US Economic Conditions And Their Effect On Elon Musk's Billions

Table of Contents

The Impact of Inflation on Tesla's Stock Price and Musk's Net Worth

Rising inflation significantly affects consumer spending, particularly on luxury goods like Tesla vehicles. Increased prices and decreased purchasing power directly impact consumer demand. This is further exacerbated by:

- Increased interest rates impacting borrowing costs for consumers: Higher interest rates make financing a Tesla more expensive, discouraging potential buyers.

- Reduced consumer confidence leading to decreased demand: Economic uncertainty caused by inflation leads to consumers delaying major purchases like electric vehicles.

- Impact on Tesla's production costs and profit margins: Inflation increases the cost of raw materials and manufacturing, squeezing Tesla's profit margins.

- Correlation between inflation rates and Tesla stock performance: As inflation rises and consumer demand weakens, Tesla's stock price often suffers, directly impacting Musk's net worth, as Tesla stock constitutes a significant portion of his wealth.

For example, a sharp increase in inflation could lead to a decrease in Tesla sales, resulting in lower profits and a subsequent drop in Tesla's stock price, thus reducing Musk's net worth considerably. This direct correlation highlights the vulnerability of such immense wealth to macroeconomic factors.

Recessionary Fears and Their Influence on SpaceX and Other Musk Ventures

Economic downturns significantly affect investment in high-risk, long-term projects like SpaceX's space exploration endeavors. During a recession, investors become more risk-averse, leading to:

- Reduced venture capital funding for startups: SpaceX, despite its successes, relies on external funding, and a recession can dry up this crucial source of capital.

- Government spending shifts away from space exploration during economic hardship: Government contracts, a vital part of SpaceX's revenue stream, are often the first to be cut during budgetary constraints.

- Impact on the valuation of SpaceX and other Musk companies: Reduced investor confidence can lead to lower valuations for all of Musk's ventures.

- The role of investor sentiment during uncertain economic times: Negative investor sentiment during a recession can trigger a sell-off, further impacting the value of Musk's holdings.

The diversified nature of Musk's holdings offers some protection, but a prolonged recession could still significantly impact his overall financial portfolio, highlighting the interconnectedness of his business empire with the broader US economic landscape.

The Role of the US Dollar and Global Markets in Musk's Wealth

The strength of the US dollar plays a crucial role in the global valuation of Tesla and SpaceX. This is due to:

- The impact of exchange rates on international sales of Tesla vehicles: A strong dollar makes Tesla vehicles more expensive in other countries, impacting sales and revenue.

- The influence of global economic uncertainty on SpaceX's international partnerships: Global economic instability can disrupt SpaceX's international collaborations and funding sources.

- How a strong dollar can positively or negatively impact Musk's net worth: While a strong dollar can boost the value of US-based assets, it can negatively affect international sales and partnerships.

- The interconnectedness of US and global economic performance: The US economy's health significantly influences global markets, impacting Musk's businesses worldwide.

Government Regulations and Their Influence

US government policies and regulations significantly impact Tesla and SpaceX.

- Subsidies and tax breaks impacting Tesla's competitiveness: Government incentives can boost Tesla's competitiveness in the electric vehicle market.

- Government contracts and space exploration funding for SpaceX: Government contracts are crucial for SpaceX's space exploration projects.

- Regulatory hurdles for new technologies and innovations: Stringent regulations can slow down the development and deployment of new technologies from Musk's companies.

These policies create an economic landscape that either supports or hinders Musk's ventures, underscoring the importance of understanding the regulatory environment when analyzing his financial success.

Conclusion

This article highlights the significant influence of US economic conditions on Elon Musk's billions. From inflation's impact on Tesla's stock price to recessionary fears affecting SpaceX, the intricate relationship is undeniable. Understanding these economic forces is crucial for comprehending the fluctuations in Musk's net worth and the future trajectory of his companies. To stay informed about how evolving US economic conditions affect this influential figure, continue to follow our analysis on the interplay between US economic conditions and the fortunes of global entrepreneurs.

