XAUUSD Rally: Gold Price Recovery On Weakening US Economic Data

Table of Contents

Weakening US Dollar – A Key Driver of the XAUUSD Rally

The inverse relationship between the US dollar and gold prices is well-established. A weaker US dollar makes gold cheaper for those holding other currencies, leading to increased demand and pushing the XAUUSD exchange rate higher. We've recently witnessed a decline in the US Dollar Index (DXY), a key indicator of the dollar's value against other major currencies. This weakening dollar is a significant factor fueling the current XAUUSD rally.

- Impact of Federal Reserve monetary policy decisions: The Federal Reserve's decisions regarding interest rates and quantitative easing directly impact the dollar's strength. Recent less hawkish stances have contributed to the dollar's weakness.

- Influence of geopolitical events: Global uncertainties and geopolitical tensions often drive investors towards safe-haven assets like gold, increasing demand and weakening the dollar.

- Other factors impacting USD: Trade deficits, inflation concerns, and the overall global economic outlook also play a role in influencing the dollar's value and consequently, the XAUUSD price.

Diminishing US Economic Growth – Safe-Haven Demand for Gold

Several indicators point towards a slowdown in US economic growth. Concerns about GDP growth, rising inflation rates, and declining consumer confidence are all contributing to a flight to safety. Gold, traditionally viewed as a safe-haven asset, benefits from this increased demand during periods of economic uncertainty.

- Recent economic data indicating a slowdown: Recent data releases showing lower-than-expected GDP growth, slowing manufacturing activity, and weakening consumer spending all suggest a potential economic slowdown.

- Gold's role as an inflation hedge: During periods of high inflation, gold often retains its value or even increases in price, making it an attractive investment for those seeking to protect their purchasing power.

- Investor sentiment and its impact on gold demand: Negative investor sentiment regarding the US economy and global markets further boosts demand for gold, driving up its price.

Impact of Inflation and Interest Rates on XAUUSD

The relationship between inflation, interest rates, and gold prices is complex. While high inflation can drive gold prices higher (due to its role as an inflation hedge), rising interest rates can sometimes negatively impact gold demand. This is because higher interest rates increase the opportunity cost of holding non-yielding assets like gold.

- Opportunity cost of holding gold when interest rates are high: When interest rates are high, investors can earn more returns on alternative investments, potentially reducing the attractiveness of holding gold.

- Potential for future interest rate hikes and their effect on XAUUSD: The Federal Reserve's future decisions regarding interest rate hikes will significantly influence the XAUUSD price. Further rate hikes could potentially weaken gold demand.

- Market expectations for future interest rate changes: Market sentiment and expectations regarding future interest rate movements are crucial in determining gold's price trajectory.

Technical Analysis of the XAUUSD Chart

A brief look at the XAUUSD chart reveals several bullish indicators suggesting continued upward momentum. While a detailed technical analysis is beyond the scope of this article, we can observe that key support levels have held, and moving averages are pointing upwards. (Insert relevant chart here).

- Key support and resistance levels: Identifying key support and resistance levels on the chart helps to gauge potential price movements.

- Significant chart patterns: The emergence of bullish chart patterns can further reinforce the upward trend in XAUUSD.

- Limitations of technical analysis: It's crucial to remember that technical analysis is not foolproof and should be considered alongside fundamental analysis.

Conclusion: Navigating the XAUUSD Rally – What's Next for Gold Prices?

The recent XAUUSD rally is primarily driven by a weakening US dollar, slowing economic growth leading to increased safe-haven demand, and the complex interplay between inflation and interest rates. While the upward trend is promising, predicting future gold price movements remains challenging due to the inherent volatility of the market. It's crucial to continue monitoring key US economic data, Federal Reserve actions, and geopolitical events to understand the forces shaping the XAUUSD exchange rate.

Stay updated on the latest XAUUSD movements and economic indicators to capitalize on potential gold price recovery opportunities. Learn more about XAUUSD trading strategies to navigate the fluctuating gold market and make informed investment decisions.

