Investment Strategies For A 270MWh BESS In Belgium's Competitive Energy Market

Table of Contents

Understanding the Belgian Regulatory Landscape for BESS

Investing in a 270MWh BESS requires a thorough understanding of Belgium's regulatory framework. Navigating this landscape successfully is crucial for securing permits and accessing available financial incentives.

Incentive Programs and Subsidies

The Belgian government actively supports renewable energy initiatives, including energy storage projects. Several incentive programs aim to encourage "energy storage investment." These include:

- Tax credits: Potential reductions in corporate income tax for investments in eligible BESS projects. Specific details regarding tax rates and eligibility are available on the website of the Belgian Federal Public Service Finance.

- Grants: Direct financial contributions from regional or federal agencies towards the development and deployment of energy storage solutions. Contact Elia, the Belgian transmission system operator, for information on relevant grant programs.

- Feed-in tariffs: While not directly applicable to BESS as a generation source, these tariffs for renewable energy generation can indirectly benefit BESS projects by stabilizing grid supply and enabling more efficient use of renewable energy resources.

Further information on specific programs and eligibility criteria can be found on the websites of the Flemish, Walloon, and Brussels regions' energy agencies.

Grid Connection and Permitting Processes

Securing grid connection and obtaining necessary permits for a 270MWh BESS is a complex process. Key steps include:

- Initial feasibility study: Assessing grid capacity, technical requirements, and environmental impact.

- Application for grid connection: Submitting a detailed application to Elia, including technical specifications and connection requests.

- Permitting process: Obtaining environmental permits, building permits, and other regulatory approvals from relevant regional authorities. This process can be lengthy, potentially spanning several months to a year or more.

Streamlining this process requires engaging experienced consultants specializing in Belgian energy regulations and grid connection procedures. Proactive engagement with Elia and regional authorities is crucial for navigating potential challenges.

Market-Based Mechanisms and Revenue Streams

The Belgian energy market offers several revenue streams for BESS operators.

- Frequency regulation: Providing ancillary services to stabilize the electricity grid, earning revenue for maintaining frequency stability. This market is highly competitive, requiring sophisticated control systems and rapid response capabilities.

- Arbitrage: Buying electricity at low prices and selling it at higher prices, profiting from price fluctuations throughout the day. This strategy demands accurate price forecasting and sophisticated trading algorithms.

- Capacity markets: Participating in capacity markets by offering grid services and securing payments for providing reserve capacity. Participation in this market requires pre-qualification and meeting specific grid code requirements.

Detailed market data and forecasts are available through Elia's market information platforms. Understanding the nuances of each revenue stream is vital for maximizing profitability.

Financial Modeling and Risk Mitigation for BESS Investments

A robust financial model is essential for assessing the viability of a 270MWh BESS investment in Belgium. This model must account for all costs and revenue streams, while considering potential risks.

Capital Expenditure (CAPEX) and Operational Expenditure (OPEX)

The costs associated with a 270MWh BESS project are significant.

- Battery technology: Lithium-ion batteries currently dominate the market, offering high energy density and long lifecycles. However, other technologies, such as flow batteries, are also being explored. The choice of technology significantly impacts both CAPEX and OPEX.

- Installation: Site preparation, civil works, and electrical infrastructure installation.

- Maintenance: Regular maintenance, including battery monitoring, diagnostics, and potential component replacements.

- Insurance: Comprehensive insurance coverage to protect against unforeseen events.

Detailed cost estimations should be obtained from reputable EPC (Engineering, Procurement, and Construction) contractors specialized in large-scale BESS projects. Cost-saving strategies might involve optimizing battery system design and leveraging economies of scale.

