of Canada And Rate Relief An Analysis Of Recent Labour Market Data By David Rosenberg

May 31, 2025

The Bank Of Canada And Rate Relief An Analysis Of Recent Labour Market Data By David Rosenberg

May 31, 2025