Analysis Of Roche's First-Quarter Sales Growth: Pipeline's Key Role

Table of Contents

Strong Performance Across Key Therapeutic Areas

Roche's Q1 sales growth demonstrates strength across its diverse therapeutic portfolio. This success is not confined to a single area but reflects a broad-based performance across oncology, immunology, ophthalmology, neuroscience, and its crucial diagnostics division. Each area contributed significantly to the overall revenue increase.

- Significant growth in oncology: This was driven primarily by strong sales of Tecentriq (atezolizumab), a leading immunotherapy treatment for various cancers, and its other targeted therapies like Perjeta (pertuzumab) and Herceptin (trastuzumab). Specific sales figures, if publicly released, would further solidify this analysis, illustrating the market dominance of these drugs.

- Solid performance in immunology: The success of Actemra (tocilizumab) in treating rheumatoid arthritis and other inflammatory conditions played a crucial role in this segment's performance. Further investigation into the sales figures for this and other immunology drugs would provide a more in-depth understanding.

- Growth in other therapeutic areas: While perhaps not as prominent as oncology and immunology, contributions from ophthalmology and neuroscience further diversified Roche's revenue streams, highlighting the resilience and breadth of its product portfolio. Identifying specific drugs and their contribution to overall sales would enhance this analysis.

- Robust diagnostics division performance: The diagnostics division, a cornerstone of Roche’s business, provided crucial support to the overall financial success. This reflects not only the diagnostic testing for the treatments offered but likely substantial sales from its broad diagnostics product line.

- Market share gains and competitive landscape: Analyzing Roche’s market share gains within each therapeutic area compared to key competitors offers valuable insight into the company’s strategic success and competitive advantages in these crucial markets.

The Pipeline's Impact: A Catalyst for Future Growth

Roche's impressive Q1 results are not solely a reflection of existing products; the company's robust R&D pipeline is a key catalyst for future growth. Significant investments in research and development are translating into a promising array of late-stage candidates poised to further expand Roche's market dominance.

- Key late-stage pipeline candidates with high market potential: Identifying and discussing specific drugs in advanced clinical trials—highlighting their potential indications and market size—would offer a clear picture of the pipeline's promise and its expected contribution to future revenue.

- Recent drug approvals and their expected contribution to future revenue streams: The impact of recently approved drugs on upcoming financial projections should be evaluated to demonstrate the pipeline's immediate impact on growth.

- Successful clinical trial data driving investor confidence: Highlighting positive clinical trial outcomes for these pipeline candidates will illustrate the scientific basis for their potential success and reinforce investor confidence in Roche's future prospects.

- Assessment of the pipeline's diversity and its role in mitigating risk: A diverse pipeline helps mitigate risk. The presence of drugs targeting various therapeutic areas and mechanisms of action across the pipeline reduces dependency on single products and protects against potential setbacks.

- Comparison with competitor pipelines to highlight Roche's competitive advantage: Analyzing Roche’s pipeline against those of its main competitors in oncology, immunology, and other therapeutic areas would offer context and demonstrate its strong position in the industry.

Focus on Oncology: A Deep Dive into the Leading Segment

Oncology remains a core strength for Roche, and a detailed analysis of its performance is crucial. The segment’s success is due to a combination of existing blockbuster drugs and a promising pipeline of innovative cancer therapies.

- Detailed analysis of Roche's oncology drug portfolio sales performance: Breaking down the performance of each key drug within the oncology portfolio, alongside its market share within specific cancer types, provides a clear picture of this division's success.

- Examination of market trends and competitive landscape in the oncology space: Understanding the broader oncology market trends and analyzing Roche's competitive positioning against major pharmaceutical companies is key to assessing the sustainability of its success.

- Discussion of Roche's strategy in personalized medicine and targeted therapies: Highlighting Roche's investments and strategies in personalized medicine and targeted therapies will showcase its commitment to innovation within this rapidly evolving sector.

- Analysis of the future potential of Roche's oncology pipeline: Focusing on the potential impact of the late-stage oncology pipeline candidates on future market share and revenue is critical for understanding the long-term growth prospects in this key area.

Financial Implications and Strategic Outlook

Roche's Q1 results showcase the financial implications of its strong pipeline and strategic investments. The growth demonstrates a healthy return on investment in R&D and positions the company favorably for continued success.

- Overview of Roche's Q1 financial results, including revenue and profit figures: Presenting the key financial data – revenue, profit margins, earnings per share – provides a clear picture of the company's financial health and growth trajectory.

- Discussion of the impact of the strong pipeline on future financial projections: Analyzing the pipeline's expected contribution to future revenue growth offers insight into the company’s long-term financial outlook.

