Volatility Alert: Billions In Bitcoin And Ethereum Options Expire Soon

Table of Contents

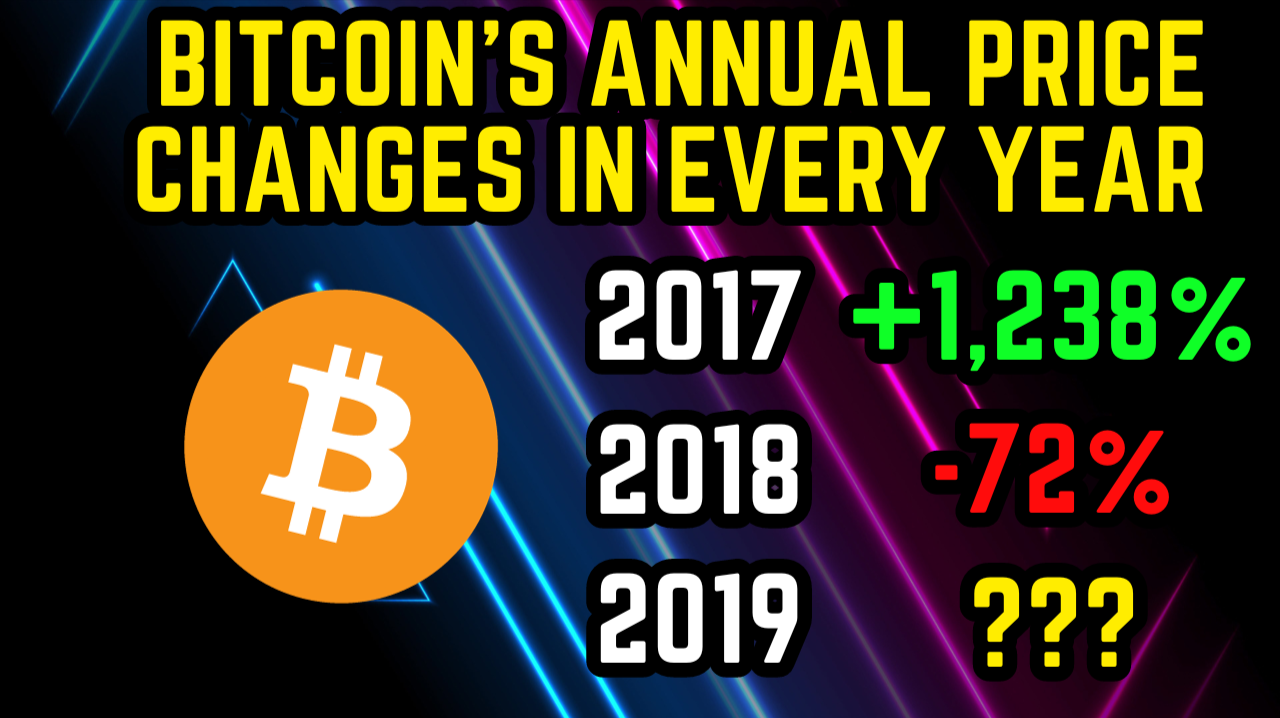

The Scale of the Expiring Options

The sheer volume of Bitcoin and Ethereum options nearing expiration is unprecedented. Billions of dollars in contracts are set to mature, representing a massive potential force impacting market prices. While precise figures fluctuate, reports from leading crypto analytics firms consistently highlight the significant increase in open interest compared to previous periods. This signifies a substantial amount of speculative activity built up around these options contracts.

- Specific Dates of Key Expirations: Keep an eye on major cryptocurrency exchanges for announcements of exact dates. These dates are often staggered across different exchanges, prolonging the period of potential volatility.

- Significant Increase in Open Interest: The open interest, which represents the total number of outstanding options contracts, has surged in recent weeks for both Bitcoin and Ethereum, indicating substantial market anticipation.

- Understanding Options Contracts: Bitcoin and Ethereum options are derivative contracts that give the buyer the right, but not the obligation, to buy (call option) or sell (put option) a specific amount of the underlying cryptocurrency at a predetermined price (strike price) on or before a specific date (expiration date). They are widely used for hedging, speculation, and leveraged trading.

