US-China Talks And Economic Data Drive Chinese Stock Market Rally

Table of Contents

Positive Developments in US-China Trade Relations

The thawing of relations between the US and China has played a pivotal role in boosting investor confidence. This improved atmosphere is directly influencing the Chinese stock market's performance.

Easing Trade Tensions

Recent positive developments in US-China trade negotiations have significantly contributed to the market rally. The easing of trade tensions, once a major source of uncertainty, is now providing a much-needed boost to investor sentiment.

- Reduced Tariffs: The recent announcement of reduced tariffs on certain goods has signaled a willingness from both sides to find common ground. This concrete step towards de-escalation has calmed market anxieties.

- De-escalation of Rhetoric: A noticeable decrease in the harsh rhetoric previously employed by both governments has created a more positive and predictable environment for businesses and investors. The shift towards constructive dialogue is palpable.

- Phased Trade Agreements: The implementation of phased trade agreements allows for a gradual reduction of trade barriers, fostering a more stable and predictable business environment, which in turn improves market confidence.

Improved Communication Channels

The restoration of open communication channels between the US and China is crucial. Improved diplomatic relations are leading to a better understanding and resolution of trade disputes.

- Increased High-Level Meetings: A higher frequency of high-level meetings and diplomatic exchanges indicates a stronger commitment from both sides to find mutually beneficial solutions. This regular dialogue reassures investors.

- Enhanced Diplomatic Relations: The overall improvement in diplomatic relations, beyond trade, projects an image of stability and cooperation, further boosting market sentiment. This broader improvement in ties extends beyond trade specifics.

Encouraging Economic Data from China

Stronger-than-expected economic data from China is providing further fuel to the market rally. These positive indicators are reinforcing investor confidence in the country's economic outlook.

Stronger-Than-Expected GDP Growth

Recent GDP growth figures have exceeded expectations, indicating a healthy and resilient Chinese economy. This positive momentum is a significant driver of the stock market rally.

- Solid GDP Growth Numbers: The recent quarterly GDP growth figures have surpassed analyst forecasts, demonstrating strong economic fundamentals.

- Positive Growth Trajectory: The sustained growth trajectory suggests that the Chinese economy is not only recovering but also demonstrating impressive resilience.

- Comparison to Previous Quarters: Comparing the current GDP growth to previous quarters shows a clear upward trend, instilling optimism about future economic performance.

Positive Retail Sales and Industrial Production

Beyond GDP growth, other key economic indicators such as retail sales and industrial production are contributing to the positive market sentiment.

- Robust Retail Sales: Strong retail sales figures demonstrate healthy consumer spending, reflecting a vibrant domestic market.

- Increased Industrial Production: Growth in industrial production indicates a robust manufacturing sector, a key driver of the Chinese economy.

- Positive Trends: The sustained positive trends across both retail sales and industrial production reinforce the overall picture of a healthy economic recovery.

Government Stimulus Measures

The Chinese government’s strategic implementation of government stimulus measures has played a vital role in bolstering economic activity and market confidence.

- Targeted Fiscal Policies: Well-targeted fiscal policies, such as infrastructure investments, have stimulated economic growth and created jobs.

- Effective Monetary Policy: Supportive monetary policies, such as interest rate adjustments, have helped maintain liquidity and encourage investment.

- Positive Market Impact: These government interventions have had a demonstrably positive impact on the stock market, further accelerating the rally.

Investor Sentiment and Market Reactions

The positive developments discussed above have significantly impacted investor sentiment and market reactions.

Increased Foreign Investment

The recent rally has been accompanied by a noticeable increase in foreign investment flowing into the Chinese stock market.

- Significant Capital Inflows: The substantial increase in capital inflows demonstrates growing confidence in the Chinese market among international investors.

- Positive Market Perception: This influx of foreign investment reflects an increasingly positive perception of the Chinese economy and its future prospects.

- Market Support: Foreign investment provides significant support to the market, further driving the upward trend.

Market Volatility and Future Outlook

While the current market trend is positive, it's essential to acknowledge market volatility and potential future risks.

- Geopolitical Uncertainties: Geopolitical risks remain, and unexpected events could impact market sentiment.

- Economic Headwinds: Potential economic headwinds, both domestic and global, could also affect the market's trajectory.

- Cautious Outlook: Therefore, a cautious outlook is warranted, with careful consideration of potential risks and uncertainties.

