Wednesday's CoreWeave Inc. (CRWV) Stock Increase: Exploring The Factors

Table of Contents

Market Sentiment and the Broader Tech Sector

Wednesday's surge in CRWV stock wasn't solely an isolated event. The broader technology sector also experienced a positive day, indicating a contributing influence of general market sentiment. Investor confidence in the tech sector is crucial for individual stock performance, especially for companies like CoreWeave that are heavily reliant on future growth projections.

- Positive news regarding [mention specific positive tech news, e.g., a new AI breakthrough, strong earnings reports from major tech companies] likely boosted overall market optimism.

- The Nasdaq Composite, a key indicator of tech sector performance, [mention its performance on Wednesday, e.g., closed up X%], showing a positive correlation with CRWV's performance. This suggests a broader market tailwind contributing to the CRWV stock increase.

- Performance of competitors in the cloud computing and data center space (e.g., [mention competitors]) might also have indirectly influenced investor perception of CRWV, particularly if those competitors also saw positive movement.

CoreWeave's Business Fundamentals and Recent Developments

CoreWeave's own business fundamentals played a significant role in the stock's upward trajectory. While specific financial details might require further research (depending on the actual date and availability of information), any recent positive developments would bolster investor confidence.

- [Mention any recent positive earnings reports or announcements, including details of revenue growth, profitability, or new customer acquisitions. Use specific numbers if available.]

- New partnerships or significant contracts are crucial for companies like CoreWeave. [Detail any new partnerships or contract wins, emphasizing their strategic importance and potential impact on future revenue streams].

- CoreWeave’s position within the rapidly expanding cloud computing and AI markets is a major strength. Its specialized infrastructure, tailored for demanding AI workloads, gives it a competitive advantage. [Highlight CoreWeave's specific technologies and competitive differentiators.]

- [Mention any new product launches or technological advancements, for example, improved data center capacity, new software offerings or enhanced AI processing capabilities.] These advancements showcase CoreWeave’s commitment to innovation and its ability to meet the ever-growing demands of the AI and cloud computing industries.

Impact of AI and Cloud Computing Growth

The explosive growth of the AI and cloud computing sectors is undeniably a major catalyst for CRWV's stock performance. CoreWeave is strategically positioned to benefit significantly from this trend.

- The AI market is projected to grow to [insert statistics on AI market growth], and the cloud computing market is similarly expanding at an impressive rate [insert statistics on cloud computing market growth]. These figures highlight the massive potential for companies like CoreWeave that provide the essential infrastructure supporting these technologies.

- CoreWeave directly benefits from this growth by providing the high-performance computing infrastructure required to train and deploy advanced AI models. This unique positioning makes it a critical player in the rapidly evolving AI landscape.

- Positive news regarding AI advancements, such as breakthroughs in [mention specific AI advancements, e.g., large language models, generative AI], often translates into increased investor confidence in companies like CRWV, which are instrumental in enabling these advancements.

Analyst Ratings and Investor Activity

Changes in analyst ratings and significant investor activity are powerful indicators of a stock's movement. Examining these factors sheds light on the market's overall perception of CRWV.

- [Mention any upgrades in analyst ratings around the time of the price increase. If possible, cite specific analyst reports and their recommendations.] Positive ratings from reputable analysts often inspire investor confidence and buying activity.

- Trading volume on Wednesday [provide data on trading volume, e.g., "was significantly higher than the average daily volume," showing strong investor interest]. High trading volume, coupled with a price increase, suggests strong buying pressure.

- [Mention any large institutional investments or significant buy/sell recommendations from prominent investors or investment firms. Details on the amount invested and the reasoning behind their actions would further bolster the analysis.] Large institutional investments can significantly impact a stock's price, driving it upwards.

Conclusion: Understanding the CoreWeave (CRWV) Stock Surge and Looking Ahead

Wednesday's CoreWeave (CRWV) stock surge resulted from a confluence of factors: positive market sentiment within the tech sector, strong business fundamentals and recent developments at CoreWeave, the escalating demand fueled by the AI and cloud computing boom, and supportive analyst ratings alongside significant investor activity. Understanding these interconnected factors is critical for making informed investment decisions.

While predicting future stock movements is inherently uncertain, continued growth in AI and cloud computing, coupled with CoreWeave's strategic positioning and execution, suggests a potentially positive outlook. However, investors should conduct their own thorough due diligence before making any investment decisions. We encourage you to further research CoreWeave Inc. (CRWV) and stay informed about its future developments to make well-informed investment choices regarding CRWV stock and other similar cloud computing and AI infrastructure stocks.

