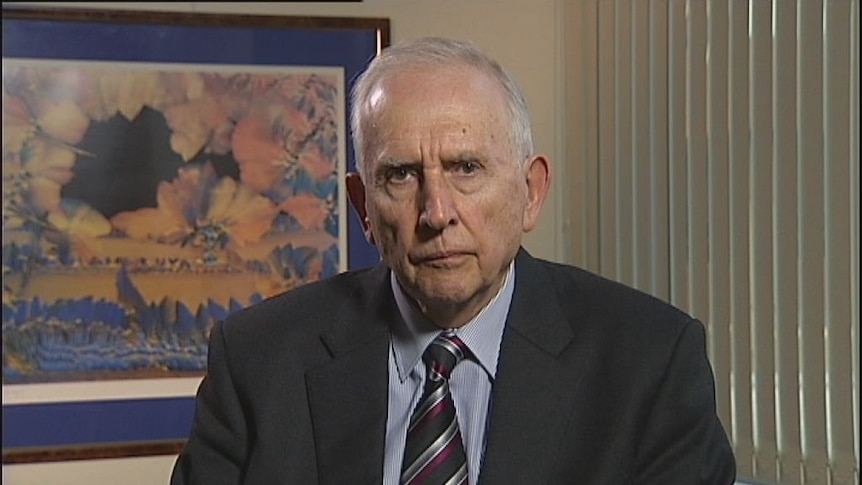

Will Australian Assets Rise After The Election? Expert Analysis

Table of Contents

Impact on Property Market

The property market is highly sensitive to government policies. Understanding the winning party's approach is crucial for predicting future trends in Australian Assets.

Government Policies and Housing

The winning party's housing policies will significantly influence property prices. For example, increased first home buyer grants could boost demand, driving up prices, particularly in already competitive markets like Sydney and Melbourne. Conversely, changes to negative gearing or capital gains tax could dampen investor activity. Infrastructure spending in regional areas could stimulate growth outside major cities.

- Increased demand: Government incentives can lead to a surge in buyer activity.

- Supply changes: New construction projects, influenced by government policy, can affect supply and pricing.

- Interest rate sensitivity: Rising interest rates can impact affordability and cool down the market.

- Potential for price growth or correction: The net effect of these factors will determine whether we see price growth or a correction in the Australian property market.

Rental Market Outlook

The rental market is equally affected by government policies. Changes to tenant rights or rental assistance programs will influence rental yields and vacancy rates. Increased demand from first-home buyers may free up rental properties, potentially impacting rental inflation.

- Rental inflation: Government policies and overall market conditions will determine the rate of rental inflation.

- Investment attractiveness of rental properties: Changes to tax incentives and regulations will impact the appeal of rental properties as investments.

- Potential for increased or decreased rental yields: The balance between supply, demand, and government regulation will dictate rental yield trends.

Stock Market Performance

The Australian stock market's performance post-election will depend on various factors, including sector-specific impacts and the government's economic policies.

Sector-Specific Analysis

Certain sectors are expected to perform better than others depending on the government's priorities. For example, a focus on renewable energy could benefit the technology and green energy sectors, while changes to mining regulations could affect the mining industry.

- Specific company examples: Individual company performance will depend on their exposure to specific government policies.

- Industry forecasts: Industry-specific analyses are needed to predict the post-election performance of different sectors.

- Potential for short-term gains or losses: Market volatility is expected in the short term as investors react to the new government's policies.

Impact of Economic Policies

The government's fiscal and monetary policies will significantly impact the Australian stock market. Inflation, interest rates, and global economic conditions will also play a role. A fiscally responsible government might instill confidence, leading to market growth, whereas inflationary pressures could lead to corrections.

- Potential for market growth: Positive economic signals and investor confidence can lead to market expansion.

- Correction: Negative economic news or policy uncertainty could trigger market corrections.

- Sideways movement: A period of stagnation is also possible depending on the interplay of economic factors.

Influence on Other Asset Classes

The election's impact extends beyond property and stocks, influencing other asset classes like agricultural investments and infrastructure.

Agricultural Investments

Government support programs and trade policies significantly influence agricultural investments. Changes to subsidies or export regulations could affect commodity prices and investment opportunities in the agribusiness sector.

- Commodity price predictions: Government policies and global demand will impact commodity prices.

- Investment opportunities in agribusiness: Government support can create lucrative investment opportunities.

- Risks and potential returns: The agricultural sector is subject to various risks, including climate change and global market fluctuations.

Infrastructure Investments

Planned infrastructure projects are a significant driver of investment. Government commitment to infrastructure spending can create investment opportunities and related job growth, impacting related industries like construction and engineering.

- Specific infrastructure projects: Identifying specific projects provides a clearer picture of potential returns.

- Potential for job creation: Large infrastructure projects create jobs across various sectors.

- Impact on related industries: Infrastructure spending stimulates growth in supporting industries.

