Analyst Downgrades Apple Target, But Remains Optimistic: Long-Term Investment Prospects

Table of Contents

Reasons Behind the Analyst Downgrade

Several factors contribute to the more cautious outlook on Apple's near-term performance, leading some analysts to lower their price targets.

Concerns about Near-Term iPhone Sales

The smartphone market, particularly the premium segment where Apple competes, is showing signs of saturation. Global economic slowdown and persistent inflation are impacting consumer spending, particularly on discretionary items like high-priced electronics. Several analyst reports, such as [link to reputable financial news source 1] and [link to reputable financial news source 2], point to lower-than-expected iPhone sales projections for the coming quarters.

- Weakening consumer demand due to inflation: Rising prices are forcing consumers to prioritize essential spending, impacting sales of non-essential electronics.

- Increased competition in the premium smartphone segment: Competitors are aggressively vying for market share, putting pressure on Apple's pricing power and sales volume.

- Potential supply chain disruptions: Geopolitical instability and ongoing logistical challenges could further impact iPhone production and availability.

Impact of the Macroeconomic Environment

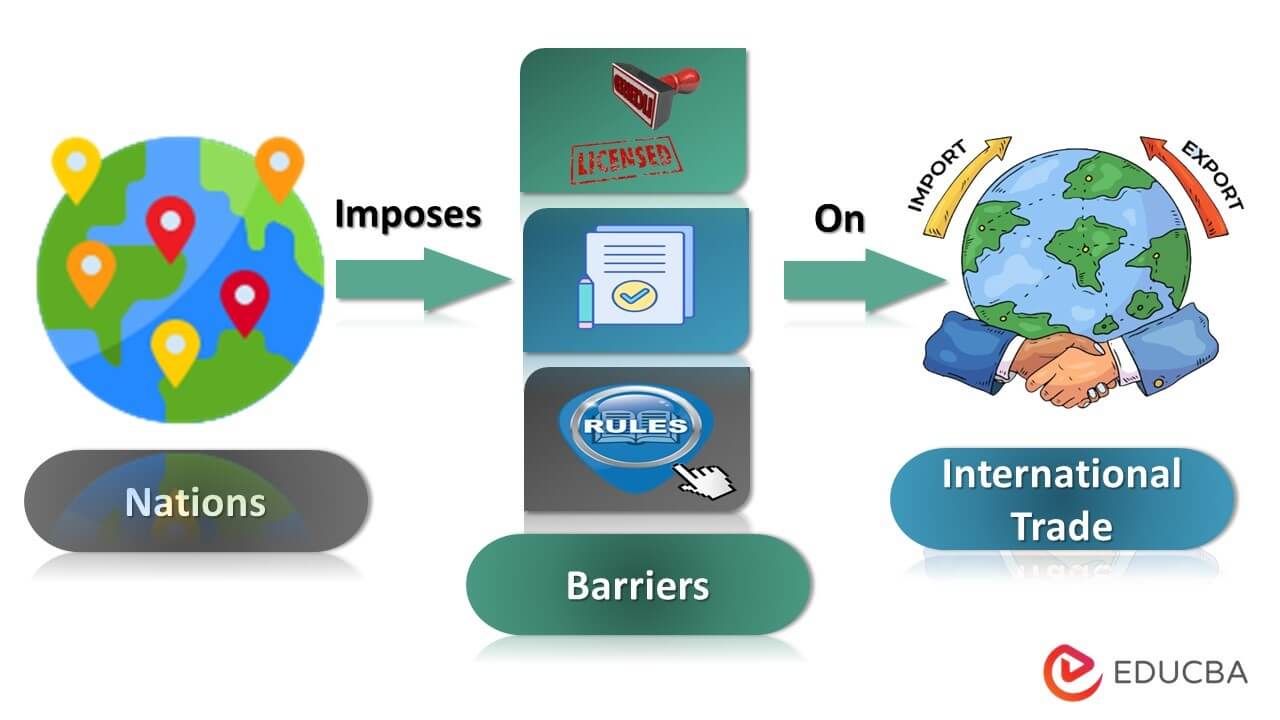

The broader macroeconomic environment significantly influences Apple's performance and investor sentiment. Rising interest rates increase borrowing costs for companies and impact investor valuations, potentially leading to lower price-to-earnings (P/E) ratios for tech stocks like Apple. Geopolitical uncertainty adds further complexity, affecting supply chains and impacting sales in various regions.

- Rising interest rates impacting valuations: Higher interest rates make future earnings less valuable, leading to lower stock valuations.

- Geopolitical uncertainty affecting supply chains: Global events can disrupt Apple's intricate supply chains, impacting production and delivery timelines.

- Inflation's effect on consumer spending: High inflation erodes purchasing power, reducing consumer demand for electronics.