Potential Market Impacts of the Expiration

The expiration of these massive options positions could significantly influence Bitcoin and Ethereum prices, potentially leading to sharp price swings. Several scenarios are possible:

- Calls Expiring In-the-Money: If a large number of call options expire "in-the-money" (meaning the market price of the cryptocurrency exceeds the strike price), buyers will likely exercise their right to buy, creating significant buying pressure and potentially driving prices upward. This could trigger a short squeeze, further exacerbating the price increase.

- Puts Expiring In-the-Money: Conversely, if many put options expire in-the-money (the market price is below the strike price), buyers will likely exercise their right to sell, potentially driving prices downward. This could trigger a wave of selling pressure, leading to a price decline.

- Increased Market Volatility: Regardless of whether calls or puts dominate, the sheer volume of expiring contracts will likely increase market volatility. Expect sharp price fluctuations and potentially rapid changes in market sentiment.

- Role of Market Makers and Institutional Investors: Large institutional investors and market makers play a critical role in managing risk during these periods. Their actions will significantly influence the overall market reaction to the options expiration. Their hedging strategies and attempts to mitigate risk could lead to additional price movements.

Strategies for Navigating the Volatility

Navigating the potential volatility surrounding the Bitcoin and Ethereum options expiration requires a proactive approach and effective risk management:

- Diversify Holdings: Don't put all your eggs in one basket. Diversifying your crypto portfolio across different assets can help mitigate potential losses from price fluctuations in Bitcoin or Ethereum.

- Monitor Market Movements Closely: Keep a close watch on market news and price action leading up to and during the expiration period. This will allow you to react swiftly to any significant developments.

- Utilize Stop-Loss Orders: Implement stop-loss orders to limit potential losses. These orders automatically sell your assets when the price reaches a predetermined level.

- Consider Hedging Strategies: Explore hedging strategies, such as using options or futures contracts, to protect your portfolio against potential downside risk.

- Avoid Impulsive Decisions: Stay calm and avoid making impulsive decisions based on short-term price movements. Stick to your investment plan and avoid emotional trading.

Understanding Implied Volatility

Implied volatility (IV) is a crucial factor influencing options pricing. It reflects the market's expectation of future price volatility. As the Bitcoin and Ethereum options expiration approaches, implied volatility typically increases, reflecting the heightened uncertainty. This increased IV makes options contracts more expensive, as traders pay a premium for the increased risk. Monitoring implied volatility levels for Bitcoin and Ethereum can give you valuable insights into the market's anticipation of price swings surrounding the options expiration.

Conclusion

The upcoming expiration of billions of dollars in Bitcoin and Ethereum options presents a significant event for the crypto market. The potential for increased volatility necessitates careful planning and risk management. Stay informed about the upcoming Bitcoin and Ethereum options expiration and implement effective strategies to navigate the potential market fluctuations. Monitor the news, understand implied volatility, and manage your risk appropriately to capitalize on the opportunities and mitigate the risks associated with this event. Don't miss out on understanding the implications of this massive Bitcoin and Ethereum options expiration. Make informed decisions and prepare for potential price swings related to this key event in the crypto calendar.

