Why Current Stock Market Valuations Are Not A Cause For Alarm (BofA)

Table of Contents

BofA's Positive Economic Outlook Mitigates Valuation Concerns

BofA's positive economic outlook significantly tempers concerns about high stock market valuations. Their analysis rests on several key pillars: strong corporate earnings growth, a controlled inflation trajectory, and resilient consumer spending.

Strong Corporate Earnings Growth

- BofA projects robust corporate earnings growth for 2024 and beyond. They anticipate growth exceeding 10% in several key sectors, significantly outpacing previous years' performance.

- Specific sectors expected to outperform include technology, healthcare, and consumer staples. These sectors are projected to benefit from ongoing technological advancements, aging populations, and resilient consumer demand.

- This robust earnings growth can justify current valuations, even at seemingly high levels. When earnings are rising substantially, higher stock prices become more justifiable, as investors are willing to pay more for companies with demonstrably strong growth prospects. Innovation and strong consumer spending are key factors driving this growth.

Controlled Inflation Trajectory

- BofA anticipates a gradual decline in inflation throughout 2024. They predict inflation will fall to near the Federal Reserve's target rate, driven by easing supply chain pressures and effective monetary policy.

- This controlled inflation reduces the risk of aggressive interest rate hikes. Aggressive interest rate increases can significantly impact market valuations by increasing borrowing costs for businesses and dampening economic activity.

- Comparing current inflation rates to historical levels provides context. While inflation remains above historical averages, BofA's projections suggest a controlled descent, avoiding a scenario of runaway inflation.

Resilient Consumer Spending

- Despite economic headwinds, BofA's analysis shows continued strength in consumer spending. Consumers remain relatively resilient, supporting corporate revenues and maintaining strong market fundamentals.

- This resilient consumer spending underpins corporate profits and justifies current market valuations. While high debt levels are a potential concern, BofA's analysis suggests that their impact on consumer spending will be manageable.

Addressing Common Concerns About High Valuations

High stock market valuations naturally trigger apprehension. However, a closer examination reveals that several factors mitigate these concerns.

The Importance of Long-Term Perspective

- Short-term market fluctuations are inherently risky. Focusing solely on short-term price movements can lead to poor investment decisions.

- Long-term investment strategies are crucial for weathering market volatility. Historically, periods of high valuations have been followed by sustained periods of growth, demonstrating the importance of patience and a long-term perspective. The stock market, over time, has delivered strong returns, despite short-term corrections.

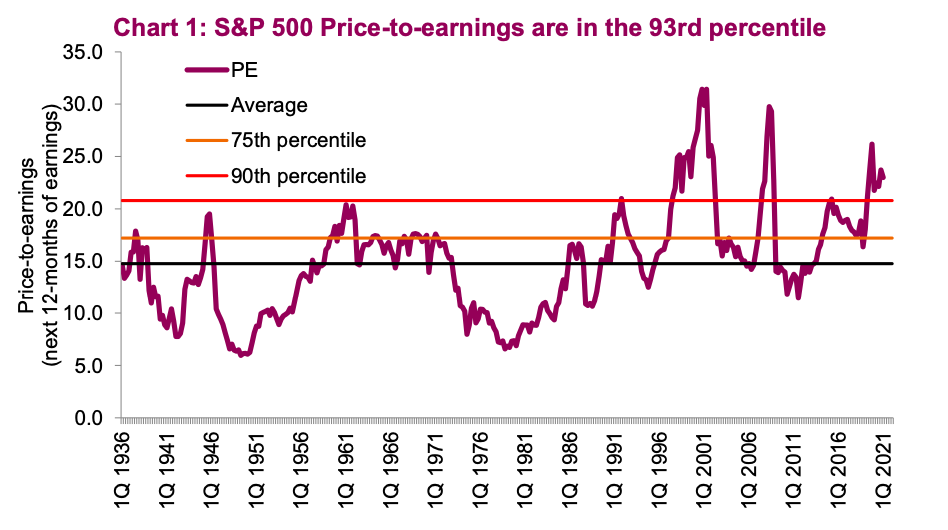

Comparing Valuations to Historical Context

- Current P/E ratios are above historical averages, but not exceptionally so compared to other periods of strong economic growth. Direct comparison to historical averages needs careful consideration as economic conditions vary widely.

- Other valuation metrics, such as Price-to-Sales ratios, offer a more nuanced perspective. Using multiple metrics provides a comprehensive understanding, revealing strengths and weaknesses in different valuation approaches. External factors such as interest rates and global events impact valuations.

Sector-Specific Valuation Analysis

- Broad market valuation metrics can be misleading. Some sectors demonstrate significantly stronger fundamentals than others.

- Sectors like technology and healthcare often command higher valuations due to robust growth prospects. A sector-specific approach reveals that high valuations are not uniform across the entire market. Focusing on specific sectors with strong growth narratives is key.

BofA's Investment Strategy Recommendations

BofA's recommendations emphasize a balanced, long-term approach.

Diversification and Risk Management

- A diversified portfolio is crucial for mitigating risk in the current market environment. Diversification across asset classes and sectors is a core strategy to weather market volatility.

- Risk management is paramount. Understanding individual risk tolerance and adjusting the portfolio accordingly is essential for achieving long-term investment goals. This includes considering both upside and downside potential.

Long-Term Growth Opportunities

- BofA identifies specific sectors and themes offering attractive long-term growth potential. These sectors often align with long-term macroeconomic trends and technological advancements.

- Their recommendations highlight opportunities in sectors poised for sustained growth, leveraging innovation and addressing global challenges. Understanding the reasons behind BofA's choices allows for informed investment decisions.

Conclusion

In conclusion, while current stock market valuations appear high, BofA's positive economic outlook, coupled with a long-term investment perspective and a nuanced approach to valuation analysis, suggests that panic is unwarranted. Don't let current stock market valuations cause unnecessary alarm. By carefully considering BofA's insights and developing a well-informed investment strategy based on their analysis, investors can navigate the current market effectively and capitalize on long-term growth opportunities. Consult with a financial advisor to formulate an investment strategy that aligns with your personal financial goals and risk tolerance, and learn more about BofA's perspective on current stock market valuations to make informed decisions.

Featured Posts

-

Understanding High Stock Market Valuations Insights From Bof A

Apr 22, 2025

Understanding High Stock Market Valuations Insights From Bof A

Apr 22, 2025 -

The La Wildfires And The Troubling Trend Of Betting On Calamities

Apr 22, 2025

The La Wildfires And The Troubling Trend Of Betting On Calamities

Apr 22, 2025 -

The Fracturing Relationship Understanding The Breakdown In U S China Relations And Its Implications

Apr 22, 2025

The Fracturing Relationship Understanding The Breakdown In U S China Relations And Its Implications

Apr 22, 2025 -

Ai Driven Podcast Creation Analyzing And Transforming Repetitive Scatological Data

Apr 22, 2025

Ai Driven Podcast Creation Analyzing And Transforming Repetitive Scatological Data

Apr 22, 2025 -

Is A New Cold War Inevitable Analyzing The Deterioration Of U S China Relations

Apr 22, 2025

Is A New Cold War Inevitable Analyzing The Deterioration Of U S China Relations

Apr 22, 2025