US Tariffs Halt Shein's London IPO Plans

Table of Contents

The Impact of US Tariffs on Shein's IPO Prospects

US tariffs have significantly impacted Shein's IPO prospects. The imposition of tariffs on goods imported from China, where Shein sources a large portion of its products, directly increases the cost of Shein's goods imported into the US, its largest market. This increased cost significantly affects Shein's financial performance and profitability. The Shein tariffs impact extends beyond just direct costs; it creates uncertainty, a key factor impacting investor confidence, making a successful Shein London IPO more challenging.

-

Increased Costs and Reduced Profitability: US tariffs dramatically increase Shein's operational costs, squeezing profit margins and impacting its ability to offer the ultra-low prices that are central to its business model. This decreased profitability directly impacts its valuation and attractiveness to potential investors.

-

Price Hikes and Competitive Disadvantage: Absorbing these increased costs might not be feasible for Shein. Raising prices to offset the tariffs could erode its competitive advantage in the budget-friendly fast-fashion market, potentially alienating its price-sensitive customer base.

-

Uncertainty and Investor Risk: The unpredictability surrounding future US trade policy and potential changes in tariff levels adds further risk for investors considering participating in the Shein stock market offering. This uncertainty makes it difficult for investors to accurately assess the long-term viability and potential returns of a Shein investment.

-

Financial Statement Analysis: Analysis of Shein's financial statements reveals a significant dependence on the US market. This heavy reliance on a single market, coupled with the sensitivity to US tariffs, presents a major risk factor for potential investors, making them hesitant to commit to a Shein IPO.

Ongoing Investigations and Their Role in the IPO Delay

Beyond the immediate impact of US tariffs, Shein is facing multiple investigations concerning its business practices, further contributing to the Shein IPO delay. These investigations span several key areas: labor practices, intellectual property rights, and environmental sustainability. This regulatory scrutiny casts a shadow over the company's image and significantly impacts investor confidence.

-

Labor Practices Scrutiny: Allegations regarding Shein's labor practices, including concerns about working conditions and worker compensation in its supply chain, have attracted significant negative media attention. These concerns raise ethical questions that can deter socially conscious investors.

-

Intellectual Property Rights Violations: Shein has also faced accusations of intellectual property theft and copyright infringement. These legal challenges create significant uncertainty and potential financial liabilities, further jeopardizing the Shein London IPO.

-

Environmental Concerns and Sustainability: Shein's rapid growth model has also raised environmental concerns regarding its waste production and overall sustainability practices. Growing pressure from consumers and regulators on sustainability is another factor adding to the challenges faced by the company.

-

Regulatory Uncertainty: The ongoing investigations and potential penalties create uncertainty regarding future regulatory compliance costs and potential legal settlements. This uncertainty makes it difficult for investors to accurately assess the potential risks associated with investing in Shein.

Alternative Strategies for Shein's Future Growth

While the Shein London IPO is currently on hold, the company can still pursue alternative strategies to drive future growth. Diversification and a focus on improved practices are key aspects of this.

-

Market Diversification: Shein could focus on expanding into markets less dependent on US trade policies to mitigate future risks associated with tariffs. This includes expanding its presence in Europe, Asia, and other regions.

-

Supply Chain Diversification: Reducing reliance on a single sourcing region by diversifying its supply chain can improve resilience against disruptions like tariffs and political instability.

-

Enhanced Sustainability Initiatives: Investing in and showcasing improved sustainability practices can help improve Shein's brand image, attract environmentally conscious consumers, and potentially attract investors prioritizing ESG factors.

-

Investment in R&D and Innovation: Shein can invest more heavily in research and development to create unique product lines and designs, reducing its reliance on replicating existing designs and minimizing intellectual property risks.

-

Strategic Partnerships: Forming strategic partnerships could assist Shein in addressing its legal and logistical challenges. Collaborating with ethical sourcing partners or engaging independent auditing firms could enhance transparency and investor trust.

Conclusion

The postponement of Shein's London IPO underscores the substantial challenges facing the fast-fashion giant. US tariffs, combined with ongoing investigations into its labor practices, intellectual property rights, and sustainability, have created significant uncertainty, impacting investor confidence and making a successful IPO currently unfeasible. The Shein tariffs impact and the broader Shein legal issues are significant factors in this delay. The future of the Shein IPO remains uncertain, but the company’s response to these challenges will determine its long-term success. Stay tuned for further updates on the Shein IPO and the ongoing impact of US tariffs on the fast-fashion industry. Follow us to receive the latest news on the Shein IPO and its future prospects.

Featured Posts

-

Wind Energy For Trains A Sustainable Solution For Rail Transport

May 04, 2025

Wind Energy For Trains A Sustainable Solution For Rail Transport

May 04, 2025 -

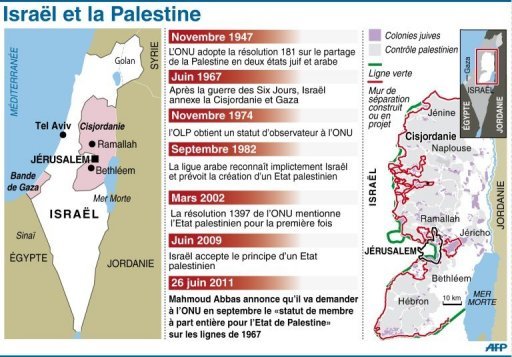

Positions Divergentes Sur L Etat Palestinien Macron Et Netanyahu S Opposent

May 04, 2025

Positions Divergentes Sur L Etat Palestinien Macron Et Netanyahu S Opposent

May 04, 2025 -

The Future Of Electric Motors Diversifying Supply Chains Beyond China

May 04, 2025

The Future Of Electric Motors Diversifying Supply Chains Beyond China

May 04, 2025 -

Press Conference An Account Of Nigel Farages Recent Event

May 04, 2025

Press Conference An Account Of Nigel Farages Recent Event

May 04, 2025 -

Alleged Torture Starvation And Assault Lead To Murder Charge Against Stepfather Of 16 Year Old

May 04, 2025

Alleged Torture Starvation And Assault Lead To Murder Charge Against Stepfather Of 16 Year Old

May 04, 2025

Latest Posts

-

Nelson Dong Triumphs At Apo Main Event Securing A 390 000

May 04, 2025

Nelson Dong Triumphs At Apo Main Event Securing A 390 000

May 04, 2025 -

A 390 000 Prize For Nelson Dong Apo Main Event Winner

May 04, 2025

A 390 000 Prize For Nelson Dong Apo Main Event Winner

May 04, 2025 -

Caged Beast How A Multi Agency Investigation Brought A Child Predator To Justice

May 04, 2025

Caged Beast How A Multi Agency Investigation Brought A Child Predator To Justice

May 04, 2025 -

Nelson Dongs A 390 000 Apo Main Event Victory

May 04, 2025

Nelson Dongs A 390 000 Apo Main Event Victory

May 04, 2025 -

Depraved Paedophile Jailed Joint Police Operation Secures Conviction

May 04, 2025

Depraved Paedophile Jailed Joint Police Operation Secures Conviction

May 04, 2025