Why High Stock Market Valuations Shouldn't Deter Investors: A BofA Analysis

Table of Contents

The Limitations of Traditional Valuation Metrics in a Low-Interest-Rate Environment

Traditional valuation metrics, like the price-to-earnings ratio (P/E ratio) and market capitalization, are often used to assess whether the stock market is overvalued. However, these metrics can be misleading in a low-interest-rate environment. The current low interest rate regime significantly impacts stock valuations, altering the traditional interpretation of these key metrics.

-

Low interest rates justify higher price-to-earnings ratios: When interest rates are low, the opportunity cost of investing in stocks decreases. Investors are less inclined to seek higher returns from bonds and other fixed-income instruments, thus driving up demand for stocks, leading to higher P/E ratios. This is supported by BofA's analysis showing a correlation between lower bond yields and increased equity valuations.

-

The impact of quantitative easing and bond yields on stock valuations: Central bank policies, such as quantitative easing (QE), directly influence bond yields and indirectly impact stock valuations. QE programs increase the money supply, pushing down bond yields and making equities relatively more attractive. BofA's research highlights this dynamic, demonstrating a clear relationship between QE programs and subsequent increases in stock market valuations.

-

Alternative valuation metrics better suited to the current environment: In a low-interest-rate environment, traditional metrics like the P/E ratio need to be considered in conjunction with alternative valuation methods, such as discounted cash flow (DCF) analysis, which takes into account the time value of money in a low-interest environment and provides a more nuanced assessment of intrinsic value. BofA's analysis emphasizes the importance of incorporating these alternative valuation metrics for a more comprehensive view of stock market valuation.

The Power of Long-Term Growth and Corporate Earnings

Despite high stock market valuations, focusing on the long-term growth potential of the market and individual companies offers a more optimistic outlook. A long-term investment strategy, considering both market capitalization and P/E ratios in context, is crucial.

-

Strong corporate earnings growth projections: BofA's analysis projects robust corporate earnings growth in the coming years, driven by factors such as technological innovation and global economic expansion. Charts and graphs from the BofA report visually reinforce these projections, highlighting a positive outlook despite current high stock market valuations.

-

Technological innovation and its impact on future earnings: The ongoing technological revolution is a significant driver of future earnings growth. Companies that embrace and leverage technological advancements are well-positioned to outperform in the long term, potentially mitigating the concerns associated with high current stock market valuations.

-

The importance of a diversified investment strategy: A well-diversified investment strategy across various sectors and asset classes mitigates risk and enhances the potential for long-term growth, even in the face of high stock market valuations. This diversification strategy helps to manage the impact of any single sector's performance on the overall portfolio.

Addressing Inflationary Pressures and Their Impact on Stock Valuations

Inflationary pressures are a valid concern for investors, but the impact on stock valuations isn't necessarily negative in the long run. It's crucial to understand how companies react and the role of central banks.

-

How companies can mitigate inflationary pressures: Companies with strong pricing power and efficient cost management strategies can often mitigate inflationary pressures and maintain profit margins. BofA's analysis identifies specific sectors and companies demonstrating resilience to inflation.

-

The Federal Reserve's role in managing inflation: The Federal Reserve's actions to manage inflation significantly impact stock valuations. While interest rate hikes can initially dampen stock prices, controlling inflation promotes long-term stability and economic growth, benefiting the stock market in the long run. BofA's experts offer insights into the Fed's likely responses and their potential influence on market valuations.

-

BofA's perspective on the long-term impact of inflation on the market: BofA's analysis suggests that while inflation poses short-term challenges, its long-term impact on stock market valuations is likely to be less dramatic than some fear. The report offers a measured perspective, weighing both the risks and opportunities presented by inflationary pressures.

The Importance of Sector-Specific Analysis

A blanket approach to stock market valuation is insufficient. A thorough sector-specific analysis is crucial for identifying opportunities and mitigating risks.

-

Sectors less susceptible to valuation concerns: Some sectors demonstrate greater resilience to valuation concerns, offering attractive investment prospects even in a high-valuation market. BofA's research highlights sectors projected to outperform, regardless of overall stock market valuation.

-

Potential for outperformance in specific sectors: Identifying sectors poised for growth, despite high overall stock market valuations, is key to a successful investment strategy. This requires careful analysis of individual company performance, industry trends, and macroeconomic factors.

-

Thorough due diligence before investing: Before making any investment decisions, investors should conduct comprehensive due diligence, paying close attention to individual company fundamentals and future growth potential. This approach allows for informed decisions that align with personal risk tolerance and financial goals, even in the context of high stock market valuations.

Conclusion: Investing Wisely Despite High Stock Market Valuations

While high stock market valuations are a legitimate concern, the BofA analysis reveals compelling reasons for remaining invested. The impact of low interest rates on traditional valuation metrics, the potential for long-term growth driven by corporate earnings and technological innovation, and the importance of sector-specific analysis all suggest a nuanced perspective. Don't let high stock market valuations deter you from building a robust investment portfolio. Consider diversifying your investments, focusing on long-term growth potential, and conducting thorough due diligence to navigate this environment effectively. Learn more about how to navigate high stock market valuations effectively by exploring further resources on investment strategies and financial analysis. (Link to relevant BofA resource or further articles here).

