Understanding Ontario's Proposed Manufacturing Tax Credit Increase

Table of Contents

Key Details of the Proposed Increase

The proposed increase to Ontario's manufacturing tax credit represents a substantial investment in the province's manufacturing sector. While specific details, such as the exact percentage increase and effective date, may vary depending on the final legislative approval, the core aim is to significantly enhance manufacturing tax incentives Ontario. This means a more generous credit for eligible businesses, potentially unlocking substantial financial advantages. Eligible activities under this expanded Ontario manufacturing grants program are expected to include a broad range of manufacturing operations, encompassing everything from traditional industries to cutting-edge advanced manufacturing.

- Eligible Activities: The credit likely covers a wide spectrum of manufacturing operations, including but not limited to, the production of goods, assembly, processing, and packaging.

- Eligibility Criteria: While precise requirements are pending final legislation, anticipated criteria will likely include aspects like minimum investment thresholds, employment levels, and potentially location-based considerations within Ontario. Specifics regarding business tax credits Ontario will be detailed in official government announcements.

- Changes from Previous Programs: This proposed increase builds upon existing tax credit programs, potentially simplifying the application process and significantly increasing the amount of credit available to eligible businesses. This streamlining aims to make Ontario manufacturing grants more accessible and beneficial.

Benefits for Ontario Manufacturers

The proposed increase in the Ontario manufacturing tax credit offers a multitude of benefits for manufacturers across the province, contributing significantly to Ontario economic growth. By reducing the tax burden on manufacturing activities, this incentive aims to spark significant investment, create numerous jobs, and enhance the overall competitiveness of Ontario-based businesses in the global marketplace.

- Job Creation: The increased tax credit can stimulate hiring, offering employment opportunities and boosting the manufacturing jobs Ontario landscape.

- Investment in Modernization & Technology: Manufacturers can leverage the tax savings to invest in advanced technologies, modernizing their operations and improving efficiency.

- Expansion and Growth: The additional financial flexibility allows businesses to expand their facilities, increase production capacity, and explore new market opportunities.

- Benefits Across Sectors: The positive impact will extend to various manufacturing sectors, including automotive, food processing, aerospace, and advanced manufacturing. This broad application demonstrates the government's commitment to supporting Ontario manufacturing grants across a range of industries.

How to Apply for the Ontario Manufacturing Tax Credit

Once the legislation is finalized and the application process is officially launched, manufacturers can access the enhanced Ontario manufacturing tax credit by following a structured procedure. This process typically involves submitting a comprehensive application package, outlining eligibility and demonstrating compliance with the program's requirements.

- Required Documentation: Expect to provide detailed financial information, employment records, and proof of manufacturing activities.

- Application Deadlines: The government will establish specific deadlines, so stay informed through official channels.

- Government Websites and Contact Information: Stay updated on the official website of the relevant Ontario government agency. This will provide the necessary forms, guidelines, and contact details for any inquiries.

- Overcoming Application Challenges: Thorough preparation is key. Seek professional advice if needed to ensure a smooth and successful application process. This proactive approach will maximize your chances of successfully claiming your Ontario manufacturing tax credit.

Potential Challenges and Considerations

While the proposed increase offers substantial advantages, manufacturers should also be aware of potential limitations and factors that could affect eligibility and the overall impact.

- Specific Eligibility Requirements: Pay close attention to detailed eligibility criteria to ensure your business qualifies for the full benefits.

- Application Complexity: The application process may involve detailed paperwork and thorough record-keeping.

- Ongoing Debates: Remain aware of any ongoing public discourse or potential revisions to the program as the legislative process unfolds.

Conclusion: Capitalizing on Ontario's Increased Manufacturing Tax Credit

The proposed increase in Ontario's manufacturing tax credit presents a significant opportunity for businesses to enhance their competitiveness, expand their operations, and contribute to the province's economic growth. Understanding the details of this program is crucial. By strategically planning and submitting a well-prepared application, manufacturers can maximize their manufacturing tax benefits and contribute to a thriving manufacturing sector in Ontario. Don't miss out on the chance to claim your Ontario manufacturing tax credit – learn more and apply when the program officially launches. Check the official government websites for up-to-date information and application details. Maximize your opportunities and learn more about Ontario's manufacturing tax credit increase today!

