Why Did CoreWeave (CRWV) Stock Price Rise Today?

Table of Contents

Positive Earnings Report and Financial Performance

CoreWeave's impressive stock performance is largely attributed to its strong financial results and positive future outlook. The company delivered an earnings beat, significantly exceeding analyst expectations across several key metrics.

Exceeded Analyst Expectations

CoreWeave's Q[Insert Quarter] earnings report showcased remarkable growth. The company reported:

- Revenue: $[Insert Revenue Figure], exceeding the predicted $[Insert Analyst Prediction] by $[Insert Percentage Difference]%.

- Earnings Per Share (EPS): $[Insert EPS Figure], significantly higher than the anticipated $[Insert Analyst Prediction].

- Year-over-Year Revenue Growth: $[Insert Percentage]%.

This exceptional performance stems from increased customer acquisition within the rapidly expanding cloud computing sector and the successful launch of new, high-demand services. The company's focus on providing cutting-edge infrastructure solutions has clearly paid off.

Strong Guidance for Future Growth

CoreWeave provided robust guidance for the coming quarters, further bolstering investor confidence. The company projects:

- Q[Insert Next Quarter] Revenue: $[Insert Projected Revenue].

- Full-Year Revenue: $[Insert Projected Full-Year Revenue].

This optimistic outlook is fueled by several strategic initiatives, including [Insert Specific Initiatives, e.g., expansion into new geographic markets, strategic partnerships, investments in R&D]. The company's ability to capitalize on the burgeoning demand for high-performance computing services is a key driver of this projected growth.

Industry-Wide Positive Sentiment and Market Trends

The positive sentiment surrounding CoreWeave isn't isolated; it reflects broader industry trends.

Booming Cloud Computing Sector

The cloud computing market is experiencing explosive growth, driven by increasing data volumes and the rise of artificial intelligence. According to [Cite a reputable source, e.g., Gartner, IDC], the global cloud computing market is projected to reach $[Insert Market Size Projection] by [Insert Year]. CoreWeave, as a leading provider of GPU-accelerated cloud computing infrastructure, is perfectly positioned to benefit from this expansion.

- Cloud computing market growth is fueled by the increasing adoption of AI/ML solutions.

- CoreWeave leverages its expertise in GPU computing and data center infrastructure to meet the demands of this rapidly growing market.

- The company's focus on sustainability and energy efficiency also contributes to its appeal in an increasingly environmentally conscious market.

Increased Demand for AI/ML Infrastructure

The surge in artificial intelligence (AI) and machine learning (ML) applications is driving unprecedented demand for high-performance computing (HPC) infrastructure. Training sophisticated AI models requires massive computing power, precisely what CoreWeave offers.

- Companies across various sectors, from finance to healthcare, are increasingly adopting AI/ML.

- This adoption necessitates significant investments in GPU-powered infrastructure to handle the intensive computational requirements of AI/ML algorithms.

- CoreWeave's specialized infrastructure uniquely meets this demand, contributing to its strong financial performance and positive outlook.

Specific News or Announcements Impacting CRWV Stock

Beyond the general market trends, specific company news likely contributed to the CRWV stock price surge.

New Partnerships or Contracts

CoreWeave's recent announcement of new partnerships and contract wins significantly boosted investor confidence. [Insert details about new partnerships, mentioning company names and the potential impact of these collaborations. Quantify the impact if possible, e.g., projected revenue increase]. These strategic partnerships expand CoreWeave's reach and solidify its position as a key player in the cloud computing market.

Technological Advancements or Product Launches

Any recent technological advancements or product launches by CoreWeave would also positively influence investor perception. [Insert details about new technologies or products, highlighting their competitive advantages and the potential for increased market share]. These innovations demonstrate CoreWeave's commitment to innovation and its ability to stay ahead of the curve in a rapidly evolving technological landscape.

Conclusion: Understanding the CoreWeave (CRWV) Stock Price Rise and What's Next

The CoreWeave (CRWV) stock price increase today is a result of a confluence of factors: exceptional financial performance exceeding analyst expectations, the booming cloud computing and AI/ML markets, and positive company announcements regarding partnerships and technological advancements. These elements have collectively driven increased investor confidence in CoreWeave's future growth trajectory. To monitor CoreWeave's stock performance and stay updated on its progress, continue to follow its news and financial reports. The outlook for CoreWeave (CRWV) remains positive, given its strong position within the rapidly growing cloud computing and AI sectors. Learn more about investing in CoreWeave and understand its potential for future growth.