Why Long-Term Investment Prospects Remain Strong

Despite near-term headwinds, Apple's long-term investment prospects remain compelling due to several key factors.

Apple's Diversification and Growth Opportunities

Apple is far from a one-trick pony. Its diversification beyond iPhones into high-growth areas like services (Apple Music, iCloud, App Store), wearables (Apple Watch, AirPods), and potential future ventures in augmented reality/virtual reality (AR/VR) and electric vehicles, offers significant avenues for future growth.

- Strong growth in services revenue: Apple's services segment is a significant and rapidly growing revenue stream, less susceptible to economic downturns.

- Expanding market share in wearables: Apple continues to dominate the wearables market, with significant potential for further expansion.

- Potential for future innovation in AR/VR and electric vehicles: These emerging technologies represent significant long-term growth opportunities for Apple.

Strong Brand Loyalty and Customer Base

Apple boasts an incredibly strong brand reputation and fiercely loyal customer base. The "Apple ecosystem" creates high switching costs for users, ensuring a sustained stream of revenue from existing customers through repeat purchases and upgrades.

- High customer satisfaction and retention rates: Apple consistently ranks high in customer satisfaction surveys, leading to high retention rates.

- Strong brand recognition and loyalty: The Apple brand is synonymous with quality, innovation, and design, fostering strong customer loyalty.

- Sticky ecosystem encourages repeat purchases: The seamless integration of Apple devices and services encourages customers to remain within the Apple ecosystem.

Apple's Robust Financial Position

Apple possesses significant cash reserves and a consistently strong financial performance, enabling it to weather economic downturns and invest in future innovation. The company's consistent dividend payouts also add to its attractiveness as a long-term investment.

- Significant cash reserves and strong balance sheet: Apple's financial strength provides a safety net during challenging economic times.

- Consistent profitability and cash flow generation: Apple consistently generates strong profits and cash flows, funding future growth initiatives.

- Attractive dividend yield: Apple's dividend payments provide a steady stream of income for investors.

Conclusion: Should You Invest in Apple Despite the Downgrade?

While near-term challenges exist, stemming from macroeconomic factors and potential iPhone sales slowdowns, Apple's robust fundamentals, diversified revenue streams, strong brand loyalty, and significant financial resources paint a positive picture for long-term growth. The analyst downgrade should be viewed with caution but not as a definitive judgment on Apple's long-term potential.

While this analyst downgrade warrants caution, the long-term investment prospects for Apple remain robust. Conduct your own thorough research and consider your individual risk tolerance before making any investment decisions regarding Apple stock (AAPL). Learn more about the long-term outlook of Apple and discover other investment opportunities. Consider consulting with a financial advisor for personalized guidance on Apple and other potential long-term investments.

Featured Posts

-

Porsche 956 Nin Ters Yuez Edilmis Sergisi Teknik Sebepler Ve Sanatsal Yorum

May 24, 2025

Porsche 956 Nin Ters Yuez Edilmis Sergisi Teknik Sebepler Ve Sanatsal Yorum

May 24, 2025 -

Analysis G 7s Consideration Of Reduced Tariffs For Chinese Products

May 24, 2025

Analysis G 7s Consideration Of Reduced Tariffs For Chinese Products

May 24, 2025 -

Brest Urban Trail Les Visages De L Evenement Benevoles Artistes Et Partenaires

May 24, 2025

Brest Urban Trail Les Visages De L Evenement Benevoles Artistes Et Partenaires

May 24, 2025 -

Teatr Mossoveta Vospominaniya O Sergee Yurskom

May 24, 2025

Teatr Mossoveta Vospominaniya O Sergee Yurskom

May 24, 2025 -

Learn From Nicki Chapman A 700 000 Escape To The Country Property Investment

May 24, 2025

Learn From Nicki Chapman A 700 000 Escape To The Country Property Investment

May 24, 2025

Latest Posts

-

Are Thames Water Executive Bonuses Justified A Critical Analysis

May 24, 2025

Are Thames Water Executive Bonuses Justified A Critical Analysis

May 24, 2025 -

The Thames Water Executive Bonus Issue Public Outrage And Corporate Accountability

May 24, 2025

The Thames Water Executive Bonus Issue Public Outrage And Corporate Accountability

May 24, 2025 -

Scrutinizing Thames Water Executive Bonuses Under The Microscope

May 24, 2025

Scrutinizing Thames Water Executive Bonuses Under The Microscope

May 24, 2025 -

Thames Waters Executive Pay Scandal Or Standard Practice

May 24, 2025

Thames Waters Executive Pay Scandal Or Standard Practice

May 24, 2025 -

Environmental Concerns In The Pilbara A Response From Rio Tinto

May 24, 2025

Environmental Concerns In The Pilbara A Response From Rio Tinto

May 24, 2025