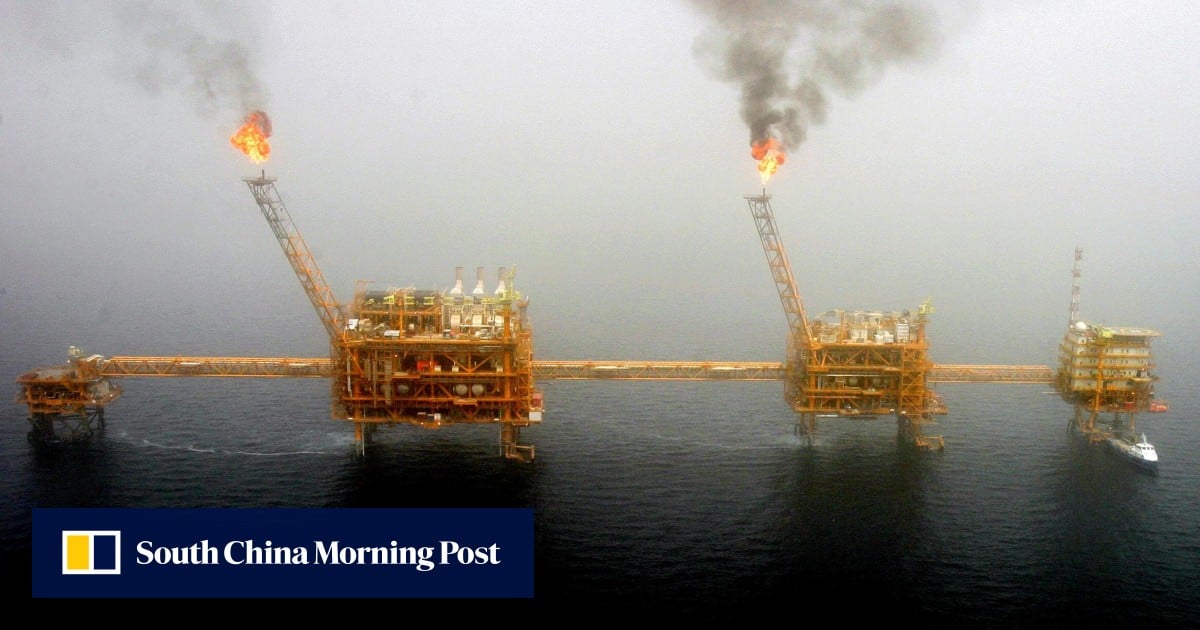

US Crackdown Threatens Chinese Plastics Supply From Iran

Table of Contents

Iran's Role as a Key Supplier of Petrochemical Feedstock to China

Petrochemical Exports: The Backbone of the Relationship

Iran has long been a vital, low-cost supplier of raw materials for China's booming plastics industry. Petrochemical exports, particularly polyethylene (PE) and polypropylene (PP), form the backbone of this relationship. These materials are essential components in countless products, from packaging and consumer goods to automotive parts and construction materials.

- Quantifiable Impact: Iran's export volume to China has historically represented a significant portion of the global market for these crucial petrochemicals, with estimates placing its market share in the double digits (precise figures vary depending on the year and reporting agency). Specific products like linear low-density polyethylene (LLDPE), high-density polyethylene (HDPE), and polypropylene (PP) have been particularly affected by this trade relationship.

- Price Competitiveness: Iranian petrochemicals have often enjoyed a significant price advantage compared to producers in other regions, making them highly attractive to cost-conscious Chinese manufacturers. This price competitiveness stemmed from Iran's abundant resources and relatively lower production costs.

Trade Volumes and Economic Dependence

The economic interdependence between China and Iran in the plastics and petrochemicals sector is substantial. The annual trade volume, measured in billions of US dollars, underscores this reliance. This significant exchange has contributed to lower production costs for Chinese businesses, boosting their competitiveness in the global market. While no formal bilateral trade agreements specifically focusing on plastics exist, the broader economic ties between the two countries have facilitated this extensive trade relationship.

