Amsterdam Stock Market Plunges: 7% Drop Amidst Trade War Fears

Table of Contents

Causes of the Amsterdam Stock Market Plunge

Escalating Trade War Uncertainty

The primary catalyst for the Amsterdam Stock Market plunge is the increasing uncertainty surrounding global trade. The Netherlands, a highly export-oriented economy deeply integrated into the European Union, is particularly vulnerable to trade disputes. The ongoing trade tensions between major global powers directly impact Dutch businesses reliant on international trade.

- Specific trade disputes: The ongoing trade war between the US and China, coupled with Brexit-related uncertainties, has created a climate of fear and instability. Tariffs imposed on Dutch exports to key markets like the US and China have severely impacted profitability.

- Tariffs and their effects: Increased tariffs on Dutch agricultural products and manufactured goods have reduced competitiveness and led to decreased export volumes, negatively impacting several Dutch companies listed on the Amsterdam Stock Exchange (AEX).

- Statements from officials: Statements from Dutch officials expressing concern over the escalating trade war and its potential impact on the Dutch economy have further fueled market anxieties. The government's attempts to mitigate the negative effects have been closely followed by investors.

Global Market Volatility

The Amsterdam Stock Market plunge didn't occur in isolation. Broader global market trends significantly contributed to the decline. The interconnected nature of global financial markets means that downturns in one region often trigger ripple effects elsewhere.

- Other market downturns: Simultaneous declines in major indices like the Dow Jones Industrial Average and the FTSE 100 amplified the negative sentiment and increased investor anxieties.

- Correlations between markets: The high correlation between the AEX and other major global markets highlights the interconnectedness of the global financial system and its susceptibility to shocks. Negative sentiment spreads rapidly across borders.

Specific Sector Impacts

Certain sectors within the AEX were disproportionately affected by the Amsterdam Stock Market plunge. Companies heavily reliant on exports or with significant exposure to markets impacted by trade wars experienced the most substantial losses.

- Export-oriented industries: Companies in the agricultural, technology, and manufacturing sectors, which rely heavily on exports, faced the brunt of the impact. Reduced demand from key trading partners directly translated into lower profits and share prices.

- Companies with US/China exposure: Dutch businesses with significant operations or sales in the US or China suffered substantial losses due to the ongoing trade conflict. The uncertainty surrounding future trade relations further exacerbated the situation.

Investor Reactions and Market Sentiment

Flight to Safety

The Amsterdam Stock Market plunge witnessed a classic "flight to safety" as investors moved away from riskier assets and sought refuge in safer havens.

- Capital flows: Significant capital flows were observed from equities into safer assets such as gold and government bonds, reflecting a widespread aversion to risk.

- Investor confidence indices: Investor confidence indices plummeted, reflecting the prevailing negative sentiment and the uncertainty surrounding future market performance.

- Analyst comments: Financial analysts expressed concern over the deepening uncertainty and warned of further potential market declines.

Increased Volatility

The Amsterdam Stock Market plunge was accompanied by a significant increase in trading volume and price swings.

- Trading volume: Trading volume on the AEX surged, indicating heightened investor activity and nervousness as traders reacted to the unfolding events.

- Price fluctuations: The market experienced dramatic price fluctuations, with significant intraday swings reflecting the heightened volatility and uncertainty.

- Market indicators: Volatility indices, such as the VIX, surged, indicating increased market uncertainty and fear.

Potential Consequences and Future Outlook for the Amsterdam Stock Market

Economic Impact on the Netherlands

The Amsterdam Stock Market plunge has significant implications for the Dutch economy, both in the short term and long term.

- GDP growth: The decline could negatively impact GDP growth, as reduced business confidence and investment can hinder economic activity.

- Employment: Job losses in sectors heavily affected by the market decline are a potential consequence.

- Consumer confidence: The market plunge could erode consumer confidence, leading to reduced spending and further economic slowdown.

Government Response and Policy Implications

The Dutch government is likely to respond to the Amsterdam Stock Market plunge with policy measures aimed at mitigating the negative economic consequences.

- Policy announcements: The government might announce fiscal stimulus measures or other policy initiatives to support affected businesses and boost investor confidence.

