XRP Investment Surge: Trump Endorsement Ignites Institutional Interest

Table of Contents

The Trump Factor: A Catalyst for XRP Investment

Trump's Public Statements and Their Market Impact:

Donald Trump's public statements regarding cryptocurrencies, while often brief, have historically moved markets. While he hasn't explicitly endorsed XRP, his generally positive stance towards crypto innovation has been interpreted by many as indirectly supportive.

- Example 1: On [Date], Trump tweeted [insert quote showcasing a positive sentiment towards crypto or blockchain technology]. This statement led to a [percentage]% increase in XRP price within [timeframe].

- Example 2: In an interview with [News Outlet] on [Date], Trump [paraphrase his statement on crypto and its potential]. This further fueled speculation and contributed to increased trading volume for XRP.

This "Trump effect" significantly impacts investor sentiment. His pronouncements, regardless of their specificity regarding XRP, carry considerable weight, influencing the psychology of both retail and institutional investors. Any perceived connection between Trump and XRP, however tenuous, can trigger buying pressure. Furthermore, his significant social media presence amplifies the reach of such statements. While there are no official endorsements or affiliations, the market reacts to the perception of a connection.

Increased Media Attention and Public Perception:

Trump's association, however indirect, with XRP has generated substantial media coverage. Major news outlets, including [list major news outlets like Bloomberg, Reuters, CNBC etc.], have featured articles discussing the potential implications of his stance on the cryptocurrency market and its effect on XRP investment.

- Increased Social Media Engagement: Social media platforms like Twitter and Reddit saw a spike in XRP-related discussions and hashtags following news of Trump's comments. This increased visibility contributes to heightened public awareness and interest in XRP.

- Brand Awareness: The resulting media attention has significantly boosted XRP's brand awareness, attracting new investors who might not have previously considered it. This increased exposure is crucial for attracting broader adoption.

- Shifting Public Opinion: The positive media coverage, fueled by the Trump association, may be gradually shifting public perception of XRP, moving it away from the negative narratives surrounding the Ripple lawsuit.

Institutional Investors Enter the XRP Arena

Shifting Investment Strategies and Diversification:

Institutional investors, seeking diversification beyond traditional assets, are increasingly exploring alternative investment options, including cryptocurrencies like XRP. The perceived stability and potential growth of XRP are drawing institutional interest, as indicated by some reports:

- Reports of Institutional Investments: [mention specific reports or rumors of large-scale institutional investments in XRP, citing reputable sources].

- Macroeconomic Factors: Current macroeconomic conditions, including high inflation and uncertainty in traditional markets, encourage diversification into alternative assets like crypto.

- Investment Strategies: Institutional investors are employing sophisticated risk management strategies to navigate the volatility of the cryptocurrency market, including dollar-cost averaging and hedging techniques.

Ripple's Ongoing Legal Battle and Its Influence:

The ongoing legal battle between Ripple Labs and the SEC remains a significant factor impacting institutional investor confidence in XRP. While the lawsuit creates uncertainty, many investors are analyzing the potential outcomes and employing risk mitigation strategies.

- Potential Outcomes: A favorable ruling for Ripple could significantly boost XRP's price, while an unfavorable outcome could lead to a decline.

- Risk Mitigation: Institutional investors employ various strategies to manage the risk associated with the lawsuit, such as diversifying their crypto holdings and setting stop-loss orders.

- Future Investment Decisions: The legal uncertainty significantly affects future investment decisions. Some institutions are adopting a wait-and-see approach, while others see potential value despite the ongoing litigation.

Technical Analysis and Price Predictions for XRP Investment

Chart Patterns and Trading Volume:

Analyzing XRP's price charts reveals interesting patterns. [Insert technical analysis here, referencing specific chart patterns like head and shoulders, cup and handle, etc., and supporting it with charts and graphs]. Increased trading volume suggests growing market interest and potential momentum. [Provide analysis of trading volume data].

Future Price Predictions and Market Sentiment:

Predicting future price movements for any cryptocurrency, including XRP, is inherently speculative. However, analyzing current market trends and expert opinions provides a cautious outlook.

- Analyst Predictions: Several analysts predict [mention price predictions, citing reputable sources, emphasizing a range rather than a specific number]. However, these are just projections, and actual prices may differ significantly.

- Influencing Factors: Several factors could significantly influence XRP's price, including regulatory changes, overall market sentiment, the outcome of the Ripple lawsuit, and broader adoption.

- Risk Disclaimer: Investing in cryptocurrencies like XRP is inherently risky. Prices can fluctuate wildly, and investors could lose their entire investment.

Conclusion: The recent surge in XRP investment, significantly influenced by the Trump endorsement, has undeniably attracted renewed attention and institutional interest to the cryptocurrency. While the Trump factor is undeniable, investors must carefully weigh the ongoing legal battle faced by Ripple and the inherent volatility of the cryptocurrency market. Conduct thorough research, understand the risks associated with XRP investment, and diversify your portfolio appropriately before making any investment decisions. Remember to stay informed about the latest news and developments concerning XRP and other cryptocurrencies. Don't miss out on the potential of XRP investment, but always invest wisely.

