Will Big Oil Yield? OPEC+ Decision And The Future Of Oil Production

Table of Contents

The Recent OPEC+ Decision and Its Implications

The latest OPEC+ decision, involving [Insert specific details of the most recent production cut/increase, e.g., a 500,000 barrel per day reduction], sent shockwaves through the global energy market.

Analysis of the Latest OPEC+ Production Cuts/Increases

- Quantifiable Impact: The [specify - cut or increase] of [quantity] barrels per day represents [percentage]% of global oil production.

- Stated Rationale: OPEC+ cited [mention reasons given by OPEC+, e.g., market stabilization in response to weakening demand, geopolitical instability in a key producing region].

- Market Reaction: The announcement led to an immediate [specify - increase or decrease] in oil prices, with Brent crude reaching [price] per barrel.

Impact on Global Oil Supply and Prices

- Global Oil Prices: The OPEC+ decision will likely [predict - increase or decrease] global oil prices in the [short-term/long-term]. This will significantly impact consumer costs and inflation rates globally.

- Impact on Economies: Oil-producing nations may benefit from higher revenues, while oil-consuming nations face increased energy costs, potentially hindering economic growth. Inflationary pressures are expected to rise in many countries dependent on oil imports.

The Future of Oil Production: A Shifting Landscape

The future of oil production is far from certain, shaped by competing forces of renewable energy adoption, geopolitical instability, and technological advancements.

The Role of Renewable Energy Sources

- Growing Adoption: Solar and wind power are experiencing rapid growth, driven by falling costs and supportive government policies (e.g., tax credits, subsidies).

- Government Investment: Many countries are investing heavily in renewable energy infrastructure, further accelerating the transition away from fossil fuels.

- Long-Term Impact on Oil Demand: The increasing penetration of renewable energy will inevitably reduce long-term demand for oil, putting pressure on oil producers.

Geopolitical Factors and Oil Production

- Geopolitical Instability: Wars, sanctions, and political tensions in major oil-producing regions (e.g., the Middle East, Russia) significantly impact global oil supply and prices.

- Specific Country Influence: Russia's role as a major oil exporter, and the impact of sanctions on its oil production, has had a significant global impact. The Middle East continues to be a key player, and its stability greatly influences oil prices.

- Supply Chain Disruptions: Geopolitical events frequently disrupt supply chains, exacerbating price volatility.

Technological Advancements in Oil Extraction and Refinement

- Fracking and Deep-Sea Drilling: Advancements in fracking and deep-sea drilling technologies have increased oil production, but also carry significant environmental risks.

- Enhanced Oil Recovery: Techniques like enhanced oil recovery aim to maximize extraction from existing fields, but their environmental impact remains a concern.

- Environmental Implications: These technological advancements, while boosting oil production, often lead to increased greenhouse gas emissions and environmental damage.

Will Big Oil Adapt? Analyzing the Response of Major Oil Companies

The response of major oil companies will be pivotal in shaping the future of the oil industry.

Investment Strategies of Major Oil Companies

- Fossil Fuel Investments: Many major oil companies continue to invest heavily in fossil fuel exploration and production, despite growing concerns about climate change.

- Diversification into Renewables: Some oil majors are diversifying their portfolios by investing in renewable energy sources, such as solar and wind power, alongside their traditional operations.

- Strategic Partnerships: Collaborations between oil companies and renewable energy firms are becoming increasingly common.

Pressure from Investors and Consumers

- ESG Investing: The rise of ESG (environmental, social, and governance) investing is putting pressure on oil companies to improve their environmental performance and reduce their carbon footprint.

- Consumer Demand: Consumers are increasingly demanding cleaner energy sources, leading to a shift in market preferences.

- Regulatory Pressure: Governments worldwide are implementing stricter environmental regulations, further incentivizing the energy transition.

Conclusion: The Uncertain Future of Oil – Will Big Oil Yield to Change?

The future of oil production is shrouded in uncertainty. OPEC+'s decisions continue to significantly influence global oil prices, but the long-term trend points towards a decreased reliance on fossil fuels. The response of major oil companies—whether they prioritize continued investment in fossil fuels or embrace a transition to renewable energy—will ultimately determine the industry's trajectory. The pressure from investors, consumers, and governments is undeniable, forcing Big Oil to adapt to a changing landscape. To stay informed about the evolving oil production outlook, the future of oil and gas, and OPEC+'s continuing impact on the energy transition, continue to follow reputable news sources and industry analyses. The energy transition is underway, and understanding its impact is crucial.

