Understanding The Correlation Between Elon Musk's Activities And Crypto Market Trends (Focusing On DOGE)

Table of Contents

Musk's Influence on Dogecoin's Price

Elon Musk's pronouncements on DOGE have repeatedly sent its price soaring, solidifying his status as the "Dogefather" in the crypto community. This influence is a potent example of how social media and powerful figures can shape cryptocurrency markets.

The "Dogefather" Effect

Musk's public endorsements of DOGE, often accompanied by memes and humorous tweets, have directly correlated with significant price surges. His actions demonstrate the power of celebrity endorsements and the impact of social media on market sentiment.

- Example 1: In February 2021, a single tweet from Musk mentioning DOGE caused its price to jump by over 20% in a matter of hours.

- Example 2: Musk's appearances on Saturday Night Live and subsequent tweets mentioning DOGE led to another significant price spike, albeit followed by a sharp correction.

- Psychological Impact: These events highlight the psychological impact on investors. The fear of missing out (FOMO) and herd mentality often drive impulsive trading decisions, exacerbating price volatility. Data analysis reveals a strong positive correlation between Musk's positive DOGE mentions and price increases.

Musk's Company Involvement (Tesla, SpaceX)

Musk's influence extends beyond his personal tweets. Tesla's brief acceptance of DOGE for merchandise purchases, though later suspended, further demonstrated the impact of his business actions on the cryptocurrency's price. Future potential involvement from SpaceX could also significantly influence DOGE's trajectory.

- Tesla's DOGE Acceptance: The temporary acceptance of DOGE for merchandise created significant positive market sentiment and a temporary price surge. This highlighted the potential for broader adoption of cryptocurrencies by mainstream companies.

- SpaceX's Potential Role: Speculation about potential future integration of DOGE within SpaceX operations could generate further price volatility, depending on the nature and scale of any such involvement. This underscores the uncertainty surrounding the long-term implications of Musk's business ventures on DOGE.

The Role of Social Media and Media Hype

Musk's actions are amplified exponentially by social media and traditional media coverage, creating a feedback loop that fuels DOGE's price volatility. News outlets and social media influencers often report on his every tweet, further influencing investor behavior.

- Media Coverage: News articles and broadcasts consistently highlight Musk's influence on DOGE, driving more attention and investment towards the cryptocurrency. This creates a self-fulfilling prophecy where increased media coverage leads to higher prices.

- Social Media Influencers: Numerous cryptocurrency influencers and communities actively discuss Musk's actions, further amplifying their impact on market sentiment and price. The collective effect of these influencers can create significant price fluctuations.

- News Cycles: The impact of news cycles on DOGE price is evident. Positive news related to Musk and DOGE typically results in price increases, while negative news can lead to significant drops.

Analyzing the Volatility of Dogecoin

Dogecoin's price is inherently volatile, and Musk's influence exacerbates this instability, creating significant risks for investors.

High Volatility and Risk

DOGE's price history demonstrates exceptionally high volatility compared to other cryptocurrencies, especially Bitcoin and Ethereum. This volatility is largely attributed to its susceptibility to speculative trading driven by news and social media trends.

- Statistical Data: Analysis shows DOGE exhibits much higher price swings and standard deviation compared to more established cryptocurrencies. This high volatility makes it a riskier investment.

- Investor Risks: Investors in DOGE face a high potential for significant losses due to sudden and unpredictable price drops. The rapid price fluctuations can wipe out investments quickly.

Market Manipulation Concerns

Concerns have been raised regarding the potential for market manipulation linked to Musk's actions. His tweets, though often playful, could be interpreted as attempts to artificially inflate DOGE's price.

- Regulatory Considerations: Regulatory bodies worldwide are increasingly scrutinizing the influence of prominent figures on cryptocurrency markets and the potential for manipulation. This could lead to future regulations impacting such activities.

- Ethical Implications: The ethical implications of using social media to influence cryptocurrency markets are significant. The potential for unfair gains and losses at the expense of less informed investors is a major concern.

- Arguments For and Against: While some argue Musk's actions constitute market manipulation, others claim his tweets are merely expressions of opinion and that the market reacts based on its own internal dynamics.

The Future of Dogecoin and Musk's Influence

Predicting the future relationship between Musk and DOGE's price is challenging, but several scenarios are possible.

Predicting Future Trends

Several scenarios could unfold, depending on Musk's continued involvement, regulatory interventions, and evolving market dynamics.

- Continued Support: If Musk continues to endorse DOGE, price volatility is likely to persist, although the magnitude of price swings might change over time.

- Decreased Involvement: Reduced engagement from Musk could lead to lower volatility, but DOGE's price would likely still be susceptible to broader market trends.

- Regulatory Intervention: Increased regulatory scrutiny could limit Musk's ability to influence the market through social media, leading to a more stable, but potentially less exciting, future for DOGE.

- Long-term Sustainability: The long-term sustainability of DOGE remains questionable, heavily reliant on external factors like continued hype and broader adoption.

The Impact on the Broader Crypto Market

Musk's actions on DOGE have implications for the broader cryptocurrency market. His influence highlights the importance of responsible investing and thorough due diligence.