The Impact of US Sanctions and Enforcement

Sanctions and Their Implications for Trade

US sanctions against Iran significantly restrict Iranian petrochemical exports to China. These sanctions employ various mechanisms to limit trade, including:

- Financial Restrictions: Sanctions target Iranian banks and financial institutions, making it difficult for Chinese companies to conduct legitimate transactions related to Iranian petrochemical purchases.

- Shipping Limitations: Restrictions on shipping and insurance related to Iranian goods make it risky and expensive for Chinese companies to import Iranian petrochemicals. This often involves secondary sanctions that penalize companies from other countries that do business with sanctioned entities.

Increased Scrutiny and Risk for Chinese Businesses

The increased scrutiny resulting from US sanctions significantly elevates the risks for Chinese businesses involved in importing Iranian petrochemicals. The potential penalties for violating sanctions are substantial, including hefty fines and reputational damage that can negatively impact future business dealings.

- Legal Ramifications: Chinese companies found to be in violation of US sanctions face serious legal consequences, potentially jeopardizing their operations in the US and impacting their global standing.

- Examples of Enforcement: Numerous cases demonstrate the US government's commitment to enforcing these sanctions, with several companies having faced substantial penalties for engaging in prohibited transactions with Iran.

China's Response and Search for Alternative Suppliers

Diversification of Supply Chains

Faced with the disruption caused by US sanctions, China is actively seeking to diversify its sources of petrochemical feedstock. This strategy involves exploring alternative suppliers and strengthening existing relationships with countries like:

- Saudi Arabia: Given its substantial petrochemical production capacity, Saudi Arabia is a potential key alternative supplier for China.

- Russia: Russia also represents a significant source of petrochemicals, and strengthened ties could help offset the shortfall from Iran. However, logistical challenges and potential geopolitical considerations play a crucial role.

The feasibility of successfully shifting reliance to these alternative suppliers depends on factors such as production capacity, pricing, transportation logistics, and geopolitical considerations.

Investment in Domestic Petrochemical Production

To reduce dependence on imports, China is significantly investing in expanding its domestic petrochemical production capacity. This involves substantial government policies and investments in new plants and infrastructure.

- Government Initiatives: China's government has implemented various policies and initiatives aimed at fostering domestic petrochemical production, offering incentives and support to relevant industries.

- Projected Timeline: While increasing domestic production will alleviate some reliance on imports, it is a long-term strategy requiring significant investments and time to fully materialize. Complete independence from Iranian petrochemicals is unlikely in the immediate future.

Conclusion

The US crackdown on Iranian sanctions poses a significant threat to the Chinese plastics supply chain, which heavily relies on Iranian petrochemicals. The economic and geopolitical implications are far-reaching, affecting Chinese manufacturing costs, global supply chain stability, and the broader relationship between China, Iran, and the US. Chinese businesses are increasingly exposed to significant risks as they navigate the complex landscape of sanctions enforcement. China's efforts to diversify supply chains and bolster domestic production are crucial steps in mitigating this disruption, but complete independence remains a long-term goal. Continued monitoring of the situation and understanding the evolving dynamics of Chinese plastics supply from Iran are essential for all stakeholders involved in this intricate global supply chain. Further research into the impact of US sanctions on global trade and the adaptation strategies employed by affected nations is strongly encouraged.

