Understanding The CoreWeave (CRWV) Stock Rise Post-Nvidia Investment

Table of Contents

Nvidia's Strategic Investment and its Implications for CoreWeave (CRWV)

Nvidia's investment in CoreWeave is not just a financial transaction; it’s a strategic maneuver with significant implications for both companies. Understanding the details is key to grasping the CRWV stock rise.

The Financial Details of Nvidia's Investment:

While the exact financial details might not be publicly available immediately, reports suggest a substantial investment (insert reported amount or range if available). This investment, likely in the form of equity (specify if known), placed a significant valuation on CoreWeave, underscoring its perceived potential in the rapidly expanding AI market.

- Strategic Rationale: Nvidia's investment likely stems from its need for robust, scalable infrastructure to support its growing AI and GPU-driven technologies. CoreWeave's specialized cloud computing services provide precisely that. This partnership ensures access to crucial infrastructure for Nvidia's continued expansion.

- Impact on Market Capitalization and Investor Confidence: The Nvidia investment dramatically boosted CoreWeave's market capitalization, signaling a vote of confidence from a major industry player. This attracted further investor interest, fueling the CRWV stock price increase.

- Potential Future Collaborations: The partnership opens doors to exciting future collaborations, including joint product development, marketing initiatives, and potentially even integrated solutions leveraging Nvidia's GPUs and CoreWeave's cloud infrastructure. This synergy could lead to long-term growth for both companies. The success of these collaborations could further propel the CRWV stock price.

CoreWeave's (CRWV) Underlying Strengths and Growth Potential

CoreWeave's remarkable growth isn't solely dependent on the Nvidia investment; it's built upon a solid foundation of innovative technology and strategic positioning.

CoreWeave's Business Model and Competitive Advantage:

CoreWeave specializes in providing high-performance cloud computing solutions specifically tailored for AI and machine learning workloads. Their infrastructure leverages the power of Nvidia GPUs, making them a perfect partner for Nvidia itself.

- Unique Technology and Infrastructure: CoreWeave's infrastructure stands out due to its optimized architecture, designed for the demanding requirements of AI applications. This efficiency translates into cost savings and improved performance for clients.

- Competition and Market Share: While facing competition from giants like AWS, Google Cloud, and Azure, CoreWeave has carved a niche for itself by focusing on the specific needs of AI and machine learning developers. Their targeted approach allows them to capture significant market share in this rapidly growing segment.

- Customer Base: CoreWeave’s customer base likely includes a mix of startups and established enterprises. The diversity of their clientele demonstrates the versatility and effectiveness of their cloud computing services.

Market Sentiment and Investor Reaction to the Nvidia Investment

The market reacted strongly and positively to the news of Nvidia's investment in CoreWeave.

Analyzing the Stock Market Response:

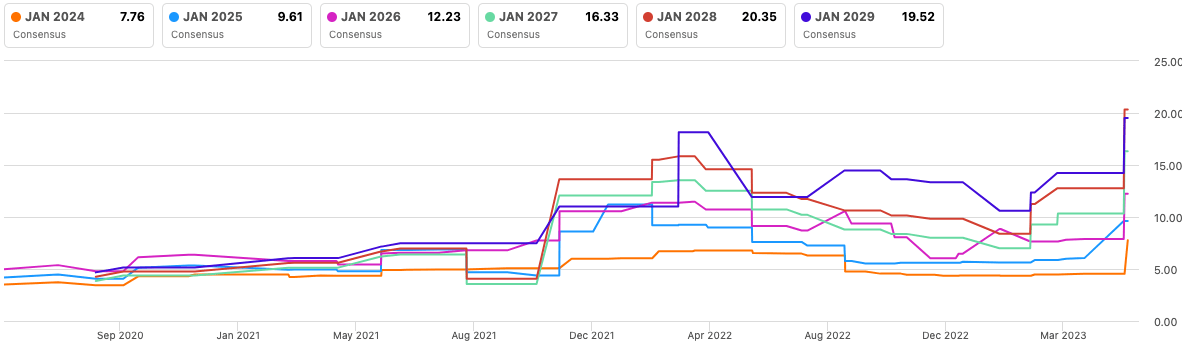

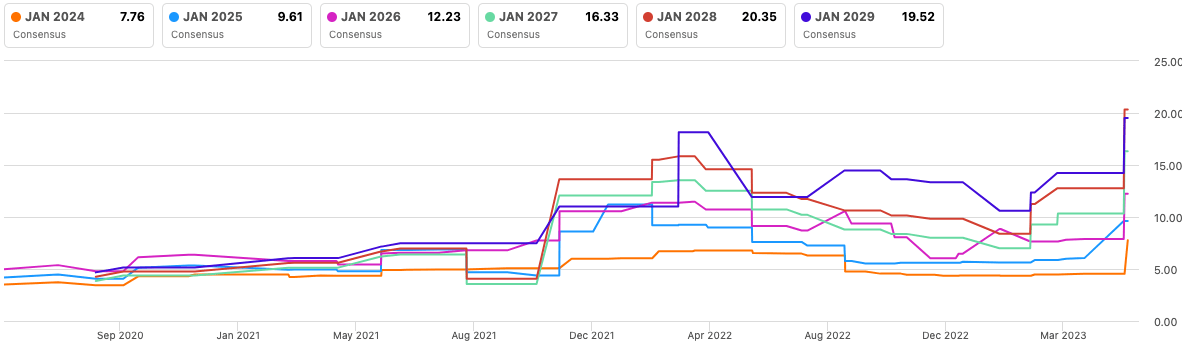

The announcement triggered an immediate and substantial increase in the CRWV stock price. This reflects a significant shift in investor sentiment.

- Investor Sentiment: Before the announcement, investor interest in CoreWeave was already growing, given the increasing demand for AI infrastructure. The Nvidia investment amplified this existing positive sentiment significantly.

- News Articles and Analyst Reports: Numerous news outlets and financial analysts commented on the deal, highlighting the strategic importance of the partnership and the potential for future growth. These positive analyses further contributed to the CRWV stock price surge.

- Potential Risks and Uncertainties: Despite the positive outlook, investors should consider inherent risks such as increased competition, market saturation, and economic downturns. A realistic assessment of these risks is essential for informed investment decisions.

Future Outlook and Predictions for CoreWeave (CRWV)

Predicting the future is inherently challenging, but analyzing market trends and potential challenges can offer valuable insights into CoreWeave's long-term prospects.

Long-Term Growth Potential and Challenges:

The long-term growth potential for CoreWeave is substantial, given the explosive growth of the AI cloud computing market.

- AI Market Outlook: The demand for AI infrastructure is expected to continue its upward trajectory for the foreseeable future. This strong market demand provides a favorable environment for CoreWeave's continued growth.

- Potential Challenges: Competition will inevitably intensify as more players enter the market. CoreWeave needs to continue innovating and adapting to maintain its competitive edge. Market saturation is also a potential long-term risk.

- Future Stock Performance: While a precise prediction is impossible, the combination of Nvidia's strategic partnership, CoreWeave's technological strengths, and the robust AI market suggests a generally positive outlook for CRWV stock performance.

Conclusion: Understanding the CoreWeave (CRWV) Stock Rise – Key Takeaways and Future Considerations

The significant rise in CoreWeave (CRWV) stock price post-Nvidia investment is a result of several key factors: Nvidia's strategic investment boosting investor confidence, CoreWeave's strong competitive position in the AI cloud computing market, overwhelmingly positive market sentiment, and exciting prospects for future growth. The partnership between these two giants promises significant synergies, leading to potential long-term success.

To fully appreciate the investment potential of CRWV, learn more about CoreWeave's stock performance by consulting reputable financial sources. Stay informed on the CRWV investment landscape and analyze the future of CoreWeave's growth potential. Understanding these factors will help you make informed decisions regarding your investment strategy.

Featured Posts

-

Impact Of Sses 3 Billion Spending Reduction On Investment And Jobs

May 22, 2025

Impact Of Sses 3 Billion Spending Reduction On Investment And Jobs

May 22, 2025 -

Barry Ward Interview The Irish Actor On Roles And Type Casting

May 22, 2025

Barry Ward Interview The Irish Actor On Roles And Type Casting

May 22, 2025 -

Music World Mourns Adam Ramey Of Dropout Kings Dead At Age

May 22, 2025

Music World Mourns Adam Ramey Of Dropout Kings Dead At Age

May 22, 2025 -

Wordle Hints And Solution Puzzle 1352 March 2nd

May 22, 2025

Wordle Hints And Solution Puzzle 1352 March 2nd

May 22, 2025 -

Funbox Indoor Bounce Park Now Open In Mesa Arizona

May 22, 2025

Funbox Indoor Bounce Park Now Open In Mesa Arizona

May 22, 2025

Latest Posts

-

Ecb Your Source For English And Welsh Cricket Information

May 23, 2025

Ecb Your Source For English And Welsh Cricket Information

May 23, 2025 -

The Cricket Bat Maker Skill And Heritage Combined

May 23, 2025

The Cricket Bat Maker Skill And Heritage Combined

May 23, 2025 -

Cricket Bat Master A Tradition Continues

May 23, 2025

Cricket Bat Master A Tradition Continues

May 23, 2025 -

Freddie Flintoff A Month Off After Devastating Top Gear Crash

May 23, 2025

Freddie Flintoff A Month Off After Devastating Top Gear Crash

May 23, 2025 -

Ecb Cricket Fixtures Scores And Latest News From England And Wales

May 23, 2025

Ecb Cricket Fixtures Scores And Latest News From England And Wales

May 23, 2025