XRP ETF In Brazil: Ripple News Dominates Headlines After Trump's Ripple Share

Table of Contents

The Ripple Effect of Trump's Ripple Investment

News of Donald Trump's purported investment in Ripple sent ripples – pun intended – throughout the cryptocurrency market. While the exact details remain unconfirmed, the mere suggestion of such high-profile involvement sparked immediate market reaction. The announcement led to a significant surge in media coverage and public interest in XRP, particularly in Brazil where cryptocurrency adoption is steadily growing.

- Increased media coverage and public interest in XRP: Brazilian news outlets extensively covered the story, leading to increased awareness and potential new investors.

- Short-term price volatility following the announcement: The news caused short-term price fluctuations, reflecting the market's sensitivity to news related to high-profile figures.

- Potential long-term implications for XRP adoption in Brazil: The positive press and increased attention could lead to greater acceptance and adoption of XRP within the Brazilian financial system.

[Insert links to relevant news sources here]

XRP ETF in Brazil: Regulatory Hurdles and Opportunities

The Brazilian regulatory landscape for cryptocurrencies is still evolving. The launch of an XRP ETF in Brazil presents both significant opportunities and considerable challenges. While an ETF would offer increased accessibility and liquidity for XRP, attracting both institutional and retail investors, navigating the regulatory framework is crucial.

- Brazilian Securities and Exchange Commission (CVM) regulations: The CVM's stance on cryptocurrencies will be paramount in determining the feasibility of an XRP ETF. Clear guidelines and regulations are needed to foster a transparent and secure market.

- Potential tax implications for investors: The tax implications of investing in an XRP ETF in Brazil need to be clearly defined to encourage investor participation.

- Comparison to other countries' regulatory approaches to crypto ETFs: Examining how other countries, such as Canada and the US, have regulated crypto ETFs can provide valuable insights for Brazil's regulatory approach.

Existing and proposed legislation related to cryptocurrencies in Brazil should be carefully considered. The CVM's ongoing efforts to create a robust regulatory framework for digital assets will be key to the success of any potential XRP ETF.

Investor Sentiment and Market Analysis

Investor sentiment towards XRP in Brazil is currently positive, fueled by the recent news and the potential for an ETF. However, this sentiment is also influenced by global market trends and the ongoing Ripple lawsuit.

- Trading volume and price fluctuations: Monitoring trading volume and price fluctuations provides valuable insights into market dynamics and investor confidence.

- Public opinion and social media sentiment: Social media platforms and online forums are valuable resources for gauging public perception and sentiment surrounding XRP in Brazil.

- Expert opinions and market analyses: Consulting financial analysts and experts provides critical perspectives on the potential trajectory of XRP within the Brazilian market.

[Insert relevant charts and graphs visualizing market data here]

The Future of XRP in Brazil: Predictions and Potential

The potential launch of an XRP ETF in Brazil holds immense potential for the future of XRP in the country. Increased accessibility through an ETF could significantly boost adoption and integration into the broader financial ecosystem.

- Long-term price projections: While price predictions are inherently speculative, analyzing market trends and adoption rates can provide insights into potential future price movements.

- Potential use cases for XRP in Brazil (e.g., remittances, payments): XRP's efficiency and low transaction costs make it a compelling option for remittances and cross-border payments within Brazil.

- Impact on the overall Brazilian economy: Widespread adoption of XRP could have a positive impact on the Brazilian economy, boosting innovation and efficiency in financial transactions.

Potential partnerships between Brazilian financial institutions and Ripple could further accelerate XRP adoption.

Conclusion

The confluence of Donald Trump's alleged Ripple investment and the potential launch of an XRP ETF in Brazil has created a significant opportunity for XRP in the Brazilian market. While regulatory hurdles remain, the potential benefits are substantial. Staying informed about the latest developments regarding the XRP ETF in Brazil is crucial for investors. Continue researching the potential investment opportunities and exploring further information on Brazilian crypto regulations and XRP investment strategies to make informed decisions in this dynamic market. The future of XRP in Brazil, fueled by innovation and potentially facilitated by an ETF, holds exciting possibilities.

