Understanding X's Transformation: A Deep Dive Into The Post-Debt Sale Financials

Table of Contents

X's recent debt sale has dramatically reshaped its financial landscape. This in-depth analysis will dissect X's post-debt sale financials, exploring the key changes, implications, and future outlook. We will examine the impact on X's financial stability, strategic direction, and overall market position. This deep dive is crucial for investors, analysts, and anyone interested in understanding the transformed financial health of X and its post-debt sale financial performance. Understanding X's post-debt sale financials is key to navigating the evolving investment landscape surrounding this company.

Analyzing X's Debt Reduction Strategy

Pre-Sale Debt Structure

Before the sale, X carried a substantial debt burden. Understanding this pre-sale debt structure is critical to appreciating the scale of the transformation.

- Types of Debt: X's pre-sale debt portfolio consisted primarily of high-yield corporate bonds, bank loans, and revolving credit facilities. The high proportion of high-yield bonds reflected a higher risk profile and consequently, higher interest payments.

- Interest Rates and Profitability: The high interest rates associated with this debt significantly impacted X's profitability, eating into operating income and limiting its ability to invest in growth initiatives. High interest expense is a common characteristic of companies with high leverage before restructuring.

- Significant Risks: The pre-sale debt structure presented significant risks, including potential defaults if interest rates rose or if X faced unexpected financial difficulties. The maturity dates of various debt instruments also posed a refinancing risk, as failing to refinance could trigger a liquidity crisis.

The Debt Sale Process

The debt sale itself was a complex transaction requiring careful planning and execution.

- Sale Mechanism: X employed a combination of a targeted private placement and a competitive auction process to maximize the value received for its debt. This hybrid approach allowed for both efficiency and competitive pricing.

- Key Buyers and Motivations: The primary buyers of X's debt were a mix of institutional investors, hedge funds, and private equity firms, motivated by the potential for a significant return on their investment once X restructured its debt. Their involvement signals confidence in X's future prospects.

- Pricing and Concessions: The sale achieved favorable pricing for X, significantly reducing its overall debt burden. While some concessions were made to attract buyers, the overall terms of the agreement were considered beneficial for X's long-term financial health.

Post-Sale Debt Levels and Composition

The impact of the debt sale on X's financial structure is considerable.

- Percentage Reduction in Total Debt: The debt sale resulted in a remarkable X% reduction in X's total debt, significantly strengthening its balance sheet. This is a key metric in assessing the success of debt reduction strategies.

- Changes in Debt Composition: The post-sale debt composition shows a significant shift from high-yield bonds to lower-interest debt instruments, resulting in lower interest expense and increased financial flexibility. Lower interest rates improved profitability.

- Remaining Debt Maturities and Risks: While the debt reduction was substantial, X still carries some debt with various maturity dates. Careful monitoring of these maturities and proactive refinancing strategies will be crucial in mitigating future risks associated with X’s post-debt sale financials.

Impact on X's Financial Performance

Changes in Key Financial Metrics

The debt sale has demonstrably improved several key financial ratios.

- Leverage and Debt-to-Equity Ratio: X's leverage and debt-to-equity ratios have decreased significantly post-sale, indicating a much stronger financial position. These improvements reflect a lower risk profile.

- Interest Coverage Ratio: The interest coverage ratio, which measures X's ability to pay its interest expense, has also improved dramatically, providing greater financial stability. This ratio is critical for creditors.

- Industry Benchmarks: Compared to industry benchmarks, X now exhibits financial ratios that are more in line with, or even exceeding, its peers, showcasing the success of its debt reduction strategy and positioning it favorably within its industry.

Profitability and Cash Flow

The reduction in interest expense has had a positive cascading effect on X's profitability and cash flow.

- Interest Expense Reduction: The lower interest expense directly contributes to higher net income and operating income, boosting overall profitability.

- Free Cash Flow: The improved cash flow position allows X to reinvest in its operations, pursue growth opportunities, and potentially return capital to shareholders through dividends or share buybacks. This increased cash flow signals potential for future growth.

- Dividend Payments and Share Buybacks: Improved cash flow could enable X to resume or increase dividend payments and potentially initiate share buyback programs, increasing shareholder value. These actions are commonly associated with improved financial health.

Strategic Implications and Future Outlook

Strategic Repositioning

The improved financial health provides X with significant strategic flexibility.

- New Investment and Expansion: X can now allocate capital to new investment projects, research and development, and expansion into new markets, capitalizing on opportunities previously constrained by its high debt load.

- Changes in Management Strategy: The debt reduction allows for a potential shift in management strategy, focusing on growth and innovation rather than solely on debt servicing.

