Why Current Stock Market Valuations Shouldn't Deter Investors: A BofA View

Table of Contents

The Limitations of Traditional Valuation Metrics in a Changing Landscape

Traditional valuation metrics, like the price-to-earnings ratio (P/E), market capitalization, and other valuation multiples, are frequently used to gauge the overall health and potential of the stock market. However, these metrics may oversimplify the complexities of the current market. Several factors need consideration before solely relying on these traditional measures of stock market valuations:

-

The impact of low interest rates and inflation on earnings: Low interest rates can artificially inflate earnings, leading to higher P/E ratios. Conversely, high inflation can erode purchasing power and impact future earnings forecasts, distorting traditional valuation benchmarks. Understanding the interplay between these macroeconomic factors and company performance is critical.

-

Rapid technological advancements and shifting economic landscapes: The rapid pace of technological change and global economic shifts render historical data less reliable for predicting future performance. Traditional valuation models often struggle to account for disruptive innovations and unforeseen geopolitical events that significantly impact stock market valuations.

-

BofA's analysis suggests that focusing solely on historical valuation benchmarks can lead to missed opportunities: BofA's research emphasizes a more dynamic approach, considering qualitative factors like innovation, competitive positioning, and long-term growth prospects alongside traditional metrics. A rigid adherence to historical valuations can blind investors to promising investment opportunities in sectors undergoing transformation.

The Importance of Long-Term Growth Potential and Sector Diversification

Rather than solely focusing on current stock market valuations, a long-term investment strategy focused on growth potential and diversification offers a more robust approach to navigating market volatility.

-

Focusing on companies with strong long-term growth potential mitigates short-term valuation concerns: Investing in companies with innovative products, strong management teams, and defensible market positions can provide higher returns over the long term, irrespective of short-term valuation fluctuations. This is a key element of a successful long-term investment strategy.

-

Sector diversification is crucial for mitigating risk and capitalizing on various growth opportunities: A diversified portfolio reduces exposure to the risks associated with any single sector. By investing across various sectors, investors can potentially capitalize on growth opportunities even if some sectors underperform. This helps manage the risks associated with fluctuating stock market valuations.

-

BofA's research points to specific sectors poised for significant growth despite current market conditions: BofA's analysts regularly identify sectors and industries expected to perform well, even during periods of market uncertainty. Their research often highlights companies with strong growth trajectories, which are key for mitigating the risks of high stock market valuations.

-

A well-diversified portfolio can weather market fluctuations more effectively: By spreading investments across different asset classes and sectors, investors create a buffer against market downturns. This diversification strategy helps to mitigate the impact of any single investment's underperformance, thus mitigating some risks associated with high stock market valuations.

BofA's Positive Outlook and Strategic Investment Recommendations

BofA maintains a cautiously optimistic outlook on the market, acknowledging the elevated valuations but emphasizing the potential for continued growth driven by innovation and technological advancements.

-

BofA's overall outlook on the market and its underlying rationale: BofA's positive outlook is grounded in the belief that long-term economic growth will continue, albeit at a potentially slower pace than in previous years. They emphasize the resilience of the corporate sector and the potential for continued innovation to drive earnings growth.

-

Key sectors or asset classes that BofA recommends for investment: BofA's recommendations often highlight sectors like technology, healthcare, and select consumer staples, citing their strong growth potential and relative resilience to economic downturns. The specific recommendations may vary depending on the market conditions and overall economic outlook.

-

Specific examples of companies or investment vehicles aligned with BofA's recommendations: While specific recommendations are often proprietary, BofA’s reports and publications regularly feature analysis of companies aligning with their strategic outlook, providing investors with insights to support informed decision-making.

-

The reasoning behind BofA's strategic investment recommendations: BofA's recommendations are based on rigorous analysis that considers fundamental factors, macroeconomic trends, and geopolitical events that impact stock market valuations and the overall investment landscape.

Managing Risk in a Potentially Volatile Market

Even with a long-term perspective, managing risk is crucial, especially in potentially volatile markets.

-

Understanding your own risk tolerance: Before making any investment decisions, it’s crucial to assess your individual risk tolerance and investment goals. This allows you to create a portfolio strategy that aligns with your comfort level and financial objectives.