Featured Posts

-

Deutsche Banks London Fixed Income Traders And The E18m Bonus Disappearance

May 30, 2025

Deutsche Banks London Fixed Income Traders And The E18m Bonus Disappearance

May 30, 2025 -

La Rental Market Exploited After Fires A Celebritys Accusation

May 30, 2025

La Rental Market Exploited After Fires A Celebritys Accusation

May 30, 2025 -

Sewd Awstabynkw Mwsm Almlaeb Altrabyt Yshhd Talqha

May 30, 2025

Sewd Awstabynkw Mwsm Almlaeb Altrabyt Yshhd Talqha

May 30, 2025 -

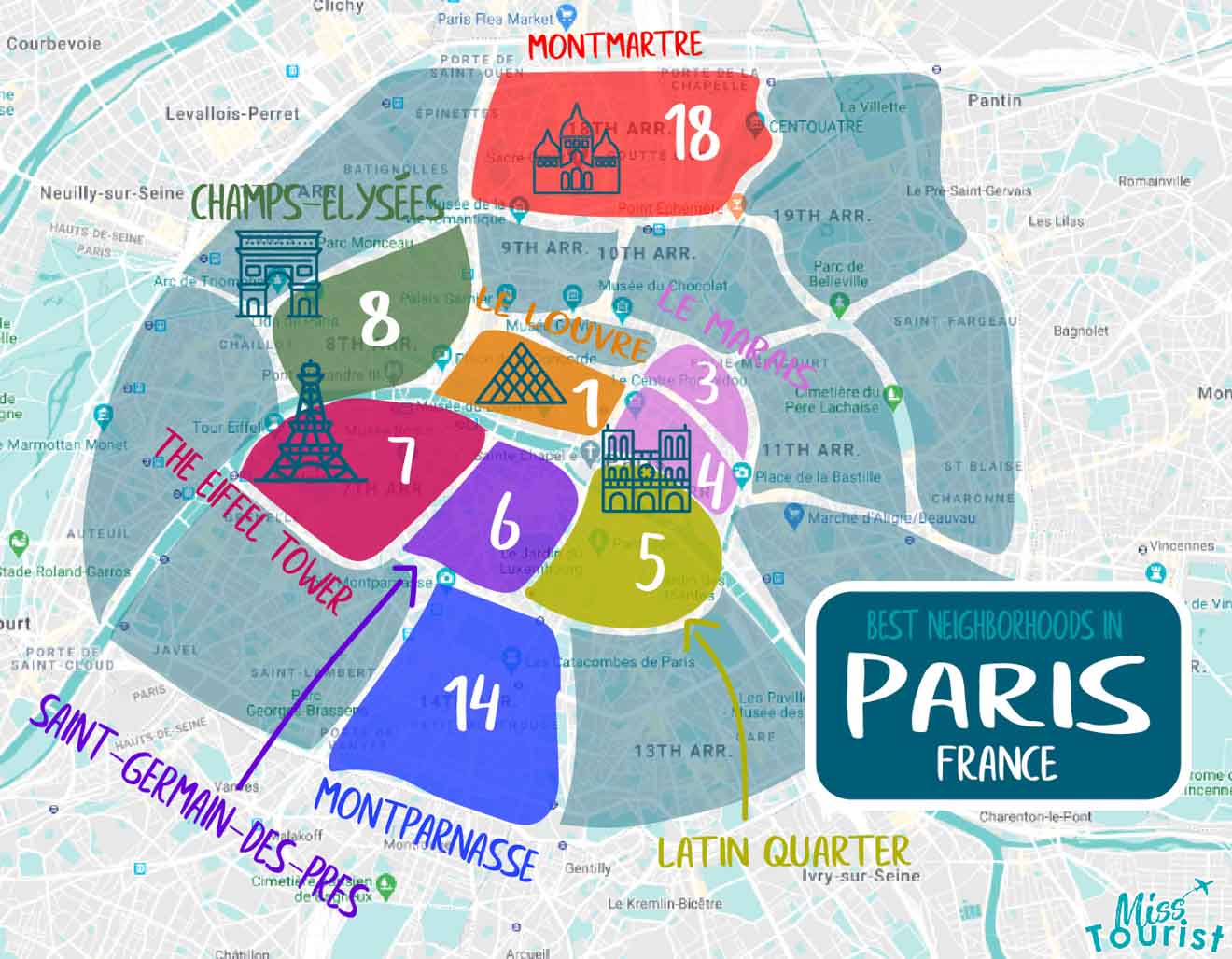

The Best Neighborhoods In Paris A Locals Perspective

May 30, 2025

The Best Neighborhoods In Paris A Locals Perspective

May 30, 2025 -

Charleston Quarterfinal Kalinskaya Triumphs Over Keys

May 30, 2025

Charleston Quarterfinal Kalinskaya Triumphs Over Keys

May 30, 2025

