XRP Price Surge: Grayscale ETF Filing Fuels Record High Hopes

Table of Contents

H2: Grayscale's Spot Bitcoin ETF Application and its Ripple Effect on XRP

Grayscale's landmark application for a spot Bitcoin ETF is not just a Bitcoin story; it's having a significant impact across the entire cryptocurrency landscape, including XRP. The connection lies in the potential for increased regulatory clarity and institutional adoption that a successful application would bring. If approved, it would signal a significant shift in regulatory sentiment towards cryptocurrencies, potentially paving the way for greater acceptance of other digital assets, including XRP.

- Increased institutional interest in cryptocurrencies: The approval of a Bitcoin ETF would likely attract substantial institutional investment into the crypto market, driving overall price increases and potentially spilling over into altcoins like XRP.

- Potential for increased trading volume and liquidity for XRP: Increased institutional involvement translates to higher trading volume and improved liquidity, making XRP a more attractive asset for both institutional and retail investors.

- Positive impact on investor confidence in the crypto market: Regulatory clarity and institutional adoption can significantly boost investor confidence, leading to greater investment in the entire crypto space, including XRP.

H2: Technical Analysis of the XRP Price Surge

Examining recent XRP price charts reveals a compelling narrative of upward momentum. Key indicators suggest a sustained bullish trend, although market volatility should always be considered. Support and resistance levels are constantly shifting, necessitating close monitoring. High trading volume accompanies the price increase, reinforcing the strength of the current upward trend.

- Chart patterns suggesting continued upward momentum: Breakouts above key resistance levels and the formation of bullish patterns (e.g., cup and handle) indicate potential for further price appreciation.

- Key technical indicators (e.g., RSI, MACD) supporting the price increase: Technical indicators suggest a strong bullish trend, with RSI levels indicating overbought conditions in some cases, but suggesting continued upward momentum overall. MACD histograms show positive momentum.

- Potential price targets based on technical analysis: While predicting exact price targets is speculative, technical analysis provides potential price ranges based on various indicators and chart patterns.

H2: Fundamental Factors Contributing to the XRP Price Increase

Beyond technical analysis, several fundamental factors contribute to the XRP price increase. These include ongoing legal developments concerning Ripple Labs and the increasing adoption of XRP in cross-border payment solutions.

- Positive legal updates related to the SEC lawsuit: Positive developments in the ongoing legal battle between Ripple and the SEC have boosted investor confidence and fueled price increases. Any favorable rulings could significantly impact XRP's price.

- Growth of XRP usage in various payment solutions: The increasing adoption of XRP for cross-border payments demonstrates its real-world utility, attracting further investment and bolstering its value.

- New collaborations and partnerships bolstering XRP's utility: New partnerships and integrations with various platforms and businesses expand XRP's utility and increase its demand, ultimately impacting its price.

H3: The Role of Social Media and Market Sentiment

Social media plays a crucial role in shaping market sentiment and influencing price movements. Positive news and discussions on platforms like Twitter and Telegram can create a "fear of missing out" (FOMO) effect, driving up demand and price.

- Increased social media engagement and positive sentiment: A surge in positive social media posts and discussions surrounding XRP contributes significantly to its price increase.

- Impact of news articles and analyst predictions on price: Positive news coverage and favorable analyst predictions fuel investor enthusiasm, pushing the price higher.

- Correlation between social media buzz and price movements: A clear correlation exists between increased social media activity and positive sentiment and subsequent price increases.

3. Conclusion:

The recent XRP price surge is a confluence of factors: Grayscale's Bitcoin ETF application creating a positive regulatory ripple effect, favorable developments in the Ripple lawsuit bolstering investor confidence, and the increasing adoption of XRP for real-world applications. These factors, combined with strong technical indicators and positive social media sentiment, have ignited record high hopes within the XRP community. While the future is always uncertain and market volatility is inherent in cryptocurrencies, the current trajectory is undeniably bullish.

However, it's crucial to approach the XRP market with caution. Always conduct thorough research and consider your own risk tolerance before making any investment decisions. Stay tuned for more updates on the XRP price surge and learn more about investing in XRP responsibly. Monitor the XRP market closely to make informed choices.

Featured Posts

-

Grayscales Xrp Etf Filing And The Subsequent Outperformance Of Xrp Against Bitcoin

May 07, 2025

Grayscales Xrp Etf Filing And The Subsequent Outperformance Of Xrp Against Bitcoin

