Wall Street's Resurgence: Defying Bear Market Predictions

Table of Contents

Unexpected Economic Strength

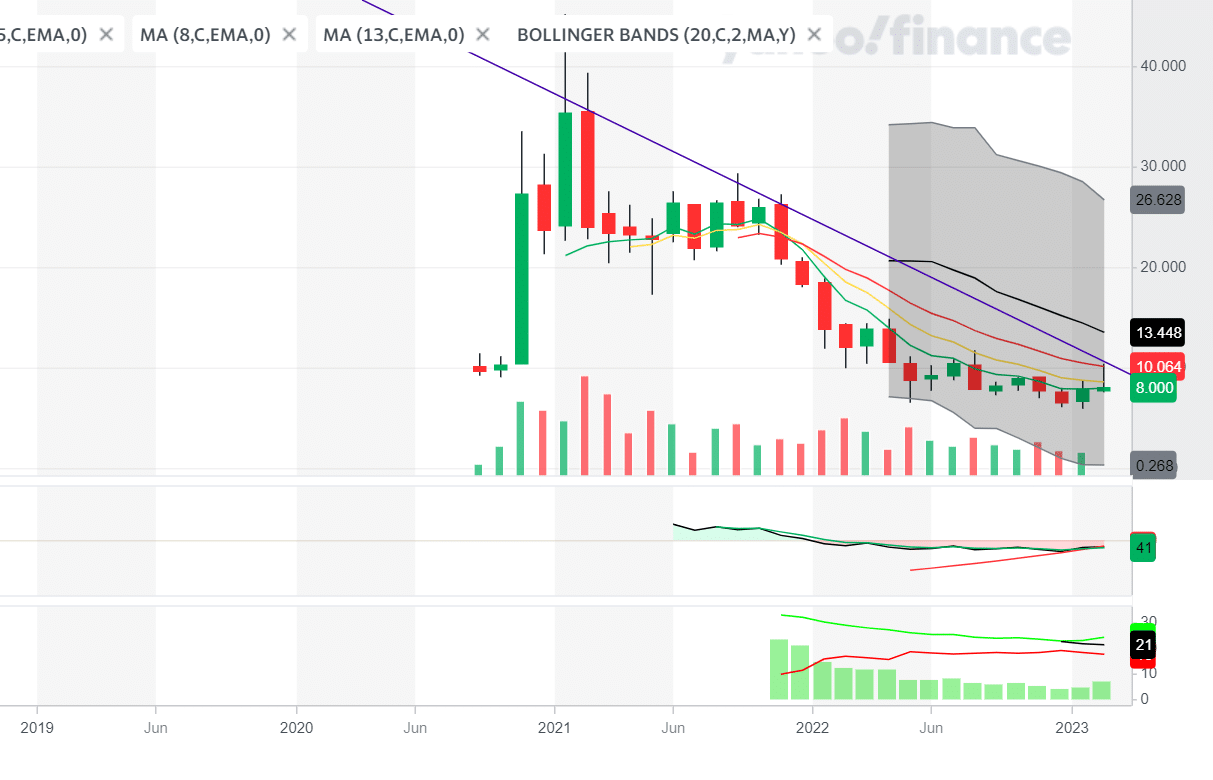

The initial predictions of a deep and prolonged bear market rested heavily on concerns about persistent inflation and its impact on the economy. However, recent economic data paints a more nuanced picture, revealing unexpected strength that has fueled Wall Street's resurgence.

Inflation Cooling Down

The recent decrease in inflation rates has significantly impacted market sentiment.

- Lower CPI figures: The Consumer Price Index (CPI) has shown a consistent, albeit gradual, decline in recent months, signaling that inflationary pressures are easing.

- Easing pressure on the Federal Reserve: This cooling inflation has given the Federal Reserve (Fed) more flexibility in its monetary policy, reducing the likelihood of further aggressive interest rate hikes.

- Impact on consumer spending: Lower inflation translates to increased consumer purchasing power, boosting consumer confidence and spending, key drivers of economic growth.

Decreasing inflation reduces fears of aggressive interest rate hikes, a major concern for investors in a bear market. This easing of monetary policy has a direct positive impact on corporate profitability and investor confidence, contributing significantly to Wall Street's resurgence.

Robust Corporate Earnings

Beyond macroeconomic indicators, the strong performance of several key sectors has also played a crucial role in the market's unexpected upswing.

- Strong Q3 2023 earnings reports: Many companies have reported better-than-expected earnings for the third quarter of 2023, defying negative predictions and showcasing the resilience of the corporate sector.

- Specific examples of high-performing companies: [Insert examples of companies with strong Q3 earnings, citing specific sectors, e.g., Tech giants like Microsoft and Apple, and energy companies benefiting from high oil prices].

- Sectors defying negative predictions: Sectors initially predicted to suffer the most during a bear market, such as technology, have shown remarkable strength, further contributing to the bullish sentiment.

Positive earnings reports directly translate to higher stock valuations and overall market optimism, effectively countering the narratives that fueled bear market predictions. This robust corporate performance is a key pillar supporting Wall Street's surprising resurgence.

The Role of Technological Innovation

The rapid advancements in technology, particularly in artificial intelligence (AI), have injected significant momentum into the market, playing a pivotal role in Wall Street's resurgence.

AI Boom and its Market Impact

The surge in Artificial Intelligence has had a profound effect on the stock market.

- Increased investment in AI technology: Massive investments are pouring into AI development and related technologies, driving growth and innovation within the sector.

- The performance of AI-related stocks: Stocks of companies heavily involved in AI research, development, and deployment have seen significant gains, outperforming broader market indices.

