Warren Buffett's Canadian Successor: A Billionaire Without Berkshire Hathaway Shares

Table of Contents

Key Characteristics of a Buffett-Style Investor

Understanding the essence of a Buffett-style investor is crucial in our search. At its core, it's about value investing: identifying undervalued assets with strong fundamentals and holding them for the long term. This approach transcends simply following market trends; it requires deep dives into company financials, understanding their business models, and assessing their intrinsic value. Buffett's philosophy is built on patience and a long-term perspective, resisting the urge to react to short-term market fluctuations.

- Long-term growth focus: Buffett famously emphasizes the importance of "sleep well at night" investments – companies with strong, predictable earnings that can withstand economic downturns.

- Understanding business fundamentals: He meticulously analyzes a company's balance sheet, income statement, and cash flow statements to assess its true worth, rather than relying solely on market sentiment.

- Intrinsic Value: Buffett seeks to buy assets significantly below their intrinsic value, creating a margin of safety against unforeseen events.

Identifying Value Investments: The Buffett Method

Buffett's success stems from his meticulous approach. He looks beyond superficial metrics and focuses on:

- Competitive advantage (moats): Identifying companies with sustainable competitive advantages that protect them from competition. Think Coca-Cola's brand recognition or Geico's efficient insurance model.

- Excellent management: He invests in companies run by competent and ethical managers who align their interests with shareholders.

- Predictable earnings: Businesses with a history of consistent and growing earnings are highly valued.

Exploring Potential Canadian Candidates

Identifying a "Canadian Buffett" requires examining successful Canadian investors who mirror his strategies. While pinpointing a single perfect match is difficult, analyzing various investors reveals intriguing parallels. For example, [mention specific successful Canadian investors and their investment firms here, providing links where available]. These individuals have demonstrated remarkable success through strategies that share common ground with Buffett’s approach.

Canadian Investment Strategies

Analyzing their portfolios, we can draw parallels:

- [Investor A]: Known for their focus on [specific industry] and a long-term perspective, similar to Buffett's approach to consumer staples. Their investment in [specific company] highlights their ability to identify undervalued assets with strong growth potential.

- [Investor B]: Demonstrates a keen understanding of business fundamentals and a disciplined approach to value investing, resulting in [mention specific achievements and returns].

- [Investor C]: Emphasizes a diversified portfolio approach, minimizing risk while pursuing long-term growth.

Successful Canadian Investors

- Key Performance Indicators (KPIs): Each investor's success can be measured through various KPIs, including return on investment (ROI), portfolio diversification, and risk-adjusted returns. [Provide data or examples where possible.]

The Importance of Long-Term Vision in Canadian Investing

The Canadian market, like any other, experiences economic cycles and geopolitical influences. A long-term perspective is essential for navigating these fluctuations and achieving sustainable success. Patience and discipline are key to weathering short-term market volatility. Focusing on the underlying value of investments, rather than reacting to daily market noise, mirrors Buffett's philosophy perfectly.

Long-Term Investing in Canada

Successful long-term investments in Canada often involve:

- Understanding cyclical industries: Sectors like natural resources experience boom and bust cycles; long-term investors need to understand these patterns.

- Adapting to geopolitical factors: Global events can impact the Canadian economy, requiring investors to adjust their strategies accordingly.

- Risk management: Diversification and careful risk assessment are crucial for achieving long-term success in any market, but especially in the Canadian context.

Beyond Berkshire Hathaway: Diversification and Unique Approaches

While mimicking Buffett's success is challenging, it's crucial to acknowledge the limitations of focusing solely on Berkshire Hathaway. Diversification across different sectors and asset classes is crucial for mitigating risk and achieving optimal returns. Canadian investors have access to unique opportunities within their domestic market, such as [mention specific sectors or investment opportunities in the Canadian market].

Diversified Canadian Investment Portfolios

Successful diversification in the Canadian market often includes:

- Real estate: Canadian real estate has shown strong long-term growth potential, offering a compelling investment opportunity.

- Energy sector: While volatile, the energy sector presents potential for significant returns to long-term investors.

- Technology sector: Canada has a growing tech industry, offering opportunities for exposure to innovative companies.

Finding Your Own "Warren Buffett's Canadian Successor": A Call to Action

In conclusion, while finding a direct successor to Warren Buffett is improbable, discovering investors who embody his core principles of value investing, long-term vision, and disciplined risk management is entirely possible, particularly within the Canadian market. By studying successful Canadian investors and applying fundamental analysis, you can develop your own investment strategies, potentially discovering your Warren Buffett's Canadian successor. Start your search for your Warren Buffett's Canadian successor today by researching value investing principles and exploring the Canadian market. [Include links to relevant resources here, such as articles on value investing, profiles of successful Canadian investors, and reputable financial websites.]

