Understanding The Monday Dip In D-Wave Quantum (QBTS) Stock Price

Table of Contents

The D-Wave Quantum (QBTS) stock price often exhibits a noticeable dip on Mondays. This recurring phenomenon, often referred to as the "Monday dip," presents a compelling question for investors interested in this leading quantum computing company: What causes this consistent price drop? Understanding the factors behind the QBTS Monday dip is crucial for developing effective investment strategies within the volatile quantum technology sector. This article will explore the potential causes, providing valuable insights for navigating the complexities of QBTS stock price movements.

Weekend News and Market Sentiment

The start of the trading week is often influenced by information disseminated over the weekend. This information can significantly impact the opening price of QBTS and other quantum computing stocks.

Impact of News Releases

News releases over the weekend, including earnings reports, industry updates, and announcements from competitors, can significantly influence the QBTS stock price on Monday.

- Positive News: A positive announcement, such as a successful partnership or a breakthrough in quantum technology, can lead to a positive opening on Monday, potentially mitigating or even reversing the typical Monday dip.

- Negative News: Conversely, negative news, such as disappointing earnings, setbacks in research and development, or strong competitor announcements, often results in selling pressure, exacerbating the Monday dip.

The speed of the market's reaction to this weekend news varies. Sometimes, the market absorbs the information before the opening bell, while other times, the impact is felt immediately, leading to a significant price movement at the market open. The psychological aspect of investors processing information over a non-trading period often contributes to more pronounced Monday movements. Investors may overreact to weekend news, leading to a sell-off on Monday morning even if the actual impact is less severe.

Broader Market Trends

The Monday dip in QBTS isn't always isolated. It often correlates with the broader "Monday effect," a phenomenon where many market indices tend to underperform on Mondays compared to other days of the week.

- Correlation Analysis: Statistical analysis comparing QBTS's Monday performance against broader market indices (like the NASDAQ Composite or the S&P 500) can reveal the strength of this correlation. Historically, a negative correlation between the overall market performance and QBTS's Monday performance might indicate that the Monday dip is partly due to broader market trends.

- The Monday Effect: This well-documented market tendency is often attributed to factors like weekend news accumulation and investor sentiment resetting at the start of the week. Understanding this broader context is essential to properly evaluate the QBTS Monday dip.

Technical Analysis of QBTS's Monday Performance

Technical analysis can provide additional insights into the Monday dip in QBTS. By examining historical price data and utilizing various technical indicators, we can identify potential patterns.

Chart Patterns and Indicators

Technical indicators such as moving averages, Relative Strength Index (RSI), and volume analysis can illuminate the dynamics leading to the Monday dip.

- Moving Averages: Analyzing moving averages (e.g., 50-day and 200-day moving averages) can help identify trend reversals or support/resistance levels that might trigger selling pressure on Mondays.

- RSI: The RSI, a momentum indicator, can help pinpoint overbought or oversold conditions, providing insights into potential price reversals. A high RSI before Monday could suggest potential selling pressure.

(Note: Including actual charts and indicator examples here would significantly enhance this section, but requires image integration capabilities beyond the scope of a text-based response.)

The interpretation of these indicators requires careful consideration, and technical analysis alone doesn't guarantee accurate prediction.

Trading Volume and Liquidity

Analyzing the trading volume on Mondays compared to other days of the week is crucial.

- Volume Comparison: Lower trading volume on Mondays compared to other days could indicate less liquidity, making the QBTS stock more susceptible to price swings based on even relatively small trades. This reduced liquidity could amplify the impact of weekend news or broader market sentiment.

- Impact of Low Liquidity: Lower liquidity means that even small orders can cause disproportionate price movements. This increased volatility on Mondays contributes to the observed dip.

Investor Behavior and Psychology

Investor behavior and psychology significantly influence the Monday dip.

Profit-Taking and Position Adjustment

Many investors use the start of the week to re-evaluate their portfolios.

- Profit-Taking: Investors who have made profits during the previous week might choose to take profits at the start of the new week, leading to selling pressure. This behavior is common and contributes to the Monday dip.

- Position Adjustments: Some investors might adjust their holdings based on new information or changed market sentiment. This active portfolio management can result in increased selling on Mondays.

Weekend Reflection and Reassessment

The weekend provides investors time to reflect on their investments.

- Reassessment and Selling: Over the weekend, investors might re-evaluate their holdings and decide to sell certain positions due to concerns about the market or specific companies. This reassessment frequently leads to selling pressure on Monday.

- Long-Term vs. Short-Term Strategies: Adopting a long-term investment strategy helps mitigate the impact of short-term volatility like the Monday dip. Focusing on the long-term potential of QBTS and the quantum computing industry is vital for successful investment.

Conclusion

The Monday dip in D-Wave Quantum (QBTS) stock price is a complex phenomenon influenced by a combination of weekend news, broader market trends, technical factors, and investor psychology. Understanding these factors requires a nuanced approach, considering various market influences and investor behavior. By carefully analyzing these influences, investors can develop more informed strategies for navigating the volatility in the QBTS stock price. Continue your research on QBTS and the broader quantum computing market to make well-informed investment decisions, mitigating the risks associated with the Monday dip and capitalizing on the long-term growth potential of D-Wave Quantum.