Featured Posts

-

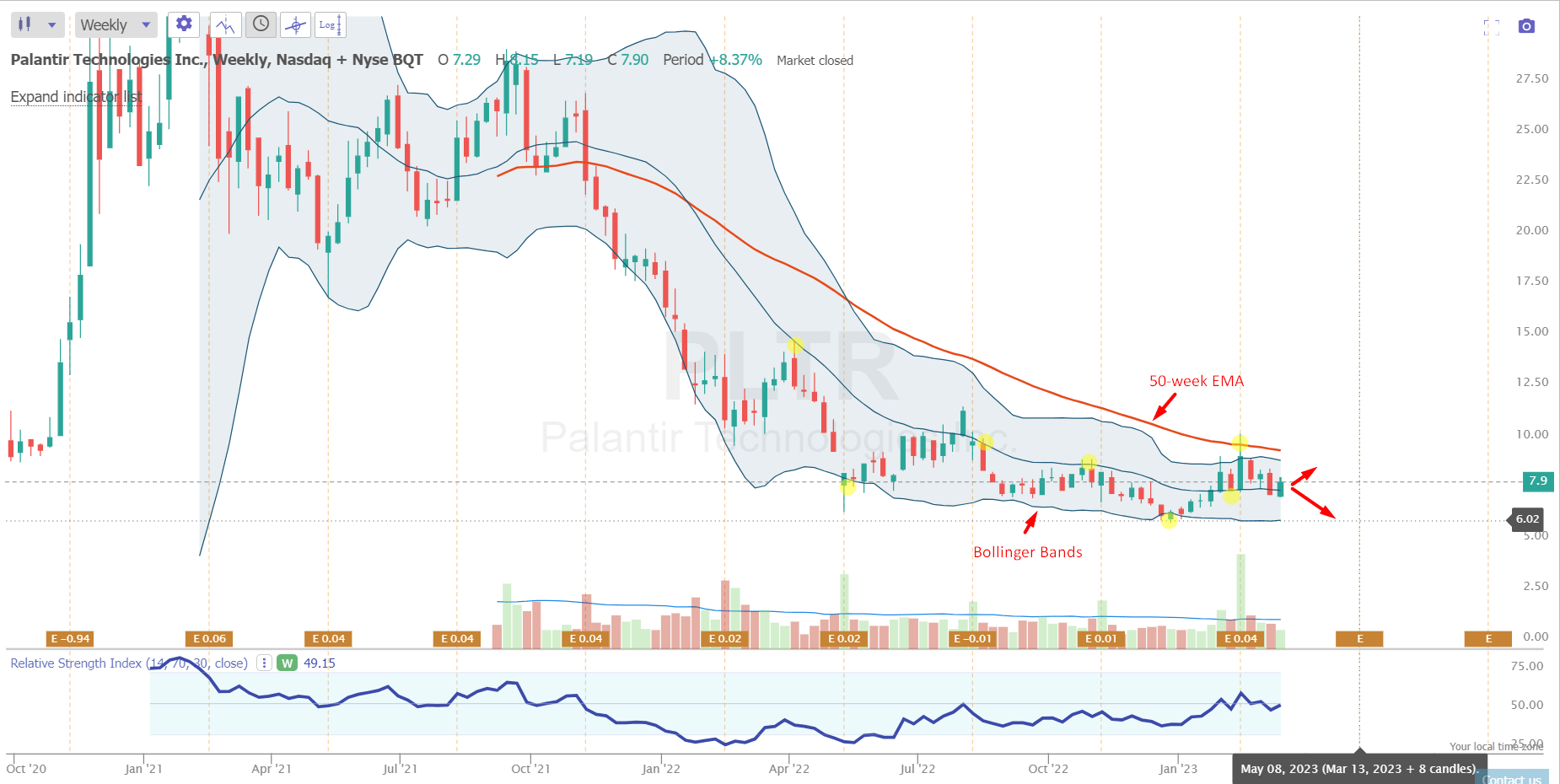

Is Palantir Technologies Stock A Buy Now A Comprehensive Analysis

May 09, 2025

Is Palantir Technologies Stock A Buy Now A Comprehensive Analysis

May 09, 2025 -

He Morgan Brothers High Potential 5 Leading Theories About David

May 09, 2025

He Morgan Brothers High Potential 5 Leading Theories About David

May 09, 2025 -

Bao Ve Tre Em Ra Soat Giam Sat Va Xu Ly Nghiem Hanh Vi Bao Hanh Tai Cac Co So Giu Tre Tu Nhan

May 09, 2025

Bao Ve Tre Em Ra Soat Giam Sat Va Xu Ly Nghiem Hanh Vi Bao Hanh Tai Cac Co So Giu Tre Tu Nhan

May 09, 2025 -

Prognoz Pogody Perm I Permskiy Kray Konets Aprelya 2025 Goda

May 09, 2025

Prognoz Pogody Perm I Permskiy Kray Konets Aprelya 2025 Goda

May 09, 2025 -

Stock Market Update Sensex And Nifty Gains Top Gainers And Losers Today

May 09, 2025

Stock Market Update Sensex And Nifty Gains Top Gainers And Losers Today

May 09, 2025