Featured Posts

-

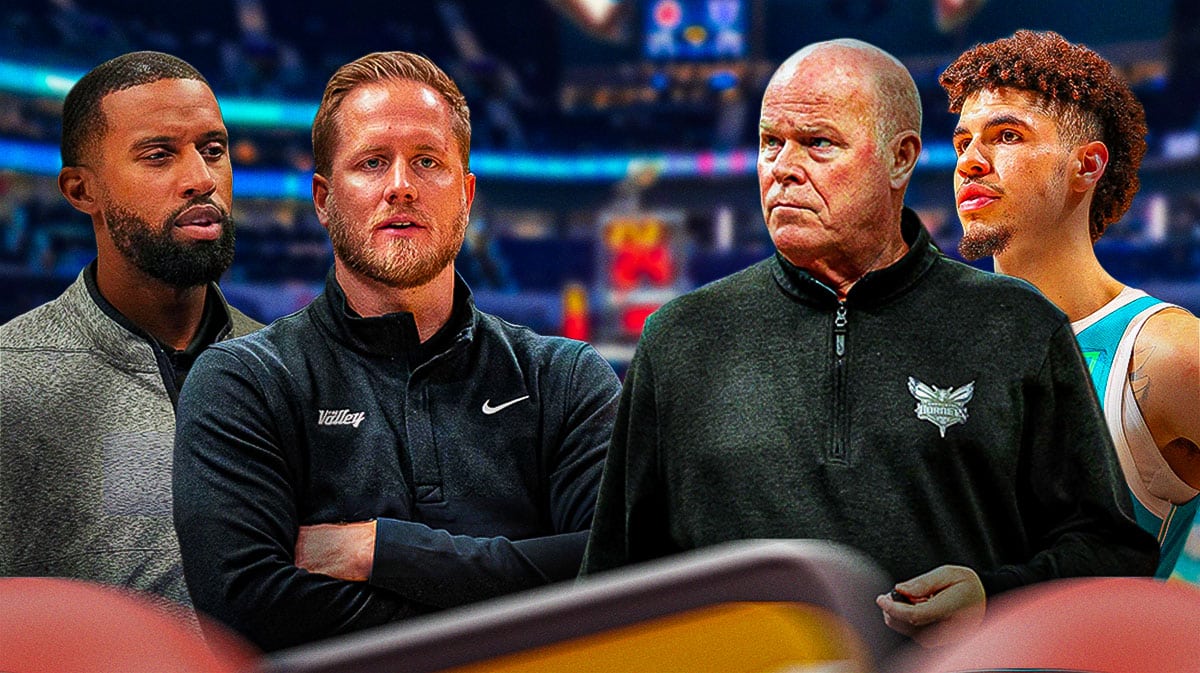

Hornets Search For A Veteran Potential Replacements For Taj Gibson

May 08, 2025

Hornets Search For A Veteran Potential Replacements For Taj Gibson

May 08, 2025 -

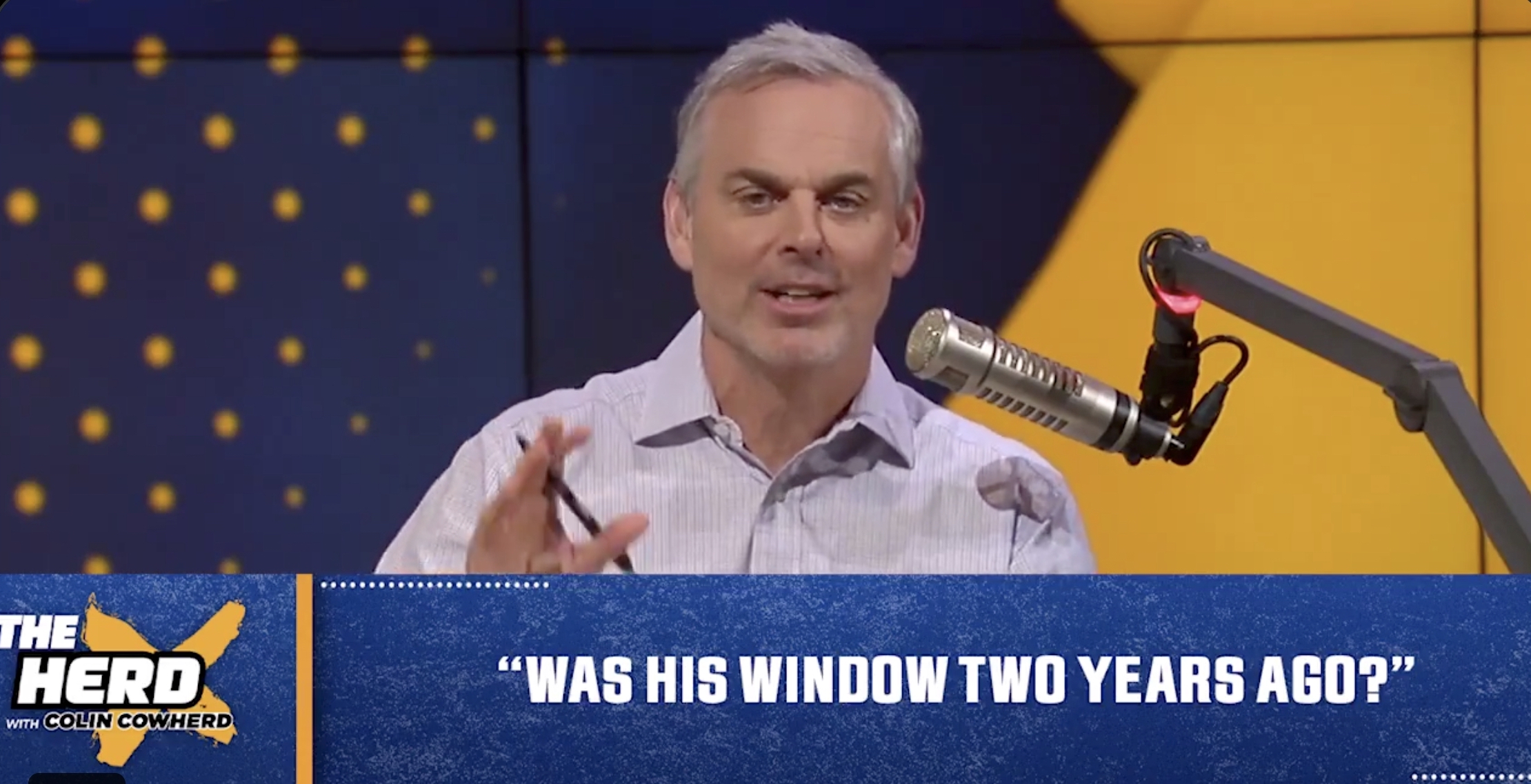

Is Jayson Tatum Overlooked Colin Cowherds Take And The Ongoing Debate

May 08, 2025

Is Jayson Tatum Overlooked Colin Cowherds Take And The Ongoing Debate

May 08, 2025 -

Bitcoins Rise Us China Trade Talks Fuel Crypto Rally

May 08, 2025

Bitcoins Rise Us China Trade Talks Fuel Crypto Rally

May 08, 2025 -

Qwmy Hyrw Aym Aym Ealm Ky 12 Wyn Brsy Aj Ky Tqrybat

May 08, 2025

Qwmy Hyrw Aym Aym Ealm Ky 12 Wyn Brsy Aj Ky Tqrybat

May 08, 2025 -

Xrp Price Prediction Will Xrp Hold 2 Support Reversal Or Fakeout

May 08, 2025

Xrp Price Prediction Will Xrp Hold 2 Support Reversal Or Fakeout

May 08, 2025