Featured Posts

-

Abn Amro Bonus Payments Under Scrutiny Potential Fine From Dutch Regulator

May 21, 2025

Abn Amro Bonus Payments Under Scrutiny Potential Fine From Dutch Regulator

May 21, 2025 -

Bp Ceos Plan Double Valuation Remain On London Stock Exchange

May 21, 2025

Bp Ceos Plan Double Valuation Remain On London Stock Exchange

May 21, 2025 -

Abn Amro Opslag Problemen Met Online Betalingen

May 21, 2025

Abn Amro Opslag Problemen Met Online Betalingen

May 21, 2025 -

Watch Sandylands U Where To Stream And Find Episodes

May 21, 2025

Watch Sandylands U Where To Stream And Find Episodes

May 21, 2025 -

Kaellmanin Maalivire Huuhkajien Apuna Mitae Odottaa

May 21, 2025

Kaellmanin Maalivire Huuhkajien Apuna Mitae Odottaa

May 21, 2025

Latest Posts

-

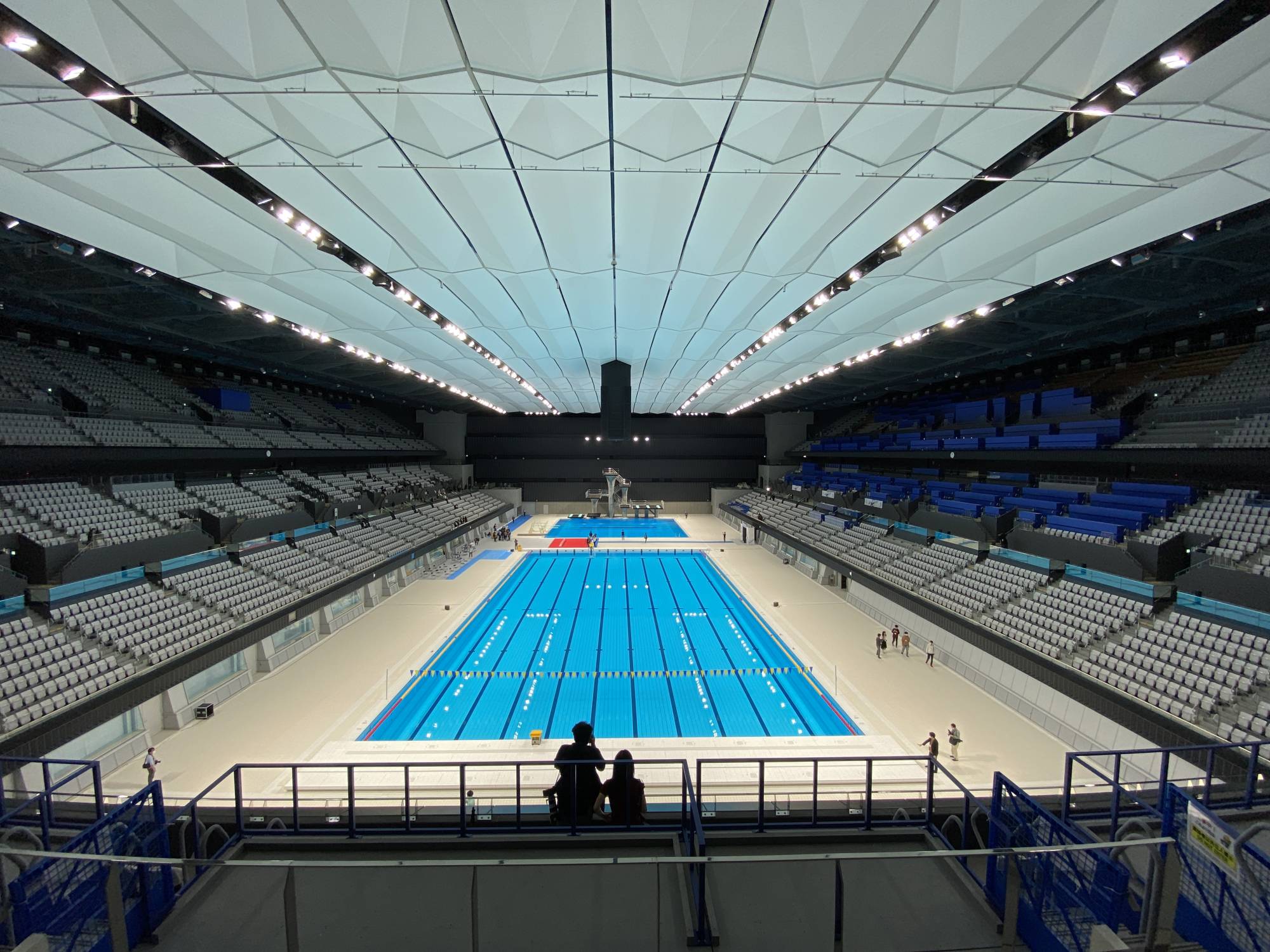

New Olympic Swimming Venue Planned For Nice Details Of The Ambitious Project

May 22, 2025

New Olympic Swimming Venue Planned For Nice Details Of The Ambitious Project

May 22, 2025 -

Taming The Love Monster A Journey To Self Acceptance And Positive Self Image

May 22, 2025

Taming The Love Monster A Journey To Self Acceptance And Positive Self Image

May 22, 2025 -

Unexpected Snowstorm Hits Southern French Alps

May 22, 2025

Unexpected Snowstorm Hits Southern French Alps

May 22, 2025 -

Love Monster A Parents Guide To Understanding And Addressing Aggressive Behavior In Children

May 22, 2025

Love Monster A Parents Guide To Understanding And Addressing Aggressive Behavior In Children

May 22, 2025 -

Nice Unveils Plans For New Olympic Sized Swimming Pool Complex

May 22, 2025

Nice Unveils Plans For New Olympic Sized Swimming Pool Complex

May 22, 2025