Featured Posts

-

Spion Peter Tazelaar Een Biografie

May 07, 2025

Spion Peter Tazelaar Een Biografie

May 07, 2025 -

Khtwt Almlkyt Almghrbyt Almzyd Mn Alrhlat Byn Albrazyl Walmghrb

May 07, 2025

Khtwt Almlkyt Almghrbyt Almzyd Mn Alrhlat Byn Albrazyl Walmghrb

May 07, 2025 -

Nhl 25 Arcade Mode Everything You Need To Know

May 07, 2025

Nhl 25 Arcade Mode Everything You Need To Know

May 07, 2025 -

Sensatsiya Novye Foto Rianny V Soblaznitelnom Rozovom Kruzheve

May 07, 2025

Sensatsiya Novye Foto Rianny V Soblaznitelnom Rozovom Kruzheve

May 07, 2025 -

Ib Ri S Dla Onetu Trzaskowski Morawiecki Duda Ranking Zaufania

May 07, 2025

Ib Ri S Dla Onetu Trzaskowski Morawiecki Duda Ranking Zaufania

May 07, 2025

Latest Posts

-

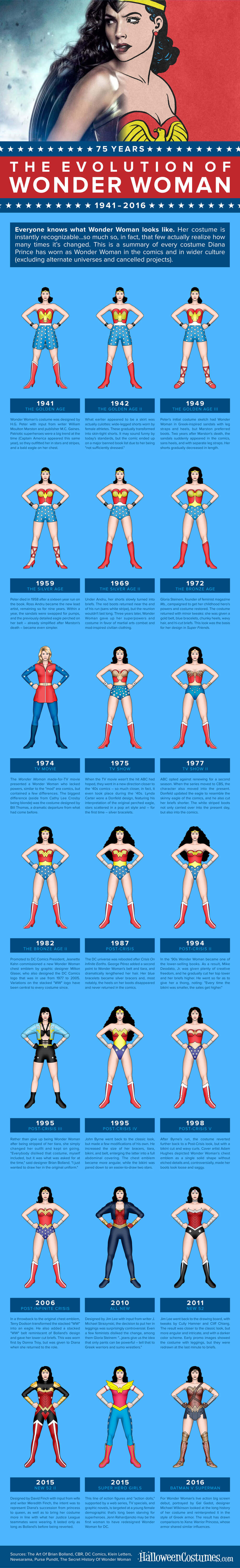

X Men Rogues Costume Evolution A Surprising Shift

May 08, 2025

X Men Rogues Costume Evolution A Surprising Shift

May 08, 2025 -

The Overvalued Canadian Dollar Time For Strategic Intervention

May 08, 2025

The Overvalued Canadian Dollar Time For Strategic Intervention

May 08, 2025 -

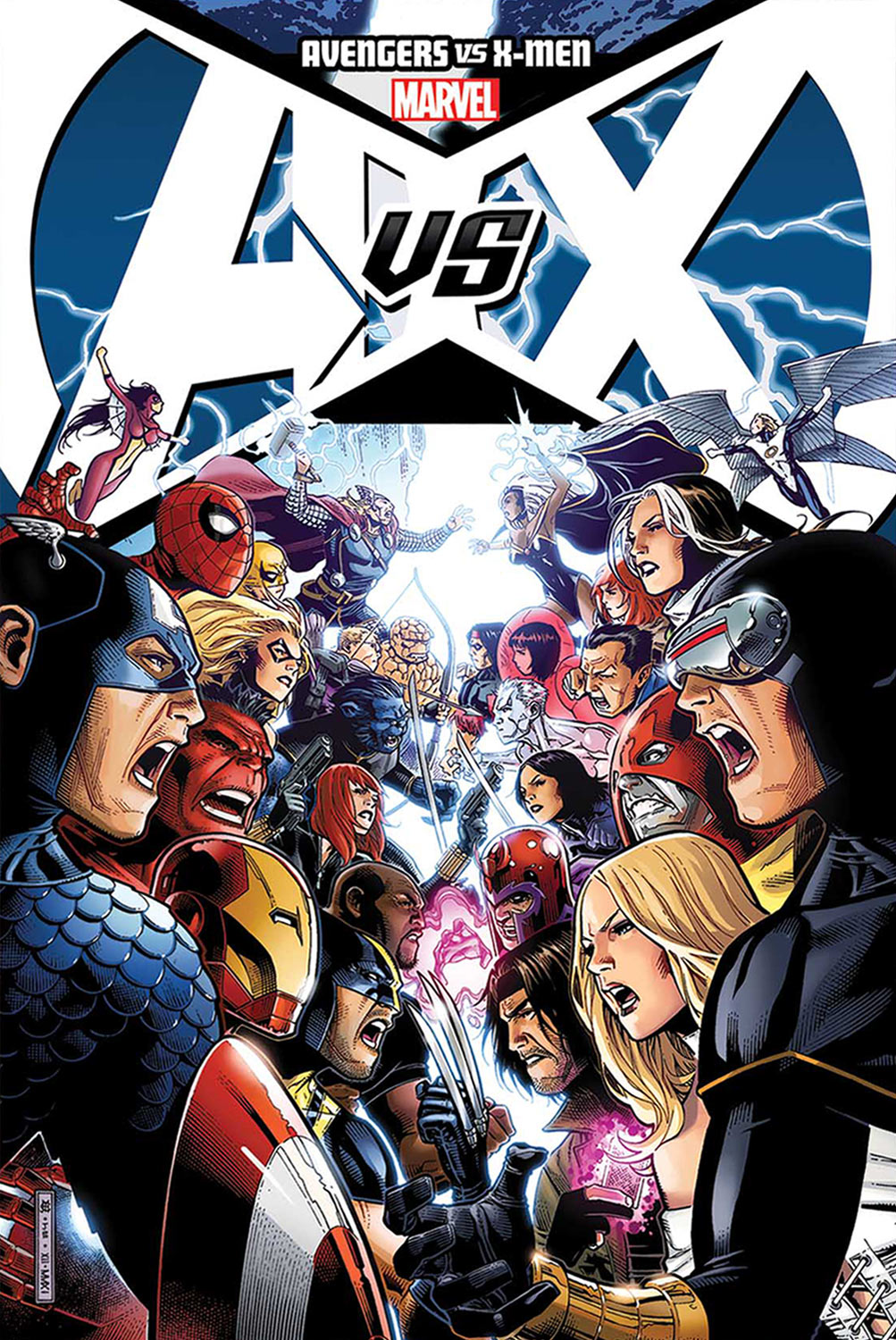

The Case For Rogue Avengers Vs X Men

May 08, 2025

The Case For Rogue Avengers Vs X Men

May 08, 2025 -

Analyzing The Canadian Dollars Overvaluation Against The Greenback

May 08, 2025

Analyzing The Canadian Dollars Overvaluation Against The Greenback

May 08, 2025 -

Rogues Team A Re Evaluation Of Her Marvel Allegiance

May 08, 2025

Rogues Team A Re Evaluation Of Her Marvel Allegiance

May 08, 2025