Will Palantir Be A Trillion-Dollar Company By 2030? A Realistic Assessment

Table of Contents

Palantir's Current Strengths and Market Position

Palantir's current success stems from its powerful data analytics platforms and a significant foothold in the government and commercial sectors. Let's examine the specifics:

-

Revenue Streams and Profitability: Palantir's revenue model is built upon software licenses, maintenance contracts, and professional services. While profitability has fluctuated, the company demonstrates a clear path towards consistent growth and increasing margins as it scales its operations.

-

Key Product Offerings: Gotham, primarily focused on government clients, and Foundry, targeting commercial enterprises, offer powerful data integration, analysis, and visualization capabilities. Their ability to handle vast datasets and provide actionable insights are key differentiators.

-

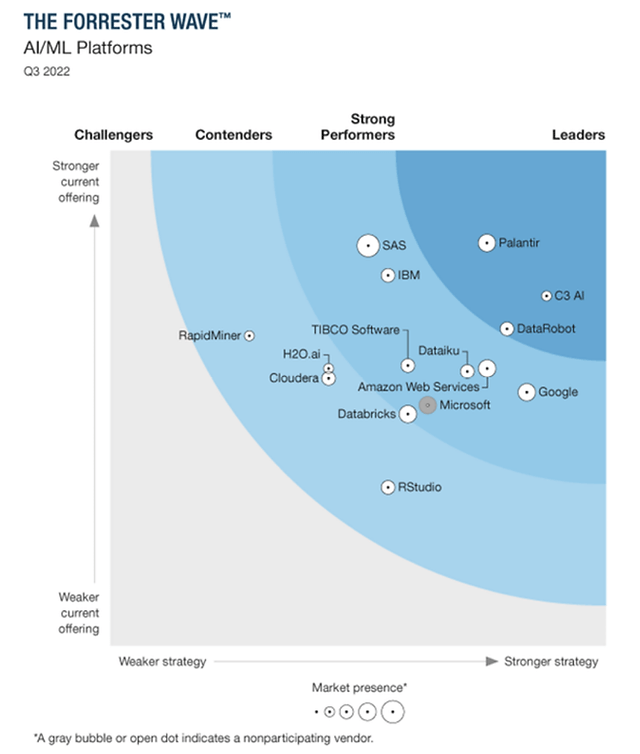

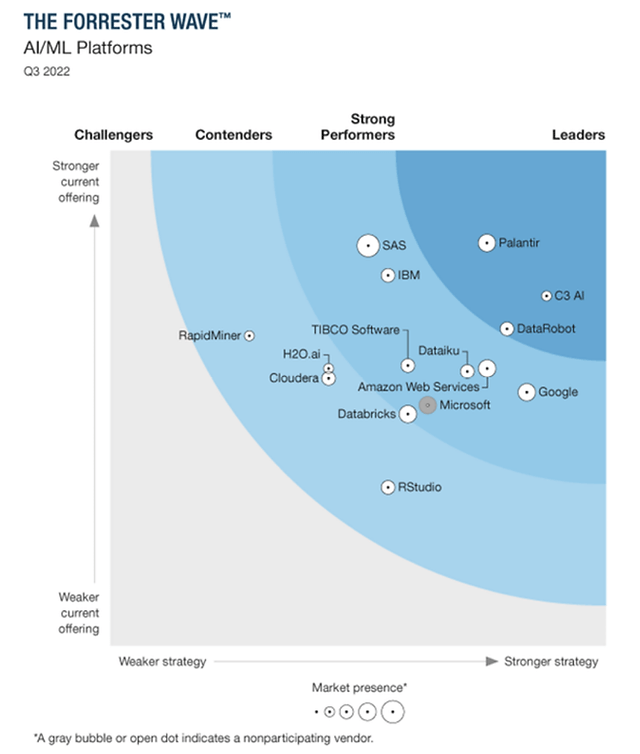

Competitive Advantages: Palantir's competitive edge lies in its highly secure platforms, robust data management capabilities, and deep expertise in data integration. This allows it to secure complex, high-value contracts that competitors often struggle to obtain.

