Will Big Oil Increase Production? OPEC+ Meeting In Focus

Table of Contents

Current Global Oil Supply and Demand Dynamics

The current global energy crisis is largely characterized by a significant imbalance between oil supply and demand. Post-pandemic economic recovery has fueled a surge in global oil consumption, while geopolitical events, particularly the war in Ukraine and subsequent sanctions on Russian oil, have significantly constrained supply. This has resulted in a noticeable oil shortage and contributed to the historically high crude oil prices we're witnessing.

-

Examine the role of sanctions on Russian oil production: The sanctions imposed on Russia, a major oil producer, have disrupted global oil supply chains, leading to reduced exports and higher prices. The extent to which these sanctions continue to impact production is a key factor in the OPEC+ decision.

-

Assess the impact of increasing energy demand from developing nations: Rapid economic growth in developing countries is driving a significant increase in oil demand, putting further pressure on existing supplies. This increased demand from emerging markets needs to be considered alongside the recovery in developed nations.

-

Discuss the effect of underinvestment in new oil and gas projects on future supply: Years of underinvestment in new oil and gas exploration and production projects, partly due to a push towards renewable energy, has left the global energy system vulnerable to supply shocks. This long-term trend further exacerbates the current supply-demand imbalance.

OPEC+'s Internal Politics and Diverging Interests

OPEC+, a coalition of the Organization of the Petroleum Exporting Countries (OPEC) and other major oil-producing nations, notably Russia, holds significant influence over global oil supply. However, reaching a consensus on production levels within the group is often challenging due to the diverging interests of its members.

-

Discuss potential disagreements between members regarding production increases: Saudi Arabia, a key player in OPEC+, may face pressure to increase production to stabilize prices. However, other members, particularly those with lower production capacity or different economic priorities, may resist such increases.

-

Analyze the influence of geopolitical factors on member nations' decisions: Geopolitical considerations play a crucial role. The ongoing conflict in Ukraine, relations between Russia and the West, and broader geopolitical tensions influence the strategic decisions of OPEC+ members.

-

Examine the pressure from consuming nations to increase oil supply: Consumer nations are actively lobbying OPEC+ for increased oil production to alleviate high prices and mitigate the impact on their economies. This external pressure adds another layer of complexity to the decision-making process.

Potential Scenarios and Their Impacts on Oil Prices

The upcoming OPEC+ meeting could result in several scenarios, each with far-reaching implications for global oil prices and energy security.

-

A significant production increase: A substantial increase in oil production by OPEC+ could lead to a considerable decrease in crude oil prices, easing inflationary pressures and boosting global economic growth. However, it could also impact the long-term profitability of oil producers.

-

A minor increase or maintaining current levels: A minor increase or a decision to maintain current production levels would likely keep oil prices relatively high, potentially prolonging inflationary pressures and causing further volatility in the energy market. This scenario could also lead to ongoing concerns about energy security.

-

Analyze the impact of a production increase on inflation and global economic growth: Lower oil prices, as a result of increased production, can positively impact inflation and stimulate global economic growth by reducing input costs for businesses and consumers.

-

Discuss the consequences of maintaining current production levels on energy security: Maintaining current production levels would likely exacerbate energy security concerns, particularly for nations heavily reliant on oil imports. This might lead to increased competition for limited supplies and could impact political relations.

-

Explore potential price volatility following the announcement of the OPEC+ decision: Regardless of the decision, the announcement itself could trigger significant price volatility in the short term, as markets react to the news and adjust their expectations.

The Role of Other Oil Producers Outside OPEC+

While OPEC+ plays a dominant role, other oil producers, notably the United States with its shale oil industry, also influence global supply. However, these producers face various constraints, including regulatory hurdles and cost considerations, limiting their ability to rapidly increase production to meet the current global demand. The interplay between OPEC+ decisions and the actions of non-OPEC+ producers is a critical factor shaping the global oil market.

Conclusion

The OPEC+ meeting’s outcome will significantly impact global oil prices and energy security. Key factors influencing the decision include global oil demand, the complex internal politics within OPEC+, and the actions of other oil producers. The potential scenarios range from a significant production increase leading to lower prices and boosted economic growth, to a continuation of tight supplies, resulting in persistent high prices and potential energy security issues. The interplay between these factors will shape the future of the energy market. Stay tuned for updates on whether Big Oil will increase production and how this decision will shape the future of the energy market. Follow us for ongoing analysis of the situation and further insights into the dynamics of oil production and the OPEC+ decisions.