Featured Posts

-

Haly Wwd Astar Tam Krwz Pr Mdah Ka Ghyr Memwly Waqeh

May 17, 2025

Haly Wwd Astar Tam Krwz Pr Mdah Ka Ghyr Memwly Waqeh

May 17, 2025 -

S And P Tsx Composite Index Canadas Markets Hit New Intraday Record

May 17, 2025

S And P Tsx Composite Index Canadas Markets Hit New Intraday Record

May 17, 2025 -

Atlantic Canadian Lobster Fishers Struggle Amidst Low Prices And Economic Downturn

May 17, 2025

Atlantic Canadian Lobster Fishers Struggle Amidst Low Prices And Economic Downturn

May 17, 2025 -

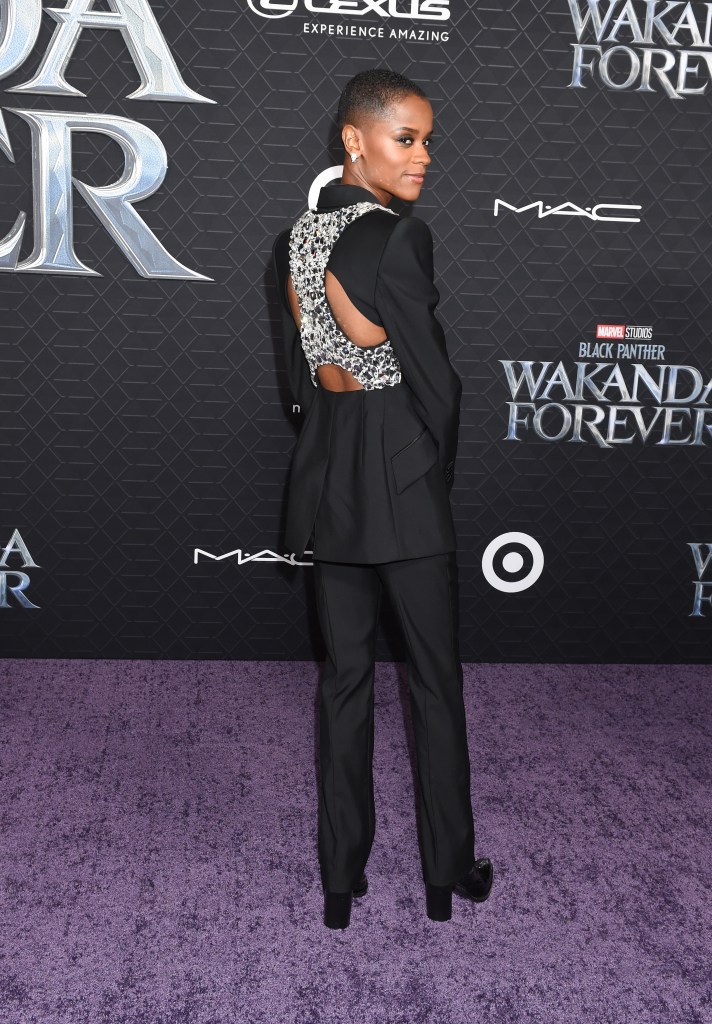

The Red Carpets Rules Why Guests Continuously Violate Them

May 17, 2025

The Red Carpets Rules Why Guests Continuously Violate Them

May 17, 2025 -

Fwarq Alaemar Fy Hwlywwd Thlyl Elaqt Twm Krwz Wana Dy Armas Almhtmlt

May 17, 2025

Fwarq Alaemar Fy Hwlywwd Thlyl Elaqt Twm Krwz Wana Dy Armas Almhtmlt

May 17, 2025

Latest Posts

-

Knicks Off Season Puzzle How To Handle Landry Shamet

May 17, 2025

Knicks Off Season Puzzle How To Handle Landry Shamet

May 17, 2025 -

Mike Breens Playful Jibes At Mikal Bridges Game Time Complaints

May 17, 2025

Mike Breens Playful Jibes At Mikal Bridges Game Time Complaints

May 17, 2025 -

Angel Reese Shares Heartwarming Photos With Mom Angel Webb Reese

May 17, 2025

Angel Reese Shares Heartwarming Photos With Mom Angel Webb Reese

May 17, 2025 -

Accessing May 2025 New York Daily News Back Pages Online

May 17, 2025

Accessing May 2025 New York Daily News Back Pages Online

May 17, 2025 -

Angel Reese And Mom Angel Webb Reese Stunning Family Photos

May 17, 2025

Angel Reese And Mom Angel Webb Reese Stunning Family Photos

May 17, 2025