Vestas Investment Warning: UK Wind Auction Changes Could Halt Factory Plans

Table of Contents

The Proposed Vestas Factory and its Economic Impact

The proposed Vestas factory represents a considerable investment, potentially exceeding hundreds of millions of pounds. This large-scale undertaking promises substantial economic benefits for the UK.

Scale of the Investment:

The projected investment is expected to create thousands of jobs, both directly within the factory and indirectly through the supporting supply chain. The factory would not only manufacture wind turbine components but also serve as a center for research and development, attracting further skilled workers.

Regional Economic Benefits:

The positive impacts extend beyond job creation. The factory will stimulate regional economic growth, fostering the development of local businesses and improving infrastructure. This investment could act as a catalyst, attracting further investment in the renewable energy sector and transforming the chosen region into a hub for green technology.

- Job Roles: Manufacturing technicians, engineers, project managers, maintenance personnel, administrative staff, and logistics specialists.

- GDP Growth: Estimates suggest a significant contribution to regional and national GDP growth, potentially adding millions of pounds annually.

- Attracting Further Investment: The factory's presence will make the region more attractive to other renewable energy companies, creating a virtuous cycle of economic development.

Recent Changes to the UK Wind Auction System

The UK government's recent alterations to its Contracts for Difference (CfD) auction scheme – a crucial mechanism for supporting renewable energy projects – have introduced significant uncertainty.

Key Changes Implemented:

Specific changes include adjustments to the pricing mechanism, potentially reducing the profitability of successful bids. The increased competition within the auction process also puts pressure on project viability. These changes, coupled with adjustments to the regulatory framework, create a more challenging environment for large-scale wind projects.

Impact on Project Viability:

These modifications to the CfD scheme directly impact the financial feasibility of projects like the Vestas factory. Reduced guaranteed returns make securing private investment more difficult, potentially forcing companies to reconsider their commitments. The increased competition means that projects with slightly lower returns might be overlooked, even if they are economically and environmentally beneficial.

- CfD Pricing: Lower guaranteed prices per megawatt-hour reduce the project's overall profitability.

- Increased Competition: More bidders vying for limited funds result in lower winning bids, making projects less financially attractive.

- Regulatory Changes: New regulations related to grid connection, environmental permits, and planning permissions add to project complexities and costs.

Vestas's Response and Potential Alternatives

Vestas has yet to make a definitive statement regarding the future of its UK factory plans. However, the implications of the auction changes are undeniable.

Official Statements from Vestas:

While official statements remain somewhat guarded, Vestas has expressed concerns about the impact of the recent policy changes on investment decisions in the UK. They've highlighted the need for a stable and predictable policy environment to attract significant private investment in renewable energy.

Potential Actions:

Vestas could respond in several ways. They might delay the project, seek government assurances or subsidies, revise their project scope to reduce costs, or, unfortunately, choose to relocate their investment to a country with more favorable policies.

- Potential Delays: Postponing the project until greater policy clarity is achieved.

- Government Lobbying: Engaging in discussions with UK officials to address their concerns and advocate for supportive policy changes.

- Alternative Locations: Exploring investment opportunities in other countries with more attractive regulatory frameworks and investment incentives.

Broader Implications for the UK Renewable Energy Sector

The uncertainty surrounding the Vestas investment highlights a broader concern for the UK's renewable energy sector.

Investor Confidence:

The changes to the auction system risk damaging investor confidence in the UK's commitment to renewable energy. This could deter future investments and hinder the country's progress towards its climate goals.

Meeting Climate Targets:

The potential loss of large-scale projects like the Vestas factory could significantly impact the UK's ability to meet its ambitious climate change targets. Delayed or cancelled projects mean slower progress towards decarbonization and a greater reliance on fossil fuels.

- Impact on FDI: Reduced foreign direct investment in the renewable energy sector could lead to a slowdown in the growth of the green economy.

- Net-Zero Targets: The delay or cancellation of significant renewable energy projects could jeopardise the UK's ability to achieve its net-zero targets by 2050.

- International Comparison: The UK risks falling behind other countries that offer more supportive policies and incentives for renewable energy projects.

