Warren Buffett's Apple Sale: Perfect Timing And Future Implications

Table of Contents

Warren Buffett, the Oracle of Omaha, recently made headlines with Berkshire Hathaway's significant reduction in its Apple holdings. This move has sparked considerable debate amongst investors: was this a strategic maneuver reflecting market conditions, or a sign of a shift in Berkshire Hathaway's investment strategy? This article delves into the details of Warren Buffett's Apple sale, analyzing its timing and exploring the potential future implications for both Apple and Berkshire Hathaway.

The Context of the Apple Sale

Berkshire Hathaway's Apple Investment History

Berkshire Hathaway's relationship with Apple is a long and lucrative one. The investment began gradually, but over time, Apple became a cornerstone holding in Berkshire's massive portfolio.

- 2016-2018: Initial purchases of Apple stock, steadily increasing the stake.

- 2018-2020: Apple stock became one of Berkshire Hathaway's largest holdings, representing a significant percentage of its total portfolio value. At its peak, Apple constituted over 40% of Berkshire's equity portfolio.

- 2020-2023: Continued holding, weathering market fluctuations and benefiting from Apple's consistent growth.

This substantial investment reflected Buffett's confidence in Apple's business model and its long-term growth prospects. The sale, therefore, represents a notable departure from this long-standing commitment.

Recent Market Trends and Economic Indicators

The sale occurred against a backdrop of significant economic uncertainty. Several factors likely influenced Buffett's decision.

- Inflation: Persistently high inflation rates impacted consumer spending and potentially slowed Apple's growth trajectory.

- Interest Rates: Rising interest rates increased borrowing costs for businesses and consumers, potentially impacting Apple's future profitability.

- Market Volatility: The overall stock market experienced increased volatility, making investors more risk-averse.

These economic headwinds created an environment where reassessing even seemingly rock-solid investments like Apple became prudent.

Berkshire Hathaway's Diversification Strategy

Berkshire Hathaway is renowned for its diversified investment approach. While Apple was a significant holding, the sale aligns with the principle of not putting all eggs in one basket.

- Diversification Across Sectors: Berkshire Hathaway invests across various sectors, reducing reliance on any single company's performance.

- Long-Term Perspective: While focused on long-term growth, Berkshire Hathaway regularly rebalances its portfolio to maintain a diversified investment strategy.

- Strategic Asset Allocation: The Apple sale might reflect a shift in Berkshire's strategic asset allocation, allowing for investments in other promising sectors.

Analyzing the Timing of the Sale

Apple Stock Performance

Apple's stock performance in the period leading up to and following the sale is crucial in evaluating the timing of Buffett's decision.

- Pre-Sale Performance: While Apple's stock had experienced periods of growth, it also faced some challenges leading up to the sale.

- Post-Sale Performance: The impact of the Berkshire Hathaway sale on Apple's stock price was relatively muted, suggesting the market may have anticipated such a move. A chart comparing Apple's stock price to relevant market indices would provide a clearer picture.

Potential Factors Influencing the Decision

Several factors could have influenced Buffett's decision to reduce Berkshire Hathaway's Apple holdings.

- Profit-Taking: Realizing substantial profits on a long-term investment is a sound strategy.

- Capital Re-allocation: The proceeds from the sale could be used to invest in other opportunities deemed more attractive in the current market.

- Concerns about Future Performance: While Buffett generally holds a positive view of Apple, concerns about potential future challenges could have influenced the decision.

Was it "Perfect Timing"?

Determining whether the sale represented "perfect timing" is subjective and depends on various perspectives.

- Arguments for Perfect Timing: The sale might have occurred near a peak in Apple's short-term valuation, allowing for profit maximization.

- Arguments Against Perfect Timing: Some might argue the sale was premature, potentially missing out on future growth opportunities.

Future Implications for Apple and Berkshire Hathaway

Impact on Apple's Stock Price

The reduction of Berkshire Hathaway's stake in Apple could have several effects on Apple's stock price.

- Short-Term Impact: The initial impact was minimal, but sustained selling pressure could cause some volatility.

- Long-Term Impact: The long-term impact is likely to be negligible, given Apple's strong fundamentals and continued innovation.

Berkshire Hathaway's Future Investment Strategy

The Apple sale suggests a potential shift in Berkshire Hathaway's investment focus.

- Increased Focus on other sectors: The released capital might be invested in other areas, diversifying Berkshire's portfolio further.

- Potential New Acquisitions: Berkshire Hathaway could utilize the funds for acquisitions of promising companies in other sectors.

Lessons for Individual Investors

Warren Buffett's actions offer valuable lessons for individual investors.

- Importance of Diversification: Don't put all your eggs in one basket; a diversified portfolio reduces overall risk.

