XRP News: SEC Classification - Commodity Or Security?

Table of Contents

The SEC's Case Against Ripple

The SEC lawsuit against Ripple alleges the company conducted an unregistered securities offering of XRP, violating federal securities laws. The core of the SEC's argument rests on the claim that XRP sales constituted "investment contracts" under the Howey Test, a legal framework used to define securities.

- Explanation of the SEC's complaint: The SEC contends that Ripple sold XRP to raise capital, promising investors future profits based on Ripple's efforts. They point to Ripple's marketing and sales strategies as evidence of an intentional securities offering.

- Details on the alleged unregistered sales of XRP: The SEC alleges that billions of XRP were sold without proper registration, bypassing crucial investor protection measures mandated by federal law. This included sales to institutional investors and the general public.

- Discussion of the potential penalties for Ripple: If found guilty, Ripple faces significant penalties, including substantial fines and potential injunctions against future XRP sales. The outcome could severely impact Ripple's operations and the value of XRP.

Ripple's Defense

Ripple counters the SEC's claims, arguing that XRP is a decentralized digital asset with utility beyond investment, functioning more like a commodity or currency than a security. Their defense strategy centers on challenging the application of the Howey Test to XRP.

- Explanation of Ripple's arguments against the SEC's classification: Ripple emphasizes XRP's use in facilitating cross-border payments on its network, arguing this inherent functionality separates it from the characteristics of a security. They highlight XRP's decentralized nature and programmatic sales as evidence against an intentional investment offering.

- Details about XRP's use cases and functionalities within the Ripple network: Ripple points to the real-world utility of XRP in facilitating rapid and cost-effective transactions, arguing its use extends far beyond mere speculation.

- Discussion of Ripple's claim that XRP sales were not investment contracts: Ripple stresses that purchasers of XRP did not rely on Ripple's efforts for profit, arguing that XRP's value is determined by market forces rather than Ripple's actions.

The Howey Test and Its Application to XRP

The Howey Test is the cornerstone of securities law, defining an "investment contract" as a transaction involving: (1) an investment of money; (2) in a common enterprise; (3) with a reasonable expectation of profits; (4) derived from the efforts of others. The application of this test to XRP is central to the SEC vs. Ripple case.

- Explanation of each prong of the Howey Test: Each element of the Howey Test is meticulously examined in the context of XRP sales. This includes analyzing whether purchasers invested with the expectation of profits generated primarily from Ripple's efforts.

- Analysis of how the SEC and Ripple apply the Howey Test to XRP: The SEC and Ripple present contrasting interpretations of how the Howey Test applies to XRP, with the SEC arguing that all four elements are present and Ripple arguing that key elements are missing.

- Discussion of legal precedents and their relevance to the case: Both sides cite various legal precedents and case law to support their respective arguments, highlighting the complexities and ambiguities inherent in applying established legal frameworks to this novel technological context.

Implications of the Classification

The outcome of the SEC vs. Ripple case will significantly impact the regulatory landscape for cryptocurrencies and the future of XRP itself. The implications are far-reaching and affect investors, businesses, and the entire crypto market.

- Potential impact on the price of XRP: A ruling in favor of the SEC could severely depress the price of XRP, while a victory for Ripple could lead to a significant price surge.

- Implications for other cryptocurrencies and the broader crypto market: The decision will set a precedent, affecting how other cryptocurrencies are regulated and potentially influencing future SEC actions against other projects. Regulatory clarity (or lack thereof) will significantly impact investor sentiment and market stability.

- Impact on investor confidence and regulatory clarity: The outcome will either increase or decrease investor confidence in the cryptocurrency market depending on which side prevails. A clear legal framework will foster market stability, while persistent ambiguity will continue to create uncertainty.

Conclusion

The SEC's classification of XRP as a security versus Ripple's arguments for its status as a commodity showcase the complex legal and regulatory challenges surrounding cryptocurrencies. The outcome of this ongoing legal battle will significantly shape the future of the crypto market and set important precedents for future regulatory actions. The implications for XRP's price, the broader cryptocurrency market, and investor confidence are immense.

Call to Action: Stay informed about the latest developments in the XRP news and the SEC’s classification of XRP. Understanding this evolving legal landscape is crucial for all investors in the cryptocurrency market. Continue following updates on this significant case impacting the future of XRP and its regulatory status.