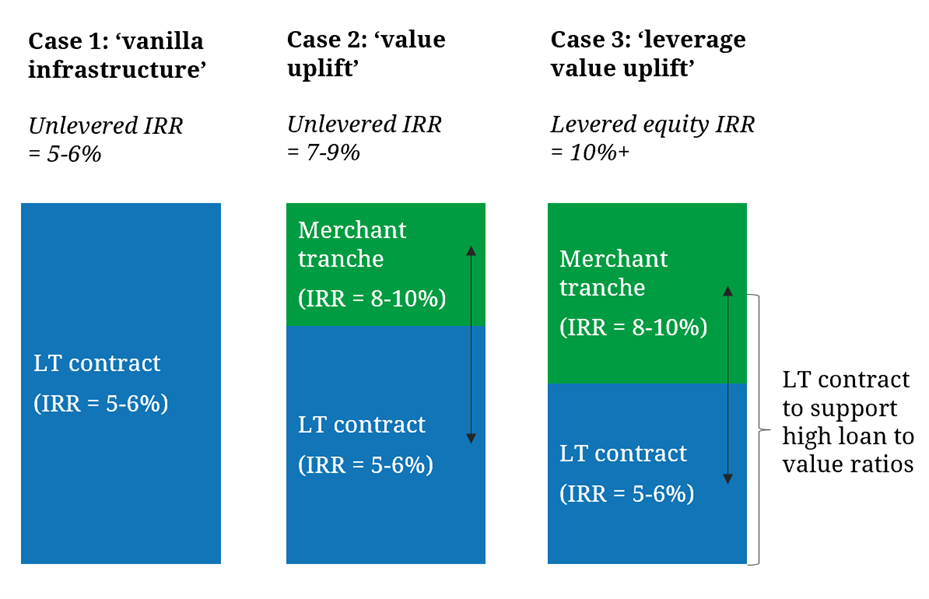

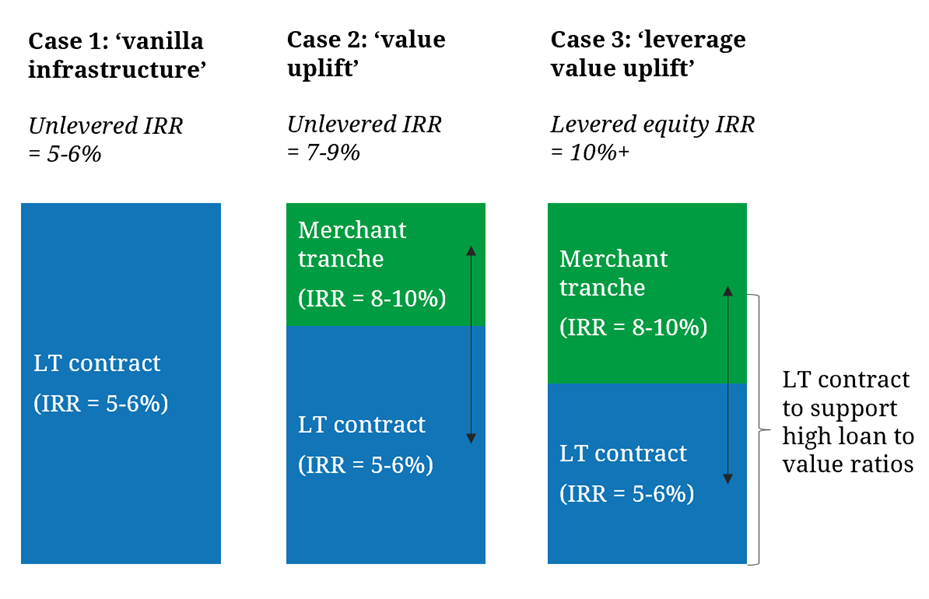

Debt Financing and Equity Investment

Securing appropriate financing is crucial for a project of this scale. Options include:

- Bank loans: Traditional bank financing, requiring a detailed business plan and strong financial projections.

- Green bonds: Bonds specifically designed for green projects, potentially attracting environmentally conscious investors.

- Private equity investments: Investments from private equity firms seeking high-growth opportunities in the renewable energy sector.

The chosen financing structure significantly influences the project's profitability and risk profile. Securing favorable financing terms requires engaging experienced financial advisors specialized in renewable energy projects.

Risk Assessment and Management

Several risks need to be addressed.