- Understanding Market Cycles: Market fluctuations are inevitable; understanding and adapting to market cycles is key to long-term success.

- Long-Term Investment Strategy: Focus on the long-term, rather than reacting to short-term market volatility.

Conclusion

Warren Buffett's Apple sale presents a complex case study, highlighting the challenges of timing the market perfectly. While the sale might have been influenced by several factors, including economic uncertainty and Berkshire Hathaway's diversification strategy, declaring it definitively "perfect timing" is difficult. Ultimately, the decision underscores the importance of understanding various economic factors and adopting a flexible, long-term investment strategy. Learn more about Warren Buffett's investment philosophy and how to make informed decisions about your own portfolio by exploring further resources on [link to relevant resources]. Understanding the intricacies of major stock sales like Warren Buffett's Apple sale is crucial for navigating the complexities of the stock market.

Featured Posts

-

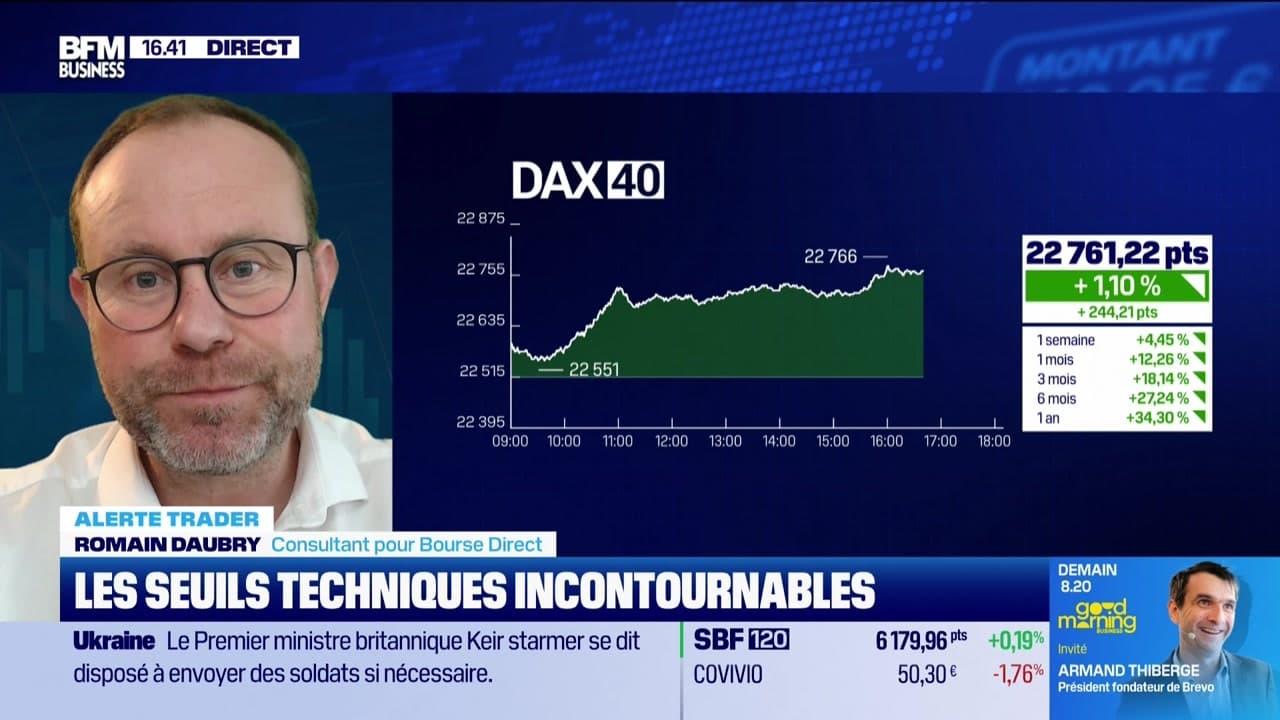

Seuils Techniques Votre Alerte Trader Pour Une Meilleure Performance

Apr 23, 2025

Seuils Techniques Votre Alerte Trader Pour Une Meilleure Performance

Apr 23, 2025 -

Hollywood Shut Down Double Strike Impacts Film And Television

Apr 23, 2025

Hollywood Shut Down Double Strike Impacts Film And Television

Apr 23, 2025 -

Us Tariffs Weigh On Copper Tonglings Short Term Forecast

Apr 23, 2025

Us Tariffs Weigh On Copper Tonglings Short Term Forecast

Apr 23, 2025 -

Invesco And Barings Making Private Credit Accessible To All Investors

Apr 23, 2025

Invesco And Barings Making Private Credit Accessible To All Investors

Apr 23, 2025 -

Reds Suffer Third Consecutive 1 0 Loss

Apr 23, 2025

Reds Suffer Third Consecutive 1 0 Loss

Apr 23, 2025