Featured Posts

-

Marks And Spencer Cyber Attack 300 Million Cost Revealed

May 22, 2025

Marks And Spencer Cyber Attack 300 Million Cost Revealed

May 22, 2025 -

Teknik Direktoer Degisikligi Ancelotti Nin Yerine Klopp Uygun Mu

May 22, 2025

Teknik Direktoer Degisikligi Ancelotti Nin Yerine Klopp Uygun Mu

May 22, 2025 -

Juergen Klopp Un Doenuesue Duenya Devi Nin Yeni Lideri Mi

May 22, 2025

Juergen Klopp Un Doenuesue Duenya Devi Nin Yeni Lideri Mi

May 22, 2025 -

The Future Of Core Weave Stock Predictions And Projections

May 22, 2025

The Future Of Core Weave Stock Predictions And Projections

May 22, 2025 -

The Blake Lively Taylor Swift Feud An Examination Of The Alleged Blackmail And Leaked Texts

May 22, 2025

The Blake Lively Taylor Swift Feud An Examination Of The Alleged Blackmail And Leaked Texts

May 22, 2025

Latest Posts

-

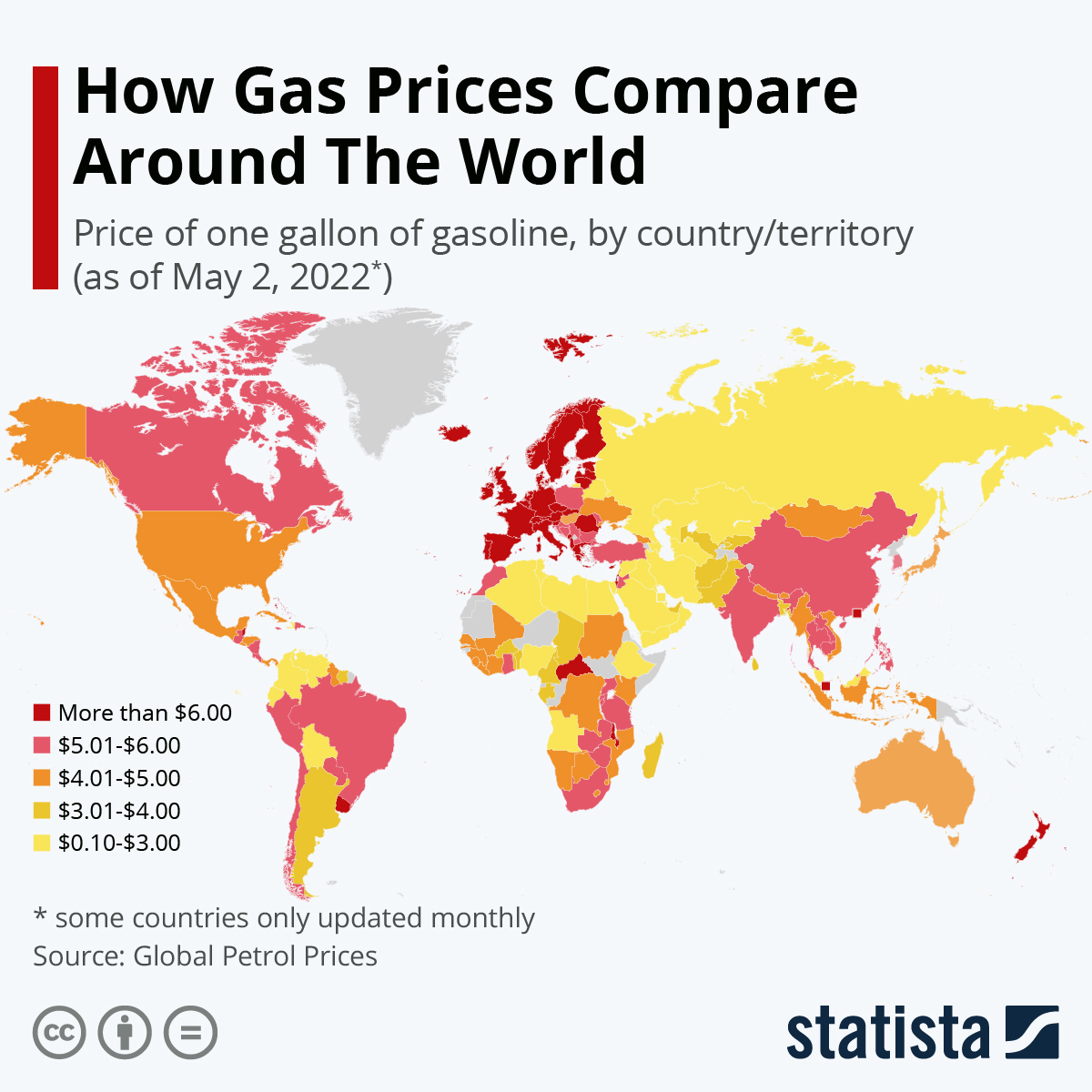

Current Gas Prices In Columbus Ohio A Price Comparison

May 22, 2025

Current Gas Prices In Columbus Ohio A Price Comparison

May 22, 2025 -

Wordle 1358 Answer And Hints For Saturday March 8th

May 22, 2025

Wordle 1358 Answer And Hints For Saturday March 8th

May 22, 2025 -

Columbus Gas Price Survey 2 83 To 3 31 Per Gallon

May 22, 2025

Columbus Gas Price Survey 2 83 To 3 31 Per Gallon

May 22, 2025 -

Significant Gas Price Variation Across Columbus Stations

May 22, 2025

Significant Gas Price Variation Across Columbus Stations

May 22, 2025 -

Wordle 1358 March 8th Hints And Solution

May 22, 2025

Wordle 1358 March 8th Hints And Solution

May 22, 2025