White House Meeting: Mark Carney And Trump To Discuss Key Issues

Table of Contents

Economic Policy Divergences Between the US and UK

The meeting is set against a backdrop of stark differences in economic philosophies between the Trump and Carney administrations. These divergences, particularly concerning Brexit, trade policy, and monetary policy, are likely to dominate the conversation.

- Fiscal Policy: The Trump administration favored significant tax cuts and increased government spending, while Carney's tenure at the Bank of England emphasized fiscal prudence and sustainable growth. This fundamental difference in approach creates potential friction in discussions about global economic stability.

- Trade Protectionism: Trump's administration pursued protectionist trade policies, imposing tariffs and challenging existing trade agreements. Carney, on the other hand, consistently advocated for free trade and global cooperation. This clash in ideologies will undoubtedly be a focal point of the discussions.

- Monetary Policy: The two sides also hold contrasting views on monetary policy and interest rate management. Trump often pressured the Federal Reserve to lower interest rates, while Carney’s focus was on maintaining price stability and managing financial risks. These differing approaches have significant implications for global financial markets.

- Impact on Global Markets: The differing economic philosophies have already led to volatility in global financial markets. The White House meeting offers an opportunity to address these concerns and potentially mitigate future instability.

Brexit and its Global Economic Implications

Brexit will undoubtedly be a central theme of the White House meeting. Its consequences for the US and the global economy are far-reaching and complex.

- Hard vs. Soft Brexit: The implications of a "hard" Brexit (complete departure from the EU single market and customs union) versus a "soft" Brexit (closer alignment with the EU) will be debated. A hard Brexit could significantly impact transatlantic trade and financial stability.

- Financial Stability: The uncertainty surrounding Brexit has already created instability in financial markets. The meeting may address measures to mitigate risks and ensure a smooth transition.

- US Support: The role of the US in supporting a smooth Brexit transition and maintaining strong economic ties with the UK will likely be discussed. The US's economic interests are deeply intertwined with those of the UK.

- Future Trade Relationships: Discussions will likely cover the future trade relationship between the UK and the US, including the negotiation of a potential bilateral trade agreement post-Brexit. Uncertainty in this area contributes significantly to market instability.

Global Financial Stability and Regulatory Cooperation

Maintaining global financial stability requires international cooperation, a critical aspect expected to be addressed in the White House meeting.

- Regulatory Frameworks: The meeting may involve discussions on coordinating regulatory frameworks for financial institutions to prevent future crises. Harmonizing regulations is vital for maintaining stability in the global financial system.

- Systemic Risks: Identifying and addressing systemic risks in the global financial system is another crucial element. Collaboration is necessary to prevent and mitigate potential future crises.

- Combating Financial Crime: Cooperation is key in tackling issues such as money laundering and financial crime, which pose threats to global financial stability. The meeting may explore enhancing international efforts in this area.

- Role of International Organizations: The importance of international organizations, like the International Monetary Fund (IMF) and the Bank for International Settlements (BIS), in maintaining global financial stability will likely be discussed.

Trade Relations Between the US and UK

Post-Brexit, US-UK trade relations will be critical for both economies. The White House meeting provides a platform to discuss potential trade agreements and their impact.

- Bilateral Trade Agreement: Negotiations on a potential bilateral trade agreement between the US and the UK are likely to be a key focus. Such an agreement could significantly shape future economic relations.

- Tariffs and Trade Barriers: The discussions will likely address tariffs and other trade barriers that could hinder the free flow of goods and services between the two countries.

- Sectoral Impact: The impact of a new trade agreement on specific sectors, such as agriculture and manufacturing, will require careful consideration. Trade agreements have varying consequences across industries.

- Benefits and Drawbacks: The potential benefits and drawbacks of a new trade agreement must be carefully weighed to ensure a mutually beneficial outcome. A comprehensive assessment is necessary.

Analyzing the Outcomes of the White House Meeting Between Mark Carney and Trump

The White House meeting between Mark Carney and Donald Trump is poised to address crucial issues shaping global economics and US-UK relations. The discussions on economic policy divergences, Brexit’s impact, global financial stability, and bilateral trade relations will have far-reaching consequences. The potential outcomes, including new trade agreements or commitments to increased regulatory cooperation, will significantly influence market dynamics and international relations. To stay informed about further developments, follow reputable news sources such as the Financial Times, the Wall Street Journal, and official statements from the involved parties. Understanding the impact of this White House meeting on global economic stability and the future of US-UK relations is paramount. Stay informed about further developments regarding this critical White House meeting.

Featured Posts

-

Lower Electricity Tariffs Dutch Trial During Solar Production Peaks

May 04, 2025

Lower Electricity Tariffs Dutch Trial During Solar Production Peaks

May 04, 2025 -

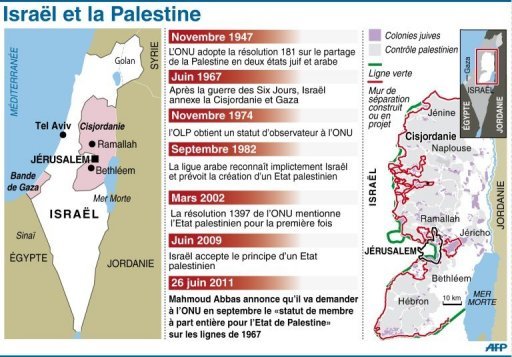

Positions Divergentes Sur L Etat Palestinien Macron Et Netanyahu S Opposent

May 04, 2025

Positions Divergentes Sur L Etat Palestinien Macron Et Netanyahu S Opposent

May 04, 2025 -

The Trump Tariffs Nicolai Tangens Investment Strategy

May 04, 2025

The Trump Tariffs Nicolai Tangens Investment Strategy

May 04, 2025 -

Norways Sovereign Wealth Fund And The Trump Tariffs Nicolai Tangens Role

May 04, 2025

Norways Sovereign Wealth Fund And The Trump Tariffs Nicolai Tangens Role

May 04, 2025 -

Foxs Indy Car Debut What To Expect This Season

May 04, 2025

Foxs Indy Car Debut What To Expect This Season

May 04, 2025

Latest Posts

-

Emma Stone And Margaret Qualley Oscars Incident Fact Or Fiction

May 04, 2025

Emma Stone And Margaret Qualley Oscars Incident Fact Or Fiction

May 04, 2025 -

The Truth Behind The Emma Stone Margaret Qualley Oscars Drama

May 04, 2025

The Truth Behind The Emma Stone Margaret Qualley Oscars Drama

May 04, 2025 -

Emma Stones Show Stopping Oscars 2025 Ensemble Sequin Dress And Pixie Haircut

May 04, 2025

Emma Stones Show Stopping Oscars 2025 Ensemble Sequin Dress And Pixie Haircut

May 04, 2025 -

Did Emma Stone And Margaret Qualley Have A Feud At The Oscars

May 04, 2025

Did Emma Stone And Margaret Qualley Have A Feud At The Oscars

May 04, 2025 -

James Burns Belfast Ex Soldiers Hospital Hammer Incident

May 04, 2025

James Burns Belfast Ex Soldiers Hospital Hammer Incident

May 04, 2025