Venture Capital Secondary Market: A Look At The Current Boom

Table of Contents

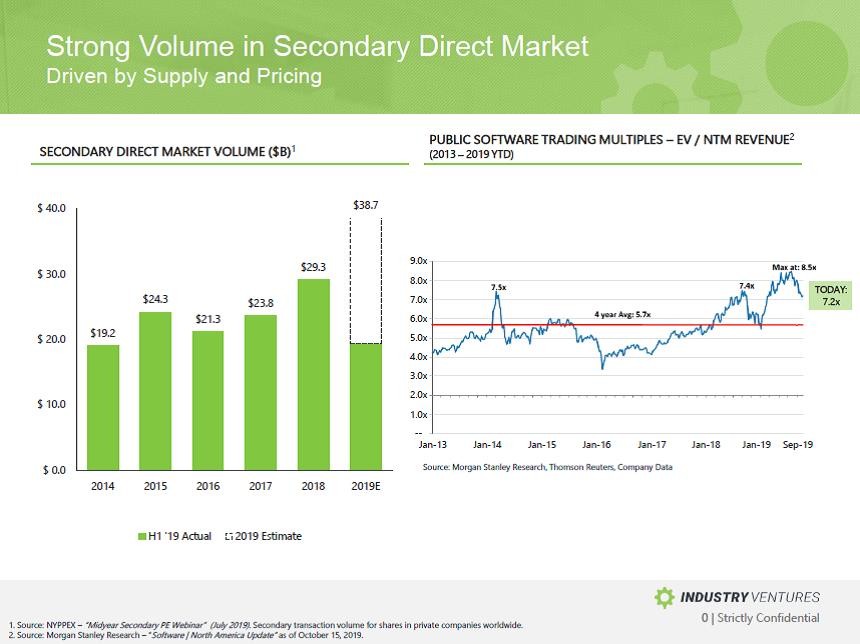

The Drivers of the Venture Capital Secondary Market Boom

Several key factors are propelling the unprecedented growth of the Venture Capital Secondary Market. Understanding these drivers is crucial for investors seeking to participate effectively.

Increased Demand for Liquidity

Limited liquidity has historically been a defining characteristic of venture capital investments. However, the current market environment shows a dramatically increased demand for liquidity, stemming from several sources:

- Limited liquidity options for Venture Capital investments: The traditional illiquidity of venture capital is forcing investors to seek alternative avenues for capital retrieval.

- Growing demand from Limited Partners (LPs) seeking to rebalance portfolios: LPs are increasingly looking to re-allocate capital, often driven by changing investment strategies or the need to meet specific funding obligations.

- Increased interest from institutional investors seeking diversification: Institutional investors are recognizing the value of diversifying their portfolios beyond traditional asset classes and are actively seeking exposure to the private equity space through secondary transactions.

- Higher returns in certain sectors driving desire for earlier liquidity: Strong performance in specific sectors is encouraging investors to realize gains sooner rather than later.

- Rising interest rates impacting investor appetite for illiquid assets: The shift towards higher interest rates makes illiquid assets less attractive, further stimulating demand for liquidity in the secondary market.

Strategic Portfolio Restructuring by General Partners (GPs)

General Partners (GPs) are also actively utilizing the secondary market as a tool for strategic portfolio management:

- Focus on strengthening core investments: GPs are leveraging secondary transactions to concentrate resources on their most promising portfolio companies.

- Opportunities to improve fund performance metrics: Selling underperforming assets can significantly boost the overall performance of a fund.

- Capital recycling to fund new investments: Proceeds from secondary sales provide GPs with capital for fresh investments and expansion into emerging opportunities.

- GP-led secondaries allow for selective divestment: This approach allows GPs to maintain control and influence the terms of the transaction.

- Improved portfolio concentration and risk management: Strategic divestment improves the overall risk profile and enhances the fund's focus.

The Rise of Specialized Secondary Market Funds

The rise of specialized secondary market funds has significantly contributed to the market's growth and sophistication:

- Increased professionalization of the secondary market: Dedicated funds bring expertise and a structured approach to deal execution.

- Dedicated funds providing expertise and capital: These funds possess deep market knowledge and offer significant capital to facilitate transactions.

- More sophisticated due diligence and valuation processes: Specialized funds employ rigorous due diligence procedures, leading to more accurate valuations and reduced risk for investors.

- Competitive bidding drives favorable pricing: The involvement of multiple specialized funds increases competition, often resulting in favorable pricing for sellers.

- Enhanced transparency and standardized processes: This leads to more efficient and predictable transactions.

Key Players and Strategies in the Venture Capital Secondary Market

The Venture Capital Secondary Market involves a complex interplay of key players, each with unique motivations and strategies:

Limited Partners (LPs)

- Motivations: Portfolio diversification, liquidity needs, capital reallocation.