- Potential for future growth: The long-term potential of AI across various industries is immense, fueling investor enthusiasm and attracting significant capital into the sector.

This influx of capital into AI and the subsequent rise in valuations of AI-related companies have significantly boosted market confidence and contributed substantially to Wall Street's resurgence.

Other Technological Advancements

Beyond AI, other technological advancements are also driving market growth and influencing the current bullish trend.

- Examples of other innovative technologies driving growth: This includes advancements in renewable energy, biotechnology, and cloud computing, each with the potential to disrupt existing industries.

- Their impact on specific sectors: These technologies are fostering growth and innovation in various sectors, creating new opportunities and driving investment.

- Long-term implications: The cumulative effect of these technological advancements paints a positive picture for long-term market growth, contributing to the overall bullish sentiment.

The disruptive potential of emerging tech beyond AI further strengthens the positive market outlook and reinforces Wall Street's surprising resurgence.

Shifting Investor Sentiment and Strategies

A crucial factor driving Wall Street's resurgence is a palpable shift in investor sentiment and investment strategies.

Increased Risk Appetite

Investor confidence has demonstrably increased.

- Data showing increased investment: Data indicates a clear rise in investment across various asset classes, signaling a growing appetite for risk.

- Movement away from safe haven assets: Investors are shifting away from traditionally "safe" assets, like government bonds, indicating a growing belief in market recovery.

- Growing optimism: A general sense of optimism prevails among investors, fueled by positive economic data and technological advancements.

This renewed risk appetite is a powerful catalyst for market growth, directly contributing to the unexpected bullish turn in the market.

Strategic Portfolio Adjustments

Investors are actively adapting their strategies to capitalize on this positive market shift.

- Examples of portfolio adjustments: Many investors are increasing their allocations to growth stocks, particularly those in technology and AI.

- Focus on growth stocks: The focus is shifting from defensive, value-oriented stocks to growth stocks with higher potential returns.

- Increased allocations to specific sectors: Investors are strategically increasing their exposure to sectors that are experiencing strong growth, such as technology, renewable energy, and healthcare.

By adapting their strategies to capitalize on the current market environment, investors are actively participating in and driving Wall Street's resurgence.

Conclusion

Wall Street's resurgence has been a surprising turn of events, defying many bear market predictions. The combination of unexpected economic strength, the powerful influence of technological innovation, and a shift in investor sentiment has created a bullish environment. While future market performance remains uncertain, understanding the factors driving this current positive trend is crucial for investors seeking to navigate this dynamic landscape. Stay informed about the latest developments and continue to analyze Wall Street's resurgence to make informed investment decisions. Learn more about how to capitalize on this surprising Wall Street resurgence by [link to relevant resource, e.g., investment guide].

Featured Posts

-

Harry Styles Reaction To A Hilariously Bad Snl Impression

May 10, 2025

Harry Styles Reaction To A Hilariously Bad Snl Impression

May 10, 2025 -

Palantir Stock Before May 5th Wall Streets Prediction And What It Means For Investors

May 10, 2025

Palantir Stock Before May 5th Wall Streets Prediction And What It Means For Investors

May 10, 2025 -

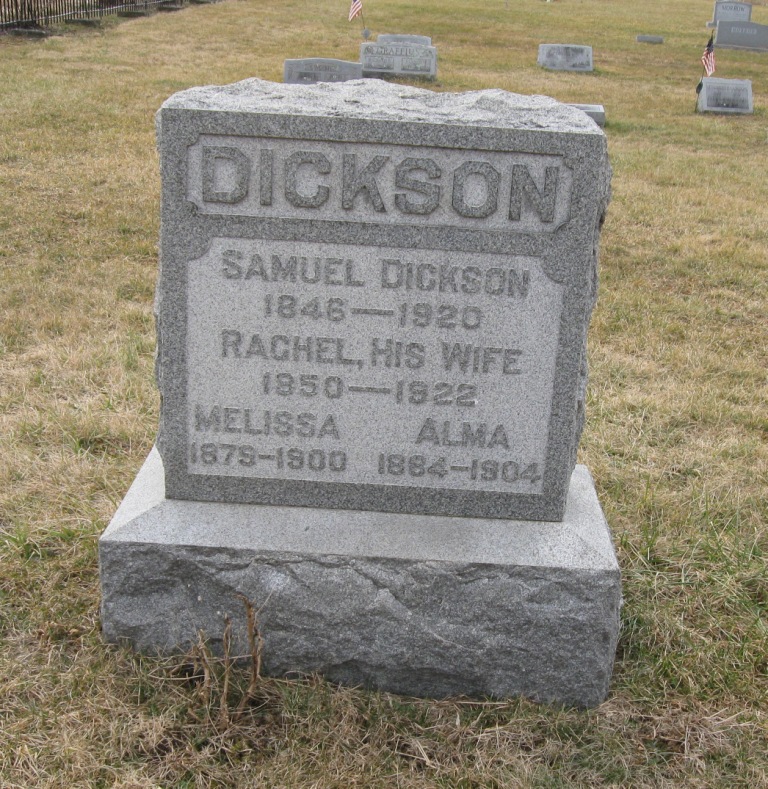

Samuel Dickson Life And Times Of A Canadian Industrialist

May 10, 2025

Samuel Dickson Life And Times Of A Canadian Industrialist

May 10, 2025 -

Nyt Strands Game 402 Hints And Solutions For April 9th

May 10, 2025

Nyt Strands Game 402 Hints And Solutions For April 9th

May 10, 2025 -

Bodycam Video Shows Police Officers Quick Response To Choking Toddler

May 10, 2025

Bodycam Video Shows Police Officers Quick Response To Choking Toddler

May 10, 2025