Latest Posts

-

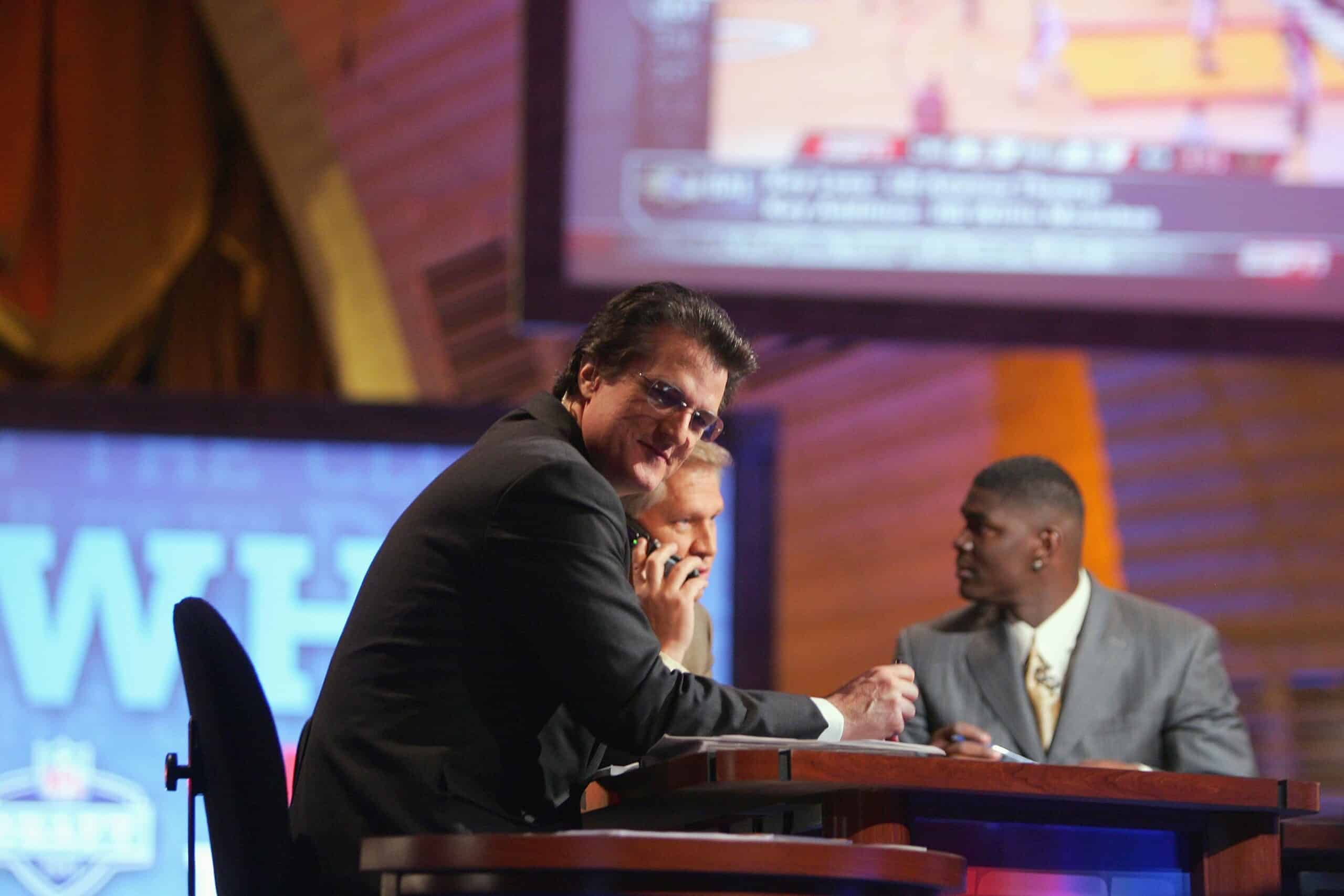

Mel Kiper Jr On The Browns No 2 Pick Who Will They Draft

May 31, 2025

Mel Kiper Jr On The Browns No 2 Pick Who Will They Draft

May 31, 2025 -

Mel Kiper Jr S Prediction Browns No 2 Overall Draft Pick

May 31, 2025

Mel Kiper Jr S Prediction Browns No 2 Overall Draft Pick

May 31, 2025 -

Strong Thunderstorms Target Northeast Ohio Latest Forecasts And Alerts

May 31, 2025

Strong Thunderstorms Target Northeast Ohio Latest Forecasts And Alerts

May 31, 2025 -

Part Time Position In Cleveland For Former Fox19 Meteorologist

May 31, 2025

Part Time Position In Cleveland For Former Fox19 Meteorologist

May 31, 2025 -

Former Fox19 Meteorologist Lands Part Time Cleveland Job

May 31, 2025

Former Fox19 Meteorologist Lands Part Time Cleveland Job

May 31, 2025