- Assessment of Roche's strategic investments in R&D and their return on investment: Showcasing the returns on its R&D investments reinforces the success of its strategic approach.

- Analysis of the company’s overall strategic outlook and its plans for future growth: Summarizing Roche’s overall strategic direction and planned investments will reveal the company's commitment to sustained growth and leadership within the pharmaceutical industry.

Conclusion

Roche's impressive first-quarter sales growth is a testament to its robust product portfolio and its thriving pharmaceutical and diagnostics pipeline. The company's strategic investments in R&D are clearly paying off, solidifying its position as a global healthcare leader. The strong performance across key therapeutic areas, notably oncology, and the promising late-stage pipeline projects are strong indicators of continued future growth.

Call to Action: Stay informed about the continued success of Roche and its impact on the pharmaceutical landscape. Follow our blog for further analysis of Roche's Q1 sales growth and the ongoing contribution of its innovative pipeline. Learn more about Roche's pharmaceutical pipeline and its future potential.

Featured Posts

-

Aussie Veterans Warning Anzac Day Ignored National Identity At Risk

Apr 25, 2025

Aussie Veterans Warning Anzac Day Ignored National Identity At Risk

Apr 25, 2025 -

Lotus Eletre A 230 000 Electric Suv Is It Worth The Price

Apr 25, 2025

Lotus Eletre A 230 000 Electric Suv Is It Worth The Price

Apr 25, 2025 -

Election Promises And Economic Slowdown A Realistic Assessment Of Fiscal Implications

Apr 25, 2025

Election Promises And Economic Slowdown A Realistic Assessment Of Fiscal Implications