- Strategies: Direct sales, participation in secondary funds.

- Considerations: Valuation, timing, transaction costs.

- LPs benefit from accessing expert advice and networks: Secondary market funds provide access to professional networks and expertise.

- Negotiating favorable terms crucial for maximizing returns: Strong negotiation skills are essential for LPs to achieve optimal outcomes.

General Partners (GPs)

- Motivations: Portfolio optimization, capital recycling, enhancing fund performance.

- Strategies: GP-led secondary transactions, partial divestments.

- Considerations: Maintaining control, preserving investor relations.

- GPs can unlock value and improve investor returns: Strategic divestment can improve overall fund performance and return for investors.

- Careful planning and execution are essential for success: GPs must carefully plan and manage these transactions to achieve their objectives.

Secondary Market Funds and Advisors

- Expertise in deal sourcing, valuation, and due diligence: These funds offer specialist expertise in all aspects of the transaction process.

- Access to a wide network of potential buyers and sellers: They facilitate connections between buyers and sellers, facilitating smooth transactions.

- Providing liquidity solutions and strategic advice: They provide comprehensive support to both buyers and sellers.

- Professional support and market knowledge: They deliver critical market intelligence and professional guidance.

- Assisting with complex negotiations and documentation: They handle the complexities of legal and financial documentation.

Challenges and Considerations in the Venture Capital Secondary Market

Despite the numerous opportunities, navigating the Venture Capital Secondary Market presents certain challenges:

Valuation Challenges

- Difficulty in accurately assessing the value of illiquid assets: Valuing private companies requires sophisticated methodologies and expertise.

- Dependence on financial modeling and market comparables: Valuations often rely on complex models and comparisons with publicly traded companies.

- Impact of macroeconomic factors and market volatility: External market forces can significantly influence valuations.

- Transparency and standardized valuation methods needed: Improved standardization would enhance transparency and improve valuation accuracy.

- Expert valuation critical to avoid over or undervaluation: Professional valuation is crucial to mitigate risk and secure favorable terms.

Regulatory and Legal Considerations

- Compliance with securities regulations and investor protection laws: Navigating regulatory complexities is essential for all parties involved.

- Negotiating complex transaction structures and agreements: Transactions require detailed legal agreements and meticulous structuring.

- Managing legal and tax implications: Tax implications must be carefully considered and addressed throughout the process.

- Expert legal counsel is essential to navigate complexities: Engaging expert legal counsel is essential to minimize risk and ensure compliance.

- Careful consideration of tax implications for all parties: All tax implications for buyers, sellers, and the fund must be thoroughly examined.

Conclusion

The Venture Capital Secondary Market is experiencing a period of remarkable growth, driven by a confluence of factors including heightened demand for liquidity, strategic portfolio adjustments by GPs, and the rise of sophisticated secondary market funds. While challenges related to valuation and regulatory compliance exist, the potential rewards for both LPs and GPs are substantial. A deep understanding of the key players, prevailing strategies, and inherent risks is crucial for successfully navigating this dynamic market. To stay informed and seize the opportunities within the Venture Capital Secondary Market, dedicate time to researching current market trends and consulting with experienced professionals in VC secondary market investments. Consider diversifying your portfolio and unlocking potential high-growth opportunities by exploring this rapidly expanding investment sector.

