US To Eliminate Penny Circulation: What This Means For Consumers And Businesses By 2026

Table of Contents

The Economic Case for Penny Elimination

The economic arguments for eliminating the penny are compelling, focusing on cost savings and environmental benefits.

Cost Savings for the US Mint

Producing, distributing, and storing pennies is surprisingly expensive. The US Mint incurs significant costs in:

- Metal sourcing and refining: The cost of copper and zinc fluctuates, impacting the overall penny production price.

- Manufacturing and stamping: The process of creating pennies involves complex machinery and labor.

- Transportation and distribution: Shipping millions of pennies across the country consumes considerable fuel and resources.

- Storage and handling: Banks and businesses incur costs associated with storing and handling large quantities of pennies.

Studies estimate that eliminating the penny could save the US Mint tens, if not hundreds, of millions of dollars annually. This cost savings could be reallocated to other essential government programs. Canada's experience with eliminating the penny in 2013 provides a relevant case study, demonstrating substantial cost reductions after the phasing out of the one-cent coin.

Environmental Impact of Penny Production

The environmental impact of penny production is substantial. Consider:

- Resource depletion: Mining copper and zinc requires significant energy consumption and generates pollution.

- Carbon footprint: The transportation and distribution of pennies contribute significantly to greenhouse gas emissions.

- Waste generation: Many pennies end up discarded, adding to landfill waste.

Eliminating the penny would reduce the demand for these resources, resulting in a smaller environmental footprint. Transitioning to more sustainable alternatives in coin production could further mitigate the environmental effects.

Reduced Handling Costs for Businesses

Businesses, especially retailers, handle vast numbers of pennies daily. This translates into:

- Increased labor costs: Counting and sorting pennies is time-consuming.

- Storage challenges: Storing large quantities of pennies requires significant space.

- Security concerns: Large volumes of cash, including pennies, can be a security risk.

Removing the penny would streamline business operations, reducing handling time and costs significantly, improving efficiency, and potentially boosting profitability.

The Impact on Consumers

While the economic benefits are clear, the impact on consumers requires careful consideration.

Rounding Up or Down

Price rounding is the most significant change consumers will experience. Transactions would likely be rounded to the nearest nickel. This means:

- Minor financial impact: Consumers may experience minor gains or losses on individual transactions. The overall impact is likely to be negligible over time.

- Predictable rounding: Clear and consistent rounding rules will help consumers understand the potential variations.

- Transparency: Retailers will need to ensure transparency in their rounding procedures.

Changes in Cash Transactions

Penny elimination may accelerate the shift towards cashless transactions. This means:

- Increased reliance on cards and digital payments: Consumers may opt for credit cards, debit cards, or mobile payment apps.

- Challenges for cash-dependent individuals: Individuals who rely heavily on cash may face challenges. Measures must be implemented to ensure equitable access to financial services for all.

- Infrastructure preparedness: The digital payment infrastructure needs to be robust and reliable to handle the increased volume of transactions.

Public Perception and Acceptance

Public opinion regarding penny elimination is mixed. Concerns include:

- Fairness: Some worry about the potential for unfair financial impact on lower-income individuals.

- Sentimental value: The penny holds sentimental value for many.

- Loss of choice: Some prefer the option of using cash over digital payments.

Addressing these concerns through clear communication, education, and the implementation of appropriate mitigation strategies will be crucial to ensure a smooth transition.

Preparing Businesses for a Pennyless Future

Businesses must actively prepare for a pennyless future by adapting their systems and processes.

Updating Point-of-Sale Systems

POS systems will need updates to handle price rounding accurately. This includes:

- Software upgrades: Businesses need to ensure their POS software is compatible with the new rounding rules.

- Cost of upgrades: The cost of upgrading POS systems can vary, so planning is essential.

- Support and training: Businesses will need access to adequate support and training during the transition.

Adjusting Pricing Strategies

Businesses may need to adjust their pricing strategies to accommodate rounding. This could involve:

- Price optimization: Reviewing existing prices to minimize potential losses due to rounding.

- Margin adjustments: Strategies to maintain profit margins despite price changes.

- Communication with customers: Open communication with customers regarding price adjustments will foster trust and understanding.

Training Employees

Training employees on the new procedures is crucial to ensure a smooth transition and minimize customer confusion. This includes:

- Clear guidelines: Businesses need to provide clear, easy-to-understand guidelines for employees.

- Training materials: Accessible training materials, such as manuals and videos, can help employees learn the new procedures quickly.

- Customer service training: Staff should be trained to handle customer inquiries and address any concerns about the new system.

Conclusion

The potential elimination of the penny by 2026 presents a complex scenario with significant implications for both consumers and businesses. While cost savings and environmental benefits are substantial, careful planning and adaptation are crucial to mitigate potential disruptions. Understanding the changes, adapting to the new system, and ensuring clear communication will be key to a successful transition.

Call to Action: Stay informed about the progress of this significant financial policy shift. Further research into the implications of penny elimination and its potential effect on your business or household is encouraged. Learn more about the debate surrounding penny elimination in the US and prepare for the changes ahead.

