XRP Price Prediction: $5 Target Realistic After SEC Developments?

Table of Contents

1. Ripple vs. SEC Lawsuit: A Deep Dive

The SEC's lawsuit against Ripple Labs, alleging that XRP is an unregistered security, has been a major factor influencing XRP's price. Understanding the core arguments is crucial for any XRP price prediction.

H3: The Core Arguments:

The SEC claims Ripple sold XRP as an unregistered security, violating federal laws. Their argument centers on the assertion that XRP investors expected profits based on Ripple's efforts, meeting the Howey Test criteria for a security. Ripple, on the other hand, maintains that XRP is a decentralized digital asset, not a security, and that its sales were not subject to SEC regulation. They point to the decentralized nature of XRP and its widespread use in various payment systems as evidence.

Bullet Points:

- SEC's Case: The SEC alleges Ripple raised billions of dollars through unregistered sales of XRP, defrauding investors. They specifically highlight Ripple's programmatic sales and institutional partnerships.

- Ripple's Defense: Ripple argues XRP is a currency, similar to Bitcoin or Ethereum, and that its sales were not investment contracts. They emphasize XRP's utility in cross-border payments and its independent market operation.

- Court Rulings & Testimonies: Key expert testimonies and court decisions regarding the classification of XRP as a security will heavily influence the final outcome and subsequently the XRP price prediction. These rulings will shape future regulatory expectations.

- Impact on Trading Volume and Price: The lawsuit has undeniably impacted XRP's trading volume and price. Periods of uncertainty often lead to price drops, while positive developments can boost prices significantly. This volatility makes accurate XRP price prediction challenging. The use of keywords like "Ripple lawsuit," "SEC vs. Ripple," "XRP security classification," and "Ripple legal battle" is crucial for SEO purposes in this section.

2. Market Sentiment and XRP's Price Action

Analyzing XRP's price action and market sentiment is crucial for any realistic XRP price prediction.

H3: Analyzing Price Trends:

Examining historical price data, support and resistance levels, and correlation with other cryptocurrencies provides valuable insights.

Bullet Points:

- Historical Price Data: Tracking XRP's past performance reveals patterns, trends, and volatility levels, offering clues for potential future price movements. Consider using charts and graphs for visual representation to increase user engagement.

- Correlation with Bitcoin and other Cryptocurrencies: XRP's price often correlates with the overall cryptocurrency market. Bitcoin's price movements, for instance, significantly impact XRP's performance.

- Impact of News: Positive news, such as favorable court rulings or partnerships, often leads to price increases. Negative news, conversely, can cause price drops.

- Technical Analysis Indicators: Employing technical indicators like moving averages and the Relative Strength Index (RSI) can help identify potential price trends and predict future movements. This requires using keywords like "XRP price chart," "XRP market analysis," "XRP technical analysis," and "crypto market sentiment."

3. Factors Influencing a Potential $5 XRP Price

Several factors could contribute to XRP reaching a $5 price.

H3: Adoption and Utility:

Widespread adoption of XRP in cross-border payments and other applications is crucial.

Bullet Points:

- Partnerships and Collaborations: Ripple's strategic partnerships with financial institutions significantly boost XRP's adoption and utility.

- Use in Payment Solutions: The increasing use of XRP in various payment solutions demonstrates its practicality and potential for mass adoption.

- Positive Court Ruling: A favorable court ruling in the SEC lawsuit would likely remove a significant barrier to XRP's wider acceptance and adoption, potentially driving up its price.

- Institutional Investment: Increased institutional investment in XRP could propel its price upwards.

H3: Market Capitalization and Supply:

XRP's market capitalization relative to its total supply is critical.

Bullet Points:

- Comparison with Other Cryptocurrencies: Comparing XRP's market cap to other established cryptocurrencies helps gauge its potential for growth.

- Circulating and Total Supply: Understanding the circulating supply and the total supply of XRP helps determine the potential for price appreciation.

- Supply-Reducing Mechanisms: Token burning or other mechanisms that reduce the circulating supply can increase scarcity and drive up the price. This necessitates the use of keywords like "XRP adoption," "XRP utility," "market capitalization XRP," "XRP supply," and "XRP price target."

4. Risks and Challenges to Achieving a $5 Price

Despite the potential, several factors could hinder XRP from reaching $5.

H3: Regulatory Uncertainty:

The regulatory environment for cryptocurrencies remains uncertain, posing a significant risk.

Bullet Points:

- Regulatory Landscape: Varying regulatory stances across different jurisdictions create uncertainty and potential obstacles for XRP's growth.

- Future Regulatory Actions: Future regulatory actions could significantly impact XRP's price and adoption.

- Negative Court Rulings: An unfavorable court ruling in the SEC lawsuit could severely damage XRP's prospects and negatively impact its price.

H3: Market Volatility:

The cryptocurrency market is inherently volatile, making accurate price predictions difficult.