US-China Talks and Economic Data Drive Chinese Stock Market Rally – A Summary and Call to Action

In summary, the recent rally in the Chinese stock market is primarily driven by the positive impact of improved US-China talks and robust economic data. Easing trade tensions, strengthened communication channels, and strong economic indicators have all contributed to increased investor confidence and significant capital inflows. The government's stimulus measures have also played a key role.

Key Takeaways: The interplay between improved US-China relations and positive economic data is crucial for understanding the current market dynamics. While the outlook is generally positive, investors should remain mindful of potential risks.

Call to Action: Stay updated on the latest developments in US-China talks and economic data to effectively navigate the Chinese stock market and make informed investment decisions. Understanding this complex relationship is critical for successful investment in this dynamic market.

Featured Posts

-

John Wick 5 Debunking The Myth Of John Wicks Return After Death

May 07, 2025

John Wick 5 Debunking The Myth Of John Wicks Return After Death

May 07, 2025 -

Ldc Resilience Key Outcomes From The Third Future Forum

May 07, 2025

Ldc Resilience Key Outcomes From The Third Future Forum

May 07, 2025 -

Packers Steelers Trade Could Josh Jacobs Get His Wish

May 07, 2025

Packers Steelers Trade Could Josh Jacobs Get His Wish

May 07, 2025 -

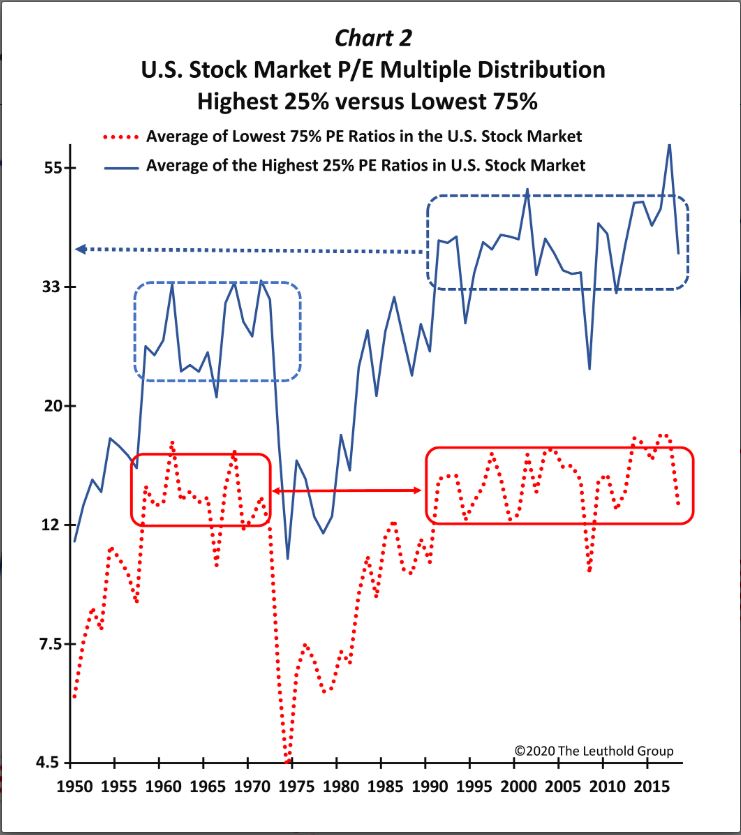

Bof A Why Stretched Stock Market Valuations Shouldnt Worry Investors

May 07, 2025

Bof A Why Stretched Stock Market Valuations Shouldnt Worry Investors

May 07, 2025 -

The Future Of A Steelers Star Wide Receiver The Teams Decision

May 07, 2025

The Future Of A Steelers Star Wide Receiver The Teams Decision

May 07, 2025

Latest Posts

-

Wto Accession Speed Up A Privilege Based Analysis

May 07, 2025

Wto Accession Speed Up A Privilege Based Analysis

May 07, 2025 -

The Privilege Dilemma Implications For Wto Accession

May 07, 2025

The Privilege Dilemma Implications For Wto Accession

May 07, 2025 -

Flood Preparedness For Livestock Mitigation And Response Strategies

May 07, 2025

Flood Preparedness For Livestock Mitigation And Response Strategies

May 07, 2025 -

Protecting Livestock From Flood Damage A Comprehensive Guide

May 07, 2025

Protecting Livestock From Flood Damage A Comprehensive Guide

May 07, 2025 -

Livestock At Risk Understanding The Dangers Of Flooding

May 07, 2025

Livestock At Risk Understanding The Dangers Of Flooding

May 07, 2025