Understanding Stock Market Valuations: BofA's Advice For Investors

Table of Contents

Key Valuation Metrics Explained

Understanding how to value stocks is crucial for successful investing. Several key metrics help investors assess whether a stock is overvalued, undervalued, or fairly priced. Let's explore some of the most important ones:

Price-to-Earnings Ratio (P/E)

The Price-to-Earnings ratio (P/E) is perhaps the most widely used valuation metric. It represents the market price per share divided by the company's earnings per share (EPS). A higher P/E ratio generally suggests investors are willing to pay more for each dollar of earnings, often indicating expectations of higher future growth.

- High P/E ratios: May suggest high growth potential, but also carry higher risk. Investors are betting on significant future earnings growth to justify the current price.

- Low P/E ratios: Might indicate undervaluation or potential problems with the company. However, it could also signify a mature company with slower growth prospects.

- Industry Comparison: Comparing P/E ratios across similar companies within the same industry is crucial for accurate interpretation. A high P/E ratio might be reasonable within a high-growth sector but unreasonable in a mature, slow-growth industry.

Price-to-Book Ratio (P/B)

The Price-to-Book ratio (P/B) compares a company's market capitalization to its net asset value (book value). It's calculated by dividing the market price per share by the book value per share. This metric is particularly useful for valuing companies with significant tangible assets, such as banks or manufacturing firms.

- Useful for asset-heavy companies: The P/B ratio provides a valuable perspective on whether a company's market value accurately reflects its underlying assets.

- P/B ratio below 1: Might suggest undervaluation, although this isn't always the case. It could indicate that the market doesn't have confidence in the company's ability to utilize its assets effectively.

- Industry Context: Consider the industry context when interpreting P/B ratios. Different industries have different typical P/B ratios.

Price-to-Sales Ratio (P/S)

The Price-to-Sales ratio (P/S) is the market capitalization divided by the company's revenue. It's particularly useful for valuing companies with no earnings or negative earnings, such as many rapidly growing technology companies.

- Growth Stock Valuation: A common metric for valuing growth stocks and tech companies where profitability might not yet be established.

- Stability during losses: Provides a more stable valuation measure compared to P/E during periods of low or negative profitability.

- Growth Trajectory: Consider the company's growth trajectory when using P/S. High growth justifies a higher P/S ratio.

BofA's Perspective on Current Market Valuations

Bank of America (BofA) regularly publishes market analysis and offers insights into current stock market valuations. Their perspective is valuable for investors seeking to understand potential opportunities and risks.

Identifying Potential Overvalued and Undervalued Stocks

BofA employs a sophisticated research methodology, utilizing various data sources including financial statements, economic indicators, and industry trends, to identify potentially overvalued and undervalued stocks.

- Research Methodology: BofA's analysts use quantitative models and qualitative assessments to evaluate companies and sectors.

- Specific Examples: [Note: This section would ideally include specific examples from recent BofA reports. Due to the dynamic nature of the market, providing specific examples here would require real-time data access and would quickly become outdated.] BofA's reports often highlight specific sectors or companies showing signs of overvaluation or undervaluation based on their valuation models and market forecasts.

- Rationale: BofA’s assessments are based on a combination of factors, including economic forecasts, industry trends, competitive analysis, and management quality.

BofA's Investment Strategies and Recommendations

Based on their valuation analysis, BofA offers investment strategies and recommendations. These might include sector rotation, focusing on specific undervalued sectors, or recommending individual stocks.

- Risk Tolerance: BofA's recommendations usually account for different investor risk tolerances. Some strategies are more aggressive, aiming for higher returns with higher risks, while others are more conservative.

- Diversification: BofA always emphasizes the importance of diversification to mitigate risk.

- Research Reports: Refer to BofA's official research reports for detailed analysis and specific recommendations. [Insert links to relevant reports if available].

Beyond the Numbers: Qualitative Factors in Stock Valuation

While quantitative metrics are crucial, qualitative factors play a significant role in determining a company's true value.

Management Quality and Corporate Governance

The quality of a company's management team and its corporate governance structure significantly impacts long-term performance and shareholder value.

- Strong Leadership: Strong leadership translates to better strategic decision-making, efficient operations, and stronger growth prospects.

- Weak Governance: Weak corporate governance can lead to increased risk, including accounting irregularities or ethical breaches.

Competitive Landscape and Industry Trends

Analyzing the competitive landscape and industry trends is critical for understanding a company's future prospects.

- Market Share and Competitive Advantages: A company’s market share and competitive advantages (e.g., patents, strong brand recognition) significantly impact its long-term profitability.

- Disruptive Technologies and Emerging Trends: The impact of disruptive technologies and emerging trends on an industry cannot be ignored. Companies failing to adapt may face significant challenges.

Economic Outlook and Interest Rates

The broader macroeconomic environment has a profound impact on stock valuations.

- Interest Rate Hikes: Interest rate hikes can impact valuation multiples, especially for growth stocks reliant on future earnings.

- Economic Cycles: Economic growth or recession significantly affects stock prices. Recessions often lead to lower valuations across the board.