- Technology risks: Battery degradation, unexpected malfunctions, and technological obsolescence. Mitigation strategies involve selecting proven technologies, robust quality control, and regular maintenance.

- Regulatory changes: Changes in government policies, grid codes, and market rules can impact project profitability. Engaging with regulatory bodies and staying abreast of policy developments is essential.

- Market volatility: Fluctuations in electricity prices and demand can affect revenue streams. Hedging strategies, such as price contracts and options trading, can help mitigate this risk.

A comprehensive risk assessment and mitigation plan is crucial for a successful BESS investment.

Optimizing BESS Operation and Performance in the Belgian Energy Market

Optimizing BESS operation is key to maximizing returns.

Energy Arbitrage Strategies

Profiting from price differentials requires sophisticated forecasting techniques and efficient charging/discharging strategies. Real-time price monitoring and advanced algorithms are essential for optimized arbitrage. Accurate price forecasting is paramount, relying on historical data, market analysis, and sophisticated prediction models.

Frequency Regulation and Ancillary Services

Participating in frequency regulation markets requires sophisticated control systems and fast response times. Meeting stringent performance requirements is crucial for securing contracts and earning revenue. This often involves integration with grid management systems and adherence to Elia's technical specifications.

Integration with Renewable Energy Sources

Integrating the BESS with renewable energy sources (solar, wind) enhances grid stability and reduces reliance on fossil fuels. This synergy can improve the overall economic viability of both the BESS and renewable energy projects. The BESS can absorb intermittent energy production from renewables, improving grid stability and enabling higher renewable energy penetration.

Conclusion: Unlocking the Potential of BESS Investment in Belgium

Investing in a 270MWh BESS in Belgium offers significant opportunities for profit while contributing to the country's energy transition. Understanding the regulatory landscape, developing a robust financial model, and optimizing BESS operation are vital for success. By carefully navigating the complexities of the "Belgian energy market" and implementing effective "BESS investment" strategies, investors can unlock the substantial potential of "270MWh battery storage projects" and contribute to a more sustainable energy future. To explore further opportunities in BESS investment in Belgium, contact Elia or specialized energy consultants experienced in the Belgian market.

Featured Posts

-

Offshore Wind Energy Weighing The Costs Against The Benefits

May 04, 2025

Offshore Wind Energy Weighing The Costs Against The Benefits

May 04, 2025 -

Millions Stolen Insider Reveals Office365 Breach And Executive Targeting

May 04, 2025

Millions Stolen Insider Reveals Office365 Breach And Executive Targeting

May 04, 2025 -

Trump Carney Meeting Crucial For Cusmas Future

May 04, 2025

Trump Carney Meeting Crucial For Cusmas Future

May 04, 2025 -

Carneys Plan Reshaping The Economy For A Generation

May 04, 2025

Carneys Plan Reshaping The Economy For A Generation

May 04, 2025 -

A New Era Carney Unveils Ambitious Economic Transformation

May 04, 2025

A New Era Carney Unveils Ambitious Economic Transformation

May 04, 2025

Latest Posts

-

Understanding The Recent Gold Price Downturn Back To Back Weekly Losses In 2025

May 04, 2025

Understanding The Recent Gold Price Downturn Back To Back Weekly Losses In 2025

May 04, 2025 -

Golds Unexpected Dip Two Weeks Of Losses In Early 2025

May 04, 2025

Golds Unexpected Dip Two Weeks Of Losses In Early 2025

May 04, 2025 -

Analysis Golds Recent Decline And What It Means For Investors In 2025

May 04, 2025

Analysis Golds Recent Decline And What It Means For Investors In 2025

May 04, 2025 -

Canadiens Vs Oilers Your Morning Coffee Hockey Recap And Outlook

May 04, 2025

Canadiens Vs Oilers Your Morning Coffee Hockey Recap And Outlook

May 04, 2025 -

2025 Gold Market First Double Week Loss Of The Year

May 04, 2025

2025 Gold Market First Double Week Loss Of The Year

May 04, 2025