- Mergers and Acquisitions: X's stronger balance sheet enhances its ability to pursue mergers and acquisitions, potentially accelerating growth through strategic consolidation.

Risk Assessment

While the debt sale has significantly improved X's position, certain risks remain.

- Economic and Industry-Specific Risks: X remains vulnerable to broader economic downturns and industry-specific challenges. Careful risk management is essential.

- Remaining Financial Risks and Vulnerabilities: While significantly reduced, the remaining debt still presents a degree of financial risk. Maintaining healthy liquidity remains crucial.

- Contingency Plans: X should maintain contingency plans to address potential future economic downturns or industry-specific challenges. A proactive approach minimizes risks.

Conclusion:

This in-depth analysis of X's post-debt sale financials reveals a significantly improved financial position. The strategic debt reduction has lowered X's financial risk profile, improved its key financial metrics, and opened up new avenues for future growth. However, remaining risks need careful consideration. To stay informed about X's continued transformation and its long-term financial outlook, regularly review updated financial reports and analysis focusing on X's post-debt sale financials. Understanding these changes is key to making informed investment decisions about X. Staying abreast of X's post-debt sale financial performance is crucial for all stakeholders.

Featured Posts

-

Riviera Blue Porsche 911 S T Exceptional Pts Example For Sale

Apr 29, 2025

Riviera Blue Porsche 911 S T Exceptional Pts Example For Sale

Apr 29, 2025 -

Saudi Pif Imposes One Year Ban On Pw C Advisory Services

Apr 29, 2025

Saudi Pif Imposes One Year Ban On Pw C Advisory Services

Apr 29, 2025 -

Where Should The White Lotus Film Next A Perfect Location

Apr 29, 2025

Where Should The White Lotus Film Next A Perfect Location

Apr 29, 2025 -

Car Ramming Attack On Canadian Filipino Community What We Know

Apr 29, 2025

Car Ramming Attack On Canadian Filipino Community What We Know

Apr 29, 2025 -

How You Tube Is Attracting An Older Viewership

Apr 29, 2025

How You Tube Is Attracting An Older Viewership

Apr 29, 2025

Latest Posts

-

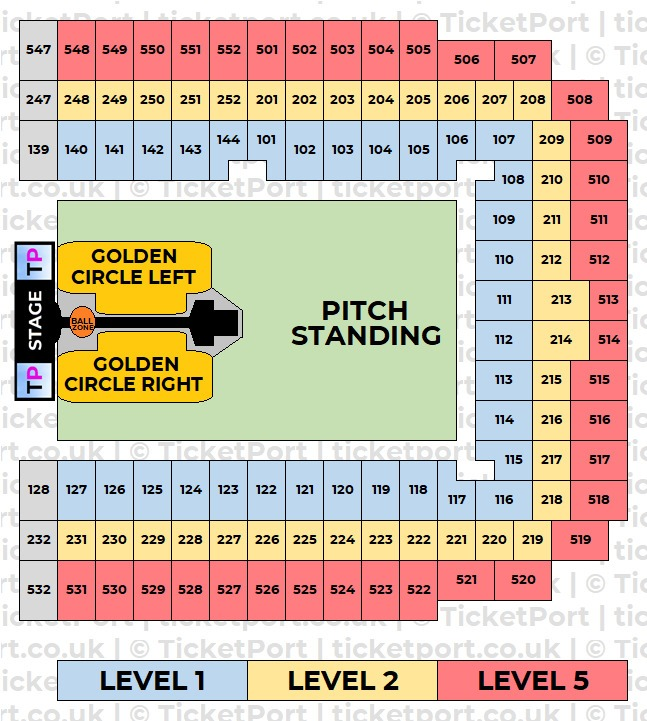

Capital Summertime Ball 2025 Where And How To Buy Tickets

Apr 29, 2025

Capital Summertime Ball 2025 Where And How To Buy Tickets

Apr 29, 2025 -

Capital Summertime Ball 2025 How To Buy Tickets Successfully

Apr 29, 2025

Capital Summertime Ball 2025 How To Buy Tickets Successfully

Apr 29, 2025 -

Get Capital Summertime Ball 2025 Tickets Official Ticket Outlets And Resellers

Apr 29, 2025

Get Capital Summertime Ball 2025 Tickets Official Ticket Outlets And Resellers

Apr 29, 2025 -

Finding Capital Summertime Ball 2025 Tickets The Ultimate Guide

Apr 29, 2025

Finding Capital Summertime Ball 2025 Tickets The Ultimate Guide

Apr 29, 2025 -

Capital Summertime Ball 2025 Tickets Purchase Information And Tips

Apr 29, 2025

Capital Summertime Ball 2025 Tickets Purchase Information And Tips

Apr 29, 2025