Featured Posts

-

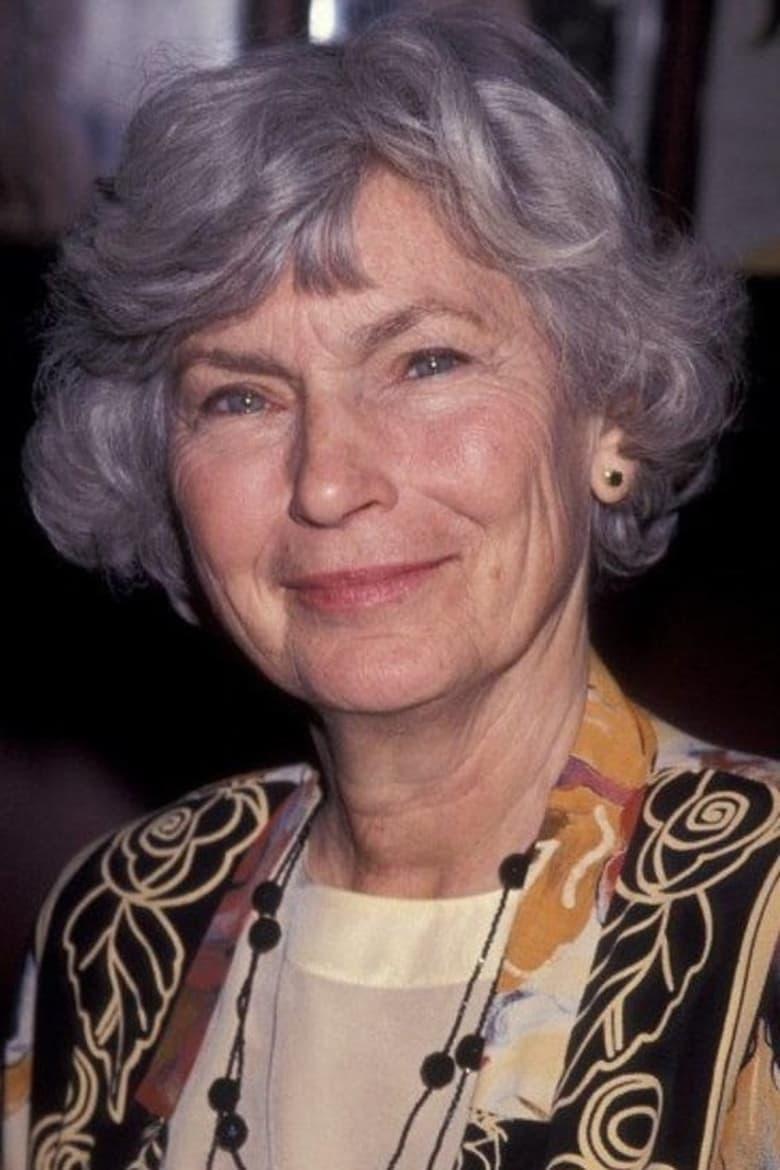

Remembering Priscilla Pointer A Life On Stage And Screen 1923 2023

May 01, 2025

Remembering Priscilla Pointer A Life On Stage And Screen 1923 2023

May 01, 2025 -

Samoas Miss Pacific Islands 2025 Victory

May 01, 2025

Samoas Miss Pacific Islands 2025 Victory

May 01, 2025 -

The Future Of Xrp Predictions And Analysis

May 01, 2025

The Future Of Xrp Predictions And Analysis

May 01, 2025 -

Bkpm Rp 3 6 Triliun Investasi Untuk Pekanbaru Di Tahun Ini

May 01, 2025

Bkpm Rp 3 6 Triliun Investasi Untuk Pekanbaru Di Tahun Ini

May 01, 2025 -

Trtyb Alhdafyn Fy Aldwry Alinjlyzy Haland Ytsdr Bed Hdfh Fy Twtnham

May 01, 2025

Trtyb Alhdafyn Fy Aldwry Alinjlyzy Haland Ytsdr Bed Hdfh Fy Twtnham

May 01, 2025

Latest Posts

-

Tributes Pour In After Passing Of Dallas Star 100

May 01, 2025

Tributes Pour In After Passing Of Dallas Star 100

May 01, 2025 -

Dallas Stars Death Reflecting On The 80s Soap Opera Golden Age

May 01, 2025

Dallas Stars Death Reflecting On The 80s Soap Opera Golden Age

May 01, 2025 -

Dallas Icon Passes Away At The Age Of 100

May 01, 2025

Dallas Icon Passes Away At The Age Of 100

May 01, 2025 -

The End Of An Era Dallas Star And 80s Soap Legend Passes Away

May 01, 2025

The End Of An Era Dallas Star And 80s Soap Legend Passes Away

May 01, 2025 -

100 Year Old Dallas Star Passes Away

May 01, 2025

100 Year Old Dallas Star Passes Away

May 01, 2025