Will Negative Inflation In Thailand Lead To More Interest Rate Cuts?

Table of Contents

1. Understanding Negative Inflation in Thailand's Context

Negative inflation, or deflation, signifies a sustained decrease in the general price level of goods and services. Unlike low inflation, where prices rise slowly, deflation represents a more severe economic condition. In Thailand, several factors could contribute to this concerning trend. Weak consumer demand, stemming from uncertainty and decreased purchasing power, plays a significant role. Falling commodity prices on the global market also exert downward pressure on domestic prices. Furthermore, a strong baht can make imports cheaper, further suppressing inflation.

The consequences of deflation on the Thai economy are potentially severe:

- Decreased consumer spending: Consumers delay purchases anticipating further price drops, leading to reduced economic activity.

- Increased debt burden: Deflation increases the real value of debt, making it harder for businesses and individuals to repay loans.

- Delayed investment decisions: Businesses postpone investment projects due to uncertainty and lower expected returns.

- Potential for a deflationary spiral: A downward spiral can occur where falling prices lead to reduced demand, further driving down prices, creating a vicious cycle.

2. The Bank of Thailand's Response to Deflation

The Bank of Thailand (BOT) is responsible for maintaining price stability and promoting sustainable economic growth. Its primary tool for influencing inflation is manipulating interest rates. Facing the possibility of deflation, the BOT might consider further interest rate cuts in Thailand to stimulate borrowing and spending. This approach aims to inject liquidity into the economy and encourage investment.

However, the BOT's past responses to economic downturns offer mixed results. Analyzing these past decisions provides valuable insight into their likely course of action. Challenges remain, including:

- Exchange rate fluctuations: Interest rate cuts can weaken the baht, impacting import costs and potentially fueling inflation in the long run.

- Capital flight: Lower interest rates could incentivize investors to move their funds elsewhere seeking higher returns.

3. Analyzing the Effectiveness of Interest Rate Cuts

Interest rate cuts work by lowering borrowing costs, making it cheaper for businesses and consumers to borrow money. This increased borrowing should lead to higher investment and spending, boosting economic activity. However, the effectiveness of this mechanism is not always guaranteed. Previous interest rate cuts in Thailand have yielded varying degrees of success, depending on the broader economic context and consumer sentiment.

The BOT may consider alternative policy measures alongside interest rate cuts:

- Quantitative easing: Injecting liquidity directly into the financial system by purchasing assets.

- Fiscal stimulus: Government spending on infrastructure projects or other initiatives to boost demand.

4. Economic Indicators and Their Implications for Interest Rate Cuts

The BOT closely monitors key economic indicators to guide its monetary policy decisions. These include:

- GDP growth: Reflects the overall health of the Thai economy.

- Inflation rate: The primary measure of price changes.

- Unemployment rate: Indicates the labor market's strength.

- Consumer confidence: A gauge of consumer spending intentions.

Analyzing the current state of these indicators provides crucial insights into the likelihood of further interest rate cuts in Thailand. A significant decline in GDP growth coupled with persistently low or negative inflation could strengthen the case for additional monetary easing.

5. Potential Risks and Opportunities Associated with Further Interest Rate Cuts

While interest rate cuts aim to stimulate the economy, they also carry potential risks:

- Increased inflation in the long term: Excessive monetary easing can lead to inflationary pressures later on.

- Weakening of the Thai baht: This can make imports more expensive and impact Thailand's trade balance.

- Increased debt levels for businesses and consumers: Increased borrowing could lead to unsustainable debt levels if the economic recovery is slow.

However, further interest rate cuts in Thailand could also offer opportunities:

- Stimulation of economic growth: Lower borrowing costs can incentivize investment and consumption, leading to faster economic growth.

- Increased investment and job creation: Businesses may be more willing to invest in expansion projects, leading to job creation.

- Increased consumer spending: Lower interest rates on loans can boost consumer purchasing power.

Conclusion:

The relationship between negative inflation in Thailand and the potential for further interest rate cuts is complex. The BOT must carefully weigh the potential benefits of stimulating economic growth against the risks of increased inflation and currency fluctuations. Key factors influencing the BOT's decision include the state of key economic indicators, global economic conditions, and the effectiveness of past monetary policy measures. Keep an eye on future announcements regarding interest rate cuts in Thailand to make informed financial decisions. Understanding the dynamics of interest rate cuts in Thailand is crucial for navigating the current economic climate, and for businesses and individuals alike to make strategic financial plans.