Featured Posts

-

Leeds Uniteds Pursuit Of Kyle Walker Peters Transfer Update

May 24, 2025

Leeds Uniteds Pursuit Of Kyle Walker Peters Transfer Update

May 24, 2025 -

Amsterdam Stock Exchange Three Consecutive Days Of Heavy Losses

May 24, 2025

Amsterdam Stock Exchange Three Consecutive Days Of Heavy Losses

May 24, 2025 -

Sean Penn And Woody Allen Examining A Continued Me Too Blind Spot

May 24, 2025

Sean Penn And Woody Allen Examining A Continued Me Too Blind Spot

May 24, 2025 -

17 Famous Faces Sudden Falls From Grace In Hollywood

May 24, 2025

17 Famous Faces Sudden Falls From Grace In Hollywood

May 24, 2025 -

Outrage As Ferrari Targets Lewis Hamiltons Unfair Comments

May 24, 2025

Outrage As Ferrari Targets Lewis Hamiltons Unfair Comments

May 24, 2025

Latest Posts

-

Rybakina Leads Kazakhstan To Billie Jean King Cup Finals

May 24, 2025

Rybakina Leads Kazakhstan To Billie Jean King Cup Finals

May 24, 2025 -

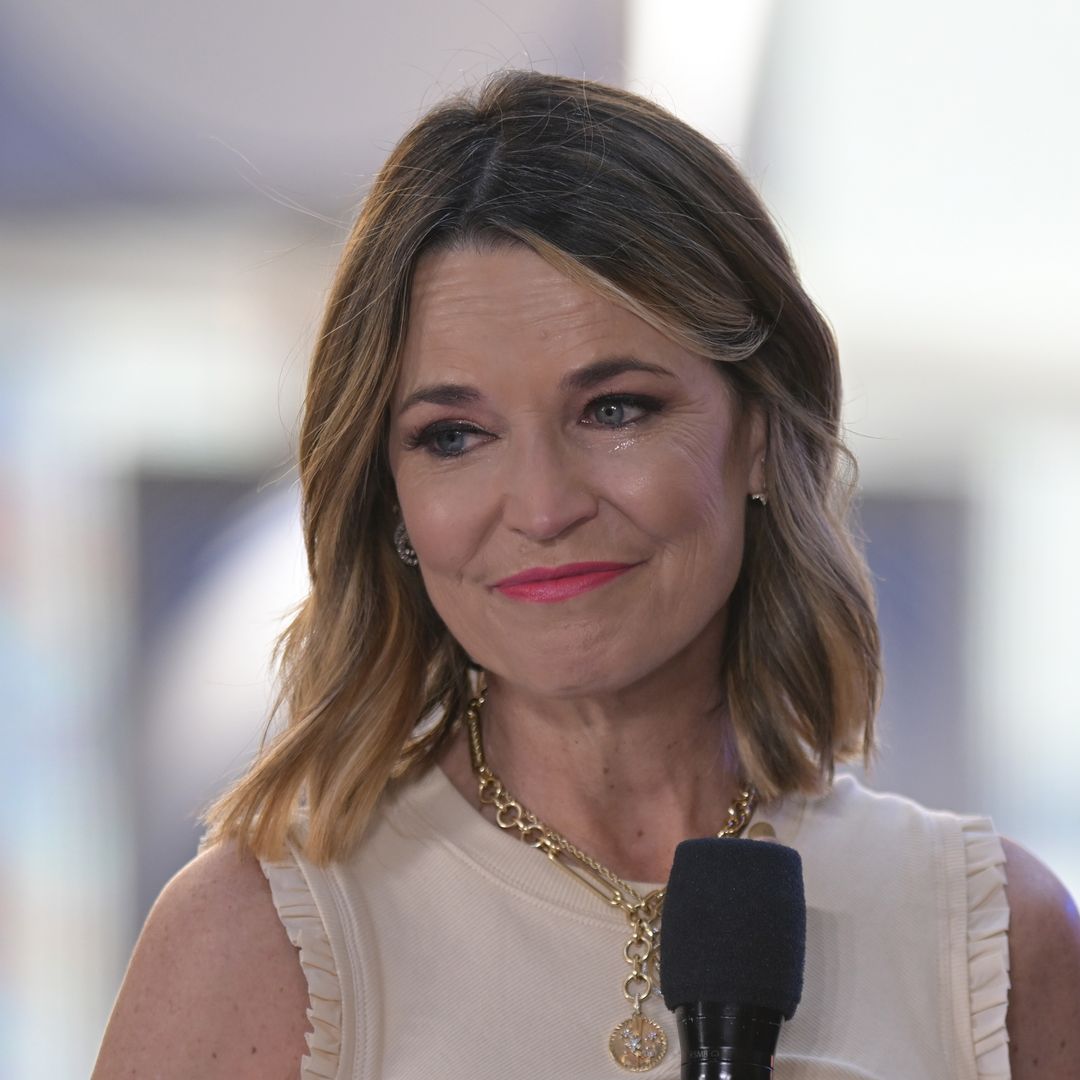

Savannah Guthries Replacement Co Host A Weekday Shake Up

May 24, 2025

Savannah Guthries Replacement Co Host A Weekday Shake Up

May 24, 2025 -

Dylan Dreyer And Brian Fichera New Post Generates Buzz

May 24, 2025

Dylan Dreyer And Brian Fichera New Post Generates Buzz

May 24, 2025 -

The Today Show Dylan Dreyers Close Call And What Happened

May 24, 2025

The Today Show Dylan Dreyers Close Call And What Happened

May 24, 2025 -

Walt Frazier Teases Today Show Host Dylan Dreyer With Championship Rings

May 24, 2025

Walt Frazier Teases Today Show Host Dylan Dreyer With Championship Rings

May 24, 2025