Conclusion

Understanding stock market valuations is crucial for successful investing. By utilizing key metrics like P/E, P/B, and P/S ratios, alongside insights from reputable sources such as BofA's market analysis, investors can make more informed decisions. Remember to consider both quantitative data and qualitative factors to build a robust investment strategy. Don't rely solely on numbers; thorough research and understanding of the market are vital. Start improving your stock market valuation understanding today, and learn more about BofA's advice and other expert opinions to refine your investment approach.

Featured Posts

-

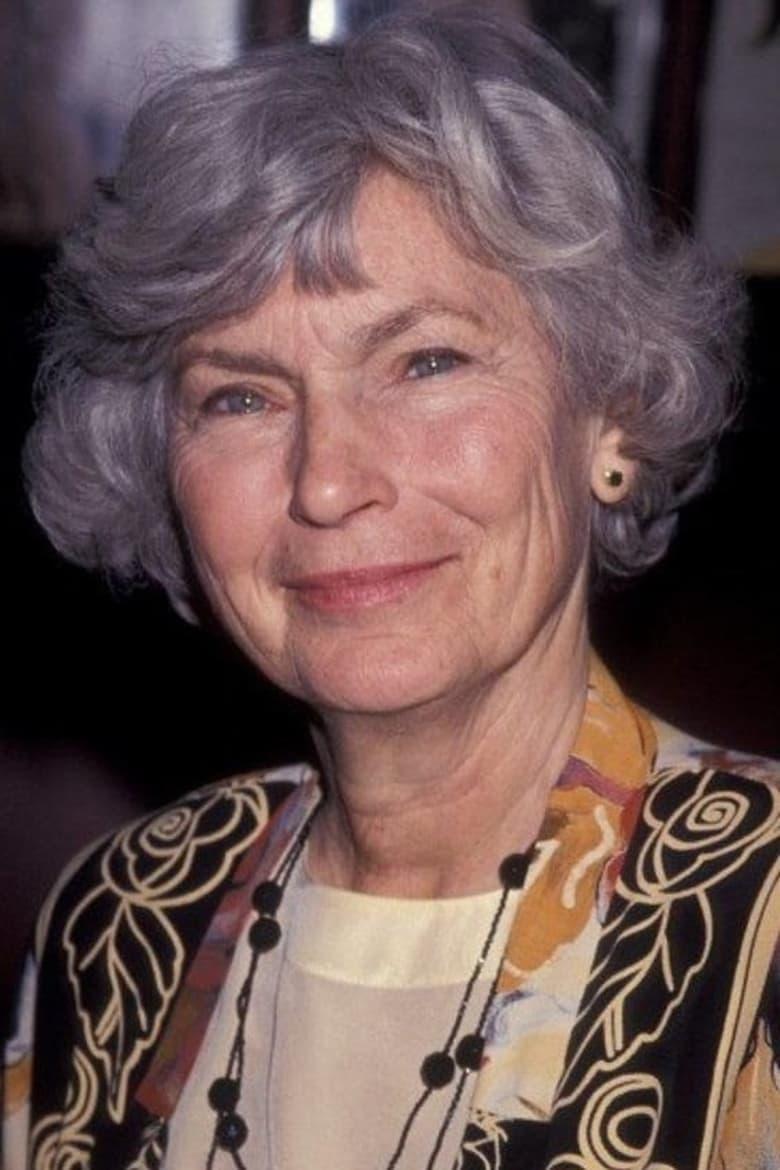

Remembering Priscilla Pointer A Dalla Stars Legacy

May 02, 2025

Remembering Priscilla Pointer A Dalla Stars Legacy

May 02, 2025 -

Xrp Price Prediction 5 Target Realistic After Sec Developments

May 02, 2025

Xrp Price Prediction 5 Target Realistic After Sec Developments

May 02, 2025 -

France Wins Six Nations Englands Dominant Display Scotland And Ireland Underperform

May 02, 2025

France Wins Six Nations Englands Dominant Display Scotland And Ireland Underperform

May 02, 2025 -

Kad Sam Se Vratio Zasto Se Udala Zdravkova Prva Ljubav

May 02, 2025

Kad Sam Se Vratio Zasto Se Udala Zdravkova Prva Ljubav

May 02, 2025 -

Merrie Monarch Festival A Showcase Of Pacific Island Cultures

May 02, 2025

Merrie Monarch Festival A Showcase Of Pacific Island Cultures

May 02, 2025

Latest Posts

-

Chief Election Commissioner On Robust Poll Data Systems

May 02, 2025

Chief Election Commissioner On Robust Poll Data Systems

May 02, 2025 -

Reform Uk Faces Scrutiny Bullying Allegations Against Rupert Lowe

May 02, 2025

Reform Uk Faces Scrutiny Bullying Allegations Against Rupert Lowe

May 02, 2025 -

Farage Lowe Feud Public Barbs Fly In Heated Exchange

May 02, 2025

Farage Lowe Feud Public Barbs Fly In Heated Exchange

May 02, 2025 -

Securing Elections A Robust Poll Data System Approach

May 02, 2025

Securing Elections A Robust Poll Data System Approach

May 02, 2025 -

Investigation Into Rupert Lowe Following Bullying Complaints

May 02, 2025

Investigation Into Rupert Lowe Following Bullying Complaints

May 02, 2025