Conclusion

This article examined the potential impact of the recent Australian federal election on various asset classes, including Australian assets. While predictions are inherently uncertain, analyzing the winning party's policies and the overall economic outlook provides valuable insights into the post-election market. We've explored the potential effects on the property market, the stock market, and other asset classes, offering a nuanced perspective on where opportunities and challenges may lie for investors. Understanding the potential movement of Australian assets after the election is crucial for informed investment decisions. Stay updated on market trends and policy developments to make the most of your investment strategy in the evolving Australian landscape. Conduct thorough due diligence and consider seeking professional financial advice before making any investment decisions related to Australian assets.

Featured Posts

-

Broadcoms Proposed V Mware Price Hike At And T Details A 1050 Cost Surge

May 06, 2025

Broadcoms Proposed V Mware Price Hike At And T Details A 1050 Cost Surge

May 06, 2025 -

Los Angeles Style Patrick Schwarzeneggers Bronco Ride

May 06, 2025

Los Angeles Style Patrick Schwarzeneggers Bronco Ride

May 06, 2025 -

Wildfire Speculation A Grim Reflection Of Our Times Los Angeles

May 06, 2025

Wildfire Speculation A Grim Reflection Of Our Times Los Angeles

May 06, 2025 -

Options Trading Signals Aussie Dollar Strength Against Kiwi

May 06, 2025

Options Trading Signals Aussie Dollar Strength Against Kiwi

May 06, 2025 -

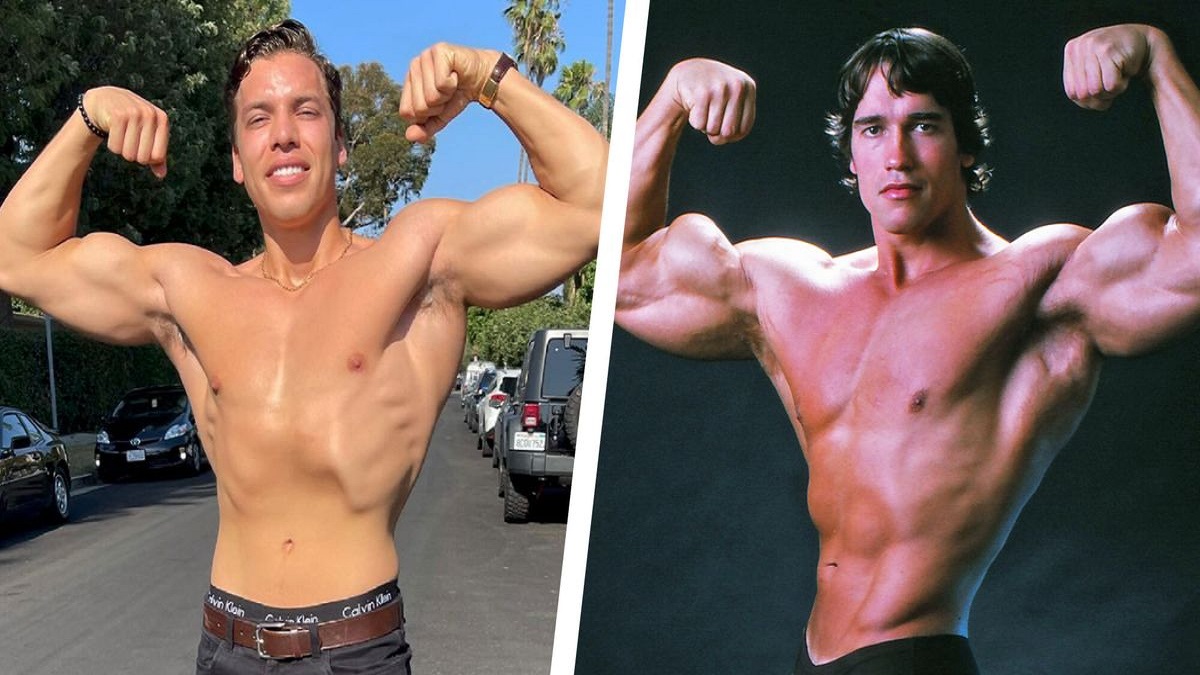

Arnold Schwarzenegger Es Joseph Baena Kapcsolata Apa Es Fia

May 06, 2025

Arnold Schwarzenegger Es Joseph Baena Kapcsolata Apa Es Fia

May 06, 2025

Latest Posts

-

Arnold Schwarzenegger Es Joseph Baena Kapcsolata Apa Es Fia

May 06, 2025

Arnold Schwarzenegger Es Joseph Baena Kapcsolata Apa Es Fia

May 06, 2025 -

Arnold Schwarzenegger Bueszke Fia Joseph Baena Sikerei Es Elete

May 06, 2025

Arnold Schwarzenegger Bueszke Fia Joseph Baena Sikerei Es Elete

May 06, 2025 -

Copper Price Forecast Considering The China Us Trade Factor

May 06, 2025

Copper Price Forecast Considering The China Us Trade Factor

May 06, 2025 -

Schwarzeneggers Superman Audition What Went Wrong Corenswets Casting Explained

May 06, 2025

Schwarzeneggers Superman Audition What Went Wrong Corenswets Casting Explained

May 06, 2025 -

Copper Market Outlook Analysis Of China Us Trade Relations

May 06, 2025

Copper Market Outlook Analysis Of China Us Trade Relations

May 06, 2025