Conclusion: The Future of Vestas Investment in the UK

The recent changes to the UK wind auction system pose a significant threat to Vestas’s planned factory, jeopardizing a substantial investment and associated economic benefits. The uncertainty created by these changes undermines investor confidence and risks hindering the UK's progress toward its climate goals. Addressing the Vestas investment concerns is crucial. We urge you to contact your elected officials to express your concern about the potential loss of this vital investment and advocate for policies that support renewable energy development. Securing Vestas investment is not just about one company; it's about securing a sustainable energy future for the UK. The long-term implications of failing to support projects like this will be felt far beyond the immediate economic impact. Let's ensure the UK remains a leader in the global renewable energy market.

Featured Posts

-

Mission Impossible Dead Reckonings Omission Of Two Sequels

Apr 26, 2025

Mission Impossible Dead Reckonings Omission Of Two Sequels

Apr 26, 2025 -

Trump Congressional Stock Trading Ban A Time Magazine Interview

Apr 26, 2025

Trump Congressional Stock Trading Ban A Time Magazine Interview

Apr 26, 2025 -

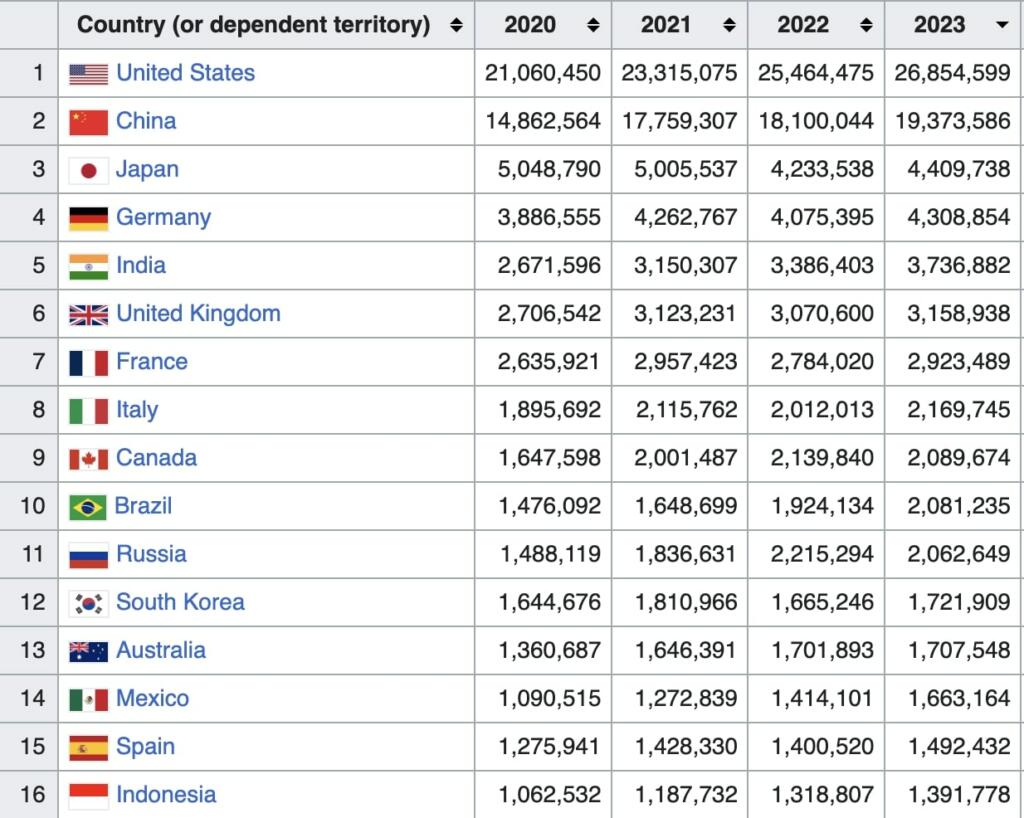

California Now Worlds Fourth Largest Economy Analysis And Implications

Apr 26, 2025

California Now Worlds Fourth Largest Economy Analysis And Implications

Apr 26, 2025 -

Evaluating The Accuracy Of Statements Made About Gavin Newsom

Apr 26, 2025

Evaluating The Accuracy Of Statements Made About Gavin Newsom

Apr 26, 2025 -

Behind The Scenes Mission Impossible Dead Reckonings Epic Plane Stunt

Apr 26, 2025

Behind The Scenes Mission Impossible Dead Reckonings Epic Plane Stunt

Apr 26, 2025