Upcoming Changes In Financial Planning: CFP Board CEO Retiring In 2026

Table of Contents

The Impact of the CFP Board CEO's Retirement

The departure of the CFP Board CEO in 2026 marks a pivotal moment. This leadership transition will inevitably bring about shifts, creating both uncertainty and potential for positive change within the financial planning landscape.

Leadership Transition and Potential Shifts in Strategy

A new CEO will bring their own vision and priorities. This could lead to significant alterations in the CFP Board's strategic direction. Potential changes include:

- Increased Emphasis on Technology: We may see a stronger focus on integrating technology into financial planning education and practice, potentially including more robust online learning platforms and enhanced technological proficiency requirements for certification.

- New Educational Initiatives: The CFP Board might introduce innovative educational programs to better equip CFP professionals for the evolving financial landscape. This could involve expanded curriculum in areas like fintech, behavioral finance, or sustainable investing.

- Revised Certification Requirements: Changes to the CFP certification process are possible, aiming to enhance the rigor and relevance of the credential in response to market demands and technological advancements.

These shifts will directly impact CFP professionals, requiring them to adapt their skills and knowledge to maintain their competitive edge. Clients will also experience the effects indirectly, potentially through changes in the services offered by their advisors and the overall quality of financial advice.

Succession Planning and Stability at the CFP Board

The CFP Board's ability to manage this transition smoothly is paramount. A well-executed succession plan will be vital in minimizing disruption to the certification process and maintaining the high standards associated with the CFP designation.

- Maintaining Consistency: A key focus should be on ensuring consistent application of certification standards and ethical guidelines during the transition. Any changes should be implemented thoughtfully and transparently.

- Minimizing Disruption: The succession planning process should prioritize a seamless transition to minimize any disruption to CFP professionals or the broader financial planning community.

- Transparency and Communication: Open communication regarding the succession plan and any anticipated changes will help build confidence and trust among stakeholders. The CFP Board should proactively share information to alleviate concerns.

Anticipated Changes in Financial Planning Regulations and Standards

Beyond the leadership change, the financial planning industry faces evolving regulatory landscapes and technological advancements. These factors will significantly shape the profession in the coming years.

Potential Regulatory Updates

The regulatory environment for financial planning is constantly evolving to address consumer protection and market stability. Potential regulatory updates may include:

- Enhanced Fiduciary Standards: Further strengthening of fiduciary standards could lead to greater accountability and transparency in financial advice.

- Cybersecurity Regulations: Increased focus on data security and privacy will necessitate enhanced cybersecurity measures for financial advisors and their clients.

- Changes to Investment Advisory Rules: Amendments to rules governing investment advice could impact how CFP professionals manage client portfolios and provide investment recommendations.

For the most up-to-date information, refer to relevant regulatory bodies like the SEC (Securities and Exchange Commission) and the FINRA (Financial Industry Regulatory Authority) websites.

Evolving Technological Landscape

Technology is transforming the financial planning landscape, creating both opportunities and challenges.

- Rise of Robo-Advisors: Automated investment platforms are becoming increasingly prevalent, requiring CFP professionals to adapt their services to remain competitive.

- AI-Powered Tools: Artificial intelligence is being leveraged to enhance data analysis, improve client service, and automate tasks, impacting how financial advice is delivered.

- Increased Use of Data Analytics: Data-driven insights are becoming increasingly important in financial planning, demanding greater analytical skills from CFP professionals.

These technological advancements will necessitate continuous professional development for CFP professionals to stay current and effectively utilize these tools.

Preparing for the Future of Financial Planning

The changes ahead require proactive adaptation from both CFP professionals and their clients.

Strategies for CFP Professionals

CFP professionals must proactively adapt to the changing landscape:

- Continuing Education: Engaging in ongoing professional development is vital to staying abreast of regulatory changes, technological advancements, and emerging best practices.

- Embrace Technology: Integrating technology into their practice will enhance efficiency and improve client service. This includes utilizing financial planning software and data analytics tools.