May 07, 2025 -

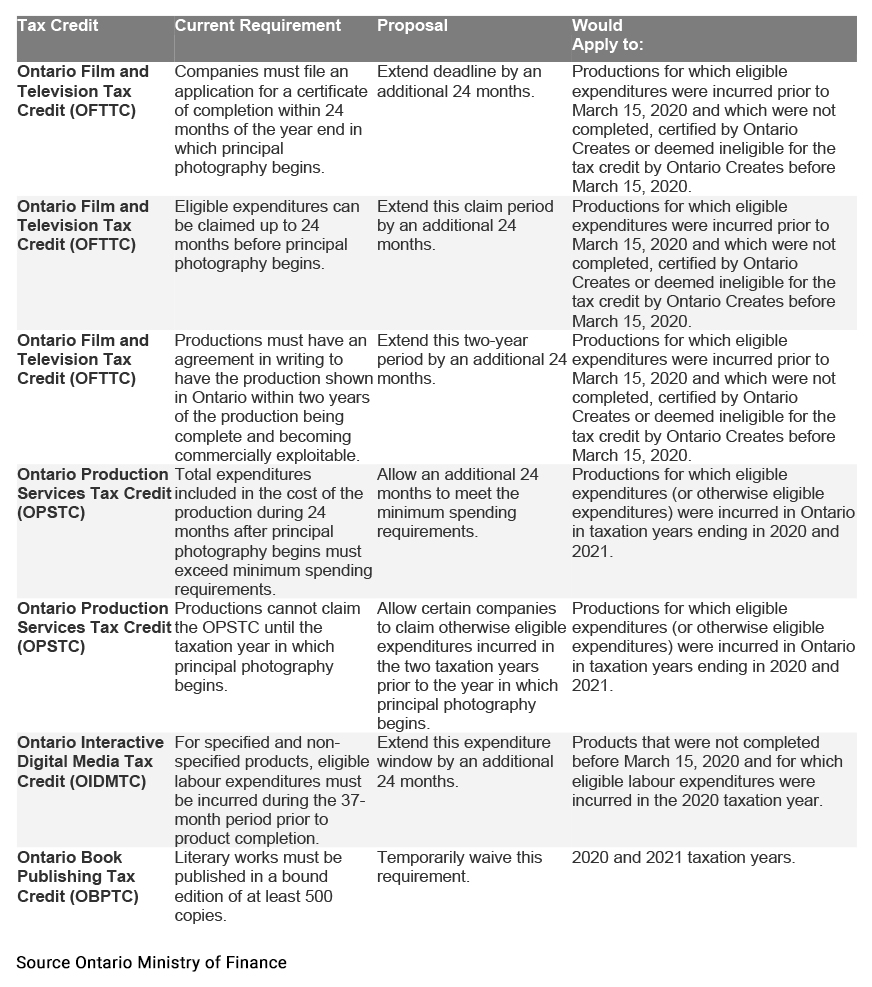

New Manufacturing Tax Credit Incentives Expected In Ontario Budget

May 07, 2025

New Manufacturing Tax Credit Incentives Expected In Ontario Budget

May 07, 2025 -

Hqayq Mdhhlt En Jaky Shan Hyat Mlyyt Balmghamrat

May 07, 2025

Hqayq Mdhhlt En Jaky Shan Hyat Mlyyt Balmghamrat

May 07, 2025 -

Fantastic Fours Box Office Potential Pedro Pascal Isabela Merced And The Superman Challenge

May 07, 2025

Fantastic Fours Box Office Potential Pedro Pascal Isabela Merced And The Superman Challenge

May 07, 2025 -

Jacek Harlukowicz I Onet 5 Publikacji O Najwiekszym Zasiegu W 2024

May 07, 2025

Jacek Harlukowicz I Onet 5 Publikacji O Najwiekszym Zasiegu W 2024

May 07, 2025

Latest Posts

-

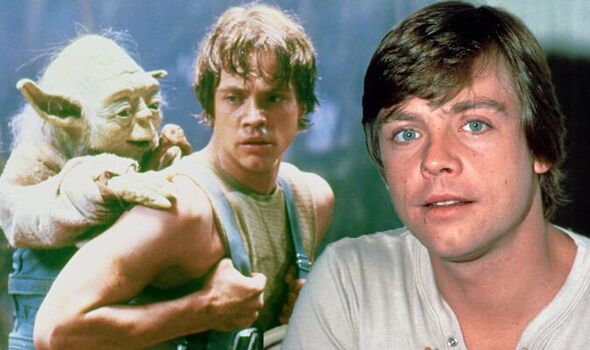

The Long Walk Mark Hamill Steps Away From Luke Skywalker

May 08, 2025

The Long Walk Mark Hamill Steps Away From Luke Skywalker

May 08, 2025 -

The Long Walk Trailer A Dark Adaptation Of Stephen Kings Novel

May 08, 2025

The Long Walk Trailer A Dark Adaptation Of Stephen Kings Novel

May 08, 2025 -

2025 A Year Of Stephen King Adaptations Regardless Of The Monkeys Success

May 08, 2025

2025 A Year Of Stephen King Adaptations Regardless Of The Monkeys Success

May 08, 2025 -

Even A Bad Monkey Adaptation Wont Dim The Brilliance Of Stephen Kings 2025

May 08, 2025

Even A Bad Monkey Adaptation Wont Dim The Brilliance Of Stephen Kings 2025

May 08, 2025 -

Will The Monkey Be Stephen Kings 2025 Low Point A Look At His Other Projects

May 08, 2025

Will The Monkey Be Stephen Kings 2025 Low Point A Look At His Other Projects

May 08, 2025