-

Client Base and Partnerships: Palantir boasts a significant client base including major government agencies (CIA, Department of Defense) and Fortune 500 companies across various industries. Strategic partnerships further enhance its market reach and technological capabilities.

Growth Projections and Revenue Forecasts

Projecting Palantir's future revenue is challenging, but analyzing historical trends and expert forecasts provides some insight.

-

Historical Revenue Growth: Palantir has demonstrated impressive revenue growth in recent years, although the rate has fluctuated. Sustaining this growth will be critical in achieving a trillion-dollar valuation.

-

Analyst Projections: Numerous financial institutions offer revenue projections for Palantir, varying in their optimism. Analyzing these projections alongside the company's own guidance provides a range of possible outcomes.

-

Influencing Factors: New product launches (e.g., AI-powered solutions), expansion into new markets (e.g., healthcare, finance), and increased government spending on national security and intelligence will significantly influence future revenue growth.

-

Plausibility of Trillion-Dollar Valuation: Achieving a trillion-dollar valuation by 2030 requires extraordinarily high and consistent revenue growth, potentially exceeding current projections. This necessitates successful execution across all areas of the business.

Challenges and Risks Facing Palantir

While Palantir's future looks promising, significant challenges and risks exist:

-

Market Competition: The big data analytics market is highly competitive, with established players and emerging startups vying for market share. Maintaining its competitive edge is crucial.

-

Economic Downturns: Government spending, a significant portion of Palantir's revenue, is vulnerable to economic fluctuations. Recessions could severely impact growth prospects.

-

Regulatory Hurdles: Operating in highly regulated industries exposes Palantir to regulatory changes impacting its government contracts and data handling practices.

-

Stock Volatility: Palantir's stock price exhibits substantial volatility. This risk is inherent to high-growth, high-valuation technology companies.

Key Factors Determining Palantir's Future Success

Palantir's success hinges on several key factors:

-

Innovation and New Product Development: Continuous innovation and the development of cutting-edge data analytics solutions are essential for maintaining a competitive advantage.

-

Strategic Partnerships and Acquisitions: Strategic alliances and acquisitions can accelerate growth and expand market reach into new sectors.

-

Marketing and Sales Strategies: Effectively communicating Palantir's value proposition and building strong relationships with potential clients is crucial for securing new contracts.

-

Talent Acquisition and Company Culture: Attracting and retaining top talent, fostering a strong company culture, and cultivating employee innovation are essential for long-term success.

Palantir's Trillion-Dollar Trajectory: A Realistic Appraisal?

Palantir's journey towards a trillion-dollar valuation by 2030 presents a significant challenge. While its strong market position, innovative technology, and substantial government contracts provide a solid foundation, significant hurdles remain. The required revenue growth is ambitious and depends on several factors outside Palantir's complete control, including macroeconomic conditions and competitive dynamics. Therefore, achieving this ambitious goal remains highly uncertain.

While the potential is substantial, the likelihood of Palantir becoming a trillion-dollar company by 2030 appears low based on current projections and inherent market risks. However, continued strong performance, strategic innovation, and successful execution could significantly enhance the company's prospects.

Stay informed on Palantir's progress and its journey towards becoming a potential trillion-dollar company by following [link to relevant resources/financial news]. Further research into Palantir's financial reports and industry analysis will provide a more comprehensive understanding of its future potential.

Featured Posts

-

High Down Payments In Canada A Barrier To Homeownership

May 10, 2025

High Down Payments In Canada A Barrier To Homeownership

May 10, 2025 -

I Enjoyed The Monkey But Kings Other 2024 Films Are More Exciting

May 10, 2025

I Enjoyed The Monkey But Kings Other 2024 Films Are More Exciting

May 10, 2025 -

High Potential Season 2 Examining The Potential Victims From The Previous Season

May 10, 2025

High Potential Season 2 Examining The Potential Victims From The Previous Season

May 10, 2025 -

Top 10 Film Noir Classics A Definitive List

May 10, 2025

Top 10 Film Noir Classics A Definitive List

May 10, 2025 -

Potential Roman Empire Replacement Show Streaming Availability And Season 2 Spoiler Alert

May 10, 2025

Potential Roman Empire Replacement Show Streaming Availability And Season 2 Spoiler Alert

May 10, 2025