Featured Posts

-

Hate Crime Attack Man Receives 53 Year Prison Sentence For Assaulting Palestinian American Family

May 05, 2025

Hate Crime Attack Man Receives 53 Year Prison Sentence For Assaulting Palestinian American Family

May 05, 2025 -

Strong April Jobs Report U S Employment Growth Continues

May 05, 2025

Strong April Jobs Report U S Employment Growth Continues

May 05, 2025 -

Dope Girls Review A World War I Drama Unlike Any Other

May 05, 2025

Dope Girls Review A World War I Drama Unlike Any Other

May 05, 2025 -

Delayed Launch Blue Origin Identifies Vehicle Subsystem Issue

May 05, 2025

Delayed Launch Blue Origin Identifies Vehicle Subsystem Issue

May 05, 2025 -

Weather Update Sharp Temperature Drop In West Bengal

May 05, 2025

Weather Update Sharp Temperature Drop In West Bengal

May 05, 2025

Latest Posts

-

The Lasting Legacy Of Fleetwood Mac Pioneering The Supergroup Concept

May 05, 2025

The Lasting Legacy Of Fleetwood Mac Pioneering The Supergroup Concept

May 05, 2025 -

Fleetwood Macs Rumours The Genesis Of The Modern Supergroup

May 05, 2025

Fleetwood Macs Rumours The Genesis Of The Modern Supergroup

May 05, 2025 -

Rumours 48 Years After Fleetwood Macs Turbulent Creation Of A Timeless Classic

May 05, 2025

Rumours 48 Years After Fleetwood Macs Turbulent Creation Of A Timeless Classic

May 05, 2025 -

Fleetwood Mac Rumours Of A World First Supergroup

May 05, 2025

Fleetwood Mac Rumours Of A World First Supergroup

May 05, 2025 -

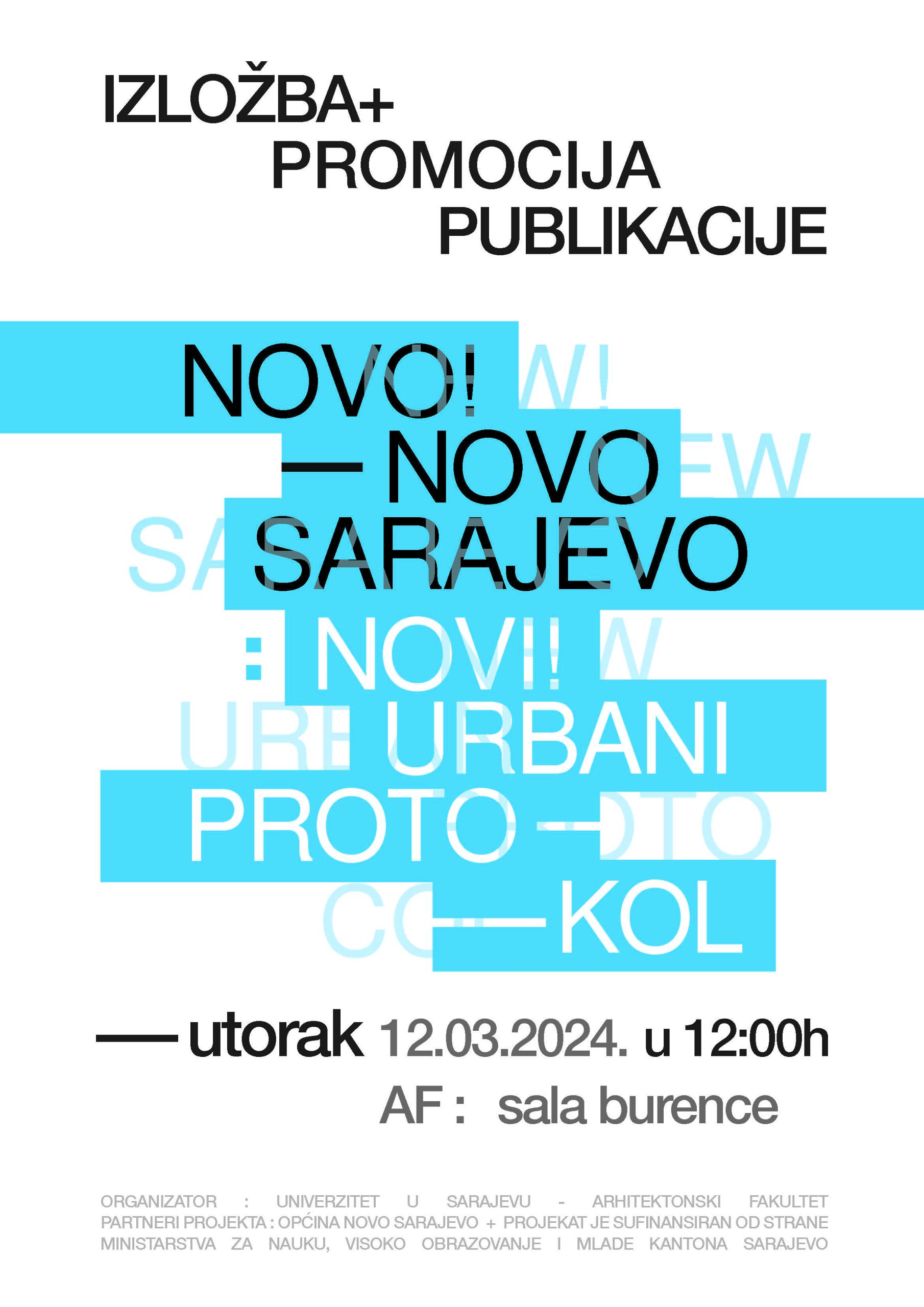

Novo Izdanje Gibonnija Promocija Na Sarajevo Book Fair U

May 05, 2025

Novo Izdanje Gibonnija Promocija Na Sarajevo Book Fair U

May 05, 2025