Featured Posts

-

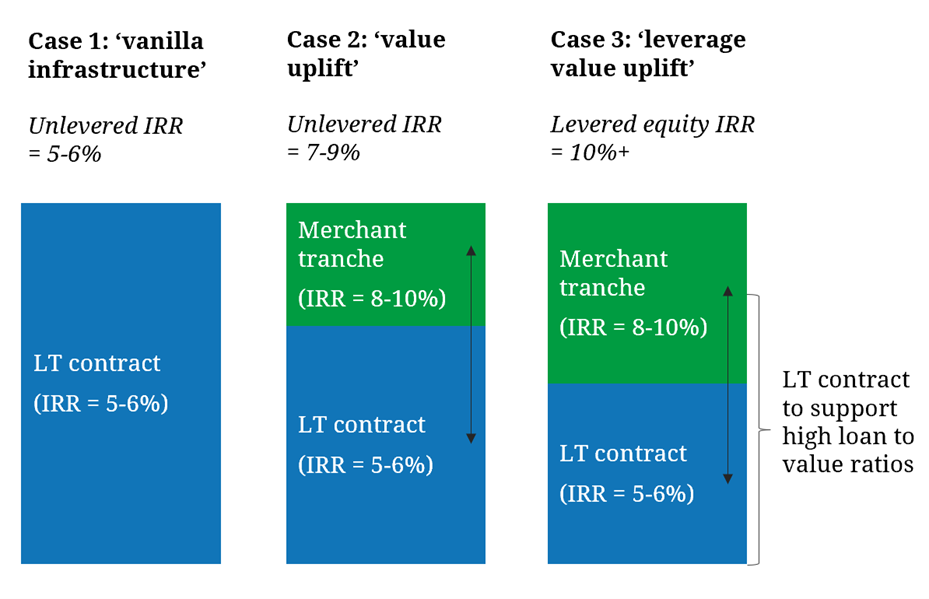

Investment Strategies For A 270 M Wh Bess In Belgiums Competitive Energy Market

May 04, 2025

Investment Strategies For A 270 M Wh Bess In Belgiums Competitive Energy Market

May 04, 2025 -

L Etat Palestinien Netanyahu Accuse Macron De Grave Erreur

May 04, 2025

L Etat Palestinien Netanyahu Accuse Macron De Grave Erreur

May 04, 2025 -

Googles Advertising Business Under Threat Of U S Government Breakup

May 04, 2025

Googles Advertising Business Under Threat Of U S Government Breakup

May 04, 2025 -

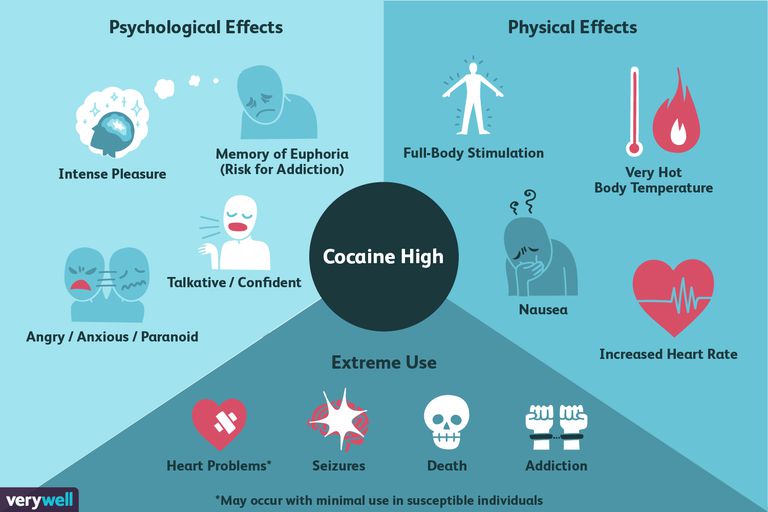

Narco Subs And Enhanced Cocaine Understanding The Drivers Of Global Increase

May 04, 2025

Narco Subs And Enhanced Cocaine Understanding The Drivers Of Global Increase

May 04, 2025 -

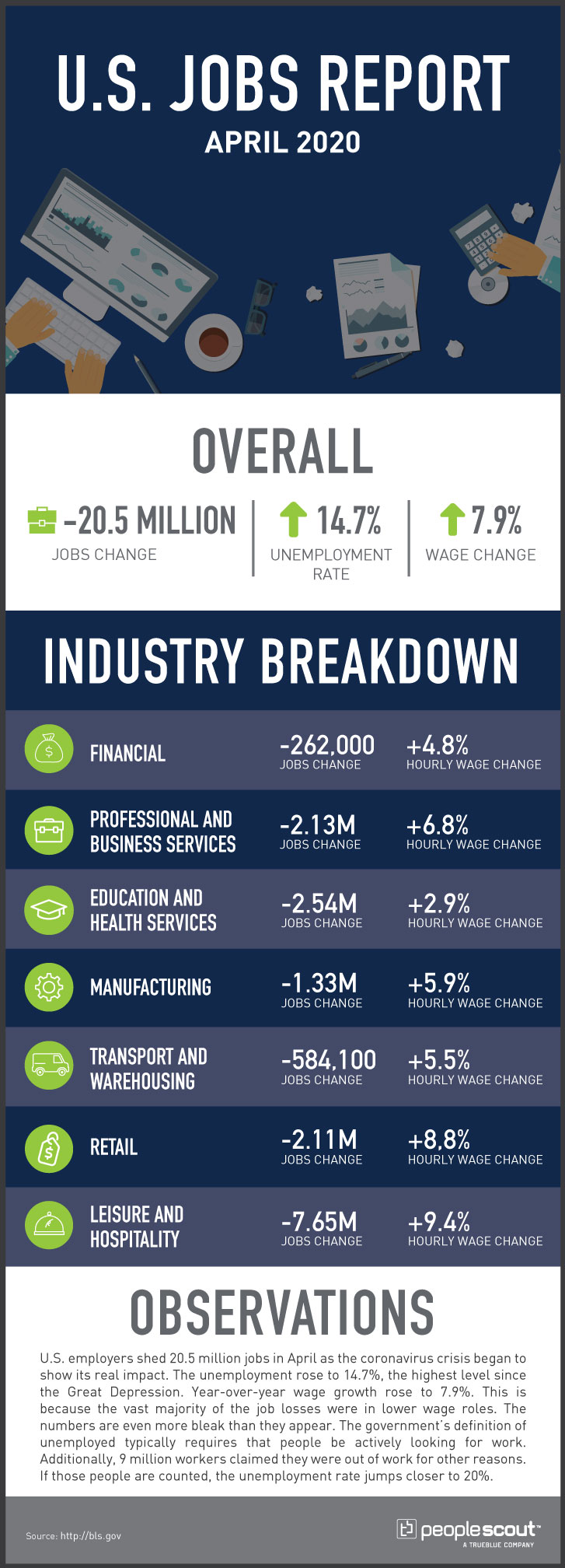

U S Jobs Report 177 000 Jobs Added In April Unemployment Steady At 4 2

May 04, 2025

U S Jobs Report 177 000 Jobs Added In April Unemployment Steady At 4 2

May 04, 2025

Latest Posts

-

1050 V Mware Price Hike At And T Details Broadcoms Proposed Increase

May 04, 2025

1050 V Mware Price Hike At And T Details Broadcoms Proposed Increase

May 04, 2025 -

Capitals Announce 2025 Playoffs Initiatives A Vanda Pharmaceuticals Partnership

May 04, 2025

Capitals Announce 2025 Playoffs Initiatives A Vanda Pharmaceuticals Partnership

May 04, 2025 -

Playoff Race Heats Up Analyzing Fridays Nhl Games And Standings

May 04, 2025

Playoff Race Heats Up Analyzing Fridays Nhl Games And Standings

May 04, 2025 -

Broadcoms V Mware Deal At And T Reveals Extreme Cost Implications

May 04, 2025

Broadcoms V Mware Deal At And T Reveals Extreme Cost Implications

May 04, 2025 -

Stanley Cup Playoffs Us Ratings Dip Despite International Interest

May 04, 2025

Stanley Cup Playoffs Us Ratings Dip Despite International Interest

May 04, 2025