Featured Posts

-

One Plus 13 R Review Should You Buy It Or Opt For A Pixel 9a

Apr 29, 2025

One Plus 13 R Review Should You Buy It Or Opt For A Pixel 9a

Apr 29, 2025 -

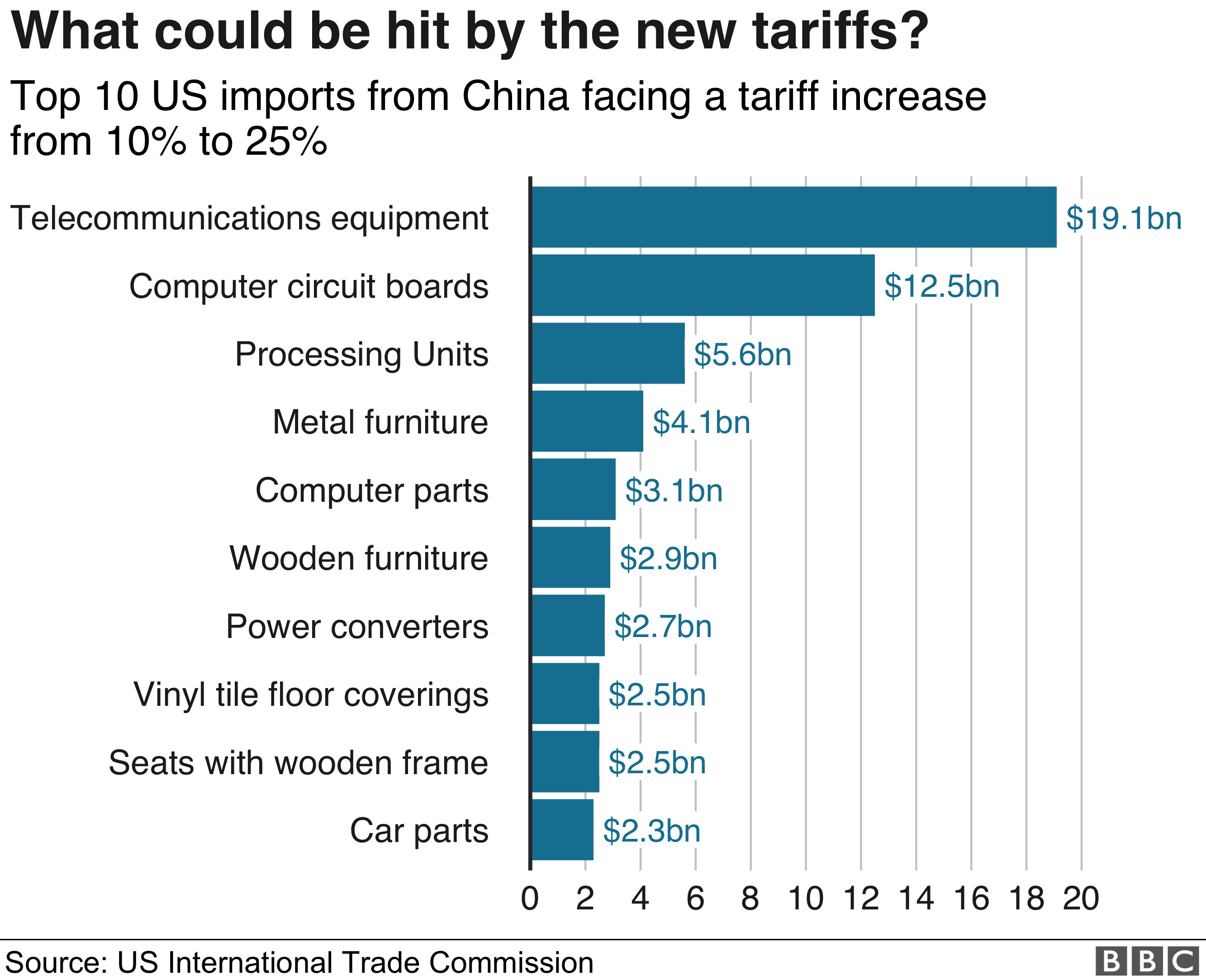

The Economic Impact Of Trumps China Tariffs A Deep Dive Into Inflation And Supply Chain Disruptions

Apr 29, 2025

The Economic Impact Of Trumps China Tariffs A Deep Dive Into Inflation And Supply Chain Disruptions

Apr 29, 2025 -

Watch Lionel Messis Inter Miami Matches Mls Schedule Live Streams And Betting

Apr 29, 2025

Watch Lionel Messis Inter Miami Matches Mls Schedule Live Streams And Betting

Apr 29, 2025 -

Kentucky Storm Damage Assessments Delays And Reasons Why

Apr 29, 2025

Kentucky Storm Damage Assessments Delays And Reasons Why

Apr 29, 2025 -

See Bob Dylan And Billy Strings Live Willie Nelsons Outlaw Music Festival In Portland

Apr 29, 2025

See Bob Dylan And Billy Strings Live Willie Nelsons Outlaw Music Festival In Portland

Apr 29, 2025

Latest Posts

-

Convicted Cardinal Claims Entitlement To Papal Conclave Vote

Apr 29, 2025

Convicted Cardinal Claims Entitlement To Papal Conclave Vote

Apr 29, 2025 -

Convicted Cardinal Claims Entitlement To Vote For Next Pope

Apr 29, 2025

Convicted Cardinal Claims Entitlement To Vote For Next Pope

Apr 29, 2025 -

Cardinal Becciu Case Further Investigations Needed Following New Revelations

Apr 29, 2025

Cardinal Becciu Case Further Investigations Needed Following New Revelations

Apr 29, 2025 -

Convicted Cardinals Right To Vote In Papal Conclave Questioned

Apr 29, 2025

Convicted Cardinals Right To Vote In Papal Conclave Questioned

Apr 29, 2025 -

You Tubes Growing Senior Audience Understanding The Trends

Apr 29, 2025

You Tubes Growing Senior Audience Understanding The Trends

Apr 29, 2025