- Influence of Prominent Figures: The case of Musk and DOGE demonstrates how prominent figures can significantly influence market sentiment and price volatility across the crypto space.

- Responsible Investing: Investors must conduct thorough research and carefully evaluate the risks associated with investing in cryptocurrencies before committing funds. Blindly following influencers can lead to significant losses.

Conclusion

Elon Musk's influence on Dogecoin's price is undeniable, highlighting the crucial role of social media and influential figures in shaping cryptocurrency markets. While the "Dogefather" effect has generated significant gains for some, it also underscores the inherent risks and volatility associated with this digital asset. Understanding this correlation is paramount for navigating the unpredictable world of cryptocurrency investment. Therefore, thorough research and a cautious approach are essential before investing in Dogecoin or any other cryptocurrency affected by the actions of prominent figures. Continue researching the correlation between Elon Musk's activities and crypto market trends to make informed investment decisions.

Featured Posts

-

The Top 9 Nhl Players Who Might Eclipse Ovechkins Goal Record

May 09, 2025

The Top 9 Nhl Players Who Might Eclipse Ovechkins Goal Record

May 09, 2025 -

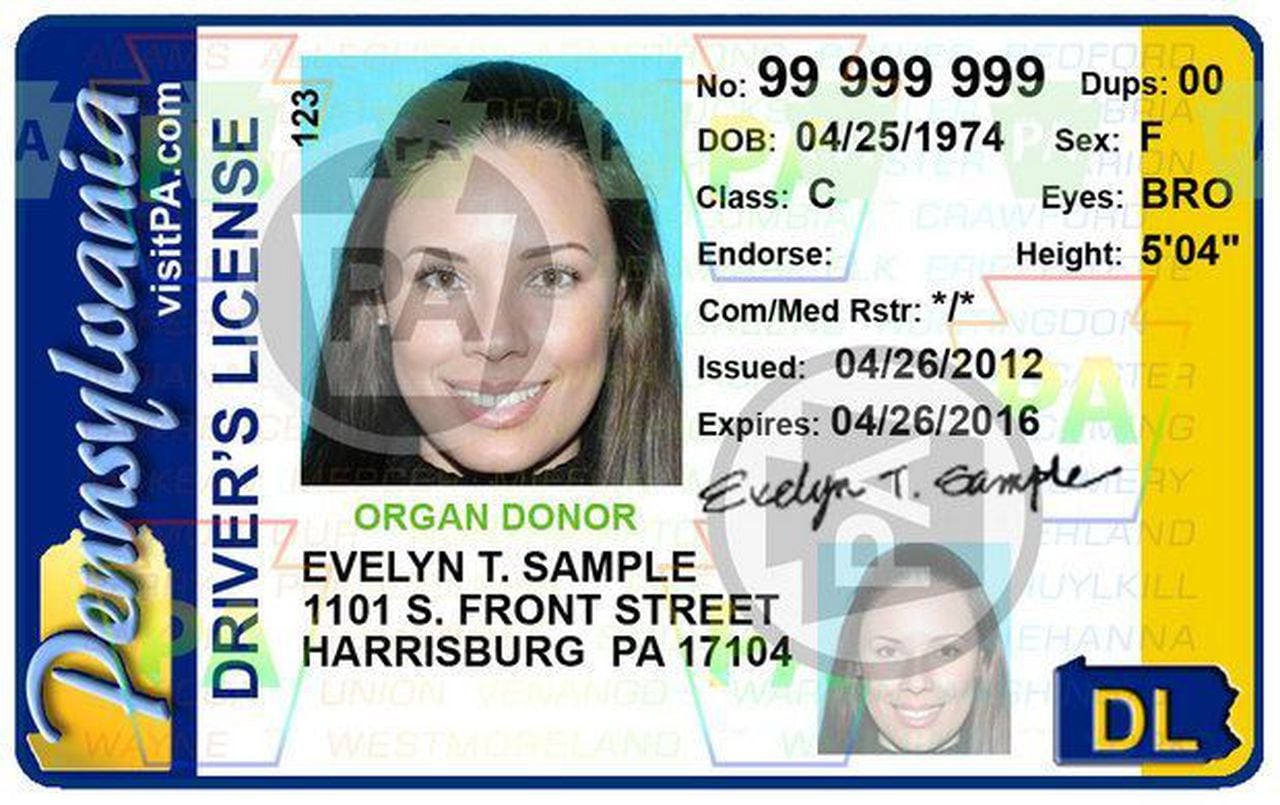

Real Id Enforcement Begins How It Affects Your Summer Travel

May 09, 2025

Real Id Enforcement Begins How It Affects Your Summer Travel

May 09, 2025 -

Warren Buffetts Canadian Successor A Billionaire Without Berkshire Hathaway Shares

May 09, 2025

Warren Buffetts Canadian Successor A Billionaire Without Berkshire Hathaway Shares

May 09, 2025 -

Barbashevs Ot Winner Golden Knights Beat Wild 4 3 Even Series

May 09, 2025

Barbashevs Ot Winner Golden Knights Beat Wild 4 3 Even Series

May 09, 2025 -

Madeleine Mc Cann Case Significant Dna Test Results Released

May 09, 2025

Madeleine Mc Cann Case Significant Dna Test Results Released

May 09, 2025