- Regulatory changes: Regulatory changes aimed at stabilizing the market and increasing investor confidence could be implemented.

Predicting Future Trends

The future outlook for the Amsterdam Stock Market remains uncertain, dependent on various factors.

- Potential catalysts for recovery: A resolution to the trade war, positive economic data, or government interventions could trigger a market recovery.

- Factors that could prolong the downturn: Continued trade tensions, global economic slowdown, or geopolitical instability could prolong the downturn.

- Expert opinions: Experts offer varied opinions on the future trajectory of the Amsterdam Stock Market, highlighting the uncertainty inherent in financial markets.

Conclusion: Amsterdam Stock Market Plunge – Navigating Uncertainty

The Amsterdam Stock Market plunge highlights the vulnerability of even robust economies to global trade tensions and market volatility. The primary causes included escalating trade war fears, broader global market instability, and the disproportionate impact on specific sectors within the AEX. Significant investor reactions, including a flight to safety and increased volatility, underscore the severity of the situation. The potential economic consequences for the Netherlands are substantial, requiring careful monitoring and proactive government responses. To navigate this uncertainty, stay informed about the Amsterdam Stock Market and its fluctuations by subscribing to reputable financial news sources, following market indicators, and consulting a financial advisor for personalized investment strategies. Remember to use search terms like "Amsterdam Stock Market Plunge" and "Amsterdam Stock Market" to stay updated on the situation.

Featured Posts

-

Importazioni Usa Quanto Costera La Moda Nel 2024

May 25, 2025

Importazioni Usa Quanto Costera La Moda Nel 2024

May 25, 2025 -

Kyle And Teddis Heated Confrontation A Dog Walker Dispute

May 25, 2025

Kyle And Teddis Heated Confrontation A Dog Walker Dispute

May 25, 2025 -

A Relaxing Escape To The Country Tips For A Stress Free Transition

May 25, 2025

A Relaxing Escape To The Country Tips For A Stress Free Transition

May 25, 2025 -

Los Angeles Wildfires Exploring The Market For Disaster Related Betting

May 25, 2025

Los Angeles Wildfires Exploring The Market For Disaster Related Betting

May 25, 2025 -

Amundi Msci World Ii Ucits Etf Usd Hedged Dist Nav Analysis And Performance

May 25, 2025

Amundi Msci World Ii Ucits Etf Usd Hedged Dist Nav Analysis And Performance

May 25, 2025

Latest Posts

-

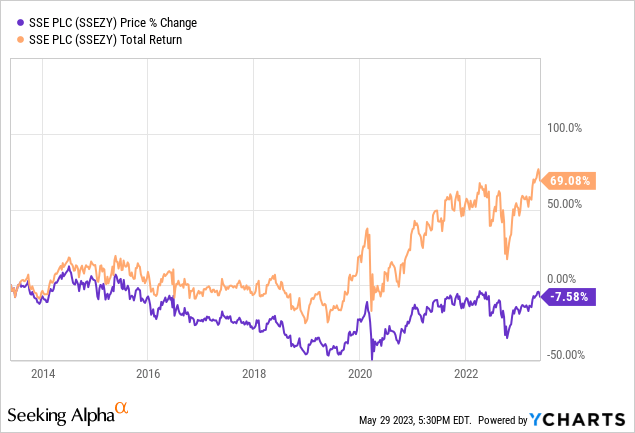

The 3 Billion Question Sses Spending Cuts And What They Mean

May 25, 2025

The 3 Billion Question Sses Spending Cuts And What They Mean

May 25, 2025 -

Rio Tintos Defence Of Its Pilbara Mining Practices

May 25, 2025

Rio Tintos Defence Of Its Pilbara Mining Practices

May 25, 2025 -

Significant Spending Cuts At Sse 3 Billion Reduction Explained

May 25, 2025

Significant Spending Cuts At Sse 3 Billion Reduction Explained

May 25, 2025 -

Rio Tinto Defends Its Pilbara Operations Amidst Environmental Concerns

May 25, 2025

Rio Tinto Defends Its Pilbara Operations Amidst Environmental Concerns

May 25, 2025 -

3 Billion Slash To Sse Spending Analysis And Implications

May 25, 2025

3 Billion Slash To Sse Spending Analysis And Implications

May 25, 2025