Featured Posts

-

Is Palantir Stock A Good Buy Before May 5th Risks And Rewards

May 09, 2025

Is Palantir Stock A Good Buy Before May 5th Risks And Rewards

May 09, 2025 -

Elizabeth City Apartment Complex Car Break Ins Dozens Of Vehicles Targeted

May 09, 2025

Elizabeth City Apartment Complex Car Break Ins Dozens Of Vehicles Targeted

May 09, 2025 -

Analyzing The China Market Challenges Faced By Bmw Porsche And The Automotive Industry

May 09, 2025

Analyzing The China Market Challenges Faced By Bmw Porsche And The Automotive Industry

May 09, 2025 -

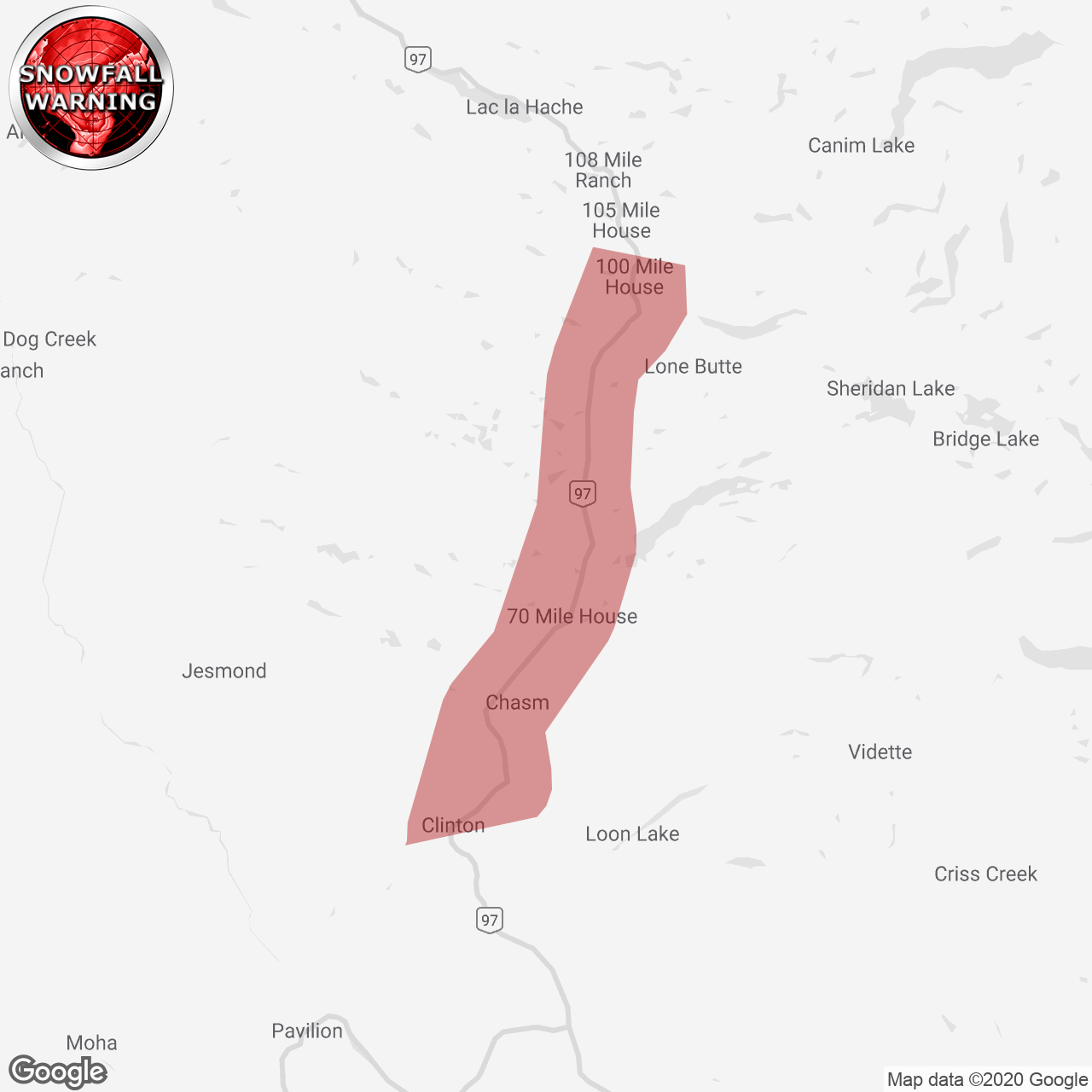

Snowfall Warning Issued For Parts Of Western Manitoba

May 09, 2025

Snowfall Warning Issued For Parts Of Western Manitoba

May 09, 2025 -

Figmas Ai Update A Game Changer Against Adobe Word Press And Canva

May 09, 2025

Figmas Ai Update A Game Changer Against Adobe Word Press And Canva

May 09, 2025