Featured Posts

-

All Star Game 2024 Steph Currys Triumph And Format Debate

May 07, 2025

All Star Game 2024 Steph Currys Triumph And Format Debate

May 07, 2025 -

The China Market A Critical Analysis Of The Experiences Of Bmw And Porsche

May 07, 2025

The China Market A Critical Analysis Of The Experiences Of Bmw And Porsche

May 07, 2025 -

The Karate Kid Part Iii Exploring The Films Themes And Legacy

May 07, 2025

The Karate Kid Part Iii Exploring The Films Themes And Legacy

May 07, 2025 -

James Gunns Superman New Hawkgirl Wing Design Revealed

May 07, 2025

James Gunns Superman New Hawkgirl Wing Design Revealed

May 07, 2025 -

Ai Development Middle East Lags Behind Us And China

May 07, 2025

Ai Development Middle East Lags Behind Us And China

May 07, 2025

Latest Posts

-

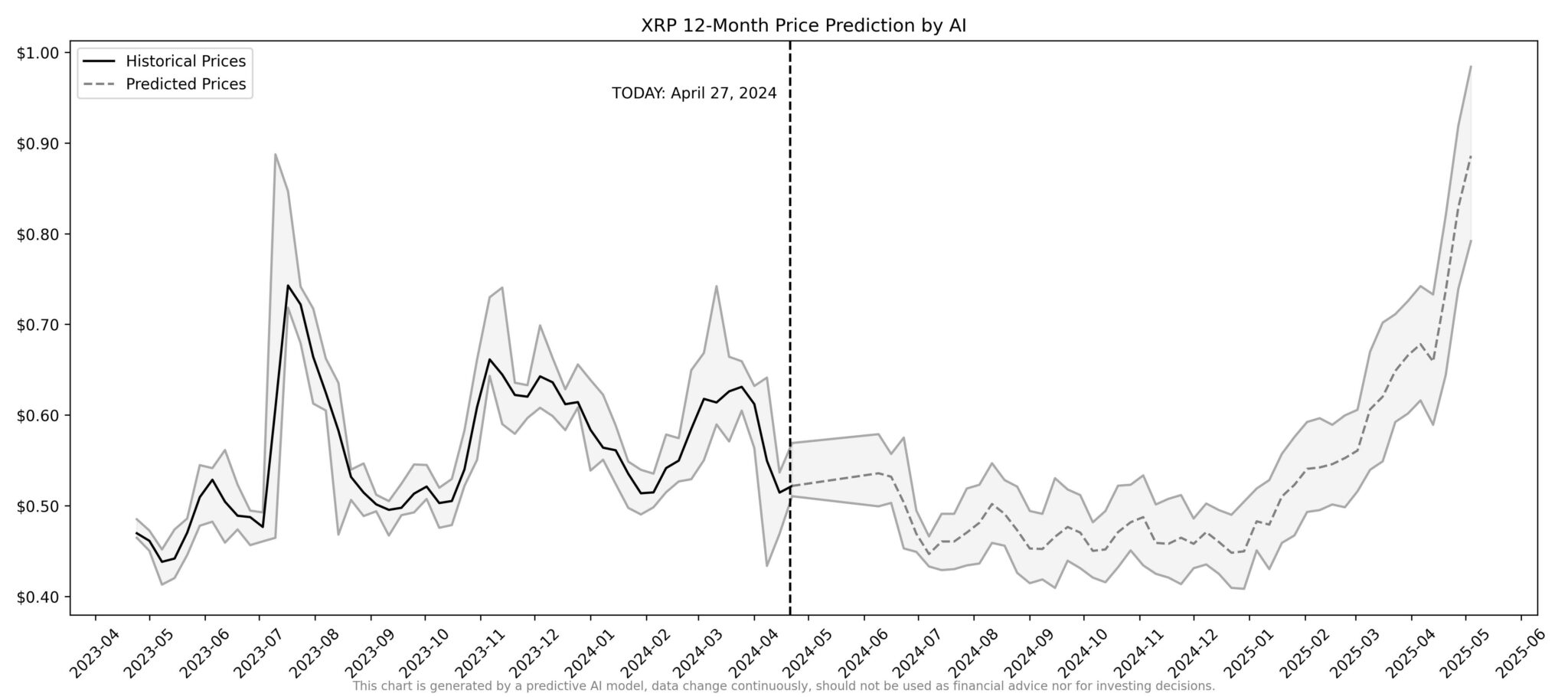

Xrp Price Analysis Assessing The Path To 3 40

May 07, 2025

Xrp Price Analysis Assessing The Path To 3 40

May 07, 2025 -

Is Xrps Recent 400 Rally A Sign Of Future Growth

May 07, 2025

Is Xrps Recent 400 Rally A Sign Of Future Growth

May 07, 2025 -

Can Ripple Xrp Hit 3 40 Analyzing The Resistance

May 07, 2025

Can Ripple Xrp Hit 3 40 Analyzing The Resistance

May 07, 2025 -

Xrp Investment Analysis Assessing The 400 Price Increase

May 07, 2025

Xrp Investment Analysis Assessing The 400 Price Increase

May 07, 2025 -

Xrp 2000 If The Language Is Chinese This Is A Possible Option

May 07, 2025

Xrp 2000 If The Language Is Chinese This Is A Possible Option

May 07, 2025