Bullet Points:

- Macroeconomic Factors: Macroeconomic factors like inflation and recession can significantly influence cryptocurrency prices, including XRP.

- Market Crashes and Corrections: The crypto market is prone to crashes and corrections, which could significantly impact XRP's price. This section requires incorporating keywords such as "XRP regulation," "cryptocurrency regulation," "market volatility," and "XRP risk."

5. Conclusion

Whether an XRP price prediction of $5 is realistic after the SEC developments depends on several intertwining factors. While the potential for adoption and utility is considerable, regulatory uncertainty and market volatility pose significant risks. A favorable outcome in the Ripple lawsuit would undeniably be a strong catalyst, but it's not a guarantee of a $5 price. The likelihood depends heavily on market sentiment, overall crypto market conditions, and continued adoption. While a $5 price is possible, given the current situation, it remains a long-term, high-risk prediction.

Final Verdict: Achieving a $5 XRP price is possible, but not probable in the short term. Several factors need to align perfectly, including a positive resolution to the SEC lawsuit, widespread adoption, and a stable, bullish crypto market.

Call to Action: Stay informed about the XRP price prediction and developments in the Ripple lawsuit and the broader cryptocurrency market. Conduct your own thorough research before making any investment decisions related to XRP. Continue your research on the XRP price and its future prospects.

Featured Posts

-

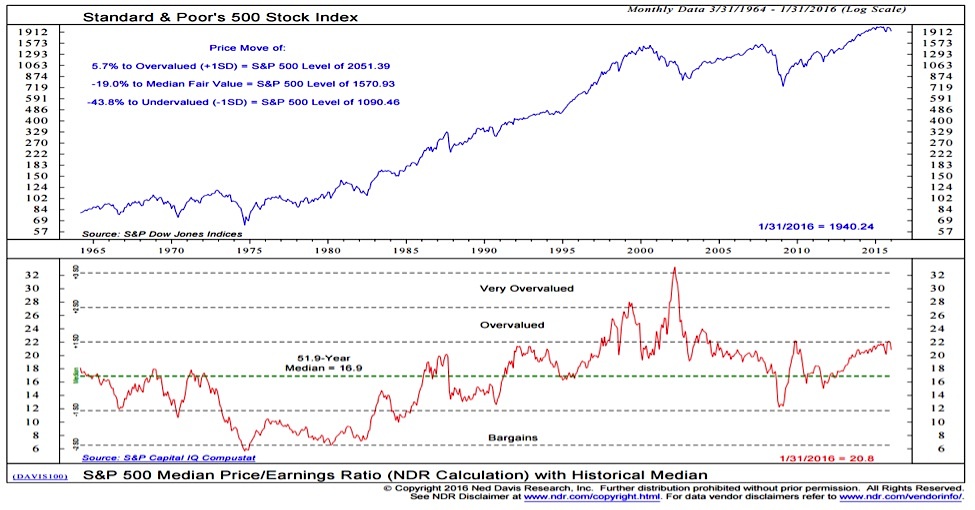

High Stock Market Valuations Bof As View And Why Investors Shouldnt Worry

May 02, 2025

High Stock Market Valuations Bof As View And Why Investors Shouldnt Worry

May 02, 2025 -

Texas Tech Beats Kansas In Close Road Victory 78 73

May 02, 2025

Texas Tech Beats Kansas In Close Road Victory 78 73

May 02, 2025 -

Landmark Saudi Rule Change To Transform Its Abs Market

May 02, 2025

Landmark Saudi Rule Change To Transform Its Abs Market

May 02, 2025 -

Early Childhood Investment Long Term Benefits For Mental Wellbeing

May 02, 2025

Early Childhood Investment Long Term Benefits For Mental Wellbeing

May 02, 2025 -

Investing In The Future Identifying The Countrys Top Business Locations

May 02, 2025

Investing In The Future Identifying The Countrys Top Business Locations

May 02, 2025

Latest Posts

-

Investing In Our Childrens Mental Health A Societal Imperative

May 02, 2025

Investing In Our Childrens Mental Health A Societal Imperative

May 02, 2025 -

New Legal Challenge For Epic Games Fortnites In Game Store Under Scrutiny

May 02, 2025

New Legal Challenge For Epic Games Fortnites In Game Store Under Scrutiny

May 02, 2025 -

Return On Investment Supporting Childhood Mental Health For Societal Gain

May 02, 2025

Return On Investment Supporting Childhood Mental Health For Societal Gain

May 02, 2025 -

1000 Days Later Popular Fortnite Skins Re Enter The Item Shop

May 02, 2025

1000 Days Later Popular Fortnite Skins Re Enter The Item Shop

May 02, 2025 -

Epic Games And Fortnite A New Lawsuit Challenges In Game Store Policies

May 02, 2025

Epic Games And Fortnite A New Lawsuit Challenges In Game Store Policies

May 02, 2025