Featured Posts

-

Giorgio Baldi Reopens Rihanna Among First To Dine After Wildfires

May 07, 2025

Giorgio Baldi Reopens Rihanna Among First To Dine After Wildfires

May 07, 2025 -

Hqayq Mdhhlt En Jaky Shan Hyat Mlyyt Balmghamrat

May 07, 2025

Hqayq Mdhhlt En Jaky Shan Hyat Mlyyt Balmghamrat

May 07, 2025 -

Steph Currys All Star Weekend Victory A New Formats Debut

May 07, 2025

Steph Currys All Star Weekend Victory A New Formats Debut

May 07, 2025 -

Ayesha Curry Putting Marriage First Her Perspective On Family Dynamics

May 07, 2025

Ayesha Curry Putting Marriage First Her Perspective On Family Dynamics

May 07, 2025 -

The Design Of Hawkgirls Wings A James Gunn Superman Update

May 07, 2025

The Design Of Hawkgirls Wings A James Gunn Superman Update

May 07, 2025

Latest Posts

-

Currys Injury Steve Kerr Offers Encouraging Update For Warriors Fans

May 07, 2025

Currys Injury Steve Kerr Offers Encouraging Update For Warriors Fans

May 07, 2025 -

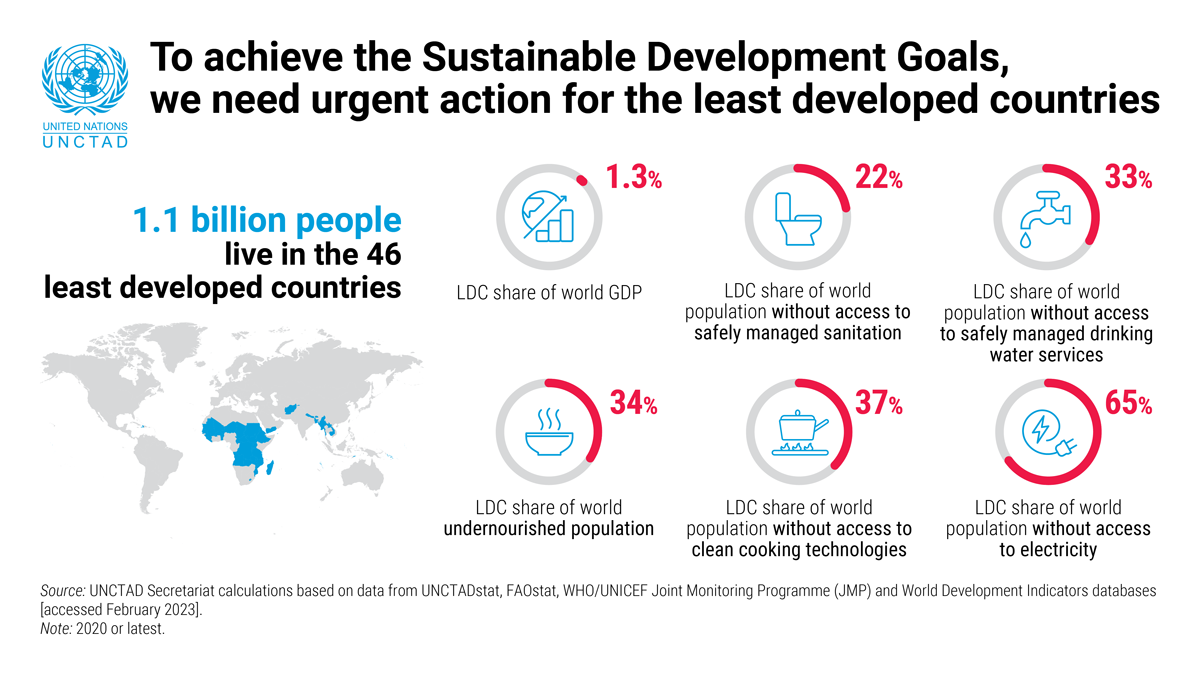

A Framework For Building Resilience And Promoting Sustainable Growth In Ldcs

May 07, 2025

A Framework For Building Resilience And Promoting Sustainable Growth In Ldcs

May 07, 2025 -

Steve Kerrs Positive Outlook On Stephen Currys Injury

May 07, 2025

Steve Kerrs Positive Outlook On Stephen Currys Injury

May 07, 2025 -

Enhancing Resilience And Sustainable Development In Least Developed Countries

May 07, 2025

Enhancing Resilience And Sustainable Development In Least Developed Countries

May 07, 2025 -

Golden State Warriors Coach Kerr On Currys Injury Return

May 07, 2025

Golden State Warriors Coach Kerr On Currys Injury Return

May 07, 2025