-

Strategies for managing portfolio risk, such as rebalancing and stop-loss orders: Regularly rebalancing your portfolio to maintain your desired asset allocation is crucial. Stop-loss orders can help limit potential losses if the market turns unexpectedly. These are key strategies to manage risk effectively when dealing with high stock market valuations.

-

The role of asset allocation in mitigating potential losses: Strategic asset allocation plays a crucial role in mitigating risk. By diversifying across asset classes (stocks, bonds, real estate, etc.), investors can reduce the overall volatility of their portfolio. This is important for investors who might be concerned about high stock market valuations.

-

Seeking professional financial advice: Consulting with a financial advisor can provide personalized guidance tailored to your specific financial situation and risk tolerance. This is especially important for investors who might be feeling overwhelmed by the current market environment and high stock market valuations.

Conclusion

While current stock market valuations might appear high based on traditional metrics, BofA's analysis suggests that a long-term perspective, focusing on growth potential and diversification, presents significant investment opportunities. By considering factors beyond simple valuation ratios and leveraging BofA's insights, investors can navigate the current market effectively. Don't let current stock market valuations deter your investment strategy. Explore BofA's insights and develop a well-informed plan to capitalize on the opportunities that exist in today's market. Learn more about navigating stock market valuations and building a robust portfolio to achieve your long-term financial goals.

Featured Posts

-

Police Officer Saves Choking Toddler Bodycam Footage Shows Dramatic Rescue

May 09, 2025

Police Officer Saves Choking Toddler Bodycam Footage Shows Dramatic Rescue

May 09, 2025 -

Kimbal Musk Beyond Elons Shadow A Look At His Life And Career

May 09, 2025

Kimbal Musk Beyond Elons Shadow A Look At His Life And Career

May 09, 2025 -

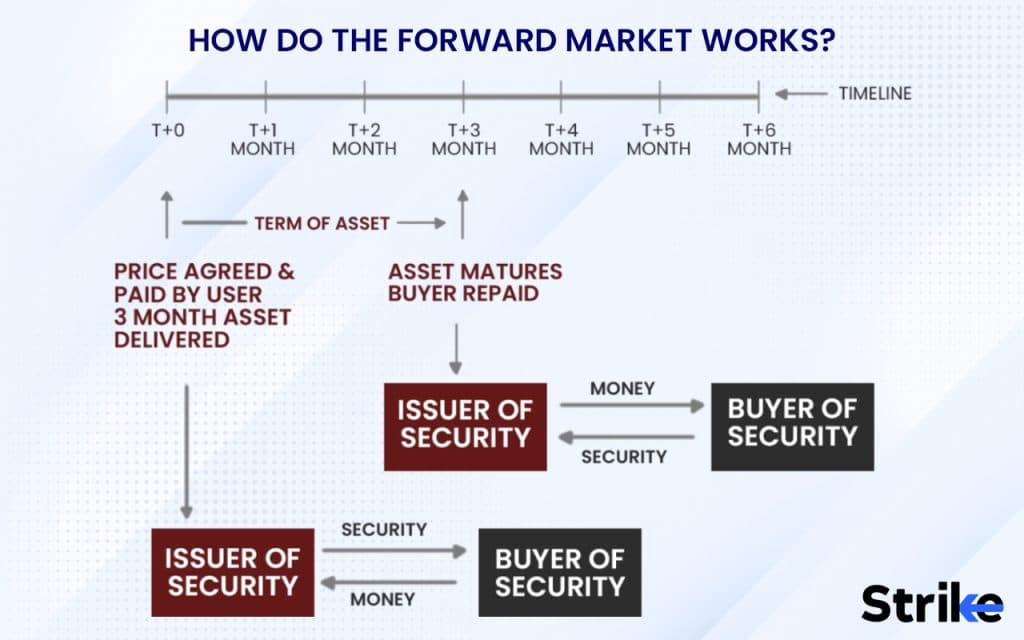

Bond Forward Market Reform The Indian Insurers Perspective

May 09, 2025

Bond Forward Market Reform The Indian Insurers Perspective

May 09, 2025 -

Madhyamik Pariksha Result 2025 Check Merit List Online

May 09, 2025

Madhyamik Pariksha Result 2025 Check Merit List Online

May 09, 2025 -

The Continued Relevance Of High Potential In Psych Spiritual Development

May 09, 2025

The Continued Relevance Of High Potential In Psych Spiritual Development

May 09, 2025