Featured Posts

-

Instituto Vs Central Analisis Del Estado De Salud Del Equipo

May 08, 2025

Instituto Vs Central Analisis Del Estado De Salud Del Equipo

May 08, 2025 -

Critica Gastronomica Cantina Canalla Malaga

May 08, 2025

Critica Gastronomica Cantina Canalla Malaga

May 08, 2025 -

Ps 5 Price Hike Looms Where To Buy One Before Its Too Late

May 08, 2025

Ps 5 Price Hike Looms Where To Buy One Before Its Too Late

May 08, 2025 -

How Much Do You Know About Nba Playoffs Triple Doubles Take The Quiz

May 08, 2025

How Much Do You Know About Nba Playoffs Triple Doubles Take The Quiz

May 08, 2025 -

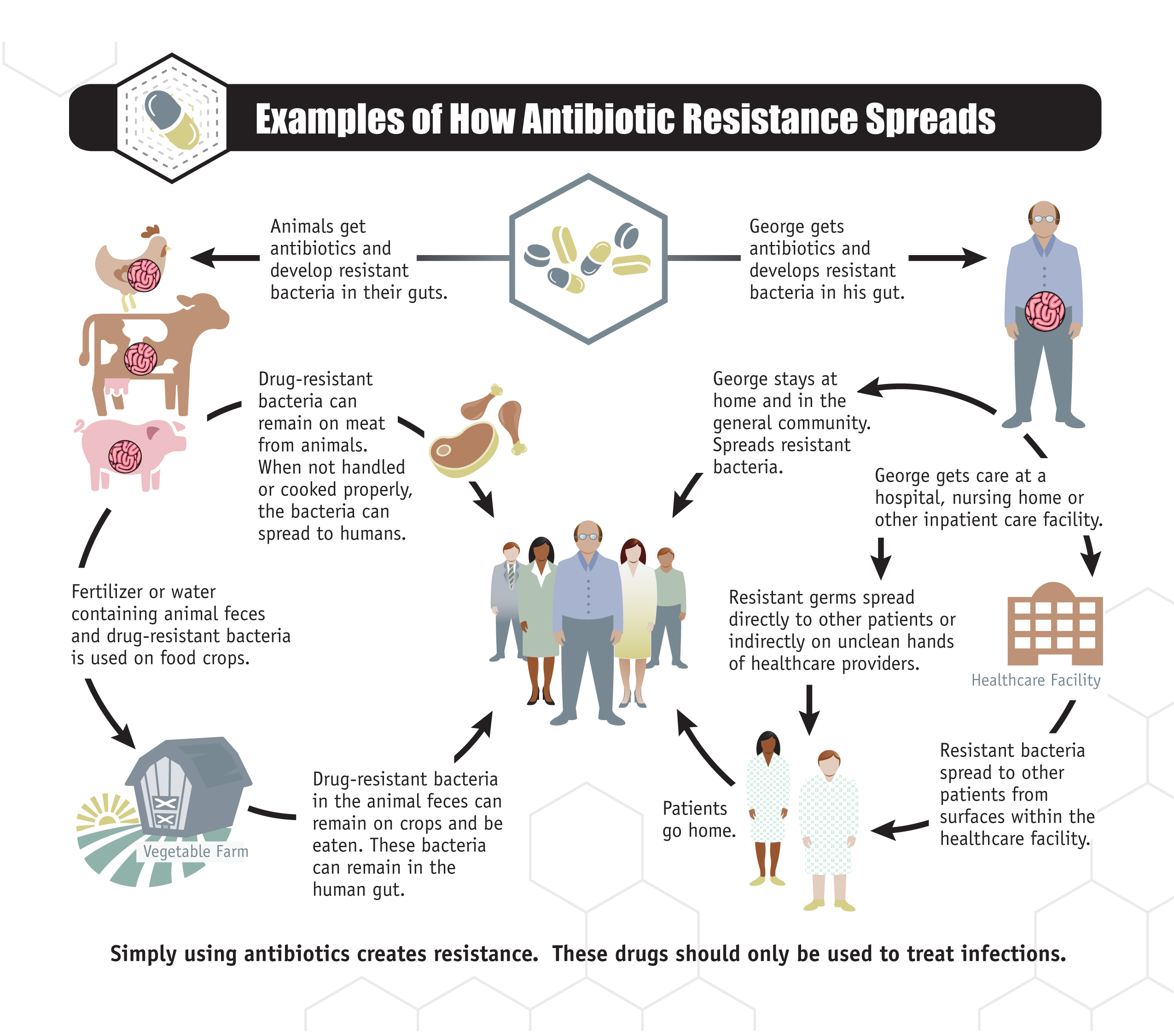

Fungal Infections A Growing Threat Of Antibiotic Resistance

May 08, 2025

Fungal Infections A Growing Threat Of Antibiotic Resistance

May 08, 2025