Apr 25, 2025 -

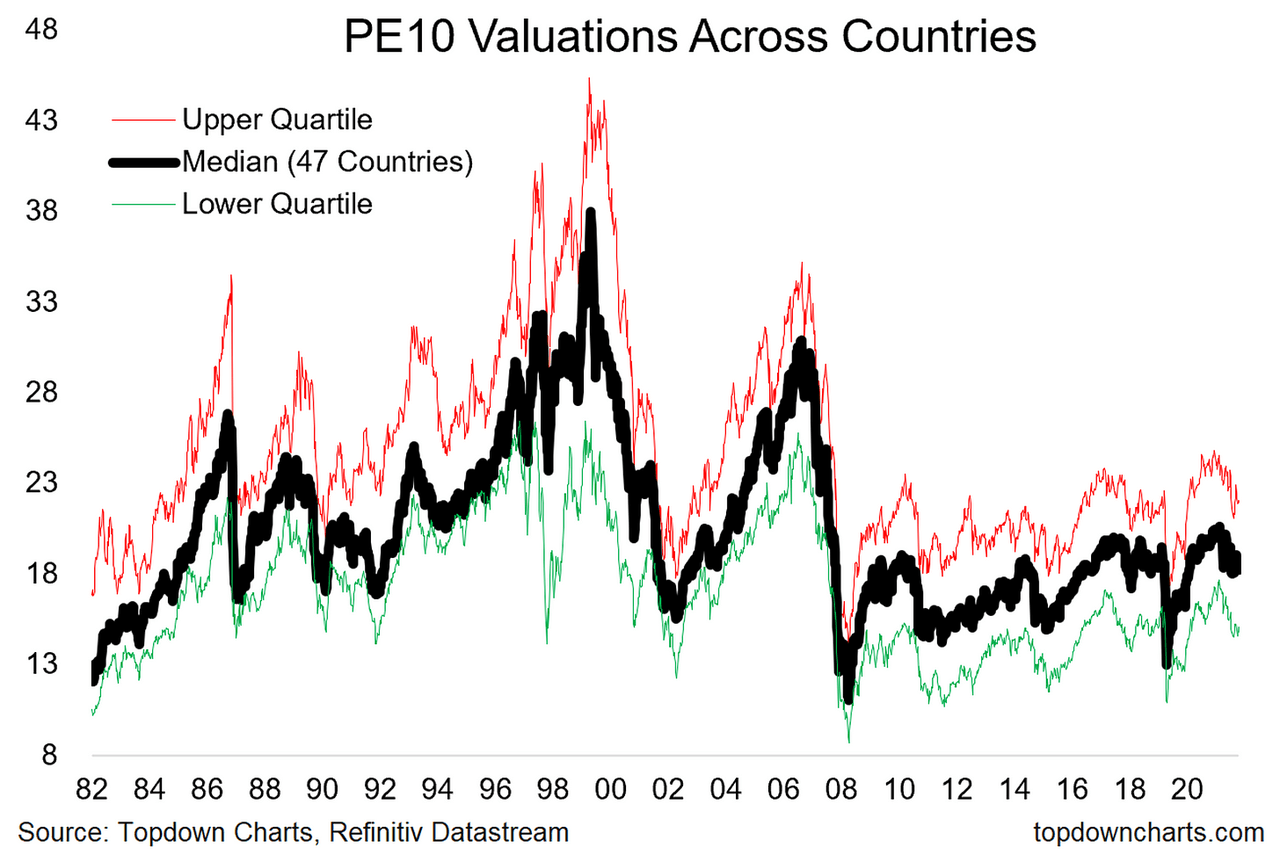

Bof As Reassurance Addressing Concerns About High Stock Market Valuations

Apr 25, 2025

Bof As Reassurance Addressing Concerns About High Stock Market Valuations

Apr 25, 2025 -

Eurovision 2024 Courtney Act And Tony Armstrong Announced As Hosts

Apr 25, 2025

Eurovision 2024 Courtney Act And Tony Armstrong Announced As Hosts

Apr 25, 2025

Latest Posts

-

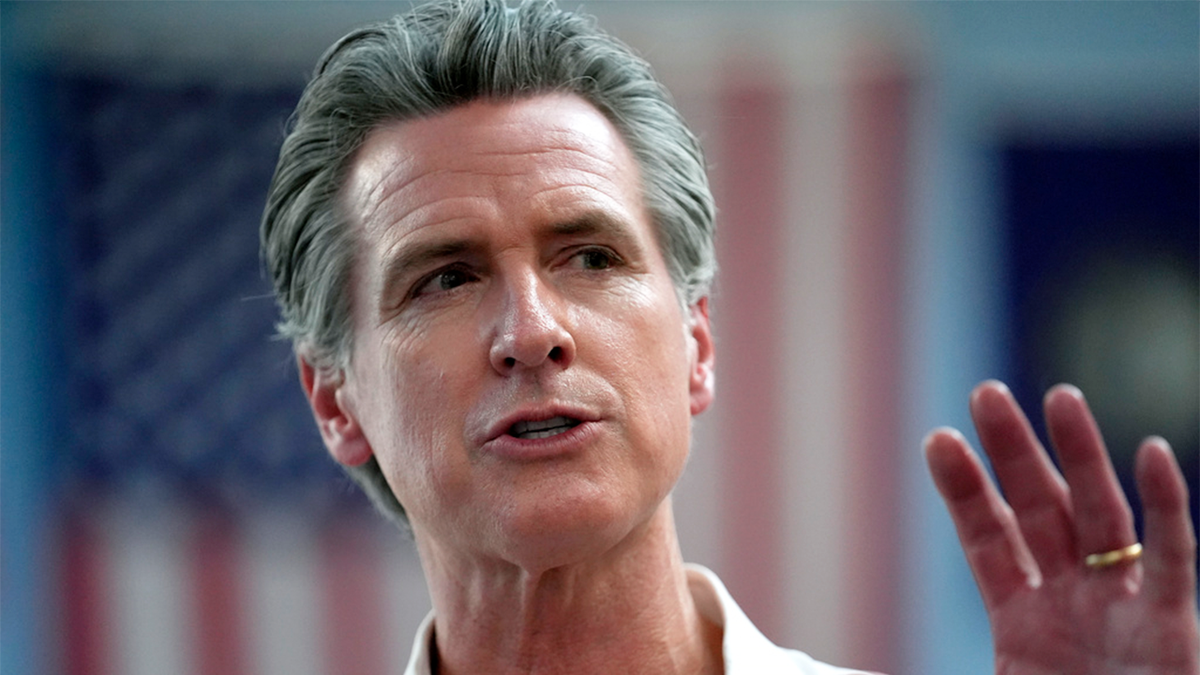

Newsoms Sharp Rebuke Of Toxic Democrats

Apr 26, 2025

Newsoms Sharp Rebuke Of Toxic Democrats

Apr 26, 2025 -

Gavin Newsom Criticizes Toxic And Judgmental Democrats

Apr 26, 2025

Gavin Newsom Criticizes Toxic And Judgmental Democrats

Apr 26, 2025 -

Newsom Faces Criticism For Toxic Democrats Comment

Apr 26, 2025

Newsom Faces Criticism For Toxic Democrats Comment

Apr 26, 2025 -

Gavin Newsoms Toxic Democrat Remark A Political Backlash

Apr 26, 2025

Gavin Newsoms Toxic Democrat Remark A Political Backlash

Apr 26, 2025