- Networking and Collaboration: Connecting with other professionals and staying engaged in industry organizations will provide valuable insights and opportunities for collaboration.

Numerous resources are available to assist CFP professionals, including the CFP Board website and various professional development organizations.

What Clients Should Know

Clients should also understand the implications of these changes:

- Choose a Qualified Advisor: Selecting a CFP professional demonstrates a commitment to receiving high-quality, ethical advice. Verify their credentials and experience.

- Open Communication: Maintain open communication with your financial advisor to discuss any concerns and ensure alignment with your financial goals in light of industry changes.

- Stay Informed: Stay informed about the changes affecting the financial planning profession to ensure you're making informed decisions about your financial future.

Conclusion

The CFP Board CEO's retirement in 2026 marks a significant turning point for financial planning. The resulting leadership transition and anticipated regulatory and technological changes will require proactive adaptation from both CFP professionals and their clients. By understanding these potential changes and taking appropriate steps, both advisors and clients can effectively navigate the evolving landscape. Find a CFP professional near you to discuss your financial plan and prepare for the future of financial planning. Stay informed about CFP Board updates and ensure your financial future is secure by working with a qualified CFP professional.

Featured Posts

-

The Tulsa Day Center And The Growing Homeless Population In Tulsa

May 03, 2025

The Tulsa Day Center And The Growing Homeless Population In Tulsa

May 03, 2025 -

Former Liverpool Captain Attacks Manchester Uniteds Transfers

May 03, 2025

Former Liverpool Captain Attacks Manchester Uniteds Transfers

May 03, 2025 -

Kocaeli 1 Mayis Kutlamalar Sirasinda Meydana Gelen Olaylar

May 03, 2025

Kocaeli 1 Mayis Kutlamalar Sirasinda Meydana Gelen Olaylar

May 03, 2025 -

Is This Christina Aguilera New Photos Raise Photoshop Concerns

May 03, 2025

Is This Christina Aguilera New Photos Raise Photoshop Concerns

May 03, 2025 -

Minnesota Special House Election Key Takeaways From Ap Decision Notes

May 03, 2025

Minnesota Special House Election Key Takeaways From Ap Decision Notes

May 03, 2025

Latest Posts

-

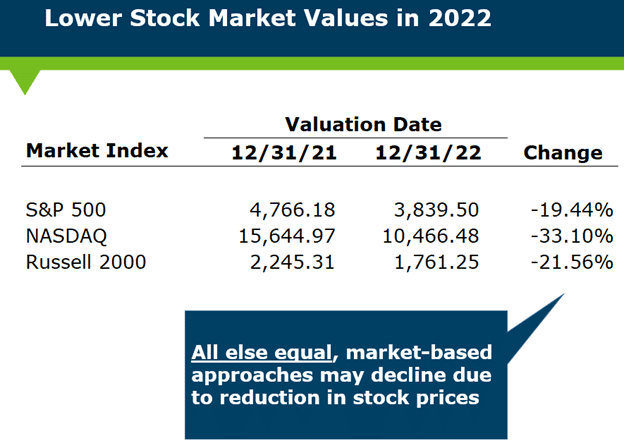

Are High Stock Market Valuations Cause For Concern Bof As Analysis

May 04, 2025

Are High Stock Market Valuations Cause For Concern Bof As Analysis

May 04, 2025 -

Effective Middle Management Key To Employee Engagement And Business Growth

May 04, 2025

Effective Middle Management Key To Employee Engagement And Business Growth

May 04, 2025 -

The China Factor Assessing Risks And Opportunities For Automakers Like Bmw And Porsche

May 04, 2025

The China Factor Assessing Risks And Opportunities For Automakers Like Bmw And Porsche

May 04, 2025 -

The Power Of Middle Management Fostering Collaboration And Driving Results

May 04, 2025

The Power Of Middle Management Fostering Collaboration And Driving Results

May 04, 2025 -

Investing In Middle Management A Strategic Approach To Business Growth

May 04, 2025

Investing In Middle Management A Strategic Approach To Business Growth

May 04, 2025