Featured Posts

-

Dwp Hardship Payments Are You Missing Out On A Refund

May 08, 2025

Dwp Hardship Payments Are You Missing Out On A Refund

May 08, 2025 -

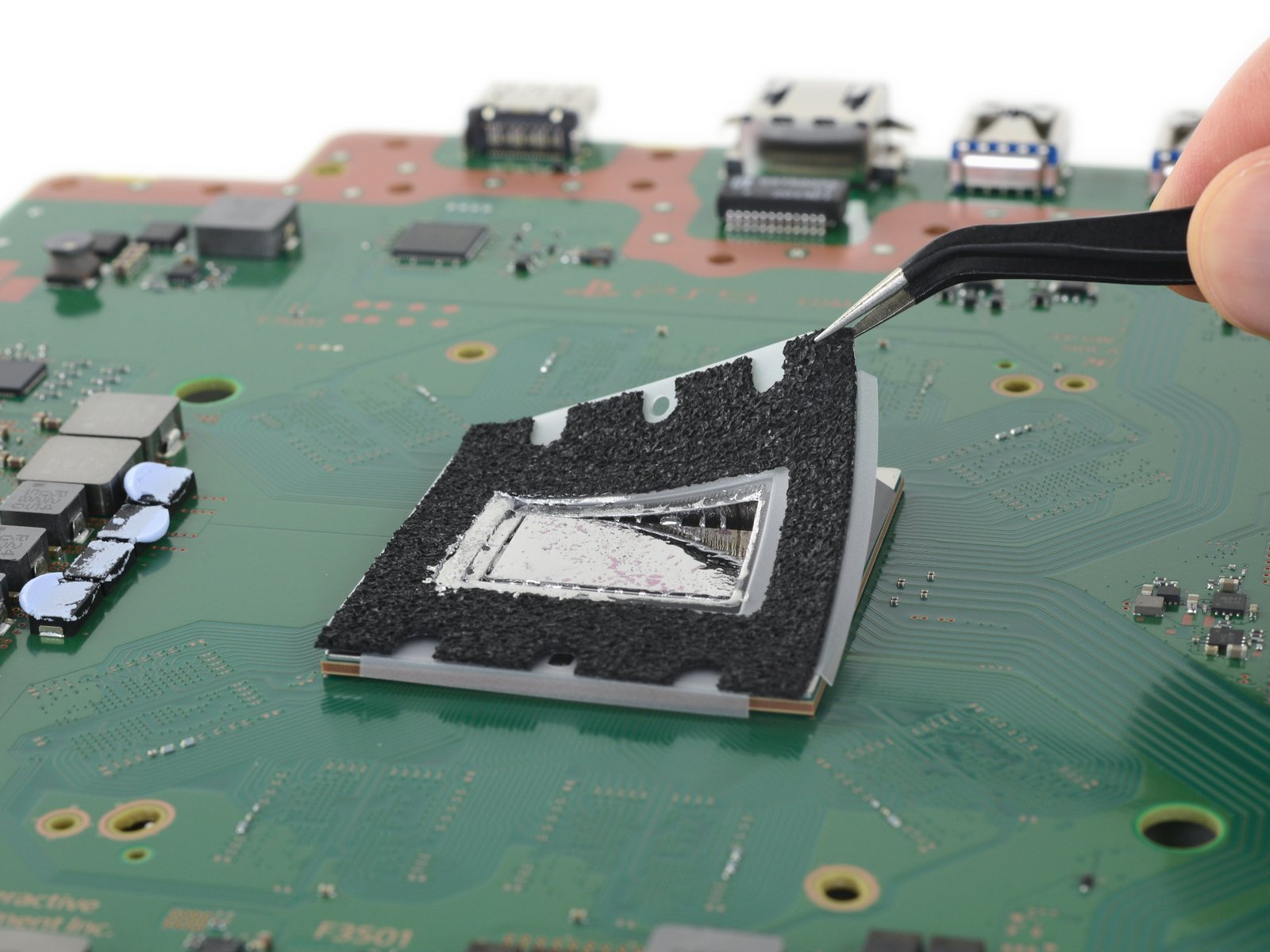

Official Sony Ps 5 Pro Teardown Shows Liquid Metal Cooling System

May 08, 2025

Official Sony Ps 5 Pro Teardown Shows Liquid Metal Cooling System

May 08, 2025 -

Stephen Kings The Long Walk Movie Adaptation Confirmed

May 08, 2025

Stephen Kings The Long Walk Movie Adaptation Confirmed

May 08, 2025 -

Bitcoin Buying Volume On Binance Tops Selling For First Time In Half A Year

May 08, 2025

Bitcoin Buying Volume On Binance Tops Selling For First Time In Half A Year

May 08, 2025 -

Bitcoin Son Dakika Fiyat Hareketleri Ve Etkileyici Haberler

May 08, 2025

Bitcoin Son Dakika Fiyat Hareketleri Ve Etkileyici Haberler

May 08, 2025