Featured Posts

-

Jim Cramers Take On Core Weave Crwv A Scrappy Companys Rise

May 22, 2025

Jim Cramers Take On Core Weave Crwv A Scrappy Companys Rise

May 22, 2025 -

Southport Attack Councillors Wifes Appeal Against Social Media Sentence Fails

May 22, 2025

Southport Attack Councillors Wifes Appeal Against Social Media Sentence Fails

May 22, 2025 -

200 Van Dong Vien Chay Bo Ket Noi Dak Lak Phu Yen

May 22, 2025

200 Van Dong Vien Chay Bo Ket Noi Dak Lak Phu Yen

May 22, 2025 -

Connaissez Vous Vraiment La Loire Atlantique Un Quiz Pour Le Decouvrir

May 22, 2025

Connaissez Vous Vraiment La Loire Atlantique Un Quiz Pour Le Decouvrir

May 22, 2025 -

Ancelotti Nin Ayriliginin Ardindan Real Madrid In Teknik Direktoer Arayisi

May 22, 2025

Ancelotti Nin Ayriliginin Ardindan Real Madrid In Teknik Direktoer Arayisi

May 22, 2025

Latest Posts

-

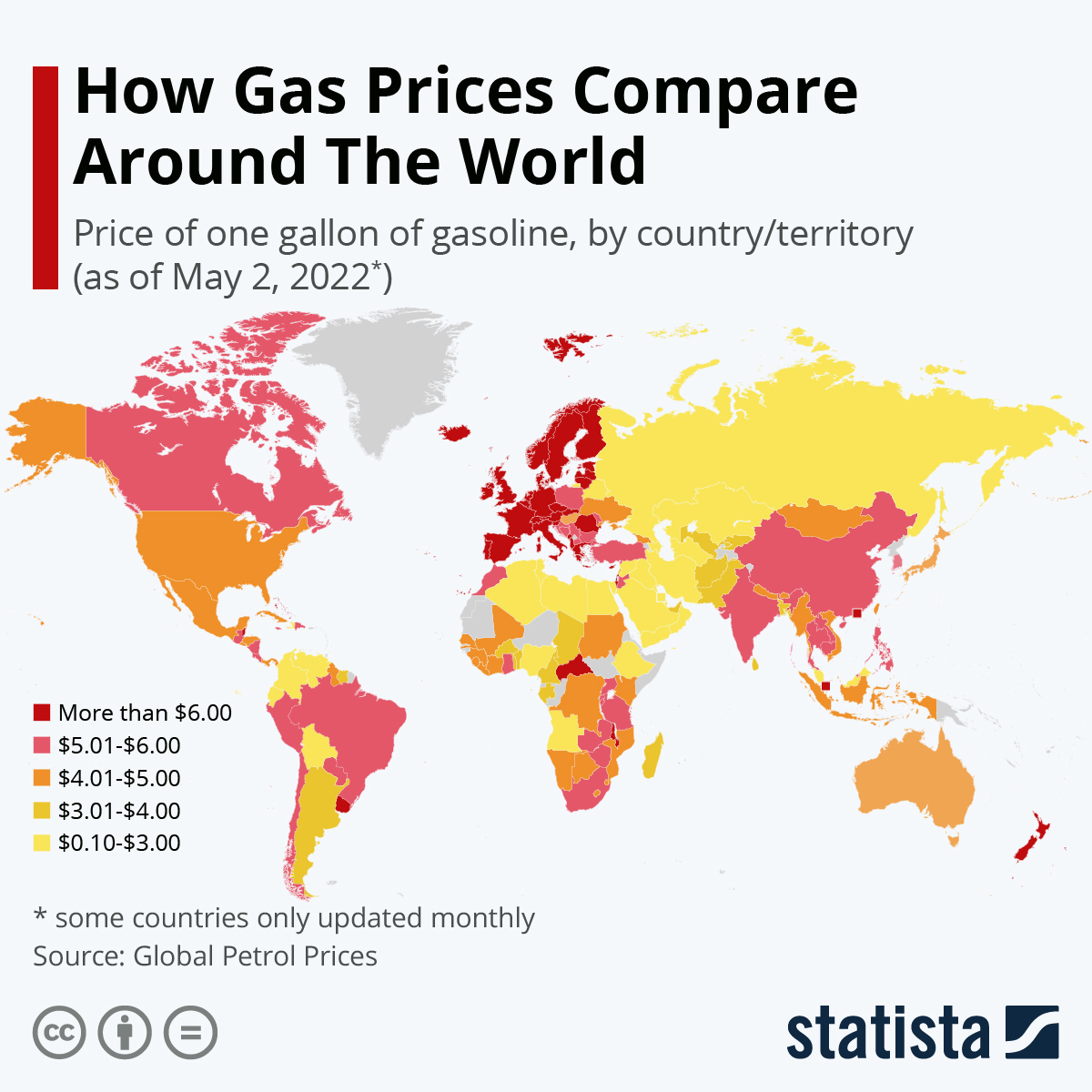

Current Gas Prices In Columbus Ohio A Price Comparison

May 22, 2025

Current Gas Prices In Columbus Ohio A Price Comparison

May 22, 2025 -

Wordle 1358 Answer And Hints For Saturday March 8th

May 22, 2025

Wordle 1358 Answer And Hints For Saturday March 8th

May 22, 2025 -

Columbus Gas Price Survey 2 83 To 3 31 Per Gallon

May 22, 2025

Columbus Gas Price Survey 2 83 To 3 31 Per Gallon

May 22, 2025 -

Significant Gas Price Variation Across Columbus Stations

May 22, 2025

Significant Gas Price Variation Across Columbus Stations

May 22, 2025 -

Wordle 1358 March 8th Hints And Solution

May 22, 2025

Wordle 1358 March 8th Hints And Solution

May 22, 2025